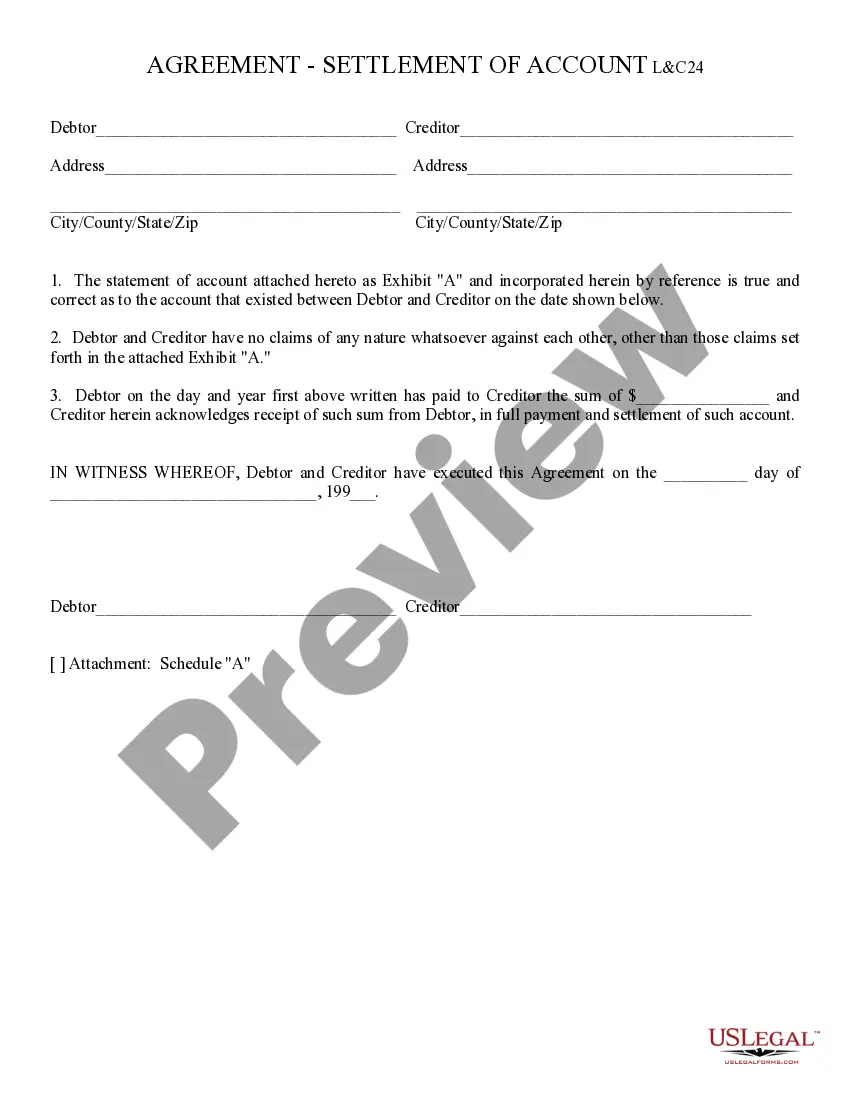

Settlement of Account: A Settlement of Account states that the Buyer and Seller previously had entered into a contract with one another; however, that contract has been fulfilled by both parties. Therefore, this a Statement that the account is settled and no other obligations are to be performed by either party. This form is available for download in both Word and Rich Text formats.

Tempe Arizona Settlement of Account refers to the legal process in which a debtor and a creditor come to an agreement to resolve an outstanding debt. This process involves negotiating a reduced amount to be paid by the debtor, often in exchange for a lump sum payment or a structured repayment plan. Keywords: Tempe Arizona, settlement of account, debtor, creditor, outstanding debt, negotiate, reduced amount, lump sum payment, structured repayment plan. There are two main types of Tempe Arizona Settlement of Account: 1. Debt Settlement: This type of settlement occurs when a debtor negotiates with a creditor to reduce the total amount owed. The debtor may propose a lower amount that they can afford to pay, often based on their financial situation. Once the creditor agrees to the reduced amount, the debtor makes the payment in a lump sum or sometimes through installment payments as agreed upon. 2. Bankruptcy: In some cases, the debtor may opt for bankruptcy as a form of settlement. Bankruptcy is a legal proceeding in which an individual or business declares their inability to repay their debts. There are different types of bankruptcy, such as Chapter 7 and Chapter 13, each with its own eligibility criteria and implications. Bankruptcy can help individuals discharge certain types of debts or restructure their repayment plans under court supervision. Overall, Tempe Arizona Settlement of Account provides individuals and businesses with an opportunity to negotiate and resolve their outstanding debts either through a reduced lump sum payment or a court-approved repayment plan. It allows debtors to address their financial obligations while offering creditors a chance to recover at least a portion of the outstanding amount. It is important for debtors to consult with financial advisors or legal professionals to understand the best course of action for their specific situation.Tempe Arizona Settlement of Account refers to the legal process in which a debtor and a creditor come to an agreement to resolve an outstanding debt. This process involves negotiating a reduced amount to be paid by the debtor, often in exchange for a lump sum payment or a structured repayment plan. Keywords: Tempe Arizona, settlement of account, debtor, creditor, outstanding debt, negotiate, reduced amount, lump sum payment, structured repayment plan. There are two main types of Tempe Arizona Settlement of Account: 1. Debt Settlement: This type of settlement occurs when a debtor negotiates with a creditor to reduce the total amount owed. The debtor may propose a lower amount that they can afford to pay, often based on their financial situation. Once the creditor agrees to the reduced amount, the debtor makes the payment in a lump sum or sometimes through installment payments as agreed upon. 2. Bankruptcy: In some cases, the debtor may opt for bankruptcy as a form of settlement. Bankruptcy is a legal proceeding in which an individual or business declares their inability to repay their debts. There are different types of bankruptcy, such as Chapter 7 and Chapter 13, each with its own eligibility criteria and implications. Bankruptcy can help individuals discharge certain types of debts or restructure their repayment plans under court supervision. Overall, Tempe Arizona Settlement of Account provides individuals and businesses with an opportunity to negotiate and resolve their outstanding debts either through a reduced lump sum payment or a court-approved repayment plan. It allows debtors to address their financial obligations while offering creditors a chance to recover at least a portion of the outstanding amount. It is important for debtors to consult with financial advisors or legal professionals to understand the best course of action for their specific situation.