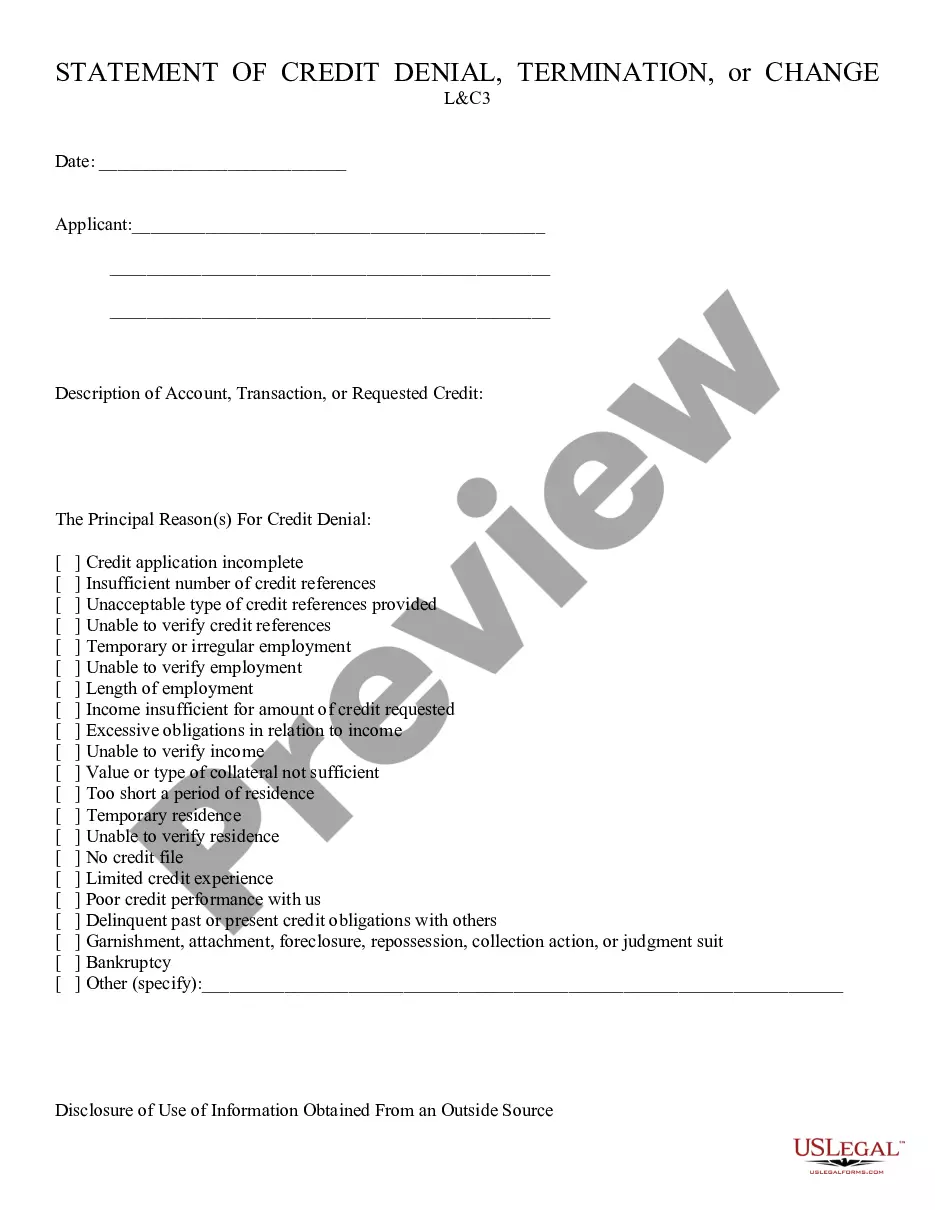

Credit Denial - Notice: This is Notice of Credit Denial which is sent to the party applying for a line of credit. It allows them to know their application has been denied, and normally, why it was denied. This form is available for download in both Word and Rich Text formats.

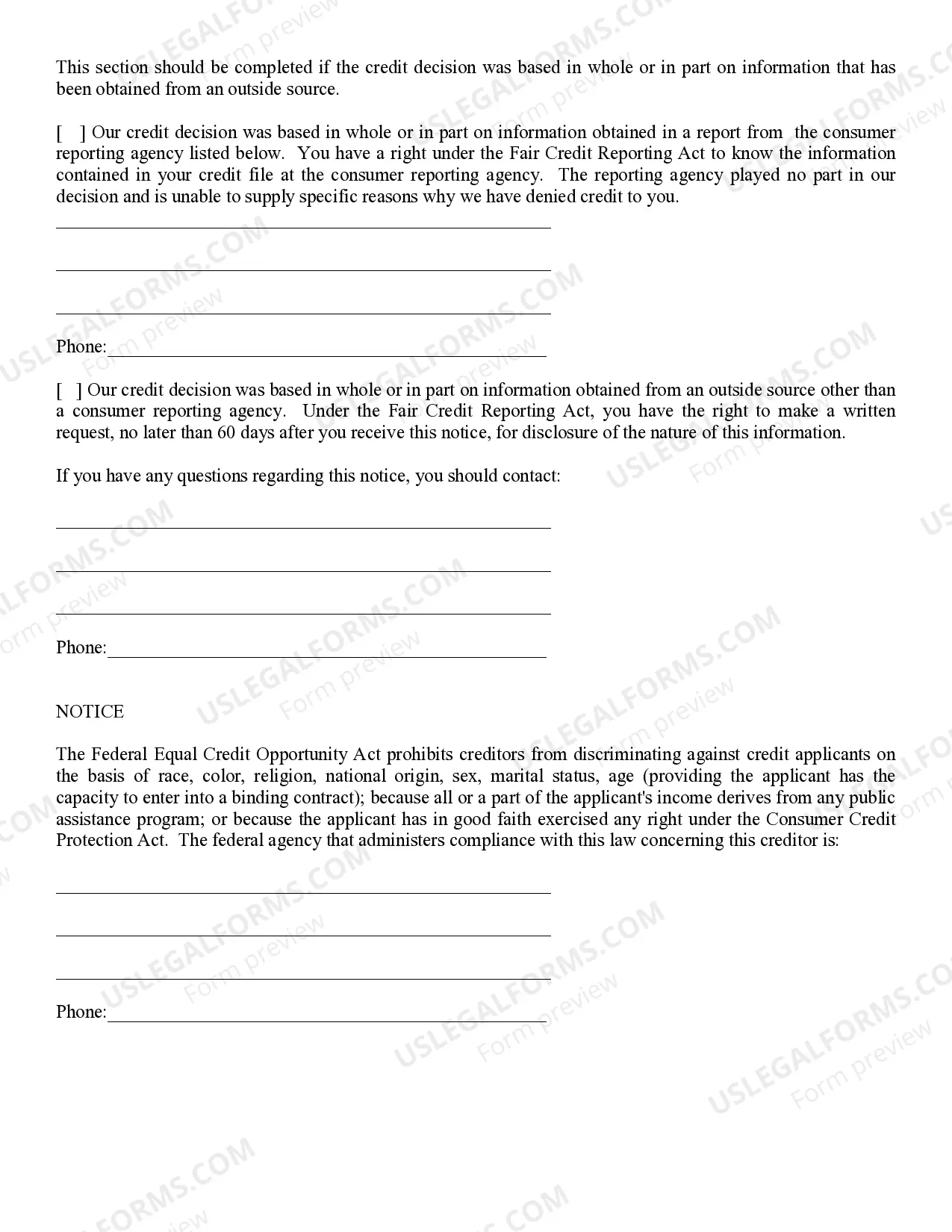

Phoenix Arizona Credit Denial — Notice is a legal document that informs an individual or business entity of the denial of credit by a lender or financial institution based in Phoenix, Arizona. It is a crucial form of communication used to notify the recipient about the rejection of their credit application and the reasons behind such a decision. The purpose of the Phoenix Arizona Credit Denial — Notice is to provide clear and concise information regarding the factors that led to the denial of credit. This notice ensures transparency and fairness in the credit evaluation process, allowing the recipient to understand why their application was rejected. This type of notice may vary depending on the specific circumstances and the lender's policies. There can be different types of Phoenix Arizona Credit Denial — Notice, including: 1. Phoenix Arizona Credit Denial — Notice for Individual Applicants: This notice is typically intended for individuals who have applied for personal credit, such as credit cards, personal loans, mortgages, or automobile loans. 2. Phoenix Arizona Credit Denial — Notice for Business Applicants: This notice is targeted towards businesses or organizations that have applied for credit, including business loans, lines of credit, or vendor credit accounts. The Phoenix Arizona Credit Denial — Notice generally contains the following key information: 1. Introduction: The notice starts with a clear statement indicating that the application for credit has been denied. 2. Reason for Denial: The notice provides a detailed explanation of the reasons behind the credit denial. This can include factors such as poor credit history, insufficient income, high debt levels, lack of collateral, or other relevant creditworthiness criteria. 3. Credit Reporting Agencies: The notice may include information on the credit reporting agencies from which the lender obtained the applicant's credit report. It may also specify the individual's right to request a free copy of their credit report to review for accuracy. 4. Contact Information: The notice usually provides the lender's contact details, allowing the recipient to inquire about the denial or seek additional information if needed. 5. Fair Credit Reporting Act (FCRA) Disclosure: In compliance with the FCRA, the notice explains the individual's rights, including the right to dispute inaccurate information on their credit report and the right to receive a copy of their report. In summary, the Phoenix Arizona Credit Denial — Notice is a crucial document that discloses information about the denial of credit to individuals or businesses. It aims to provide transparency, clarity, and an opportunity for recipients to rectify any discrepancies or improve their creditworthiness in the future.Phoenix Arizona Credit Denial — Notice is a legal document that informs an individual or business entity of the denial of credit by a lender or financial institution based in Phoenix, Arizona. It is a crucial form of communication used to notify the recipient about the rejection of their credit application and the reasons behind such a decision. The purpose of the Phoenix Arizona Credit Denial — Notice is to provide clear and concise information regarding the factors that led to the denial of credit. This notice ensures transparency and fairness in the credit evaluation process, allowing the recipient to understand why their application was rejected. This type of notice may vary depending on the specific circumstances and the lender's policies. There can be different types of Phoenix Arizona Credit Denial — Notice, including: 1. Phoenix Arizona Credit Denial — Notice for Individual Applicants: This notice is typically intended for individuals who have applied for personal credit, such as credit cards, personal loans, mortgages, or automobile loans. 2. Phoenix Arizona Credit Denial — Notice for Business Applicants: This notice is targeted towards businesses or organizations that have applied for credit, including business loans, lines of credit, or vendor credit accounts. The Phoenix Arizona Credit Denial — Notice generally contains the following key information: 1. Introduction: The notice starts with a clear statement indicating that the application for credit has been denied. 2. Reason for Denial: The notice provides a detailed explanation of the reasons behind the credit denial. This can include factors such as poor credit history, insufficient income, high debt levels, lack of collateral, or other relevant creditworthiness criteria. 3. Credit Reporting Agencies: The notice may include information on the credit reporting agencies from which the lender obtained the applicant's credit report. It may also specify the individual's right to request a free copy of their credit report to review for accuracy. 4. Contact Information: The notice usually provides the lender's contact details, allowing the recipient to inquire about the denial or seek additional information if needed. 5. Fair Credit Reporting Act (FCRA) Disclosure: In compliance with the FCRA, the notice explains the individual's rights, including the right to dispute inaccurate information on their credit report and the right to receive a copy of their report. In summary, the Phoenix Arizona Credit Denial — Notice is a crucial document that discloses information about the denial of credit to individuals or businesses. It aims to provide transparency, clarity, and an opportunity for recipients to rectify any discrepancies or improve their creditworthiness in the future.