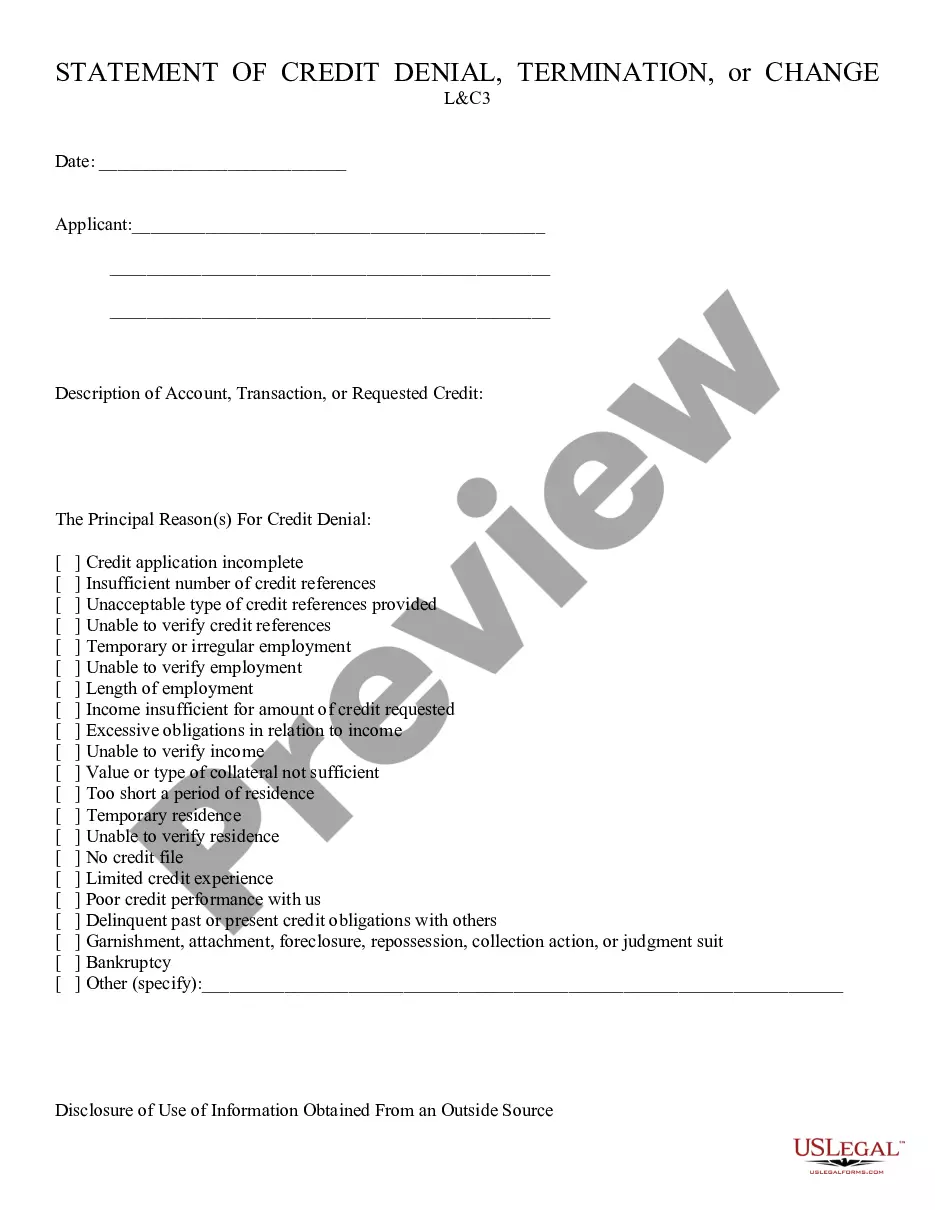

Credit Denial - Notice: This is Notice of Credit Denial which is sent to the party applying for a line of credit. It allows them to know their application has been denied, and normally, why it was denied. This form is available for download in both Word and Rich Text formats.

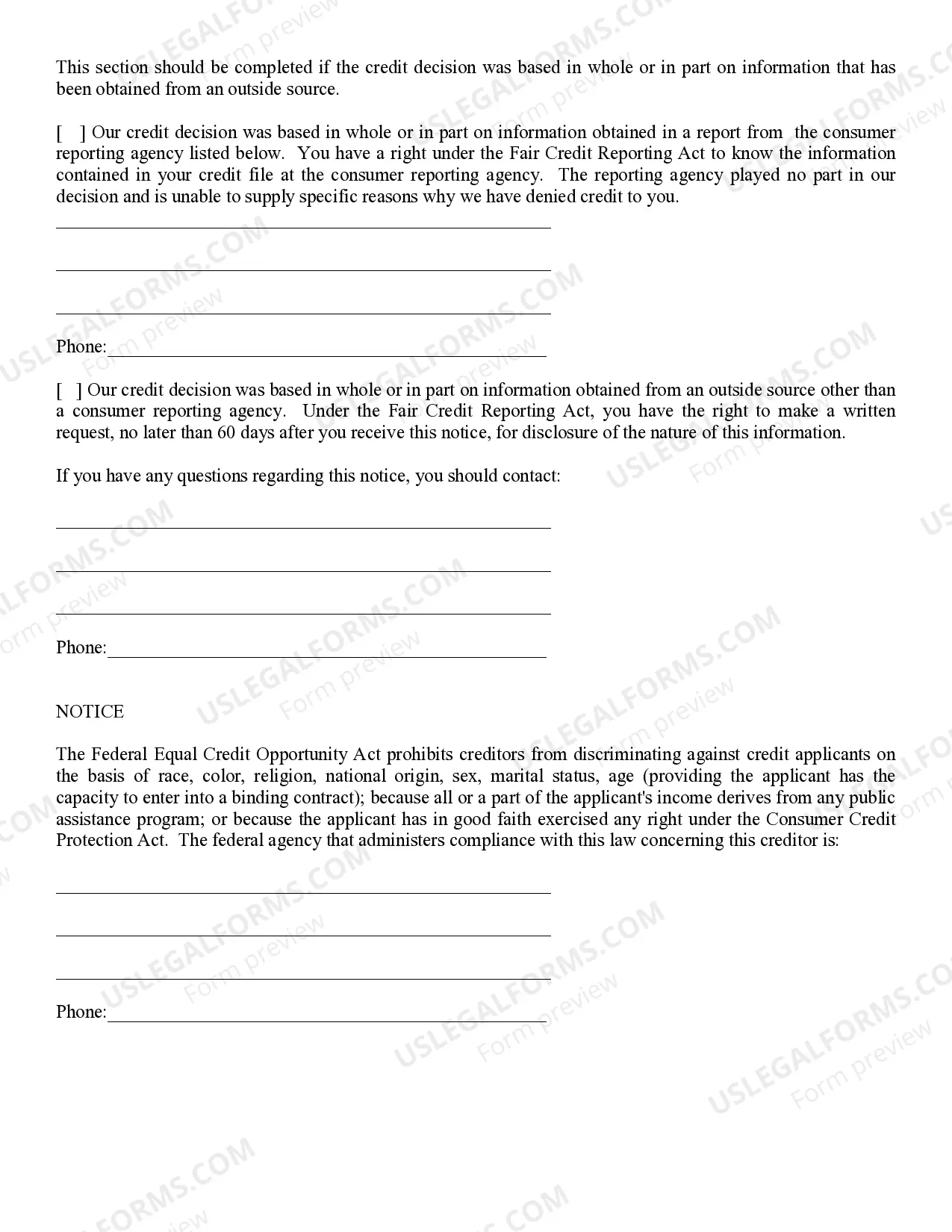

Tucson Arizona Credit Denial — Notice: Understanding its Types and Detailed Description Keywords: Tucson, Arizona, Credit Denial, Notice, Types Introduction: In Tucson, Arizona, credit denial notices serve as official communication issued by financial institutions to inform individuals about the rejection of their credit application. These notices play a crucial role in informing applicants of the reasons behind the denial and provide them with essential information on steps to take for credit improvement. While there might be various types of Tucson Arizona Credit Denial — Notices, they share the common goal of notifying individuals about their credit application status. Types of Tucson Arizona Credit Denial — Notice: 1. Standard CrediDenialia— - Notice: The standard credit denial notice is a formal document provided by financial institutions to notify individuals that their credit application has been rejected. This type of notice typically outlines the primary reason(s) for the denial, such as a low credit score, insufficient income, or existing delinquencies. It also highlights the applicant's right to request a free credit report within a specific time frame and emphasizes the importance of credit improvement. 2. Adverse Action Notice: Under the Fair Credit Reporting Act (FCRA), financial institutions are legally obligated to issue an adverse action notice to applicants whose credit requests have been declined. This notice explicitly informs individuals that the decision to deny credit was based on information obtained from a credit report. It includes the credit reporting agency's contact information and guidelines on obtaining a free copy of the credit report used in the decision-making process. 3. Risk-Based Pricing Notice: If a lender approves a credit application but offers credit terms less favorable than expected, they are required to issue a risk-based pricing notice. This notice discloses that the terms offered are based on an assessment of the applicant's creditworthiness and credit report. It provides information on the credit scores used and advises individuals of their right to request a free credit report within a certain period. Detailed Description of Tucson Arizona Credit Denial — Notice: A Tucson Arizona Credit Denial — Notice is a formal document that informs individuals about the decision to decline their credit application. It generally includes important details such as the applicant's name and address, the date of the notice, and the reasons that contributed to the denial. The notice will specify the primary factors that influenced the decision, which may include a low credit score, excessive debt, a history of delinquencies or bankruptcies, insufficient income, or other relevant financial indicators. It aims to provide transparency to the applicant, allowing them to understand why their credit request was unsuccessful. Additionally, the Tucson Arizona Credit Denial — Notice typically highlights the applicant's rights. These rights may include obtaining a free copy of the credit report related to the decision within a specific time frame, as well as the right to dispute any inaccuracies found in the report. Moreover, the notice often includes advice on steps individuals can take to improve their creditworthiness and increase the likelihood of future credit approval. This guidance may recommend actions such as paying bills on time, reducing debt, establishing a good payment history, or seeking credit counseling. Conclusion: In Tucson, Arizona, credit denial notices play a crucial role in informing individuals about the rejection of their credit application. These notices come in different forms, including standard credit denial notices, adverse action notices, and risk-based pricing notices. Regardless of the type, these notices provide detailed information on the reasons for denial, credit reporting agencies' contact information, and guidance for credit improvement. Understanding these notices assists individuals in making informed decisions to enhance their creditworthiness in the future.Tucson Arizona Credit Denial — Notice: Understanding its Types and Detailed Description Keywords: Tucson, Arizona, Credit Denial, Notice, Types Introduction: In Tucson, Arizona, credit denial notices serve as official communication issued by financial institutions to inform individuals about the rejection of their credit application. These notices play a crucial role in informing applicants of the reasons behind the denial and provide them with essential information on steps to take for credit improvement. While there might be various types of Tucson Arizona Credit Denial — Notices, they share the common goal of notifying individuals about their credit application status. Types of Tucson Arizona Credit Denial — Notice: 1. Standard CrediDenialia— - Notice: The standard credit denial notice is a formal document provided by financial institutions to notify individuals that their credit application has been rejected. This type of notice typically outlines the primary reason(s) for the denial, such as a low credit score, insufficient income, or existing delinquencies. It also highlights the applicant's right to request a free credit report within a specific time frame and emphasizes the importance of credit improvement. 2. Adverse Action Notice: Under the Fair Credit Reporting Act (FCRA), financial institutions are legally obligated to issue an adverse action notice to applicants whose credit requests have been declined. This notice explicitly informs individuals that the decision to deny credit was based on information obtained from a credit report. It includes the credit reporting agency's contact information and guidelines on obtaining a free copy of the credit report used in the decision-making process. 3. Risk-Based Pricing Notice: If a lender approves a credit application but offers credit terms less favorable than expected, they are required to issue a risk-based pricing notice. This notice discloses that the terms offered are based on an assessment of the applicant's creditworthiness and credit report. It provides information on the credit scores used and advises individuals of their right to request a free credit report within a certain period. Detailed Description of Tucson Arizona Credit Denial — Notice: A Tucson Arizona Credit Denial — Notice is a formal document that informs individuals about the decision to decline their credit application. It generally includes important details such as the applicant's name and address, the date of the notice, and the reasons that contributed to the denial. The notice will specify the primary factors that influenced the decision, which may include a low credit score, excessive debt, a history of delinquencies or bankruptcies, insufficient income, or other relevant financial indicators. It aims to provide transparency to the applicant, allowing them to understand why their credit request was unsuccessful. Additionally, the Tucson Arizona Credit Denial — Notice typically highlights the applicant's rights. These rights may include obtaining a free copy of the credit report related to the decision within a specific time frame, as well as the right to dispute any inaccuracies found in the report. Moreover, the notice often includes advice on steps individuals can take to improve their creditworthiness and increase the likelihood of future credit approval. This guidance may recommend actions such as paying bills on time, reducing debt, establishing a good payment history, or seeking credit counseling. Conclusion: In Tucson, Arizona, credit denial notices play a crucial role in informing individuals about the rejection of their credit application. These notices come in different forms, including standard credit denial notices, adverse action notices, and risk-based pricing notices. Regardless of the type, these notices provide detailed information on the reasons for denial, credit reporting agencies' contact information, and guidance for credit improvement. Understanding these notices assists individuals in making informed decisions to enhance their creditworthiness in the future.