This Small Business Accounting Package contains many of the business forms needed to operate and maintain a small business, including a variety of accounting forms. These forms may be adapted to suit your particular business or situation.

Included in your package are the following forms:

1. Profit and Loss Statement

2. Aging Accounts Payable form

3. Balance Sheet Deposit

4. Cash Disbursements and Receipts form

5. Check Request form

6. Daily Accounts Receivables form

7. Depreciation Schedule

8. Invoice

9. Petty Cash form

10. Purchase Order

11. Purchasing Cost Estimate

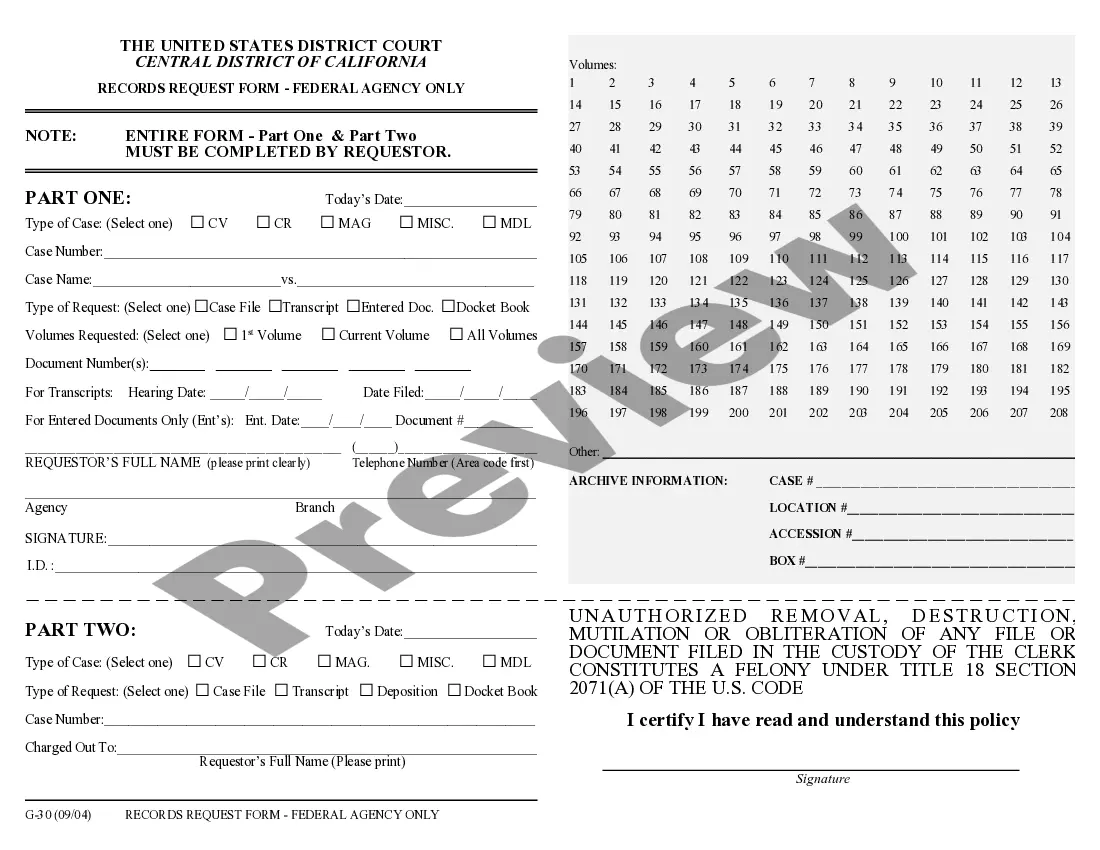

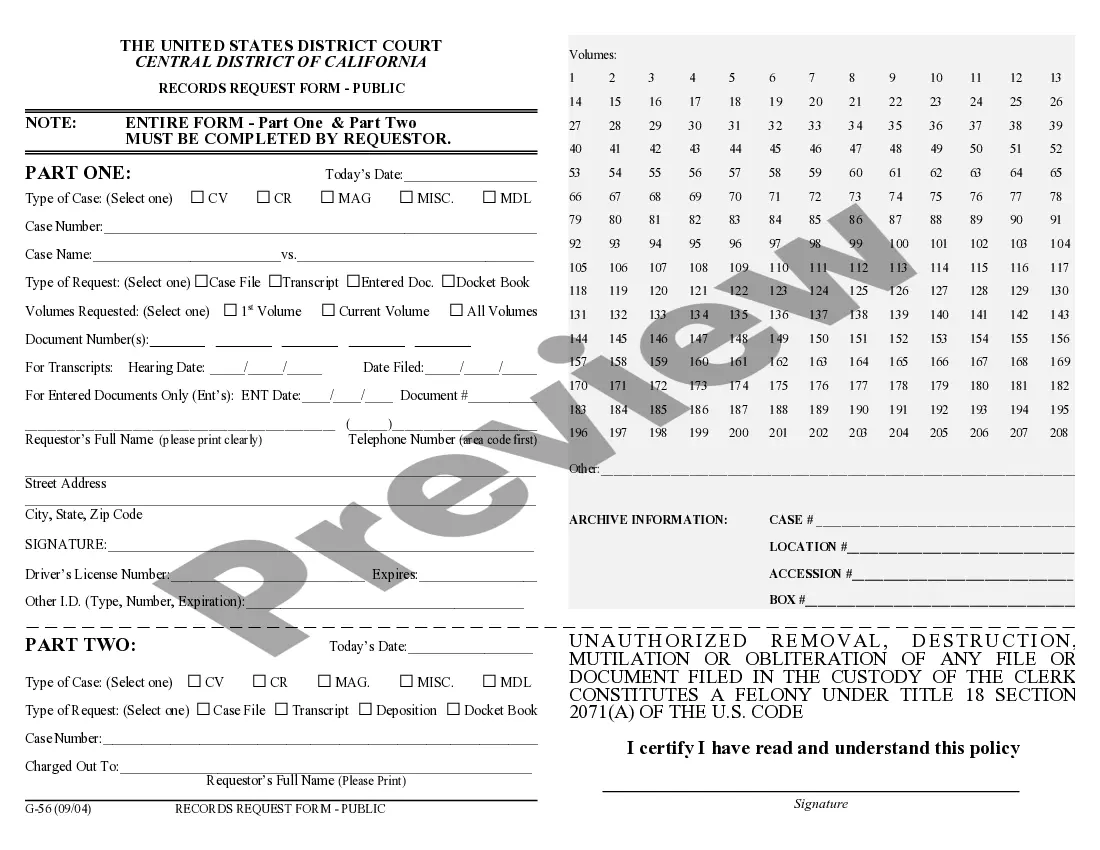

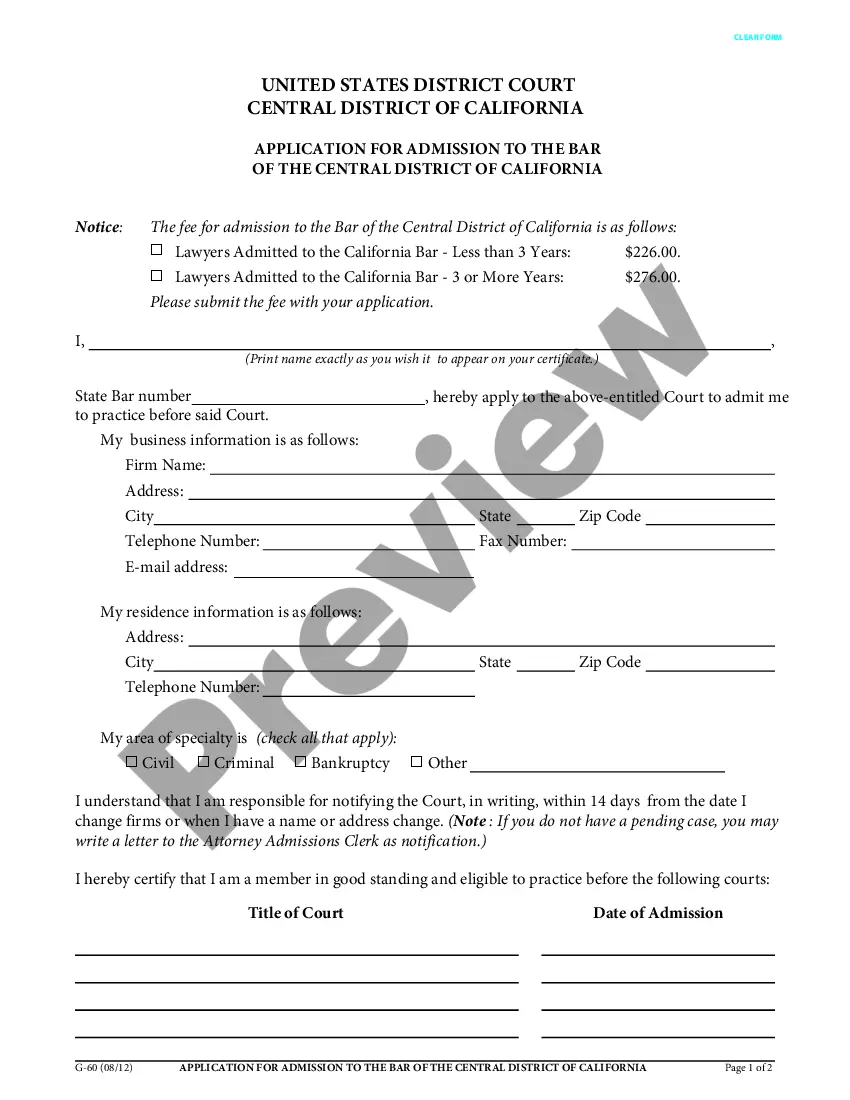

12. Records Management form

13. Yearly Expenses form

14. Yearly Expenses form by Quarter

Purchase this package and save up to 50% over purchasing the forms separately!

Tucson Arizona Small Business Accounting Package generally refers to a comprehensive software solution tailored specifically for small businesses in the Tucson, Arizona area, assisting them in effectively managing their financial tasks and facilitating smooth operations. With its user-friendly interface and a range of powerful features, this accounting package simplifies various accounting processes, enabling businesses to efficiently handle their financial records, track expenses, and generate essential financial reports. Some of the key features that commonly exist in Tucson Arizona Small Business Accounting Packages include: 1. Financial Record Keeping: This package allows small businesses to accurately record and organize their financial transactions such as income, expenses, invoices, and receipts systematically, ensuring a streamlined accounting process. 2. Invoicing and Billing: These accounting packages enable businesses to create and send professional invoices to clients or customers, along with tracking their payments and generating payment reminders, facilitating timely payments and improved cash flow management. 3. Expense Tracking: Small business owners can easily enter and categorize all their expenses, including purchases, utility bills, travel expenses, and payroll costs. This feature provides insights into overall spending patterns, allowing businesses to effectively control costs and identify areas for potential savings. 4. Financial Reporting: Tucson Arizona Small Business Accounting Packages typically offer a wide range of predesigned financial reports, including income statements, balance sheets, cash flow statements, and tax summaries. These reports provide businesses with valuable insights into their financial health and performance. 5. Payroll Management: Some accounting packages in Tucson, Arizona also offer payroll management capabilities, allowing businesses to handle payroll calculations accurately, generate pay stubs, and file payroll tax returns seamlessly. 6. Tax Preparation and Compliance: Many accounting packages are designed to simplify tax-related processes. They often provide features such as automated tax calculations, tax form generation, and electronic filing, ensuring businesses remain compliant with local and federal tax regulations. Differentiating types of Tucson Arizona Small Business Accounting Packages: 1. Basic Accounting Packages: These typically offer fundamental accounting functionalities like bookkeeping, financial record keeping, and basic reporting. 2. Advanced Accounting Packages: These packages often include additional features like inventory management, project tracking, and multi-currency support to cater to businesses with complex accounting needs. 3. Cloud-Based Accounting Packages: These accounting solutions are hosted on remote servers, accessible through the internet, and offer real-time collaboration features, data backup, and enhanced accessibility from multiple devices. 4. Industry-Specific Accounting Packages: Some providers offer specialized accounting packages tailored for specific industries, such as retail, construction, healthcare, or professional services, with industry-specific features and reporting templates. When selecting a Tucson Arizona Small Business Accounting Package, it is vital to consider the specific needs of the business and choose the package that aligns with its size, industry, budget, and growth plans.Tucson Arizona Small Business Accounting Package generally refers to a comprehensive software solution tailored specifically for small businesses in the Tucson, Arizona area, assisting them in effectively managing their financial tasks and facilitating smooth operations. With its user-friendly interface and a range of powerful features, this accounting package simplifies various accounting processes, enabling businesses to efficiently handle their financial records, track expenses, and generate essential financial reports. Some of the key features that commonly exist in Tucson Arizona Small Business Accounting Packages include: 1. Financial Record Keeping: This package allows small businesses to accurately record and organize their financial transactions such as income, expenses, invoices, and receipts systematically, ensuring a streamlined accounting process. 2. Invoicing and Billing: These accounting packages enable businesses to create and send professional invoices to clients or customers, along with tracking their payments and generating payment reminders, facilitating timely payments and improved cash flow management. 3. Expense Tracking: Small business owners can easily enter and categorize all their expenses, including purchases, utility bills, travel expenses, and payroll costs. This feature provides insights into overall spending patterns, allowing businesses to effectively control costs and identify areas for potential savings. 4. Financial Reporting: Tucson Arizona Small Business Accounting Packages typically offer a wide range of predesigned financial reports, including income statements, balance sheets, cash flow statements, and tax summaries. These reports provide businesses with valuable insights into their financial health and performance. 5. Payroll Management: Some accounting packages in Tucson, Arizona also offer payroll management capabilities, allowing businesses to handle payroll calculations accurately, generate pay stubs, and file payroll tax returns seamlessly. 6. Tax Preparation and Compliance: Many accounting packages are designed to simplify tax-related processes. They often provide features such as automated tax calculations, tax form generation, and electronic filing, ensuring businesses remain compliant with local and federal tax regulations. Differentiating types of Tucson Arizona Small Business Accounting Packages: 1. Basic Accounting Packages: These typically offer fundamental accounting functionalities like bookkeeping, financial record keeping, and basic reporting. 2. Advanced Accounting Packages: These packages often include additional features like inventory management, project tracking, and multi-currency support to cater to businesses with complex accounting needs. 3. Cloud-Based Accounting Packages: These accounting solutions are hosted on remote servers, accessible through the internet, and offer real-time collaboration features, data backup, and enhanced accessibility from multiple devices. 4. Industry-Specific Accounting Packages: Some providers offer specialized accounting packages tailored for specific industries, such as retail, construction, healthcare, or professional services, with industry-specific features and reporting templates. When selecting a Tucson Arizona Small Business Accounting Package, it is vital to consider the specific needs of the business and choose the package that aligns with its size, industry, budget, and growth plans.