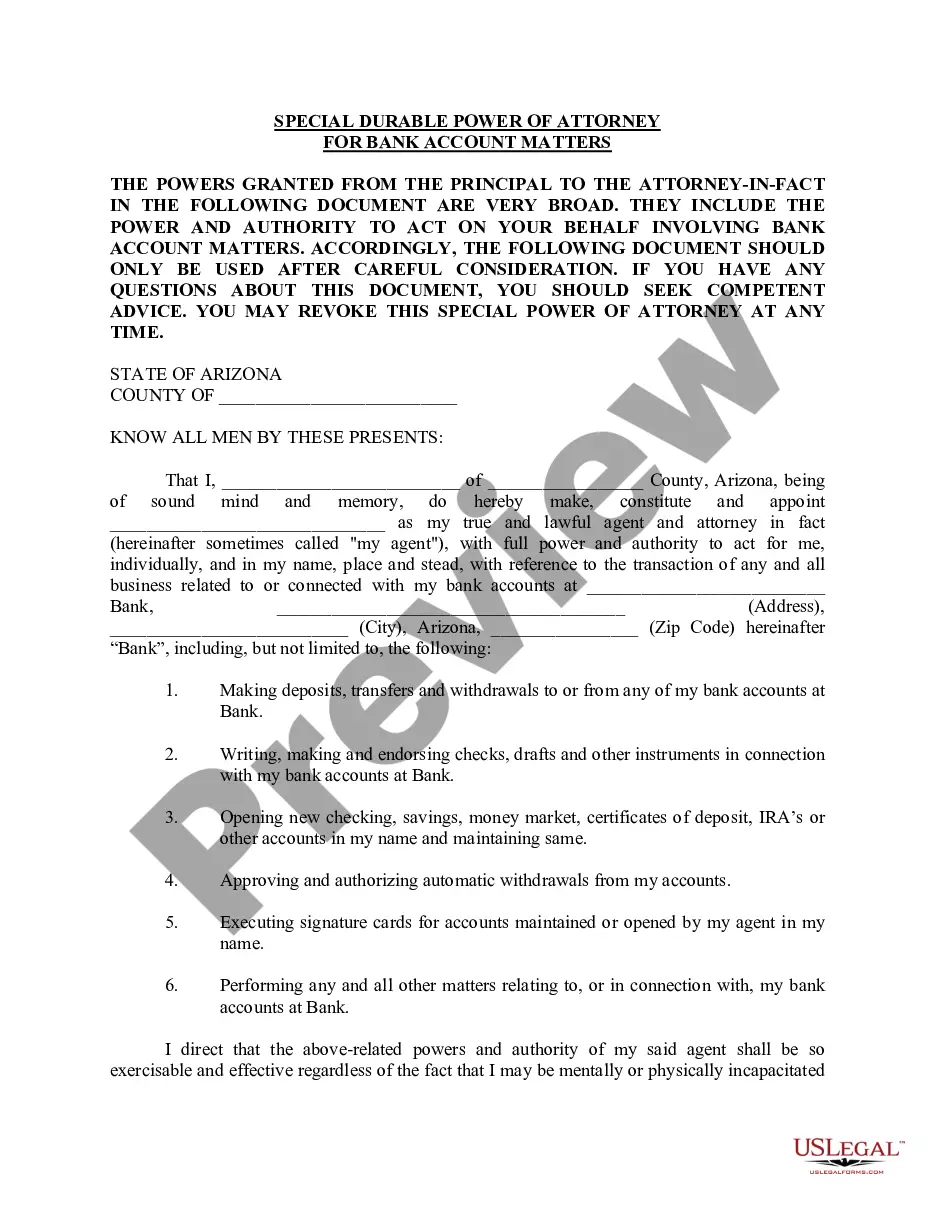

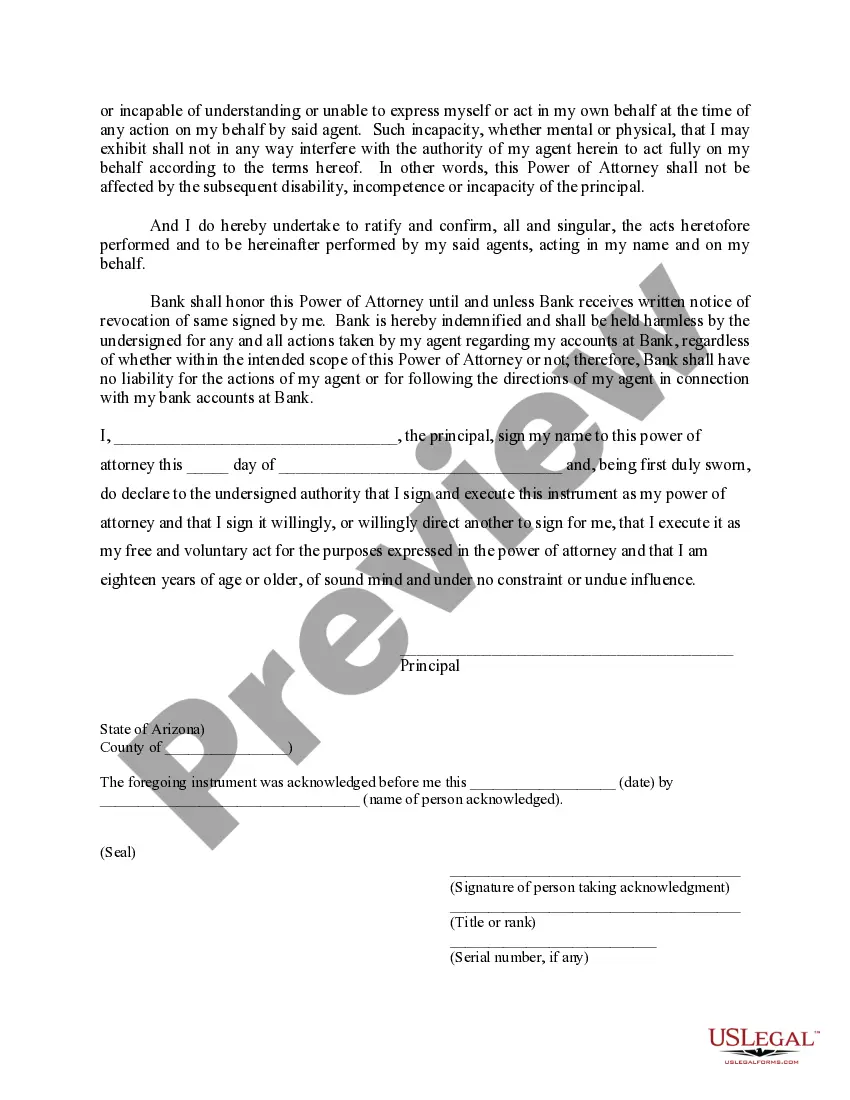

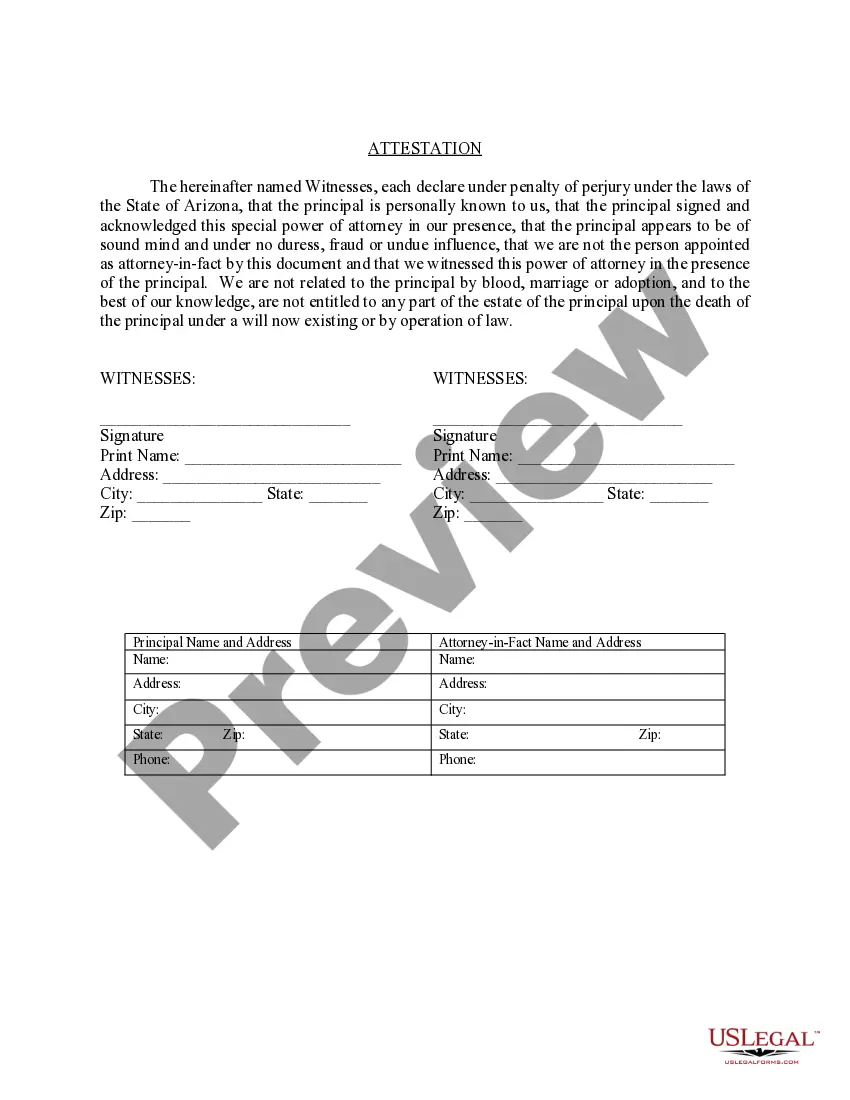

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Tucson Arizona Special Durable Power of Attorney for Bank Account Matters is a legal document that grants specific authority to an individual (known as the agent or attorney-in-fact) to handle bank account-related matters on behalf of another person (the principal). This comprehensive power of attorney ensures that the agent has the necessary control and decision-making power over the principal's bank accounts in specific situations where the principal may be unable or unavailable to manage them. One type of Tucson Arizona Special Durable Power of Attorney for Bank Account Matters is the limited power of attorney. This type grants the agent authority to perform specific tasks related to the principal's bank accounts, such as making deposits, withdrawing funds, paying bills, and managing transactions within certain parameters. The limited power of attorney is typically granted for a specific duration or until a specific event occurs, providing the principal with more control over the agent's actions. Another type of Tucson Arizona Special Durable Power of Attorney for Bank Account Matters is the general power of attorney. This version provides the agent with broad authority to handle all types of bank account matters on behalf of the principal. The agent can manage the principal's accounts, including opening and closing accounts, conducting financial transactions, managing investments, and handling any other banking activities necessary. The general power of attorney is typically effective immediately upon signing and remains valid until the principal revokes or becomes incapacitated. To create a Tucson Arizona Special Durable Power of Attorney for Bank Account Matters, certain elements must be included. It should clearly state the powers granted to the agent, such as managing bank accounts, making deposits and withdrawals, signing checks, and accessing account information. The document should also specify the limitations, if any, on the agent's authority, ensuring that the agent acts within the principal's best interests. Additionally, the Tucson Arizona Special Durable Power of Attorney for Bank Account Matters should clearly state its durability, meaning that it remains valid even if the principal becomes incapacitated or disabled. This attribute is crucial to ensure that the agent can continue managing the principal's bank accounts without interruptions during times of illness or unavailability. Overall, the Tucson Arizona Special Durable Power of Attorney for Bank Account Matters provides the principal with a reliable mechanism to grant a trusted individual the authority needed to handle important banking matters. Whether through a limited or general power of attorney, this legal document ensures that the principal's finances are properly managed, even in unforeseen circumstances. It is crucial to consult an attorney experienced in estate planning and power of attorney matters to create a valid and customized document that meets individual needs.Tucson Arizona Special Durable Power of Attorney for Bank Account Matters is a legal document that grants specific authority to an individual (known as the agent or attorney-in-fact) to handle bank account-related matters on behalf of another person (the principal). This comprehensive power of attorney ensures that the agent has the necessary control and decision-making power over the principal's bank accounts in specific situations where the principal may be unable or unavailable to manage them. One type of Tucson Arizona Special Durable Power of Attorney for Bank Account Matters is the limited power of attorney. This type grants the agent authority to perform specific tasks related to the principal's bank accounts, such as making deposits, withdrawing funds, paying bills, and managing transactions within certain parameters. The limited power of attorney is typically granted for a specific duration or until a specific event occurs, providing the principal with more control over the agent's actions. Another type of Tucson Arizona Special Durable Power of Attorney for Bank Account Matters is the general power of attorney. This version provides the agent with broad authority to handle all types of bank account matters on behalf of the principal. The agent can manage the principal's accounts, including opening and closing accounts, conducting financial transactions, managing investments, and handling any other banking activities necessary. The general power of attorney is typically effective immediately upon signing and remains valid until the principal revokes or becomes incapacitated. To create a Tucson Arizona Special Durable Power of Attorney for Bank Account Matters, certain elements must be included. It should clearly state the powers granted to the agent, such as managing bank accounts, making deposits and withdrawals, signing checks, and accessing account information. The document should also specify the limitations, if any, on the agent's authority, ensuring that the agent acts within the principal's best interests. Additionally, the Tucson Arizona Special Durable Power of Attorney for Bank Account Matters should clearly state its durability, meaning that it remains valid even if the principal becomes incapacitated or disabled. This attribute is crucial to ensure that the agent can continue managing the principal's bank accounts without interruptions during times of illness or unavailability. Overall, the Tucson Arizona Special Durable Power of Attorney for Bank Account Matters provides the principal with a reliable mechanism to grant a trusted individual the authority needed to handle important banking matters. Whether through a limited or general power of attorney, this legal document ensures that the principal's finances are properly managed, even in unforeseen circumstances. It is crucial to consult an attorney experienced in estate planning and power of attorney matters to create a valid and customized document that meets individual needs.