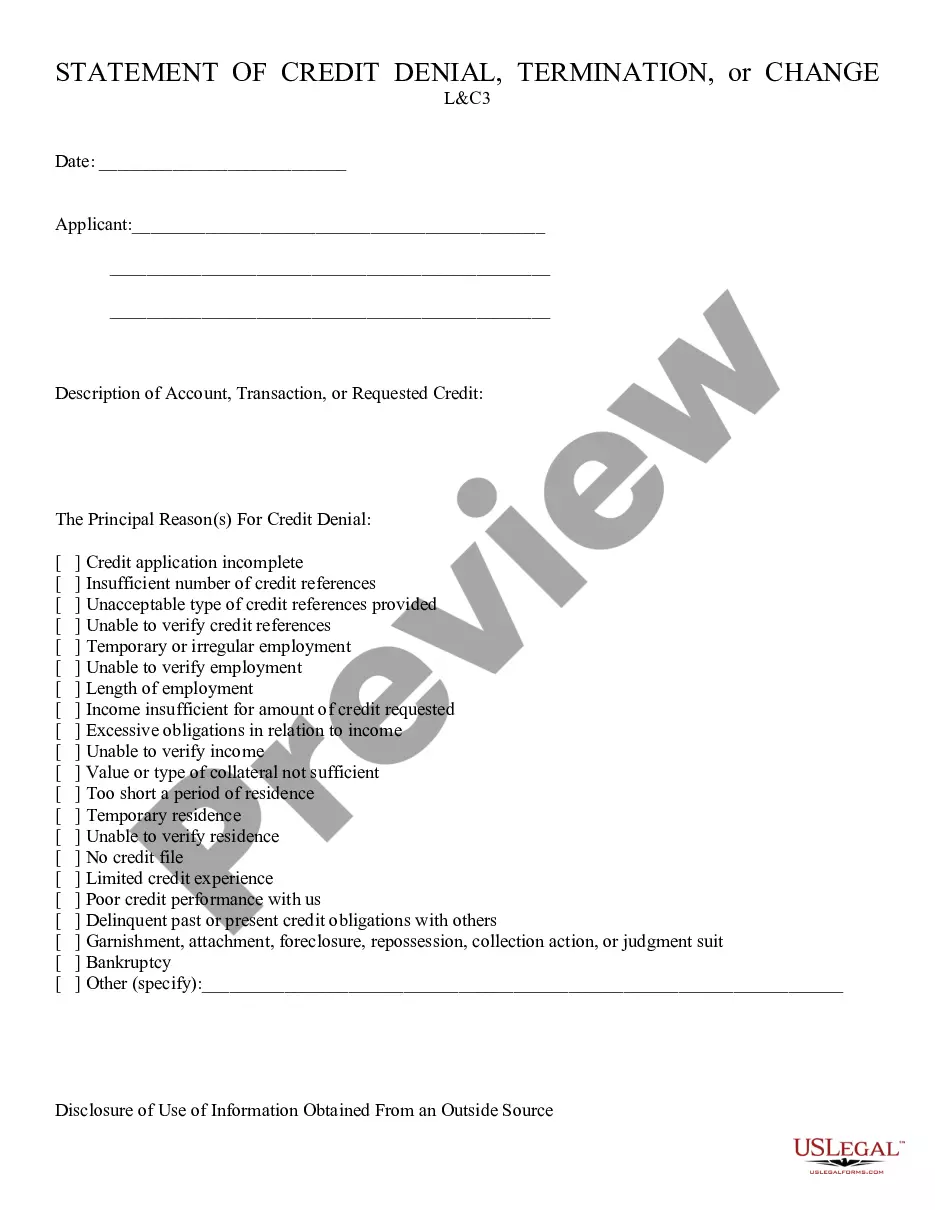

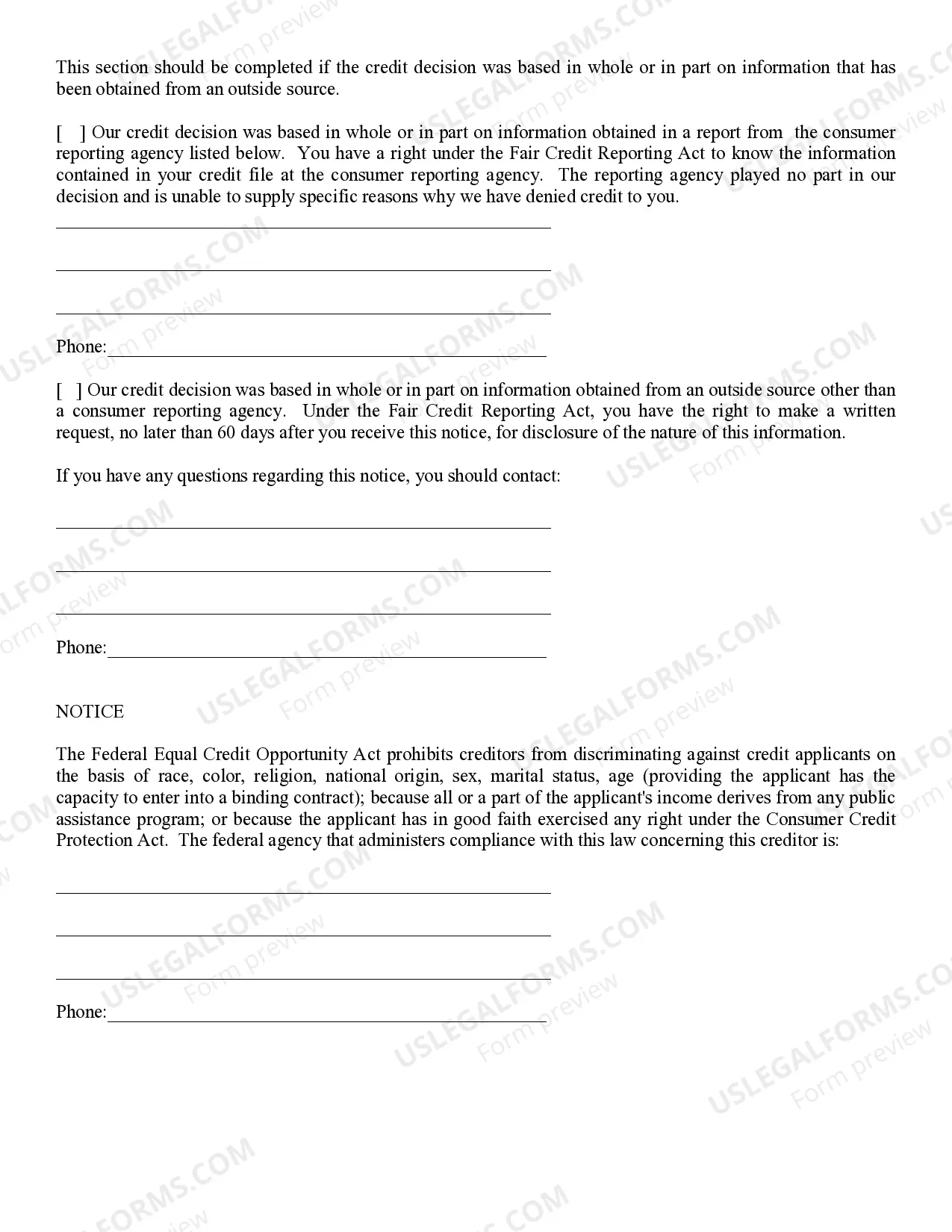

Credit Denial - Notice: This is Notice of Credit Denial which is sent to the party applying for a line of credit. It allows them to know their application has been denied, and normally, why it was denied. This form is available for download in both Word and Rich Text formats.

Tempe Arizona Credit Denial — Notice is an official communication issued by credit institutions or lenders located in Tempe, Arizona, informing individuals about the rejection of their credit application. It serves as a written explanation for the denial and provides relevant details regarding the reasons behind the decision. In the context of Tempe, Arizona, there are different types of credit denial notices that may be received by individuals: 1. Tempe Arizona Mortgage Credit Denial — Notice: This denial notice refers specifically to mortgage loan applications. It outlines the factors that led to the denial, such as poor credit history, insufficient income, high debt-to-income ratio, or other relevant reasons related to the mortgage lending process. 2. Tempe Arizona Auto Loan Credit Denial — Notice: This type of denial notice is specific to auto loan applications. It states the specific reasons for the credit denial, such as a low credit score, past auto loan default, or inadequate income to support the loan repayment. 3. Tempe Arizona Personal Loan Credit Denial — Notice: This denial notice pertains to applications for personal loans in Tempe, Arizona. It explains the reasons for the denial, such as a high debt load, recent bankruptcies, insufficient credit history, or low credit score. In general, a Tempe Arizona Credit Denial — Notice includes important information such as the applicant's name, contact details, the date of the denial notice, the name of the lending institution, and a detailed explanation of why the credit application was rejected. It may also include instructions on how to obtain a free credit report, allowing applicants to review their credit history for potential errors or discrepancies that may have contributed to the denial. Receiving a Tempe Arizona Credit Denial — Notice can be disappointing, but it is crucial for individuals to carefully review the reasons provided. This will help in identifying areas for improvement and taking necessary actions to enhance their creditworthiness in the future. It's vital to remember that credit denial notices serve as valuable feedback to guide individuals towards better financial decisions and credit management practices.Tempe Arizona Credit Denial — Notice is an official communication issued by credit institutions or lenders located in Tempe, Arizona, informing individuals about the rejection of their credit application. It serves as a written explanation for the denial and provides relevant details regarding the reasons behind the decision. In the context of Tempe, Arizona, there are different types of credit denial notices that may be received by individuals: 1. Tempe Arizona Mortgage Credit Denial — Notice: This denial notice refers specifically to mortgage loan applications. It outlines the factors that led to the denial, such as poor credit history, insufficient income, high debt-to-income ratio, or other relevant reasons related to the mortgage lending process. 2. Tempe Arizona Auto Loan Credit Denial — Notice: This type of denial notice is specific to auto loan applications. It states the specific reasons for the credit denial, such as a low credit score, past auto loan default, or inadequate income to support the loan repayment. 3. Tempe Arizona Personal Loan Credit Denial — Notice: This denial notice pertains to applications for personal loans in Tempe, Arizona. It explains the reasons for the denial, such as a high debt load, recent bankruptcies, insufficient credit history, or low credit score. In general, a Tempe Arizona Credit Denial — Notice includes important information such as the applicant's name, contact details, the date of the denial notice, the name of the lending institution, and a detailed explanation of why the credit application was rejected. It may also include instructions on how to obtain a free credit report, allowing applicants to review their credit history for potential errors or discrepancies that may have contributed to the denial. Receiving a Tempe Arizona Credit Denial — Notice can be disappointing, but it is crucial for individuals to carefully review the reasons provided. This will help in identifying areas for improvement and taking necessary actions to enhance their creditworthiness in the future. It's vital to remember that credit denial notices serve as valuable feedback to guide individuals towards better financial decisions and credit management practices.