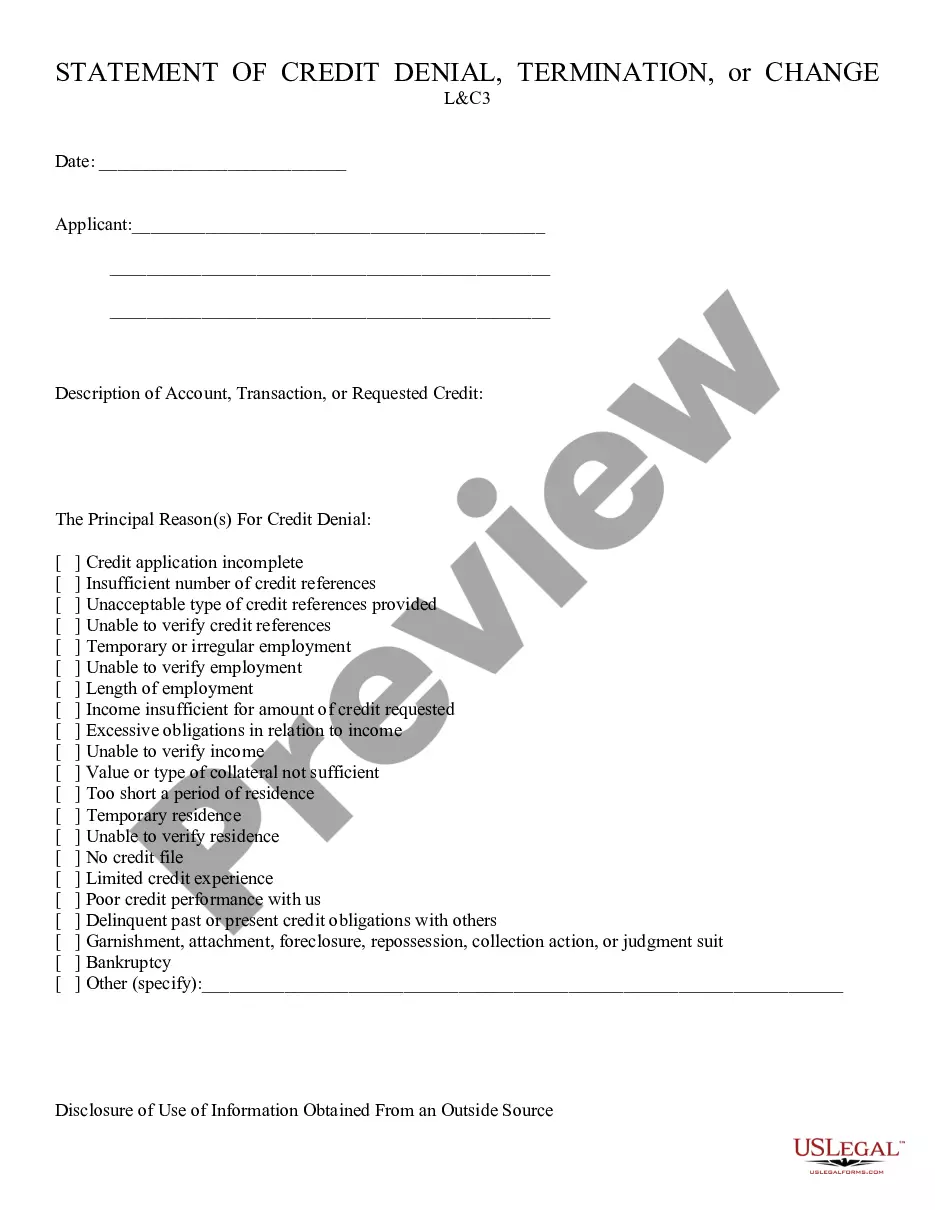

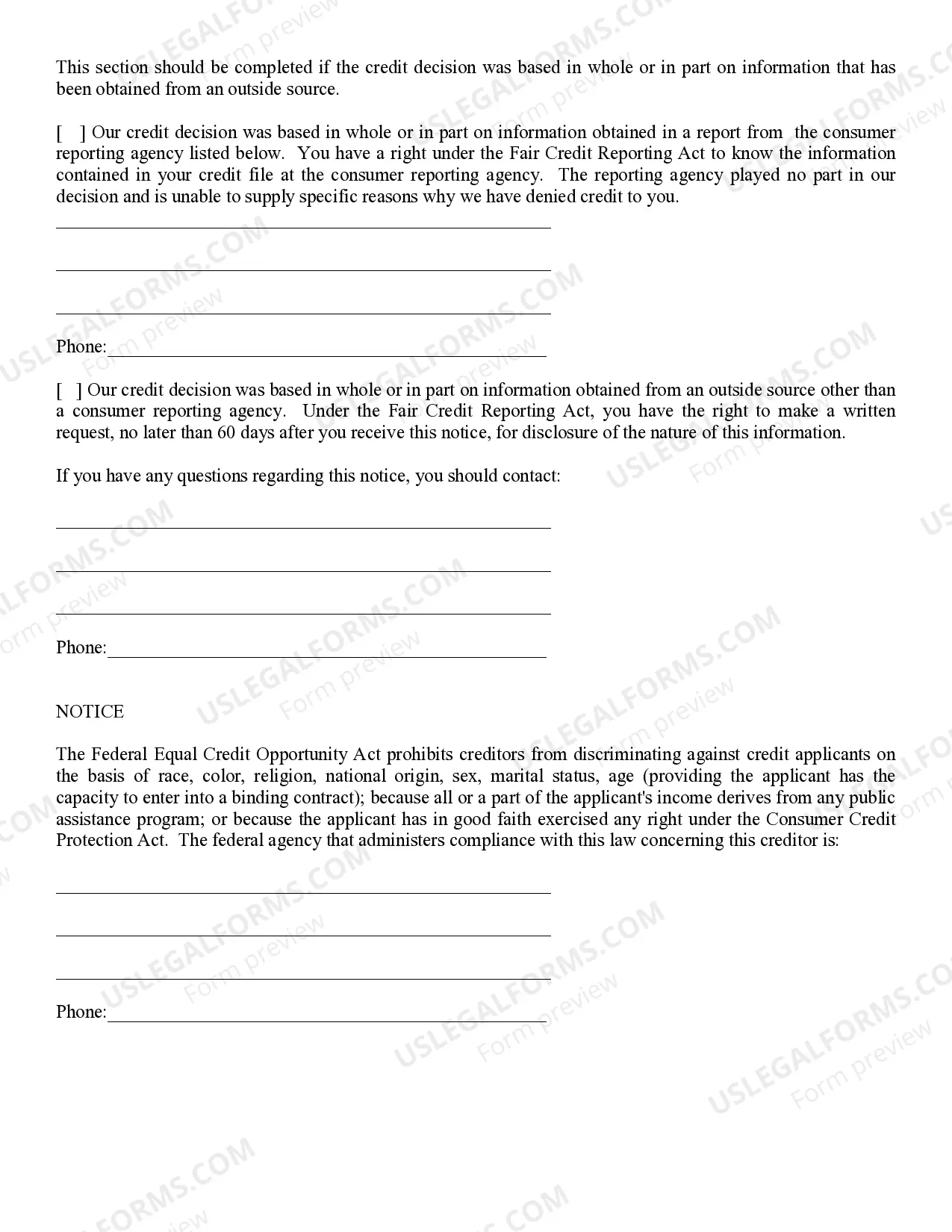

Credit Denial - Notice: This is Notice of Credit Denial which is sent to the party applying for a line of credit. It allows them to know their application has been denied, and normally, why it was denied. This form is available for download in both Word and Rich Text formats.

Glendale Arizona Credit Denial — Notice is a formal communication issued by financial institutions in Glendale, Arizona to inform individuals of the denial of their credit applications. This notice serves as a legal document detailing the reasons for the denial and the relevant policies and procedures followed by the institution. Keywords: Glendale Arizona, Credit Denial, Notice, financial institutions, credit applications, legal document, reasons for denial, policies, procedures Types of Glendale Arizona Credit Denial — Notice may include: 1. Glendale Arizona Credit Denial Noticeic— - Insufficient Credit History: This type of notice is sent to individuals who have limited or no credit history, making it difficult for the institution to assess their creditworthiness. The notice explains that the individual's lack of credit history does not meet the institution's requirements for approving credit applications. 2. Glendale Arizona Credit Denial Noticeic— - Low Credit Score: Financial institutions may send this notice to individuals with a low credit score. The notice will outline that the credit score falls below the institution's acceptable threshold, indicating a higher level of credit risk. The specific factors contributing to the low credit score may also be mentioned. 3. Glendale Arizona Credit Denial Noticeic— - High Debt-to-Income Ratio: This notice is issued to individuals who have a significant amount of debt compared to their income. The financial institution may consider this high debt-to-income ratio as a potential risk and, therefore, deny the credit application. The notice will explain the ratio calculation and provide guidance on steps to improve it. 4. Glendale Arizona Credit Denial Noticeic— - Insufficient Collateral: In cases where individuals apply for secured credit, such as loans backed by collateral, this notice may be issued if the offered collateral is deemed insufficient to secure the requested credit. The notice will detail the valuation process and the specific reason for the collateral's inadequacy. 5. Glendale Arizona Credit Denial Noticeic— - Negative/Adverse Credit History: Financial institutions may issue this notice to individuals with a history of late payments, delinquencies, defaults, or bankruptcies. The notice will explain that the individual's credit history indicates a higher level of credit risk, making their application for credit denial. Overall, Glendale Arizona Credit Denial — Notice is a crucial communication from financial institutions to individuals, providing transparency about the reasons for credit denial and offering guidance on how to improve creditworthiness for future applications.Glendale Arizona Credit Denial — Notice is a formal communication issued by financial institutions in Glendale, Arizona to inform individuals of the denial of their credit applications. This notice serves as a legal document detailing the reasons for the denial and the relevant policies and procedures followed by the institution. Keywords: Glendale Arizona, Credit Denial, Notice, financial institutions, credit applications, legal document, reasons for denial, policies, procedures Types of Glendale Arizona Credit Denial — Notice may include: 1. Glendale Arizona Credit Denial Noticeic— - Insufficient Credit History: This type of notice is sent to individuals who have limited or no credit history, making it difficult for the institution to assess their creditworthiness. The notice explains that the individual's lack of credit history does not meet the institution's requirements for approving credit applications. 2. Glendale Arizona Credit Denial Noticeic— - Low Credit Score: Financial institutions may send this notice to individuals with a low credit score. The notice will outline that the credit score falls below the institution's acceptable threshold, indicating a higher level of credit risk. The specific factors contributing to the low credit score may also be mentioned. 3. Glendale Arizona Credit Denial Noticeic— - High Debt-to-Income Ratio: This notice is issued to individuals who have a significant amount of debt compared to their income. The financial institution may consider this high debt-to-income ratio as a potential risk and, therefore, deny the credit application. The notice will explain the ratio calculation and provide guidance on steps to improve it. 4. Glendale Arizona Credit Denial Noticeic— - Insufficient Collateral: In cases where individuals apply for secured credit, such as loans backed by collateral, this notice may be issued if the offered collateral is deemed insufficient to secure the requested credit. The notice will detail the valuation process and the specific reason for the collateral's inadequacy. 5. Glendale Arizona Credit Denial Noticeic— - Negative/Adverse Credit History: Financial institutions may issue this notice to individuals with a history of late payments, delinquencies, defaults, or bankruptcies. The notice will explain that the individual's credit history indicates a higher level of credit risk, making their application for credit denial. Overall, Glendale Arizona Credit Denial — Notice is a crucial communication from financial institutions to individuals, providing transparency about the reasons for credit denial and offering guidance on how to improve creditworthiness for future applications.