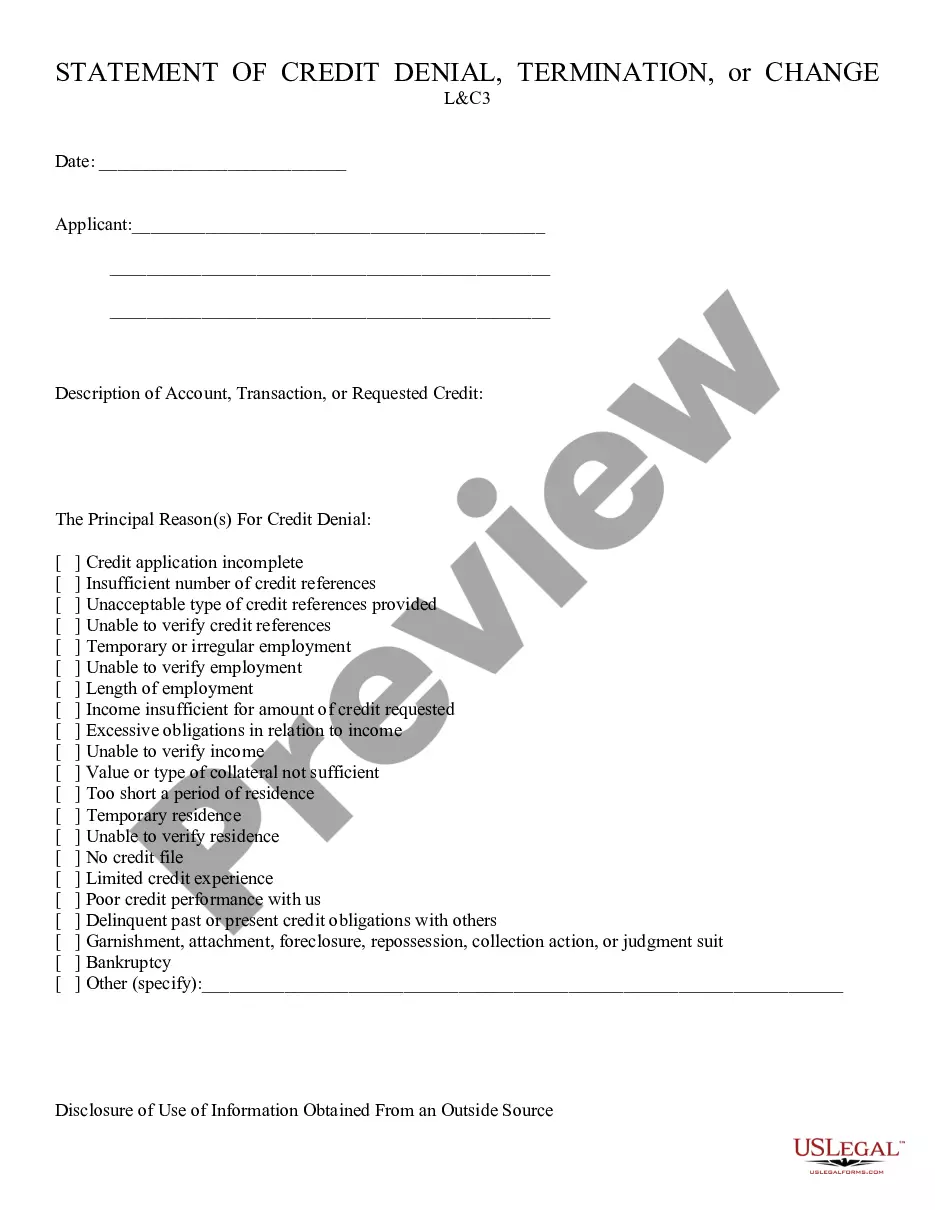

Credit Denial - Notice: This is Notice of Credit Denial which is sent to the party applying for a line of credit. It allows them to know their application has been denied, and normally, why it was denied. This form is available for download in both Word and Rich Text formats.

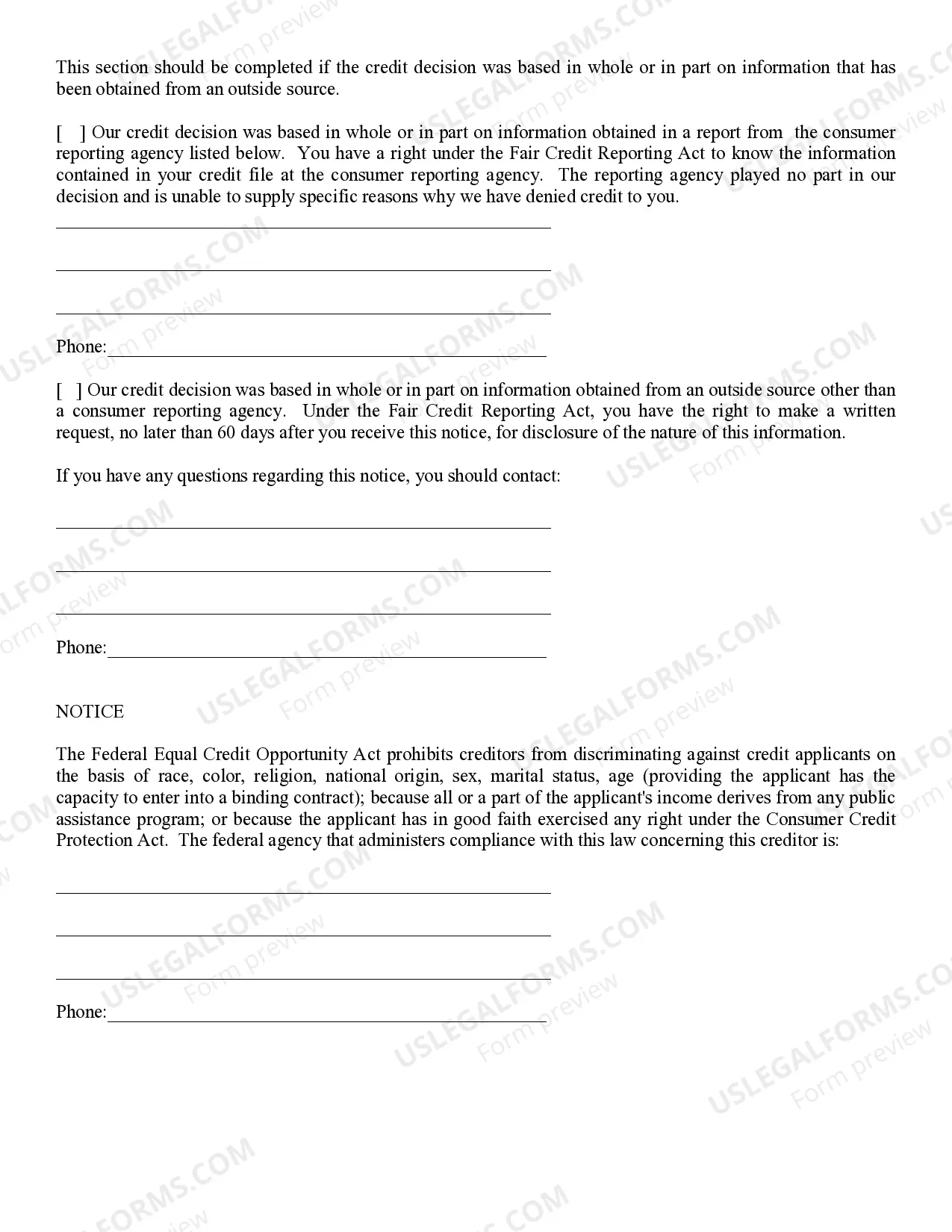

Scottsdale Arizona Credit Denial — Notice is a communication issued by a financial institution or lending agency based in Scottsdale, Arizona, informing individuals or businesses about the rejection of their credit application or request for credit extension. It serves as a formal notification outlining the reasons behind the denial and offers necessary information regarding the applicant's credit evaluation. In Scottsdale, Arizona, Credit Denial — Notice plays a crucial role in the financial landscape, as individuals and businesses rely on credit facilities to meet their diverse needs. The notice helps applicants understand why their credit request was denied, thus allowing them to take appropriate measures to improve their creditworthiness in the future. Keywords: Scottsdale, Arizona, credit denial, notice, financial institution, lending agency, rejection, credit application, credit extension, formal notification, reasons, credit evaluation, financial landscape, credit facilities, needs, creditworthiness Types of Scottsdale Arizona Credit Denial — Notice: 1. Personal CrediDenialia— - Notice: This type of notice is specific to individuals who have applied for personal credit, such as credit cards, personal loans, or mortgages, and have received a denial based on the evaluation of their personal credit history, income, or other relevant factors. 2. Business Credit Denial — Notice: This notice is directed towards businesses that have requested credit for various purposes, such as working capital, expansion, or inventory financing. It informs the applicants about the denial of their business credit application, citing reasons related to their business financials, credit history, or industry risk. 3. Student Credit Denial — Notice: This type of notice is issued to students who have applied for credit options, like student loans or credit cards designed for students, and have been denied due to insufficient credit history, income, or other factors assessed during the credit evaluation process. 4. Secured Credit Denial — Notice: This notice pertains to individuals or businesses who have applied for credit facilities secured against collateral (e.g., a car loan or home equity line of credit) but have been denied due to factors such as inadequate collateral value, credit history, or income. By receiving a Scottsdale Arizona Credit Denial — Notice, applicants gain valuable insights into the specific reasons behind the rejection, allowing them to take appropriate actions to address those issues and improve their chances of obtaining credit in the future.Scottsdale Arizona Credit Denial — Notice is a communication issued by a financial institution or lending agency based in Scottsdale, Arizona, informing individuals or businesses about the rejection of their credit application or request for credit extension. It serves as a formal notification outlining the reasons behind the denial and offers necessary information regarding the applicant's credit evaluation. In Scottsdale, Arizona, Credit Denial — Notice plays a crucial role in the financial landscape, as individuals and businesses rely on credit facilities to meet their diverse needs. The notice helps applicants understand why their credit request was denied, thus allowing them to take appropriate measures to improve their creditworthiness in the future. Keywords: Scottsdale, Arizona, credit denial, notice, financial institution, lending agency, rejection, credit application, credit extension, formal notification, reasons, credit evaluation, financial landscape, credit facilities, needs, creditworthiness Types of Scottsdale Arizona Credit Denial — Notice: 1. Personal CrediDenialia— - Notice: This type of notice is specific to individuals who have applied for personal credit, such as credit cards, personal loans, or mortgages, and have received a denial based on the evaluation of their personal credit history, income, or other relevant factors. 2. Business Credit Denial — Notice: This notice is directed towards businesses that have requested credit for various purposes, such as working capital, expansion, or inventory financing. It informs the applicants about the denial of their business credit application, citing reasons related to their business financials, credit history, or industry risk. 3. Student Credit Denial — Notice: This type of notice is issued to students who have applied for credit options, like student loans or credit cards designed for students, and have been denied due to insufficient credit history, income, or other factors assessed during the credit evaluation process. 4. Secured Credit Denial — Notice: This notice pertains to individuals or businesses who have applied for credit facilities secured against collateral (e.g., a car loan or home equity line of credit) but have been denied due to factors such as inadequate collateral value, credit history, or income. By receiving a Scottsdale Arizona Credit Denial — Notice, applicants gain valuable insights into the specific reasons behind the rejection, allowing them to take appropriate actions to address those issues and improve their chances of obtaining credit in the future.