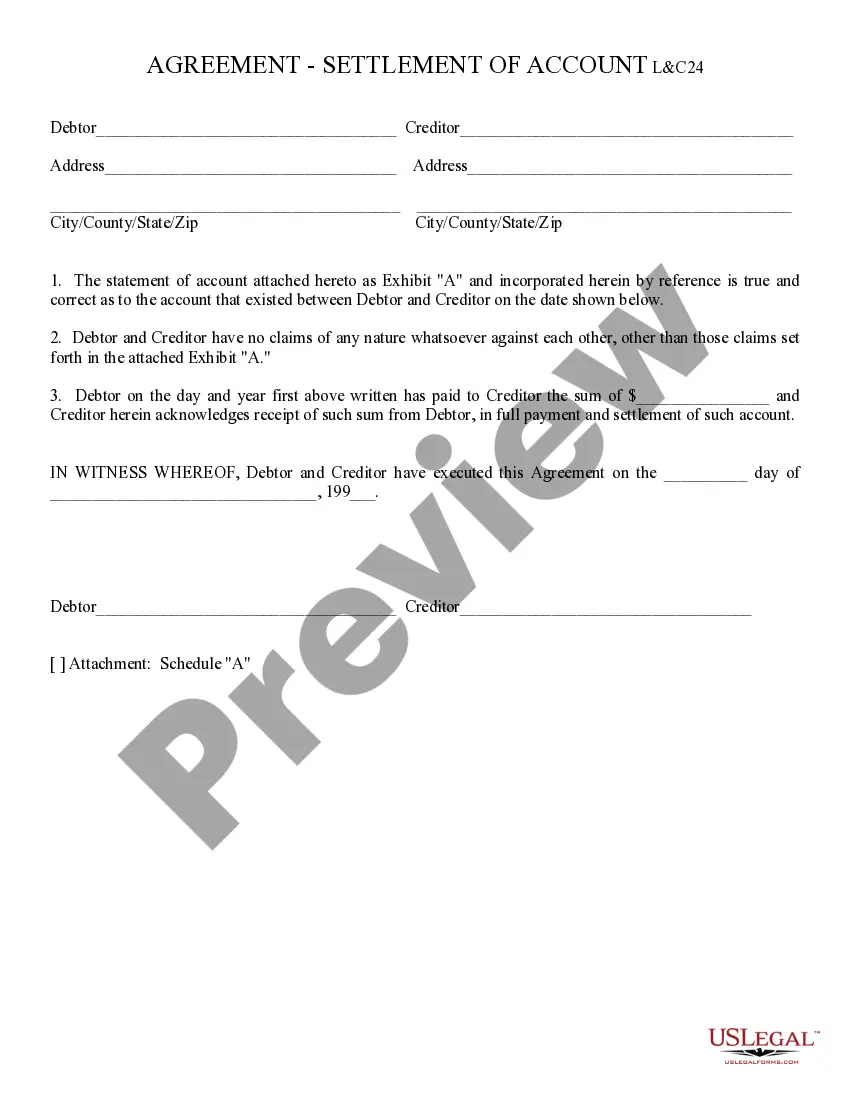

Settlement of Account: A Settlement of Account states that the Buyer and Seller previously had entered into a contract with one another; however, that contract has been fulfilled by both parties. Therefore, this a Statement that the account is settled and no other obligations are to be performed by either party. This form is available for download in both Word and Rich Text formats.

Tucson Arizona Settlement of Account refers to the process of resolving outstanding debts or financial obligations between a debtor and a creditor in Tucson, Arizona. It involves negotiating a mutually agreed-upon settlement amount to be paid in order to satisfy the debt. In Tucson, there are various types of Settlement of Account, including: 1. Credit Card Settlement: This type of settlement typically occurs when a person is unable to pay their credit card debts in full. The debtor and creditor negotiate a reduced lump sum payment that is considered as the final settlement. 2. Medical Debt Settlement: Many residents in Tucson may face difficulties in paying off high medical bills. In this case, individuals can negotiate with healthcare providers, hospitals, or collection agencies to reach a lower settlement amount. 3. Student Loan Settlement: Tucson residents burdened with student loan debts may consider settlement options to alleviate their financial strain. Negotiating with lenders or loan services may lead to a reduced amount to settle the debt. 4. Personal Loan Settlement: Individuals who have taken out personal loans and are struggling to repay them may opt for settlement arrangements. By negotiating with the lender, borrowers may agree upon a lump sum payment that satisfies the debt. 5. Mortgage Settlement: Tucson homeowners facing foreclosure or mortgage delinquency can negotiate a settlement with their lender. This may involve a reduced principal balance, modified payment terms, or a lump sum payment to settle the debt. Regardless of the type of settlement, the process typically involves assessing financial situations, gathering necessary documentation, and engaging in negotiation with the creditor or collection agency. It is crucial to consult with a reputable settlement company or seek legal advice to ensure a fair and legally binding agreement. Tucson Arizona Settlement of Account alleviates the burden of overwhelming debt and provides individuals with an opportunity to regain control over their finances. It is essential to research and choose the most suitable type of settlement depending on the specific debt situation one faces.Tucson Arizona Settlement of Account refers to the process of resolving outstanding debts or financial obligations between a debtor and a creditor in Tucson, Arizona. It involves negotiating a mutually agreed-upon settlement amount to be paid in order to satisfy the debt. In Tucson, there are various types of Settlement of Account, including: 1. Credit Card Settlement: This type of settlement typically occurs when a person is unable to pay their credit card debts in full. The debtor and creditor negotiate a reduced lump sum payment that is considered as the final settlement. 2. Medical Debt Settlement: Many residents in Tucson may face difficulties in paying off high medical bills. In this case, individuals can negotiate with healthcare providers, hospitals, or collection agencies to reach a lower settlement amount. 3. Student Loan Settlement: Tucson residents burdened with student loan debts may consider settlement options to alleviate their financial strain. Negotiating with lenders or loan services may lead to a reduced amount to settle the debt. 4. Personal Loan Settlement: Individuals who have taken out personal loans and are struggling to repay them may opt for settlement arrangements. By negotiating with the lender, borrowers may agree upon a lump sum payment that satisfies the debt. 5. Mortgage Settlement: Tucson homeowners facing foreclosure or mortgage delinquency can negotiate a settlement with their lender. This may involve a reduced principal balance, modified payment terms, or a lump sum payment to settle the debt. Regardless of the type of settlement, the process typically involves assessing financial situations, gathering necessary documentation, and engaging in negotiation with the creditor or collection agency. It is crucial to consult with a reputable settlement company or seek legal advice to ensure a fair and legally binding agreement. Tucson Arizona Settlement of Account alleviates the burden of overwhelming debt and provides individuals with an opportunity to regain control over their finances. It is essential to research and choose the most suitable type of settlement depending on the specific debt situation one faces.