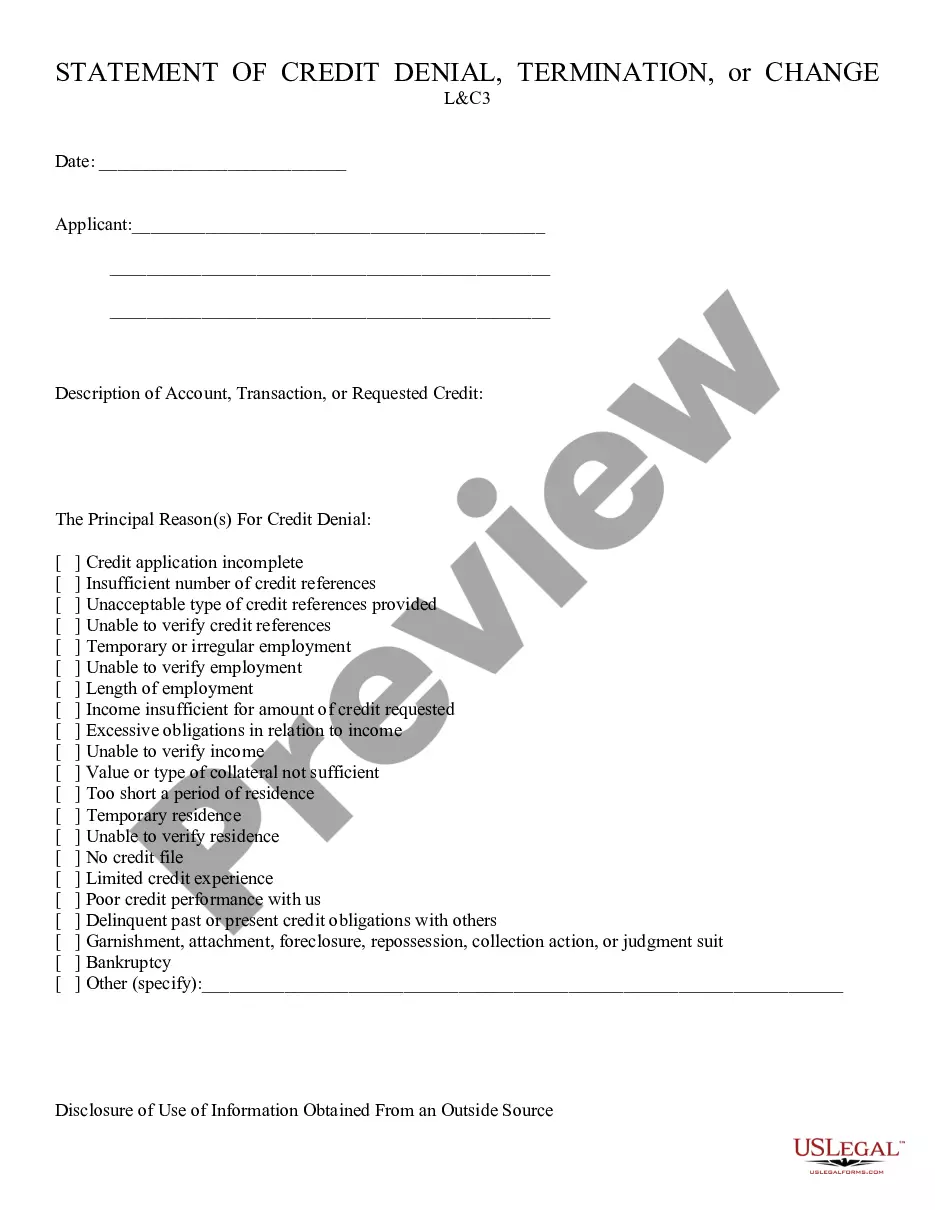

Credit Denial - Notice: This is Notice of Credit Denial which is sent to the party applying for a line of credit. It allows them to know their application has been denied, and normally, why it was denied. This form is available for download in both Word and Rich Text formats.

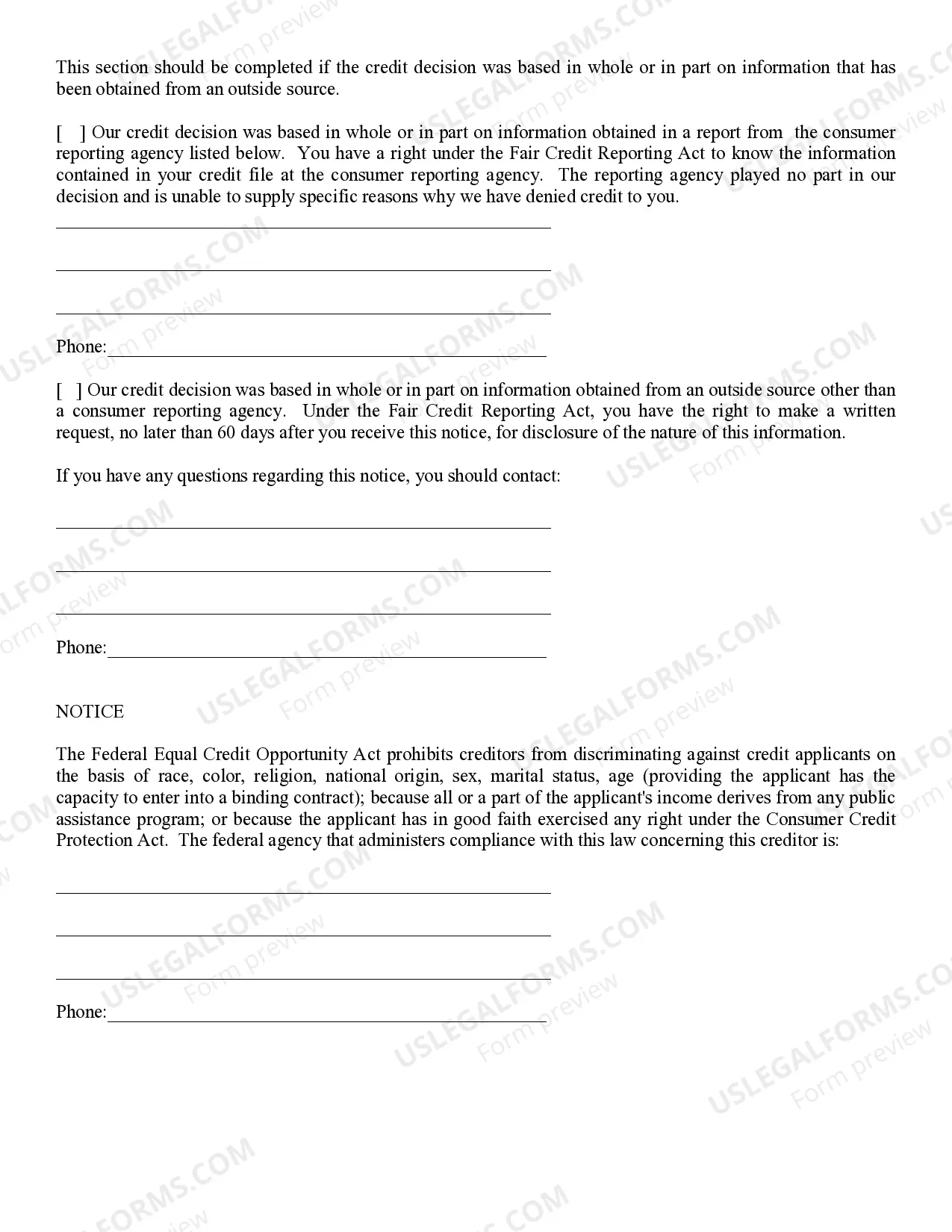

Mesa Arizona Credit Denial — Notice refers to a formal notification that is sent to an individual informing them that their application for credit has been rejected or denied in Mesa, Arizona. This notice is a crucial document as it outlines the reasons for the credit denial and provides important information regarding the individual's credit profile and standing. Mesa Arizona Credit Denial — Notice can come in various forms depending on the type of credit being applied for. Here are some different types of Mesa Arizona Credit Denial — Notice: 1. Mortgage CrediDenialia— - Notice: This type of credit denial notice specifically pertains to the rejection of a mortgage loan application in Mesa, Arizona. It includes detailed information about the reasons for denial, such as insufficient income, low credit score, or a negative credit history. 2. Auto Loan Credit Denial — Notice: If an individual's application for an auto loan is denied in Mesa, Arizona, they may receive this type of credit denial notice. It outlines the factors contributing to the denial, such as a low credit score, inadequate income, or a high debt-to-income ratio. 3. Credit Card Credit Denial — Notice: In the case of a denied application for a credit card in Mesa, Arizona, recipients will receive this type of credit denial notice. The notice typically highlights reasons like a limited credit history, a high debt-to-income ratio, or negative credit report details that led to the denial. 4. Personal Loan Credit Denial — Notice: When an application for a personal loan is rejected in Mesa, Arizona, recipients will be notified through this type of credit denial notice. It may outline reasons such as a low credit score, insufficient income, or a high debt load that contributed to the denial. Regardless of the type, Mesa Arizona Credit Denial — Notice serves as a vital document that allows individuals to understand the reasons behind their denial and take appropriate steps to improve their creditworthiness in the future. It is important for recipients to carefully review the notice, consider credit-building strategies, and potentially seek assistance from credit counseling services or financial advisors to resolve any financial issues contributing to the credit denial.Mesa Arizona Credit Denial — Notice refers to a formal notification that is sent to an individual informing them that their application for credit has been rejected or denied in Mesa, Arizona. This notice is a crucial document as it outlines the reasons for the credit denial and provides important information regarding the individual's credit profile and standing. Mesa Arizona Credit Denial — Notice can come in various forms depending on the type of credit being applied for. Here are some different types of Mesa Arizona Credit Denial — Notice: 1. Mortgage CrediDenialia— - Notice: This type of credit denial notice specifically pertains to the rejection of a mortgage loan application in Mesa, Arizona. It includes detailed information about the reasons for denial, such as insufficient income, low credit score, or a negative credit history. 2. Auto Loan Credit Denial — Notice: If an individual's application for an auto loan is denied in Mesa, Arizona, they may receive this type of credit denial notice. It outlines the factors contributing to the denial, such as a low credit score, inadequate income, or a high debt-to-income ratio. 3. Credit Card Credit Denial — Notice: In the case of a denied application for a credit card in Mesa, Arizona, recipients will receive this type of credit denial notice. The notice typically highlights reasons like a limited credit history, a high debt-to-income ratio, or negative credit report details that led to the denial. 4. Personal Loan Credit Denial — Notice: When an application for a personal loan is rejected in Mesa, Arizona, recipients will be notified through this type of credit denial notice. It may outline reasons such as a low credit score, insufficient income, or a high debt load that contributed to the denial. Regardless of the type, Mesa Arizona Credit Denial — Notice serves as a vital document that allows individuals to understand the reasons behind their denial and take appropriate steps to improve their creditworthiness in the future. It is important for recipients to carefully review the notice, consider credit-building strategies, and potentially seek assistance from credit counseling services or financial advisors to resolve any financial issues contributing to the credit denial.