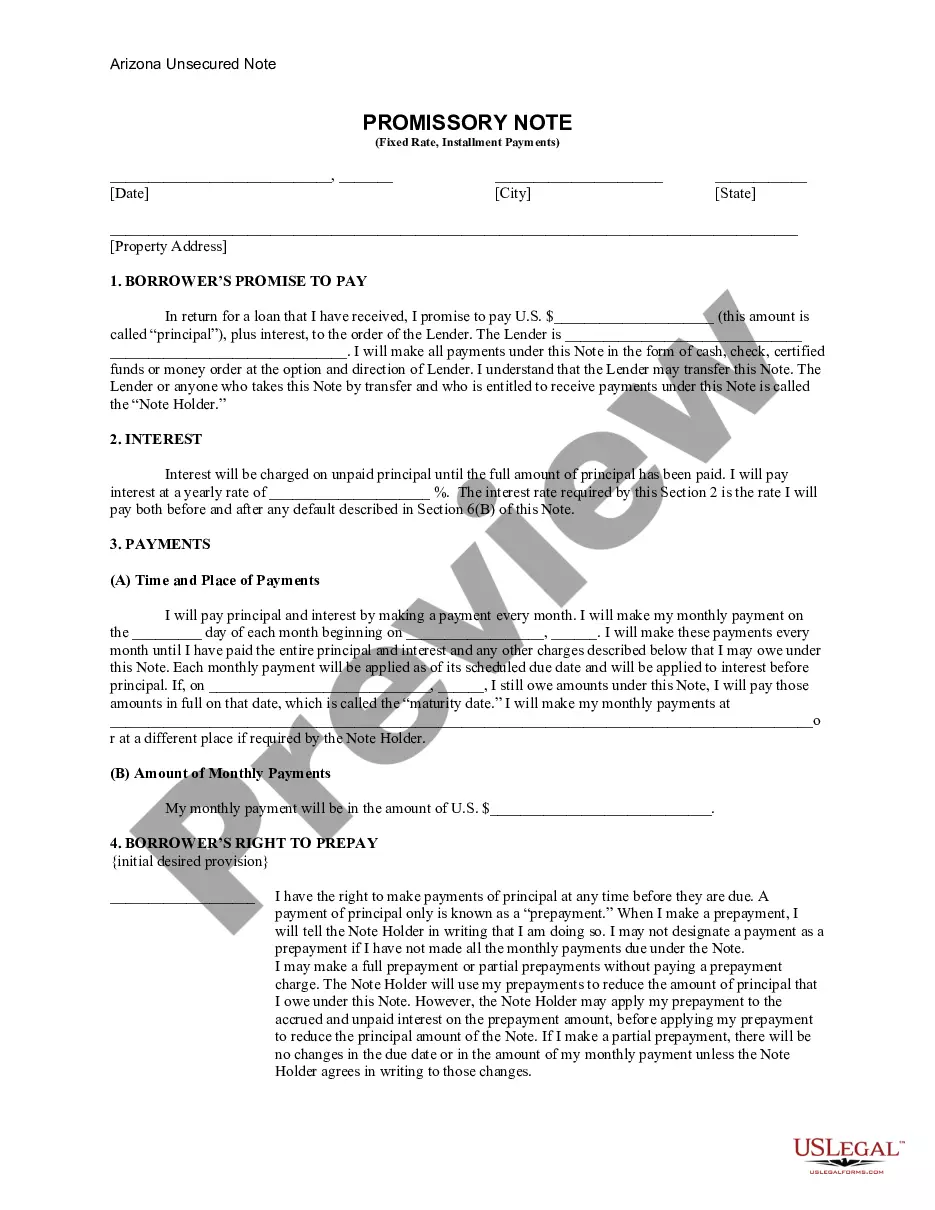

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

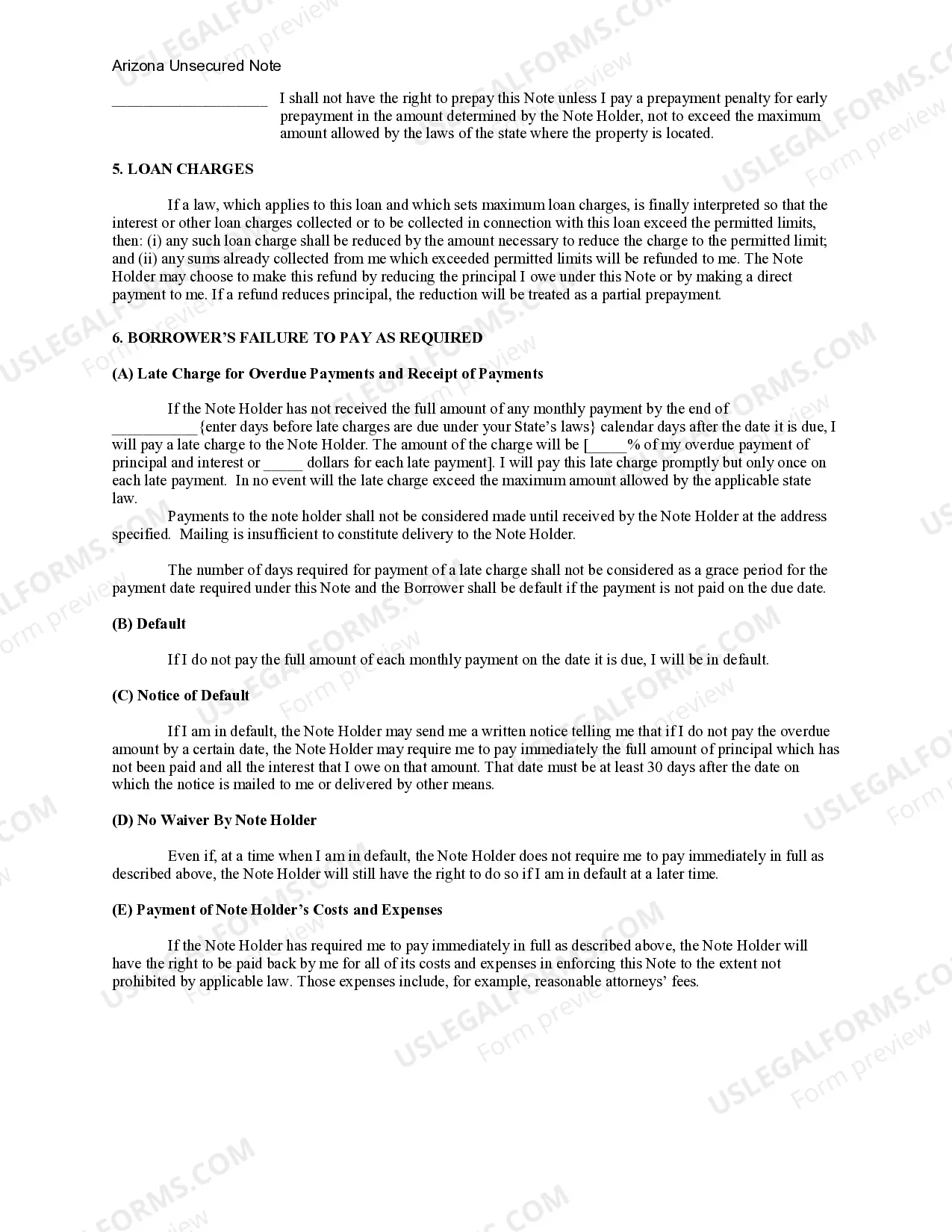

A Phoenix Arizona Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Arizona. This type of promissory note is specifically designed for unsecured loans, meaning that it does not require any collateral from the borrower. The promissory note sets out the essential details of the loan, such as the principal amount borrowed, the fixed interest rate that will be applied to the loan, and the agreed-upon repayment schedule. The fixed interest rate means that the interest rate will remain constant throughout the term of the loan, ensuring that the borrower's monthly payments remain predictable and consistent. The repayment terms in an unsecured installment payment promissory note typically involve a series of regular payments over a set period of time. These payments can be made monthly, quarterly, semi-annually, or annually, depending on the agreed-upon terms. Each payment comprises both interest and principal, with the aim of gradually reducing the outstanding balance of the loan. Different types of Phoenix Arizona Unsecured Installment Payment Promissory Notes for Fixed Rate may include variations in the repayment term, such as short-term (e.g., 6 months to 1 year), medium-term (e.g., 2 to 5 years), or long-term (e.g., 5 to 10 years) options. The promissory note may also include provisions for additional fees or penalties in case of late payments or loan default, as well as details regarding the consequences and potential legal actions that may be taken in such cases. It is important for both the lender and the borrower to carefully review and understand all the terms and conditions outlined in the Phoenix Arizona Unsecured Installment Payment Promissory Note for Fixed Rate before signing it. Consulting with legal professionals can provide additional guidance and ensure that the document is tailored to meet the specific needs and circumstances of the parties involved.A Phoenix Arizona Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Arizona. This type of promissory note is specifically designed for unsecured loans, meaning that it does not require any collateral from the borrower. The promissory note sets out the essential details of the loan, such as the principal amount borrowed, the fixed interest rate that will be applied to the loan, and the agreed-upon repayment schedule. The fixed interest rate means that the interest rate will remain constant throughout the term of the loan, ensuring that the borrower's monthly payments remain predictable and consistent. The repayment terms in an unsecured installment payment promissory note typically involve a series of regular payments over a set period of time. These payments can be made monthly, quarterly, semi-annually, or annually, depending on the agreed-upon terms. Each payment comprises both interest and principal, with the aim of gradually reducing the outstanding balance of the loan. Different types of Phoenix Arizona Unsecured Installment Payment Promissory Notes for Fixed Rate may include variations in the repayment term, such as short-term (e.g., 6 months to 1 year), medium-term (e.g., 2 to 5 years), or long-term (e.g., 5 to 10 years) options. The promissory note may also include provisions for additional fees or penalties in case of late payments or loan default, as well as details regarding the consequences and potential legal actions that may be taken in such cases. It is important for both the lender and the borrower to carefully review and understand all the terms and conditions outlined in the Phoenix Arizona Unsecured Installment Payment Promissory Note for Fixed Rate before signing it. Consulting with legal professionals can provide additional guidance and ensure that the document is tailored to meet the specific needs and circumstances of the parties involved.