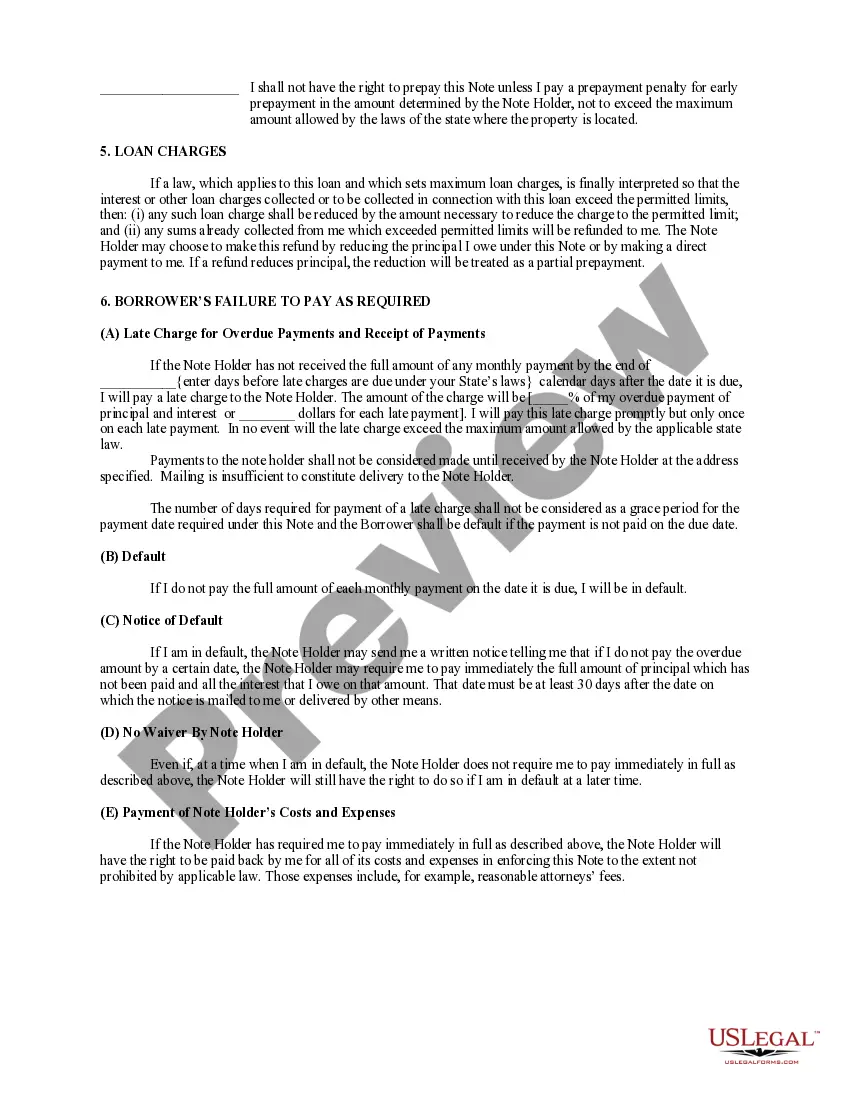

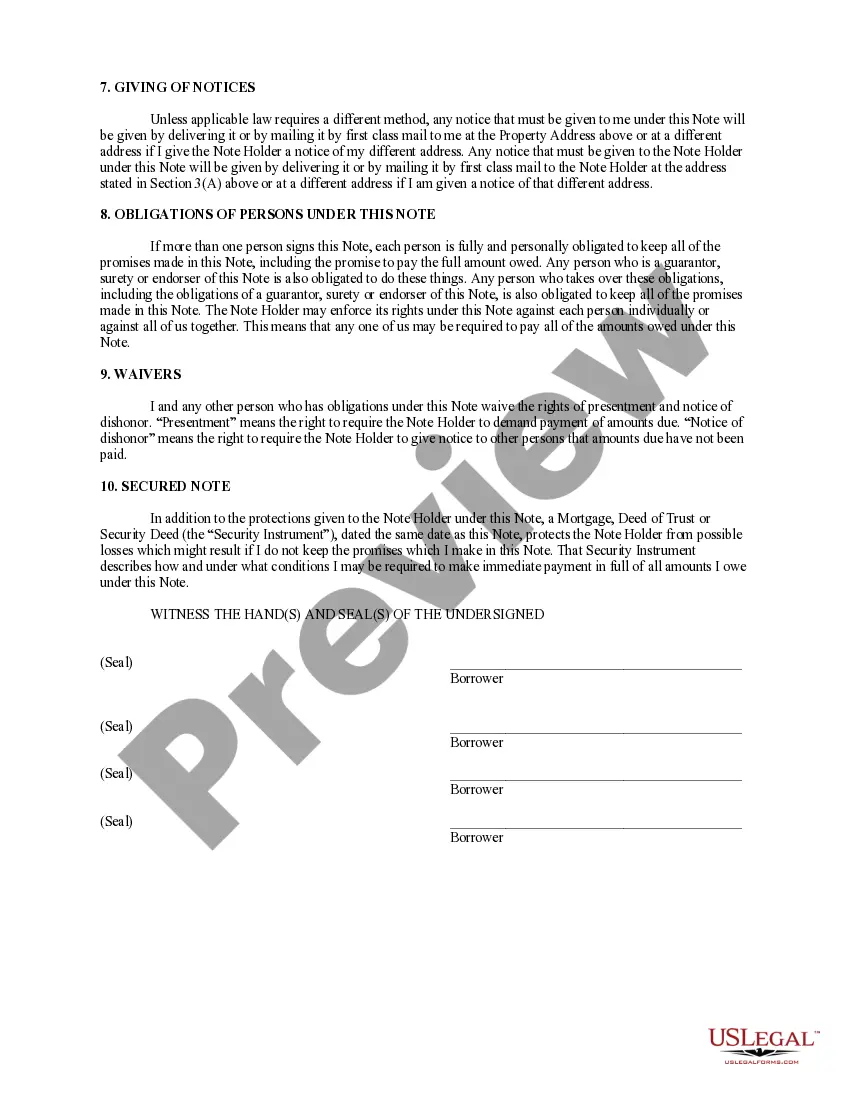

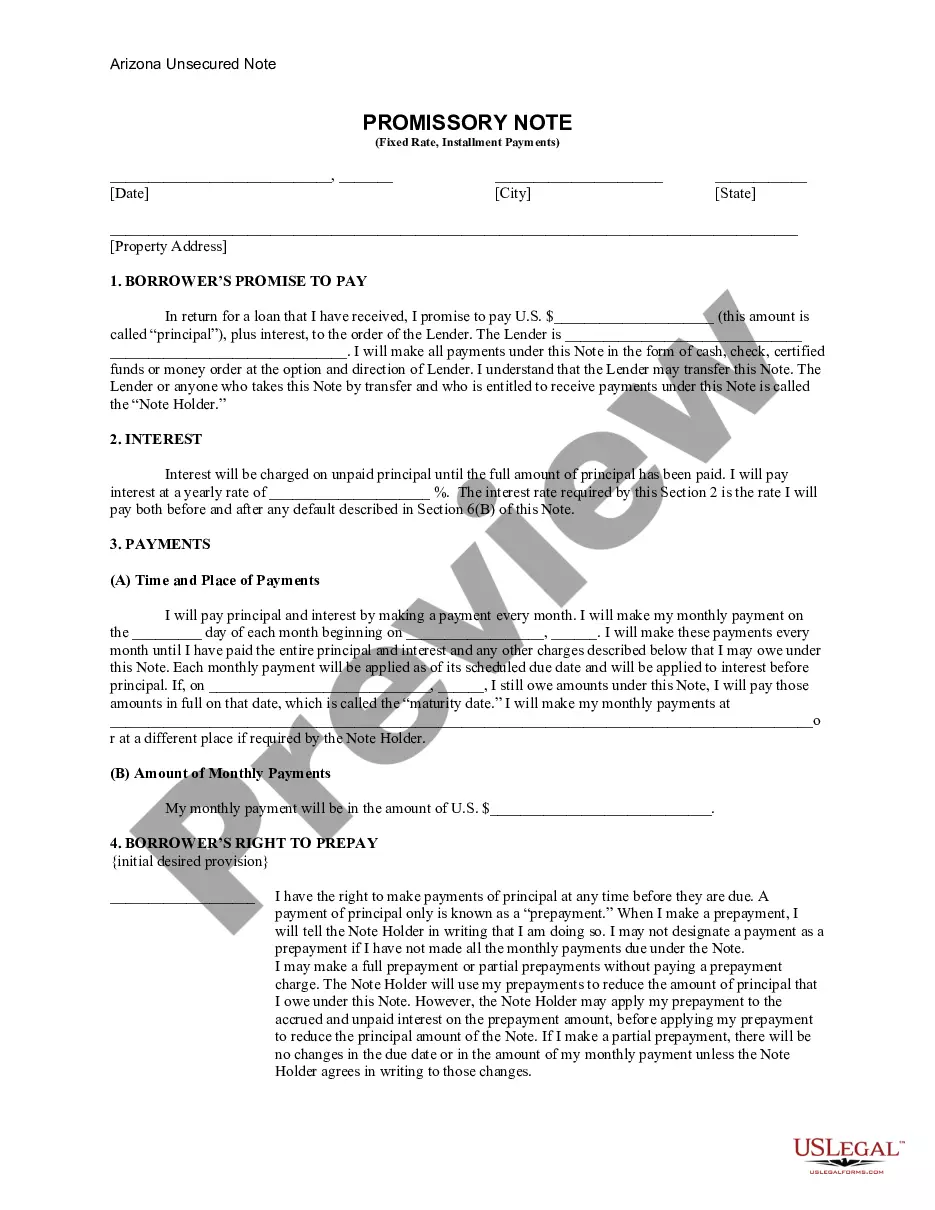

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Arizona Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you have previously accessed our service, Log In to your profile and download the Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate onto your device by selecting the Download button. Ensure that your subscription remains active. If not, please renew it as per your payment arrangement.

If this is your initial interaction with our service, follow these straightforward instructions to acquire your document.

You have continuous access to each document you have purchased: you can locate it in your profile under the My documents section whenever you need to retrieve it again. Leverage the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Ensure you’ve located a suitable document. Examine the description and utilize the Preview feature, if available, to verify if it aligns with your requirements. If it does not suit your needs, employ the Search tab above to discover the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription option.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Choose the file format for your document and download it to your device.

- Complete your sample. Print it out or utilize professional online tools to fill it out and sign it digitally.

Form popularity

FAQ

Executing a promissory note involves signing it by both the lender and the borrower, often in the presence of a witness or notary. It's crucial to ensure that all terms are clear and agreed upon before signing. A well-executed Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate safeguards both parties’ interests. To streamline this process, USLegalForms offers reliable templates to help you properly execute and document your promissory note.

Several factors can render a promissory note invalid, including lack of consideration, vague terms, or missing signatures. If the document does not meet the legal requirements or if one party was coerced into signing it, that could invalidate the note. In the case of your Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensuring clarity and fairness strengthens its validity. Using USLegalForms can help you avoid common pitfalls when creating your note.

Yes, promissory notes can be backed by various forms of collateral, significantly enhancing their security. Common collateral includes residential real estate or other valuable assets. When you back your note with real estate, such as a home in Scottsdale, Arizona, it assures lenders of recovery in case of default. USLegalForms provides templates to create a well-structured promissory note that is clearly secured.

A properly executed promissory note can hold up in court, provided it meets all legal requirements. This includes clear terms, mutual agreement, and proper signatures from both parties. By ensuring your document is thorough and legally sound, you can reinforce the validity of your Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate. With resources from USLegalForms, you can craft a robust note that stands strong in legal situations.

Yes, a promissory note can be secured by collateral, such as real estate. When you secure a note by an asset, it reduces the risk for the lender and increases the likelihood of repayment. In the context of a Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the real estate serves as valuable security, giving lenders peace of mind. Using USLegalForms can simplify the creation of a secured promissory note.

To turn a promissory note into a security, you must follow a specific legal process. Typically, this involves registering the note with the appropriate authorities and ensuring it includes all necessary disclosures. Furthermore, by ensuring the promissory note is backed by tangible assets, such as residential real estate in Scottsdale, Arizona, you enhance its security. USLegalForms can guide you through these steps to make your Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate a recognized security.

Yes, a properly drafted promissory note can hold up in court. In Arizona, courts recognize its validity as a legal instrument, provided it meets all necessary legal requirements. If you have a Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, make sure the document is clear and complies with state laws to enhance its enforceability in legal situations.

In Arizona, a promissory note remains valid for six years. This duration starts from the date of the last payment or the due date, making it essential for you to keep track of these timelines. If you are using a Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, be sure to consult a legal expert for specific terms and conditions related to your note.

A promissory note is often secured by collateral, which can be various forms of property or personal assets. In the case of a Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the collateral is usually the residential property in question. This means that should the borrower default on their payments, the lender has the right to claim the property to recover their investment. This security feature is beneficial for both lenders and borrowers, providing reassurance throughout the transaction.

Filling out a promissory note involves several key steps, starting with providing the names and addresses of both the borrower and the lender. Then, include details such as the amount borrowed, interest rate, repayment schedule, and the security provided by the property. For a Scottsdale Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you should also specify terms regarding late payments and defaults. Utilizing platforms like uslegalforms can simplify this process, ensuring all necessary elements are included correctly.