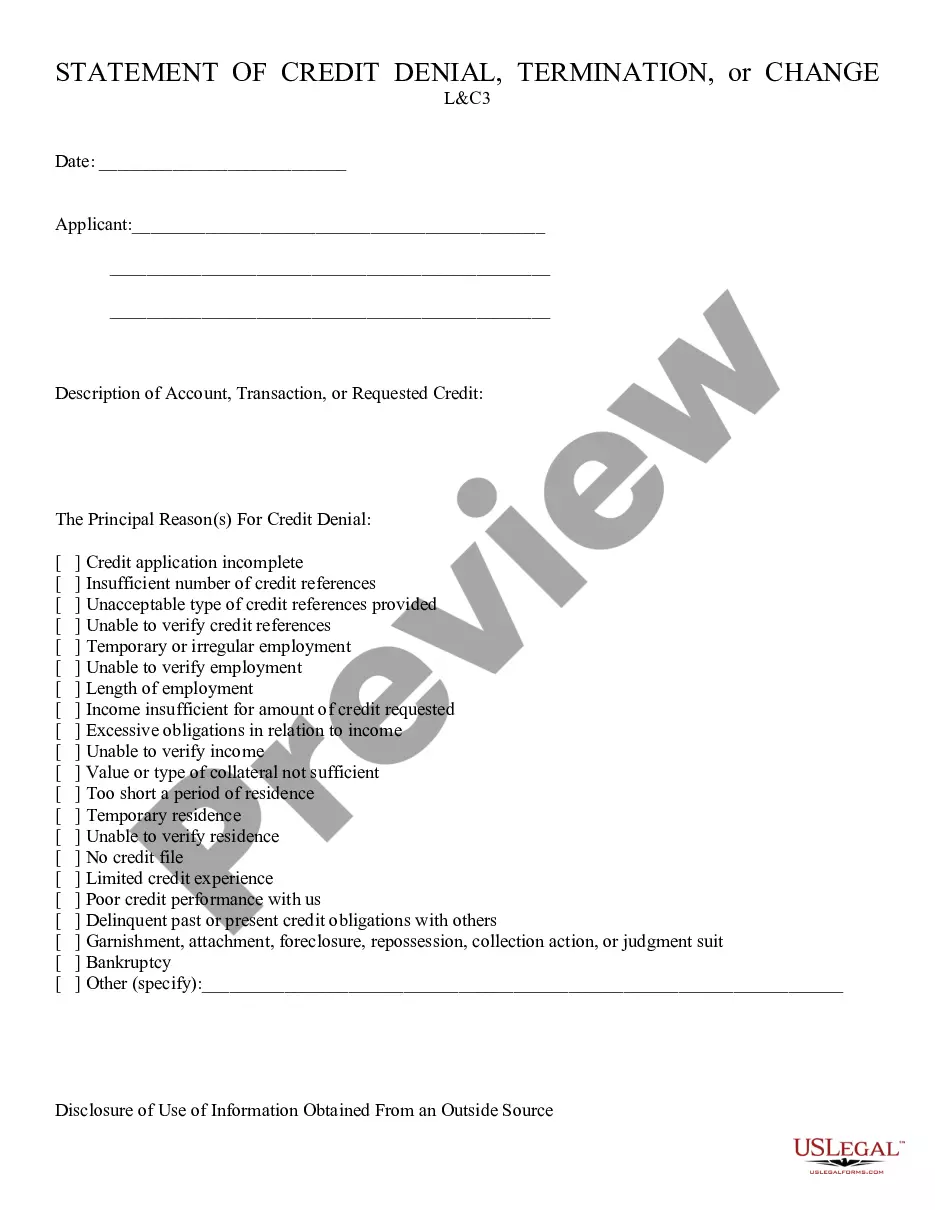

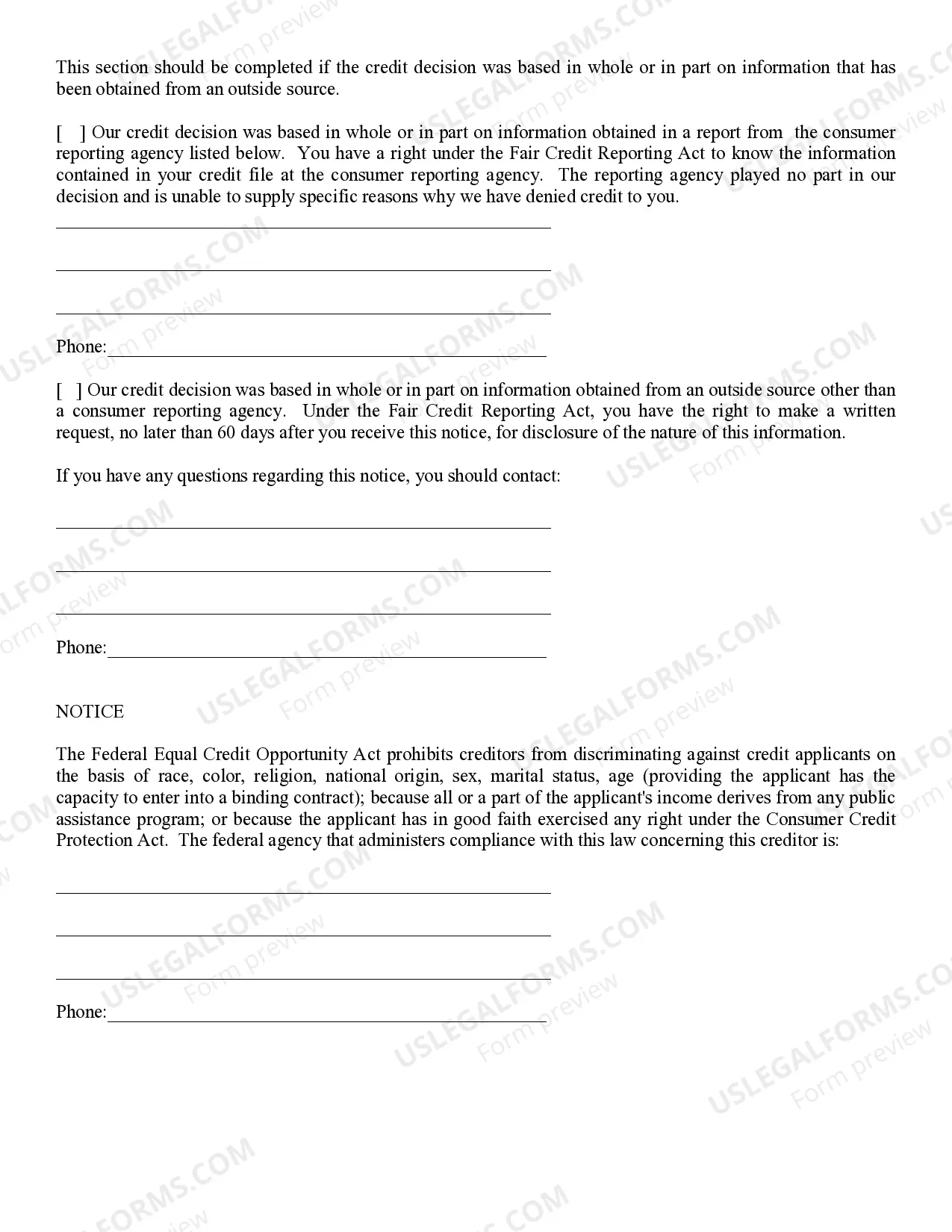

Credit Denial - Notice: This is Notice of Credit Denial which is sent to the party applying for a line of credit. It allows them to know their application has been denied, and normally, why it was denied. This form is available for download in both Word and Rich Text formats.

Lima Arizona Credit Denial — Notice is a formal document issued by financial institutions or lenders in Lima, Arizona, to inform individuals or entities about their credit denial status. It provides crucial information regarding the reasons behind the credit denial, including an assessment of the applicant's financial history, credit score, payment records, and other relevant factors that contributed to the decision. This notice aims to ensure transparency and compliance with credit evaluation regulations. There are various types of Lima Arizona Credit Denial — Notices that individuals may encounter: 1. Personal Loan Credit Denial — Notice: This type of notice specifically refers to the denial of a personal loan application. It outlines the specific reasons for the denial, such as insufficient income, high debt-to-income ratio, previous loan defaults, or negative credit history. 2. Mortgage Loan Credit Denial — Notice: When individuals apply for a mortgage loan in Lima, Arizona, they may receive a mortgage loan credit denial notice if their application does not meet the lender's requirements. The notice will provide detailed explanations for the denial, including factors such as low credit score, inadequate income to debt ratio, or inadequate collateral. 3. Credit Card Application Denial — Notice: When individuals apply for a credit card in Lima, Arizona, they may receive a credit card application denial notice if their creditworthiness does not meet the criteria set by the credit card issuer. The notice will indicate reasons like a history of late payments, high credit utilization, or a negative credit report. 4. Business Loan Credit Denial — Notice: Entrepreneurs or business owners applying for a business loan in Lima, Arizona, may receive a business loan credit denial notice if their application fails to meet the lender's requirements. The notice will outline the specific reasons for the denial, which may include poor business credit history, insufficient cash flow, or inadequate collateral. In summary, Lima Arizona Credit Denial — Notice is a formal document that communicates the credit denial status and provides a detailed explanation of the reasons behind the decision. It ensures transparency and allows individuals to understand the factors that led to their credit denial.Lima Arizona Credit Denial — Notice is a formal document issued by financial institutions or lenders in Lima, Arizona, to inform individuals or entities about their credit denial status. It provides crucial information regarding the reasons behind the credit denial, including an assessment of the applicant's financial history, credit score, payment records, and other relevant factors that contributed to the decision. This notice aims to ensure transparency and compliance with credit evaluation regulations. There are various types of Lima Arizona Credit Denial — Notices that individuals may encounter: 1. Personal Loan Credit Denial — Notice: This type of notice specifically refers to the denial of a personal loan application. It outlines the specific reasons for the denial, such as insufficient income, high debt-to-income ratio, previous loan defaults, or negative credit history. 2. Mortgage Loan Credit Denial — Notice: When individuals apply for a mortgage loan in Lima, Arizona, they may receive a mortgage loan credit denial notice if their application does not meet the lender's requirements. The notice will provide detailed explanations for the denial, including factors such as low credit score, inadequate income to debt ratio, or inadequate collateral. 3. Credit Card Application Denial — Notice: When individuals apply for a credit card in Lima, Arizona, they may receive a credit card application denial notice if their creditworthiness does not meet the criteria set by the credit card issuer. The notice will indicate reasons like a history of late payments, high credit utilization, or a negative credit report. 4. Business Loan Credit Denial — Notice: Entrepreneurs or business owners applying for a business loan in Lima, Arizona, may receive a business loan credit denial notice if their application fails to meet the lender's requirements. The notice will outline the specific reasons for the denial, which may include poor business credit history, insufficient cash flow, or inadequate collateral. In summary, Lima Arizona Credit Denial — Notice is a formal document that communicates the credit denial status and provides a detailed explanation of the reasons behind the decision. It ensures transparency and allows individuals to understand the factors that led to their credit denial.