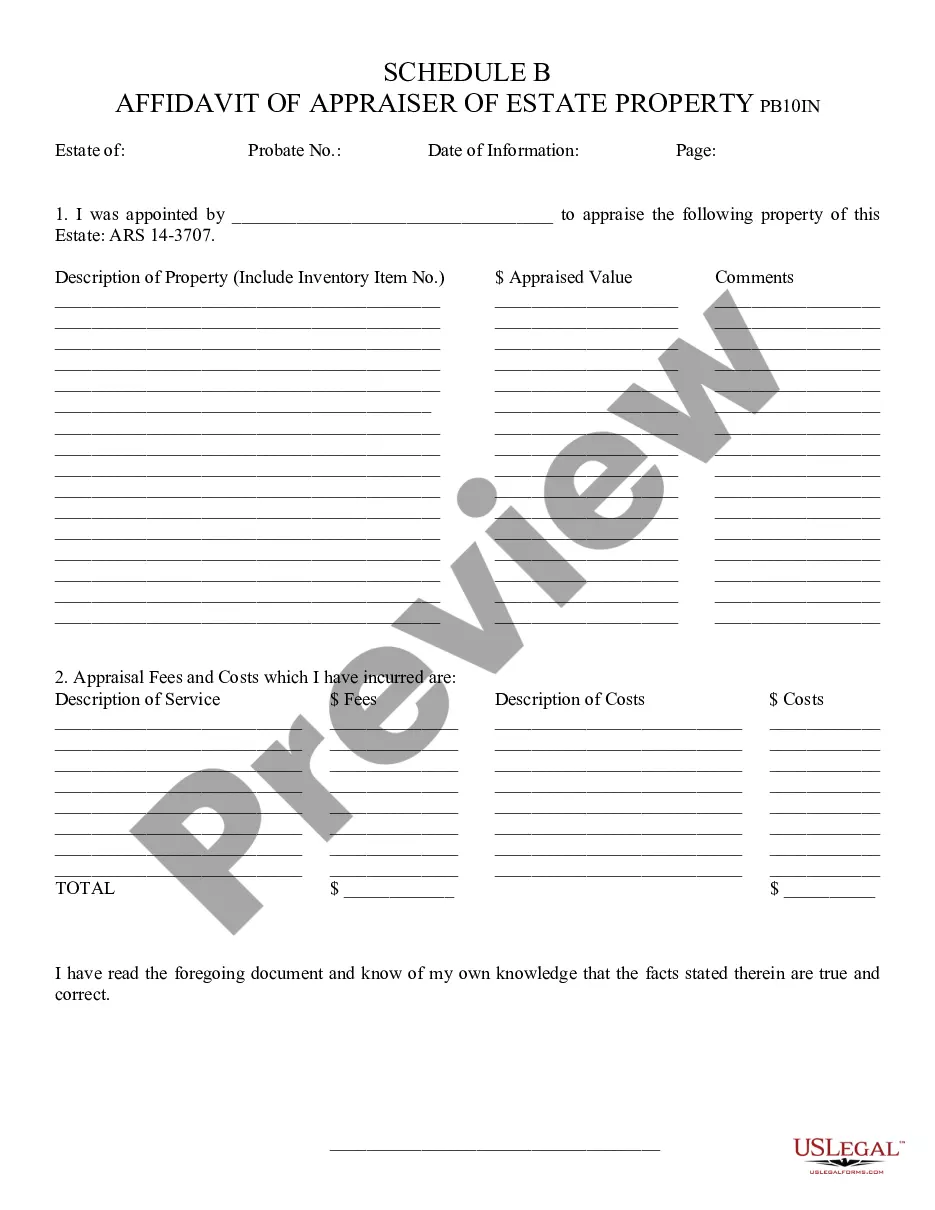

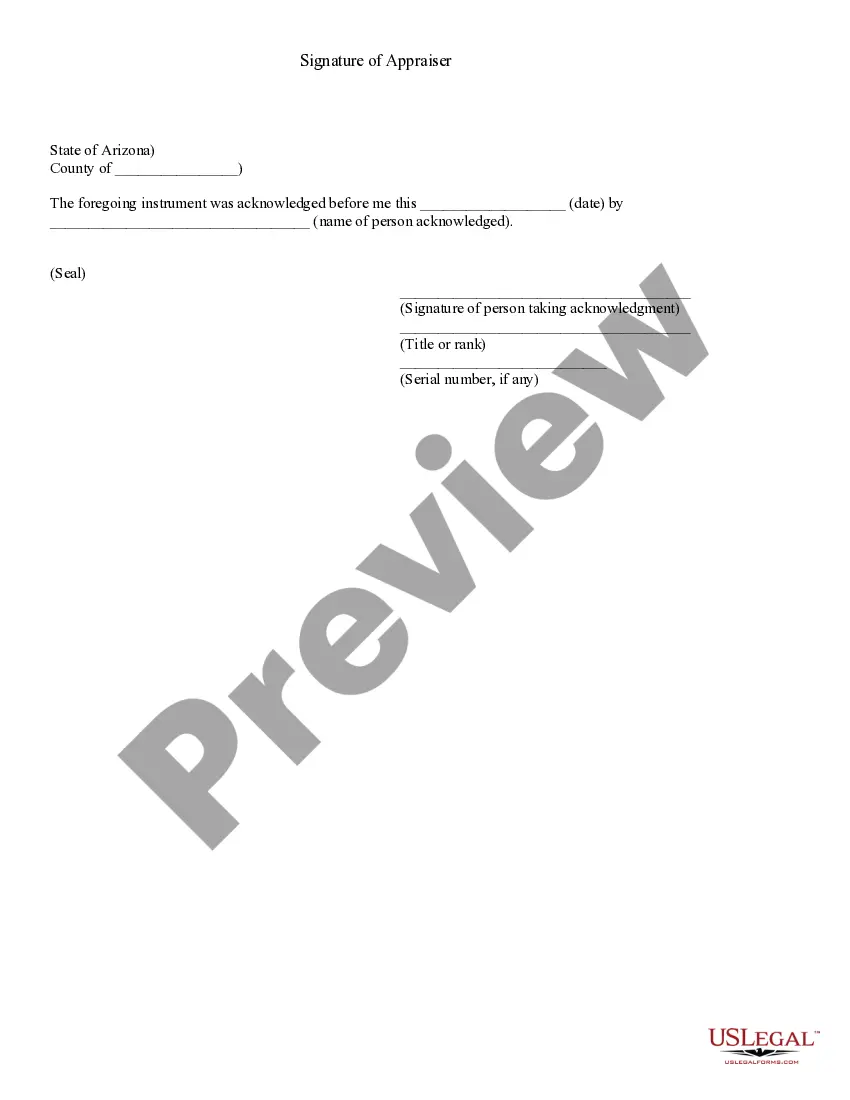

Affidavit of Appraiser of Estate Property, Schedule B - Arizona: This affidavit details the appraisal of an estate's property. The appraiser lists all the property and then gives an estimate as to its value. He/She then signs the form in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Chandler Arizona Schedule B is a tax document that provides detailed information about taxable interest and dividend income received throughout the year. This form is filed alongside the individual's federal tax return and is essential for accurately reporting and calculating tax liabilities. It helps the Internal Revenue Service (IRS) ensure that taxpayers are properly reporting their investment income. One category of Chandler Arizona Schedule B is related to interest income. This includes interest received from various sources such as bank accounts, certificates of deposit (CDs), savings bonds, and corporate bonds. The taxpayer needs to list the name of the payer, the total interest received, and the corresponding tax identification number in this section. Dividend income is another important aspect covered by Chandler Arizona Schedule B. This includes dividends received from stocks, mutual funds, and real estate investment trusts (Rests). Similar to interest income, the taxpayer needs to provide detailed information about the payer, the total dividend income, and the tax identification number. In addition, there may be different types of Chandler Arizona Schedule B depending on the taxpayer's specific circumstances. For example, if the taxpayer received more than $1,500 of ordinary dividends or received capital gains distributions from a mutual fund or real estate investment trust (REIT), they may be required to file Schedule B with additional sections such as Part II and Part III, respectively. Chandler Arizona Schedule B is an essential document for individuals who have earned interest or dividend income throughout the year. It ensures compliance with tax regulations and helps maintain accuracy in reporting taxable income to the IRS. Properly filling out this form is crucial for avoiding penalties and ensuring a smooth tax filing process.Chandler Arizona Schedule B is a tax document that provides detailed information about taxable interest and dividend income received throughout the year. This form is filed alongside the individual's federal tax return and is essential for accurately reporting and calculating tax liabilities. It helps the Internal Revenue Service (IRS) ensure that taxpayers are properly reporting their investment income. One category of Chandler Arizona Schedule B is related to interest income. This includes interest received from various sources such as bank accounts, certificates of deposit (CDs), savings bonds, and corporate bonds. The taxpayer needs to list the name of the payer, the total interest received, and the corresponding tax identification number in this section. Dividend income is another important aspect covered by Chandler Arizona Schedule B. This includes dividends received from stocks, mutual funds, and real estate investment trusts (Rests). Similar to interest income, the taxpayer needs to provide detailed information about the payer, the total dividend income, and the tax identification number. In addition, there may be different types of Chandler Arizona Schedule B depending on the taxpayer's specific circumstances. For example, if the taxpayer received more than $1,500 of ordinary dividends or received capital gains distributions from a mutual fund or real estate investment trust (REIT), they may be required to file Schedule B with additional sections such as Part II and Part III, respectively. Chandler Arizona Schedule B is an essential document for individuals who have earned interest or dividend income throughout the year. It ensures compliance with tax regulations and helps maintain accuracy in reporting taxable income to the IRS. Properly filling out this form is crucial for avoiding penalties and ensuring a smooth tax filing process.