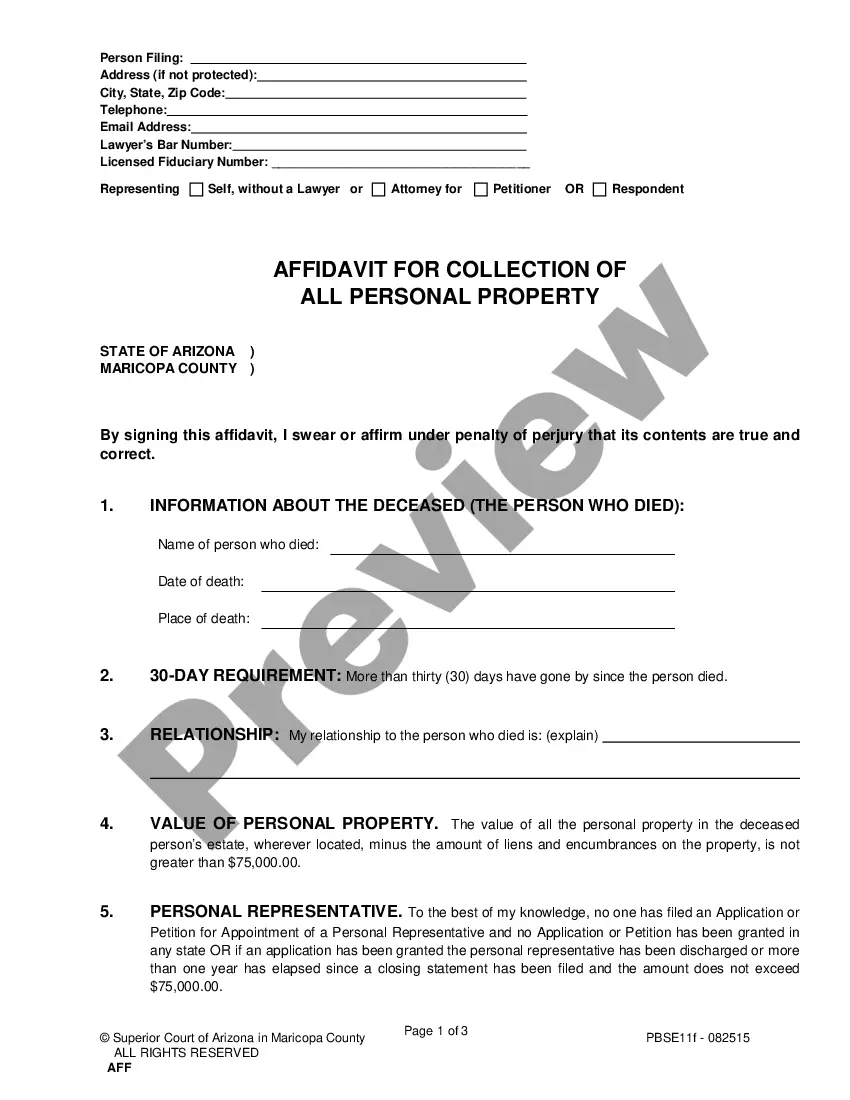

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, a Non-Probate Affidavit for Collection of Personal Property of Decedent , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s).

Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent

Description

How to fill out Arizona Nonprobate Affidavit For Collection Of Personal Property Of Decedent?

We consistently strive to reduce or evade legal repercussions when addressing intricate legal or financial issues.

To achieve this, we subscribe to legal services that are typically very expensive. However, not every legal issue is equally complicated. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and power of attorney to incorporation articles and dissolution petitions. Our platform enables you to handle your affairs without the necessity of consulting a lawyer. We provide access to legal document templates that are not always readily available.

Benefit from US Legal Forms whenever you wish to locate and obtain the Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent or any other form securely and conveniently. Just Log In to your account and click the Get button adjacent to it. If you misplace the document, you can always re-download it from the My documents section.

Once you’ve confirmed that the Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent suits your needs, you can choose the subscription option and process the payment. Then you can download the document in any desired format. With over 24 years of experience in the market, we've assisted millions by offering customizable and up-to-date legal forms. Make the most of US Legal Forms today to conserve time and resources!

- The procedure is just as simple if you are not familiar with the website!

- You can create your account in just a few minutes.

- Ensure that the Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent complies with your state and local regulations.

- Additionally, it's important to review the form’s outline (if available), and if you notice any differences from what you were initially seeking, look for another form.

Form popularity

FAQ

To file a small estate affidavit in Arizona, you will need to gather essential documents and information. First, ensure that the total value of the estate meets the state's threshold for small estates. You should also have the decedent's death certificate and a list of assets. By utilizing a Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent, you can streamline this process and help your family manage their inheritance more efficiently.

In Arizona, certain assets do not go through probate. Typically exempt assets include those held in a living trust, joint tenancy property, and life insurance policies with designated beneficiaries. Additionally, bank accounts that have a payable-on-death designation are also outside probate. This means that if you’re dealing with a Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent, you may be able to collect these exempt assets without the need for formal probate.

You will likely need an Affidavit if you intend to collect personal property from a decedent's estate without going through probate. The Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent makes this process more straightforward. Using platforms like uslegalforms can simplify document preparation and ensure that you meet all legal requirements, helping you manage your situation with confidence.

Yes, an Affidavit of property value is often necessary in Arizona, especially when settling estates without going through probate. The Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent serves as a key legal tool, allowing heirs to collect personal property efficiently. Always consider consulting with a specialist who understands state laws to navigate this process correctly.

Arizona assesses property value based on various factors including market trends, property condition, and assessed values by local authorities. For the Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent, an accurate assessment is crucial for a smooth collection process. Gathering supporting documentation can enhance the credibility of your affidavit and facilitate estate management.

In many cases, you will need the Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent to effectively claim personal property when an individual passes away. This affidavit helps clarify the value and ownership of assets, making it essential for heirs who wish to manage or collect the decedent's belongings. It's a wise step to consult with a legal professional to determine specific requirements applicable to your situation.

The purpose of the Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent is to provide a legal declaration regarding the value of the decedent's personal property. This document helps streamline the transfer of assets, allowing heirs or beneficiaries to collect property without undergoing formal probate. By establishing the value, it can ease the process of settling the estate.

An affidavit of succession to real property in Arizona allows heirs to establish their legal ownership of real estate after a decedent's death. This document serves to transfer property ownership without needing probate court intervention, providing a more efficient solution. It's particularly useful when the property is solely in the name of the decedent. You can utilize a Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent as a tool to support your claims regarding personal property and real estate.

In Arizona, if the estate is valued at more than $100,000, it usually requires probate proceedings. Smaller estates, those valued under $100,000, may avoid probate altogether through alternative means like a small estate affidavit. Understanding the value of the estate helps determine the best approach. For properties in Scottsdale, a Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent can often provide a straightforward way to manage personal property without probate.

An affidavit of heirship in Arizona is a legal document used to establish the identities of the heirs to a decedent’s estate. This form helps facilitate the transfer of property without going through probate court. Typically, it includes the names, relationships, and other pertinent details about the heirs. A Scottsdale Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent can serve to address certain situations where heirship needs to be validated.