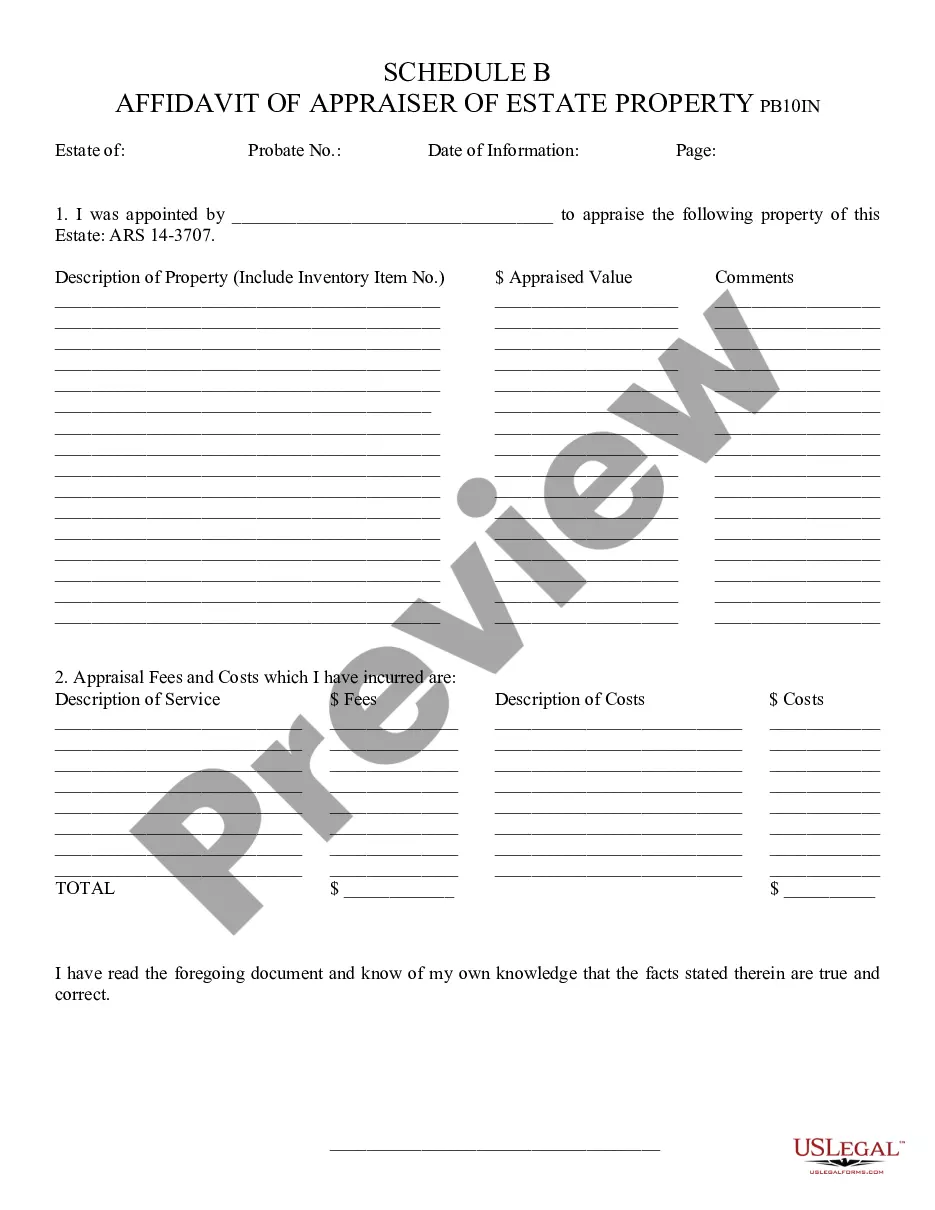

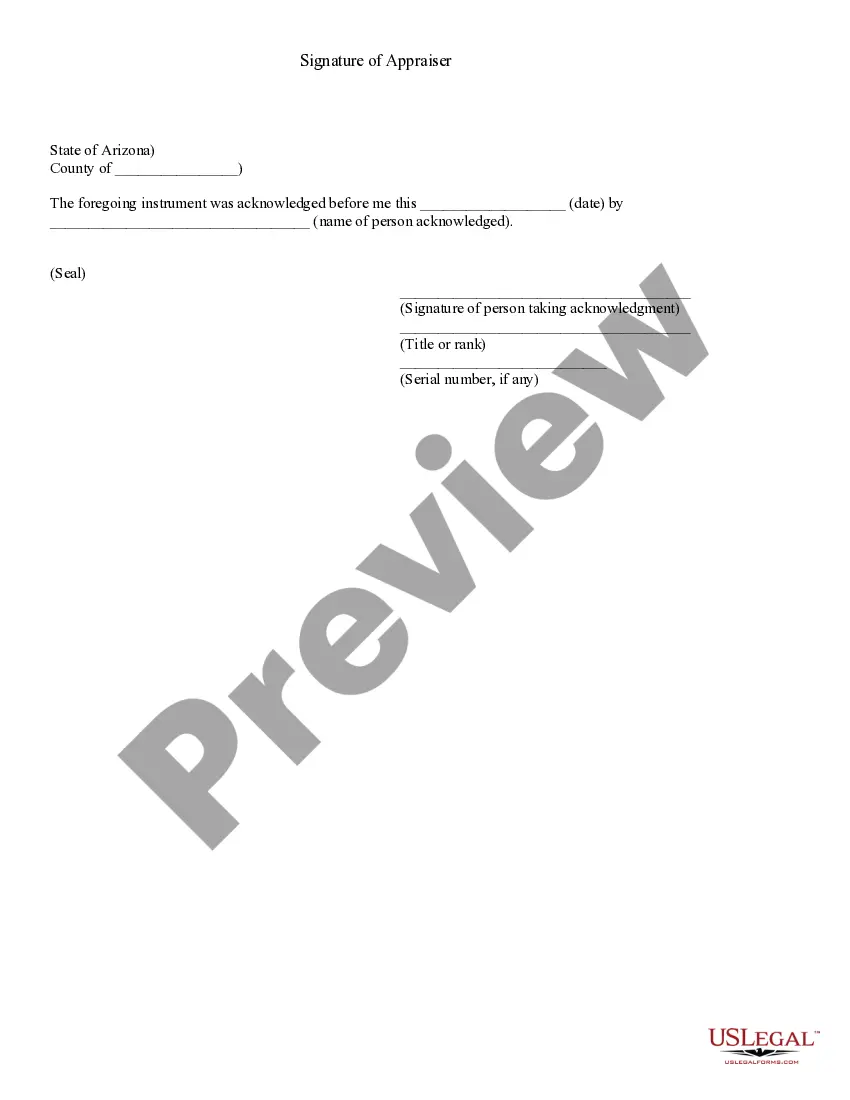

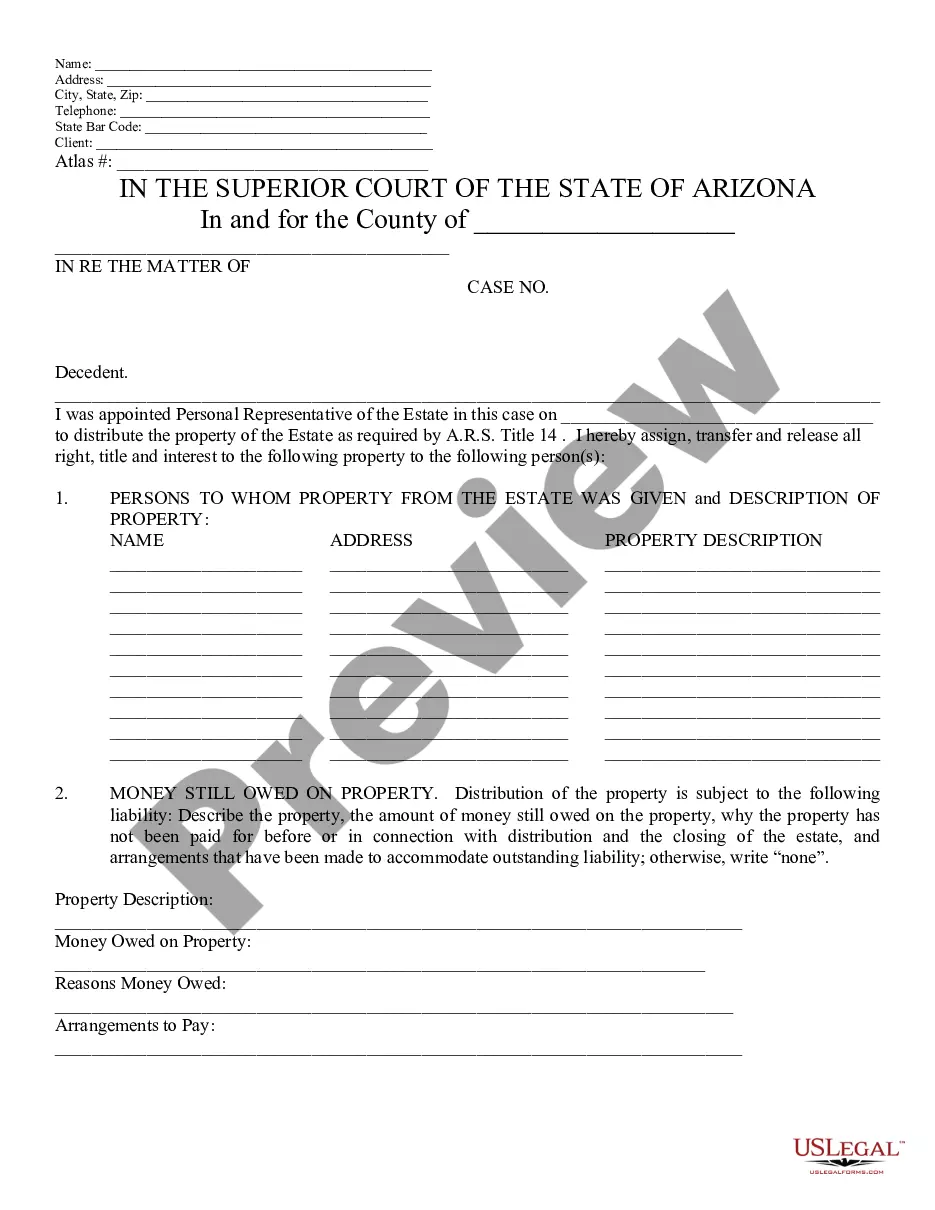

Affidavit of Appraiser of Estate Property, Schedule B - Arizona: This affidavit details the appraisal of an estate's property. The appraiser lists all the property and then gives an estimate as to its value. He/She then signs the form in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Gilbert Arizona Schedule B

Description

How to fill out Arizona Schedule B?

Are you seeking a reliable and affordable provider of legal forms to acquire the Gilbert Arizona Schedule B? US Legal Forms is your preferred option.

Whether you require a basic agreement to establish guidelines for living with your partner or a set of documents to expedite your divorce proceedings, we have you covered. Our platform features over 85,000 current legal document templates for personal and business purposes. All templates we provide access to are not generic and are crafted in alignment with the needs of specific states and regions.

To access the form, you must Log In to your account, locate the necessary template, and click the Download button adjacent to it. Please bear in mind that you can download your previously acquired form templates at any time from the My documents section.

Is this your first time on our site? No problem. You can set up an account quickly; however, before doing so, ensure you follow these steps.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is finalized, download the Gilbert Arizona Schedule B in any of the available formats. You can revisit the website anytime and redownload the form at no additional cost.

Obtaining current legal forms has never been simpler. Give US Legal Forms a try today and stop wasting your precious time researching legal documents online.

- Verify if the Gilbert Arizona Schedule B adheres to the regulations of your state and locality.

- Review the form’s description (if available) to understand who and what the form is meant for.

- Restart the search if the template does not fit your particular situation.

Form popularity

FAQ

If you earn income in Arizona but are a resident of another state, you typically need to file a nonresident tax return. This applies to anyone working in Gilbert, Arizona, without being a resident. Filing correctly is crucial to avoid penalties. Services like US Legal Forms can guide you through this process to comply with Gilbert Arizona Schedule B.

Yes, if you have interest or dividend income, you will need to file Schedule B with your federal tax return. This applies regardless of whether you're filing a state return in Gilbert, Arizona. Schedule B provides a detailed report of your income sources. Using resources from US Legal Forms can help ensure you meet these filing requirements accurately.

If you reside in California but work in Arizona, you may have to file tax returns in both states. Arizona will tax your income earned within the state, while California may tax your total income, including earnings from Arizona. This situation often requires filing nonresident returns. Seeking guidance from services like US Legal Forms can clarify your obligations regarding Gilbert Arizona Schedule B.

Yes, Arizona does tax foreign income, but there are specific regulations regarding this tax. Residents in Gilbert who earn income from foreign sources must report it on their Arizona tax returns. Be sure to check any tax treaties that might apply to your situation. Platforms like US Legal Forms can assist with understanding these complexities in relation to Gilbert Arizona Schedule B.

Property taxes in Gilbert, Arizona, vary based on the assessed value of your property and the local tax rate. On average, property owners can expect a tax rate around 1.0% to 1.2%. This tax supports local services like schools and infrastructure. For accurate calculations, tools like those offered by US Legal Forms can provide insights tailored to Gilbert, Arizona Schedule B.

Arizona Form 165 is specifically for corporations doing business or earning income in Arizona. If your business operates in Gilbert, Arizona, you must file this form to report taxable income. It's essential to understand the state's requirements to ensure compliance. Utilizing resources like US Legal Forms can help simplify the process.

When earning $70,000 in Arizona, the amount you take home will depend on your overall tax situation, such as deductions and additional income. Typically, after state and federal taxes, individuals can expect to retain approximately $50,000 to $55,000. Understanding your net income is important for proper tax reporting on Gilbert Arizona Schedule B. Utilizing uslegalforms can simplify managing these complexities.

Arizona's income tax rate is structured into several brackets, ranging from 2.59% to 4.50%. The bracket you fall under depends on your overall taxable income and filing status. Discovering the specifics of these rates is vital when preparing your taxes. For help navigating Gilbert Arizona Schedule B and understanding your obligations, uslegalforms offers helpful resources.

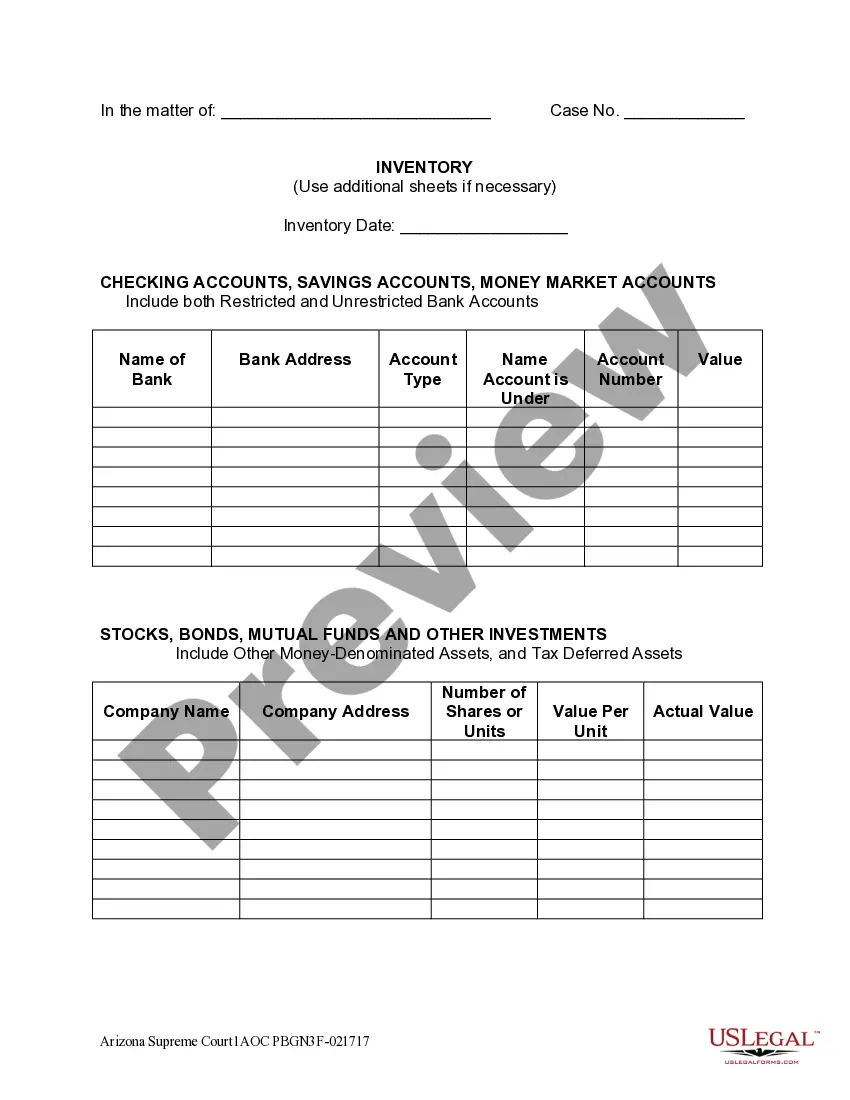

On Schedule B, you report interest and dividend income to the IRS. This includes earnings from bank accounts, stocks, and other investments. Properly filling out this form is crucial for providing a complete picture of your income. If you seek clarity on the specifics related to Gilbert Arizona Schedule B, uslegalforms can guide you with easy templates.

The tax rate in Gilbert, Arizona, can vary depending on a variety of factors, including income level and filing status. Generally, individuals face a combination of state and local taxes. In Gilbert, the local sales tax is currently around 2.0%, while the state income tax rates range from 2.59% to 4.50%. For those needing assistance with Gilbert Arizona Schedule B specifics, consider using uslegalforms to ensure accurate tax reporting.