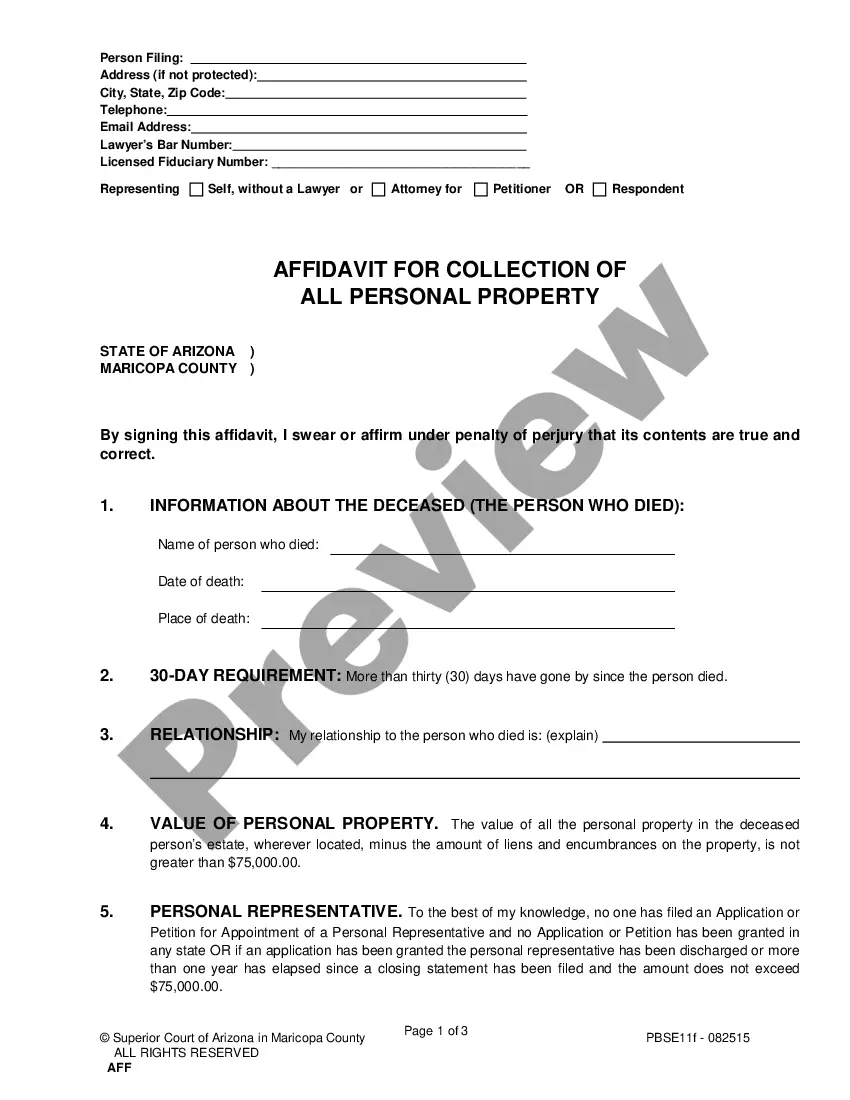

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, a Non-Probate Affidavit for Collection of Personal Property of Decedent , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s).

Phoenix Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent

Description

How to fill out Arizona Nonprobate Affidavit For Collection Of Personal Property Of Decedent?

In case you have previously utilized our service, Log In to your account and store the Phoenix Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent on your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have ongoing access to every document you have purchased: you can locate it in your profile under the My documents menu whenever you wish to reuse it. Make use of the US Legal Forms service to effortlessly search for and save any template for your personal or professional requirements!

- Confirm you’ve found a suitable document. Review the description and employ the Preview option, if available, to verify if it fulfills your requirements. If it doesn’t suit you, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Retrieve your Phoenix Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editing tools to fill it out and sign it electronically.

Form popularity

FAQ

Under current Arizona law, small estates are defined as those in which the deceased owned less than $100,000 in real estate equity or less than $75,000 worth of personal property. For estates over this size, probate is typically required, and those estates will not be eligible for the small estate affidavit process.

Arizona statutes offer an alternative to avoiding probate by using an Affidavit of Succession to Real Property in cases in which the real property value does not exceed a certain value. The estate value must be less than $100,000 minus all the liens and any other encumbrances when the decedent passed away.

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

A small estate affidavit is a legal document that can be used to transfer property to heirs without a formal probate. Not all estates qualify for small estate administration. Heirs can use a small estate affidavit in only limited circumstances.

If seeking personal property, it is not necessary to file the small estate affidavit with the court. Instead, give the completed, signed, notarized form to the person or entity holding the asset to be transferred.

Small Estate Affidavits are used in Arizona to transfer assets from a deceased person to the heirs when the total value of the assets is below the minimum value requiring a probate.

Typically, you need the property ownership document and the Will, or the Will with probate or succession certificate. In the absence of a Will, you may also need to prepare an affidavit along with a no-objection certificate from other legal heirs or their successors.

When is a probate action required in Arizona? Under Arizona law, the general rule is that if the deceased person owned more than $100,000 of equity in real estate, or more than $75,000 of personal property (including physical possessions and money), then a probate action is required to transfer the assets to the heirs.

Cost Of The Small Estate Affidavit Procedure The clerks filing fee for this procedure is usually about $350. That is generally the only court expense.