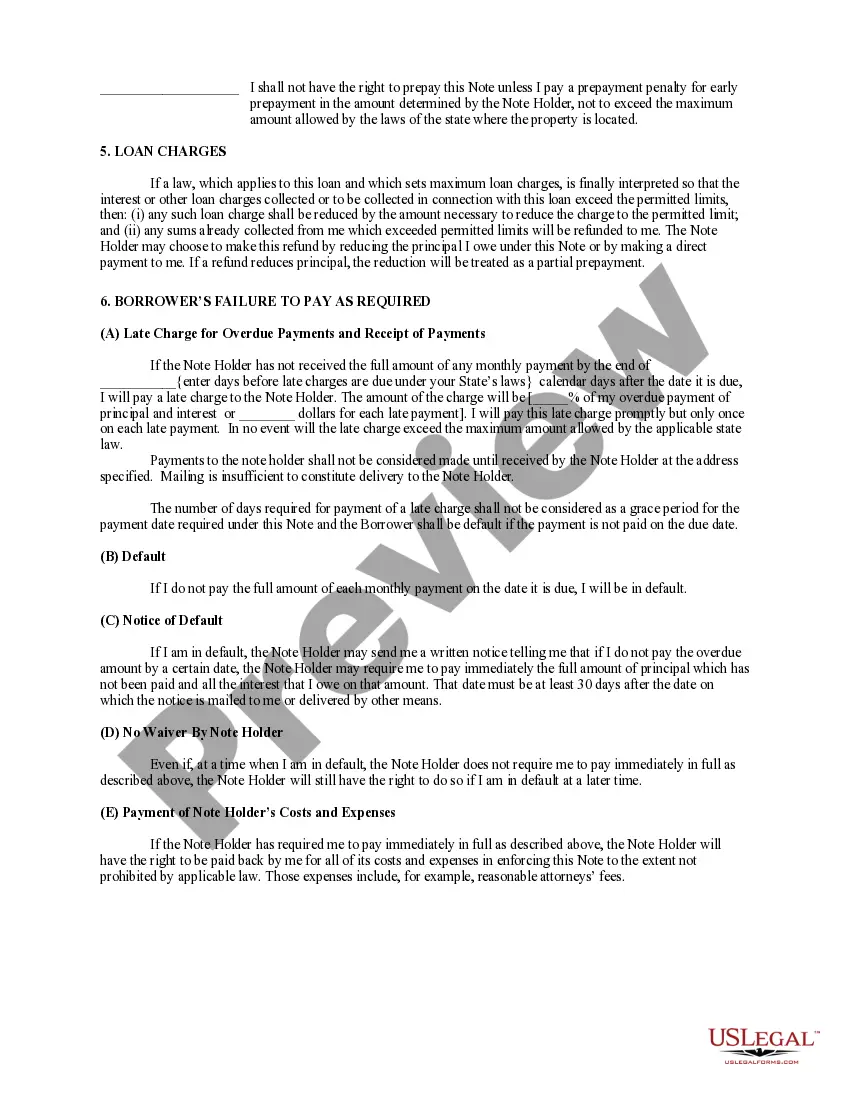

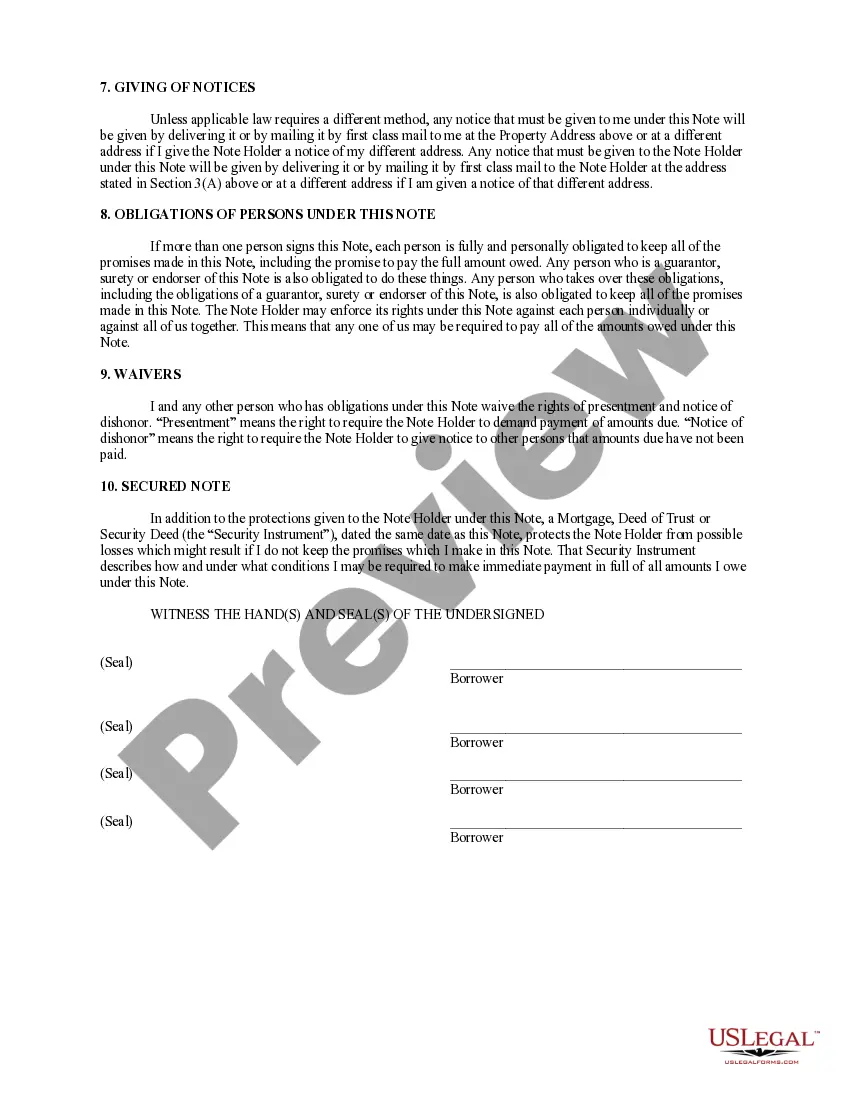

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

A Tucson Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan transaction between a lender and a borrower. The borrower pledges their residential real estate as collateral to secure the loan, providing a sense of security for the lender. These promissory notes are commonly used in real estate financing, enabling borrowers to obtain funds for various purposes such as home improvements, debt consolidation, or other personal financial needs. They are particularly beneficial for borrowers who prefer fixed interest rates and predictable monthly repayments over the life of the loan. Tucson, Arizona offers various types of Installments Fixed Rate Promissory Notes Secured by Residential Real Estate that cater to different borrower needs and circumstances. Some of these options may include: 1. Traditional Mortgage: This is the most common type of promissory note secured by residential real estate in Tucson. It involves a fixed interest rate and equal monthly installment payments over a predetermined period, typically 15 or 30 years. Borrowers can use this type of note to finance their primary residence or an investment property. 2. Home Equity Loan: Also known as a second mortgage, a home equity loan allows homeowners in Tucson to use the equity they have built in their residential real estate as collateral for a loan. This type of promissory note provides borrowers with a lump sum amount that they can repay in fixed installments over an agreed-upon term. 3. Home Equity Line of Credit (HELOT): Similar to a home equity loan, a HELOT allows Tucson homeowners to tap into their property's equity. However, instead of a lump sum, borrowers are granted access to a revolving line of credit. They can draw from this credit line as needed and pay interest only on the amount borrowed. Helots usually have variable interest rates. Regardless of the type chosen, Tucson Arizona Installments Fixed Rate Promissory Notes Secured by Residential Real Estate provide borrowers with the opportunity to access funds while leveraging the value of their property. These notes ensure a secure transaction for both parties involved, ultimately supporting the growth and stability of Tucson's real estate market.A Tucson Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan transaction between a lender and a borrower. The borrower pledges their residential real estate as collateral to secure the loan, providing a sense of security for the lender. These promissory notes are commonly used in real estate financing, enabling borrowers to obtain funds for various purposes such as home improvements, debt consolidation, or other personal financial needs. They are particularly beneficial for borrowers who prefer fixed interest rates and predictable monthly repayments over the life of the loan. Tucson, Arizona offers various types of Installments Fixed Rate Promissory Notes Secured by Residential Real Estate that cater to different borrower needs and circumstances. Some of these options may include: 1. Traditional Mortgage: This is the most common type of promissory note secured by residential real estate in Tucson. It involves a fixed interest rate and equal monthly installment payments over a predetermined period, typically 15 or 30 years. Borrowers can use this type of note to finance their primary residence or an investment property. 2. Home Equity Loan: Also known as a second mortgage, a home equity loan allows homeowners in Tucson to use the equity they have built in their residential real estate as collateral for a loan. This type of promissory note provides borrowers with a lump sum amount that they can repay in fixed installments over an agreed-upon term. 3. Home Equity Line of Credit (HELOT): Similar to a home equity loan, a HELOT allows Tucson homeowners to tap into their property's equity. However, instead of a lump sum, borrowers are granted access to a revolving line of credit. They can draw from this credit line as needed and pay interest only on the amount borrowed. Helots usually have variable interest rates. Regardless of the type chosen, Tucson Arizona Installments Fixed Rate Promissory Notes Secured by Residential Real Estate provide borrowers with the opportunity to access funds while leveraging the value of their property. These notes ensure a secure transaction for both parties involved, ultimately supporting the growth and stability of Tucson's real estate market.