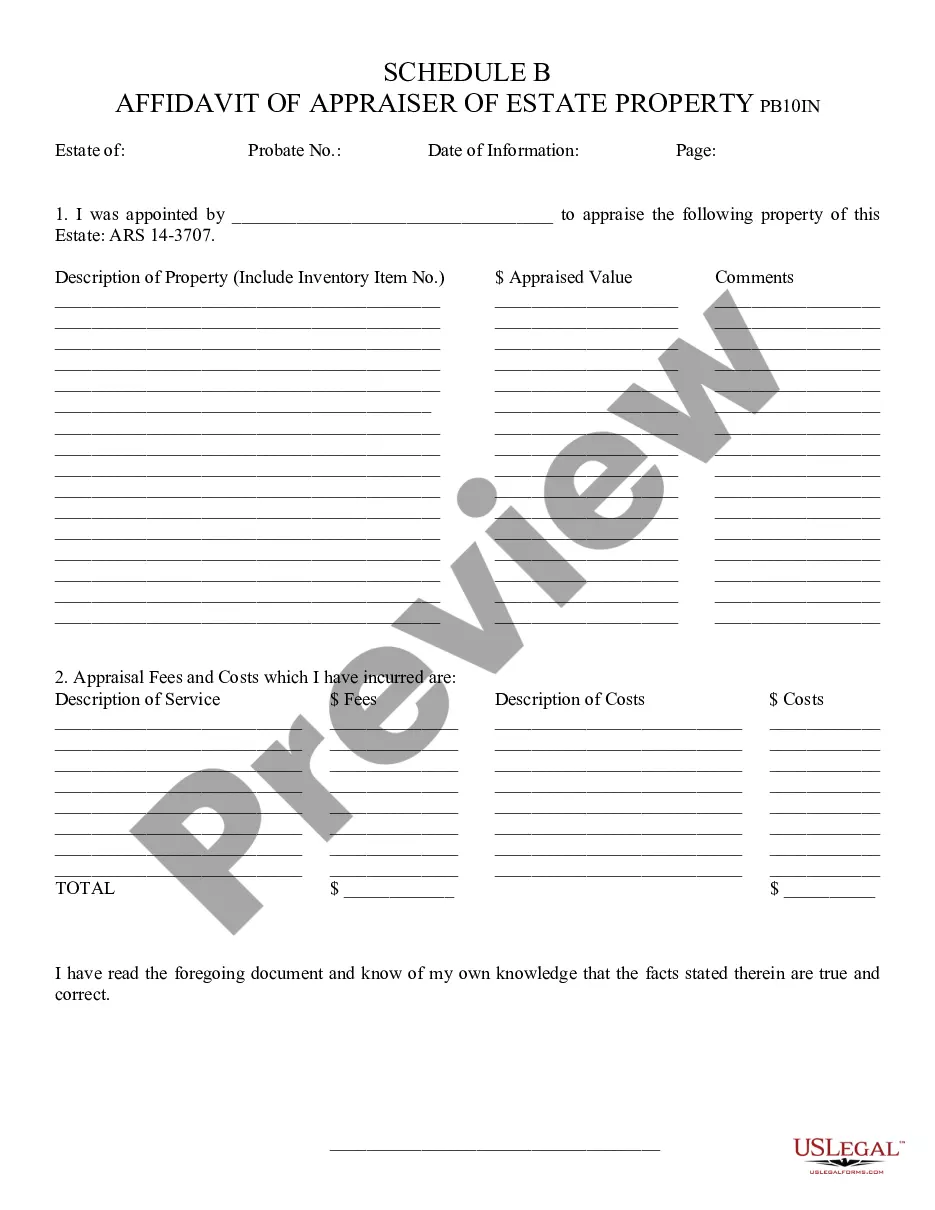

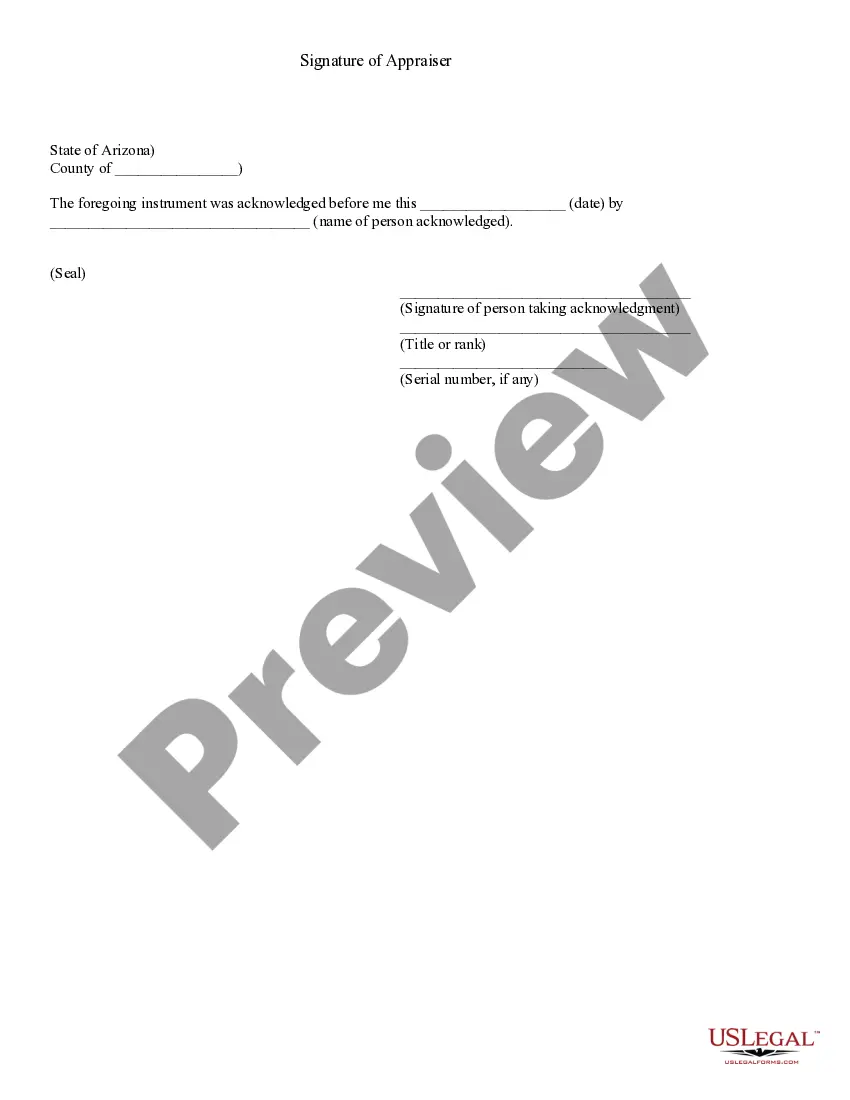

Affidavit of Appraiser of Estate Property, Schedule B - Arizona: This affidavit details the appraisal of an estate's property. The appraiser lists all the property and then gives an estimate as to its value. He/She then signs the form in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Schedule B is a tax form primarily used by individuals and businesses in Phoenix, Arizona, to report their interest and dividend income to the Arizona Department of Revenue. It serves as an attachment to the individual or corporate income tax return, ensuring accurate reporting of investment income for tax purposes. By providing a breakdown of the taxpayer's interest and dividend earnings, Schedule B helps determine the amount of taxable income that should be reported. There are different types of Phoenix Arizona Schedule B forms based on the specific tax return being filed. For individual taxpayers, the most commonly used form is Schedule B-1, which covers interest and ordinary dividends received during the tax year. This form requires taxpayers to report the name of the payer, amount received, and any tax-exempt interest earned. Additionally, if the individual received dividends from foreign sources, Form Schedule B-1 also helps in reporting those. For businesses, there is Schedule B-2, which is specifically designed for corporations and partnerships. This form is used to disclose interest and dividend income earned by such entities, similar to Schedule B-1 for individuals. It requires companies to provide information on the payer name, amount received, and tax-exempt interest. Schedule B-2 also covers foreign dividends received by the business, ensuring full disclosure of all income sources. Both individual and business taxpayers must ensure accurate and complete reporting on Phoenix Arizona Schedule B forms to avoid any potential penalties or audits. It is crucial to carefully review and cross-check the information provided to ensure the highest level of accuracy. Failing to include all interest and dividend income earned during the tax year may result in underreporting income and potential liability. In summary, Phoenix Arizona Schedule B is an essential tax form used in the city to report interest and dividend income for both individual and business taxpayers. Its variations, Schedule B-1 and Schedule B-2, cater to the specific needs of individuals and corporations/partnerships, respectively. Accurate reporting on these forms is essential to comply with tax regulations and avoid potential penalties.Phoenix Arizona Schedule B is a tax form primarily used by individuals and businesses in Phoenix, Arizona, to report their interest and dividend income to the Arizona Department of Revenue. It serves as an attachment to the individual or corporate income tax return, ensuring accurate reporting of investment income for tax purposes. By providing a breakdown of the taxpayer's interest and dividend earnings, Schedule B helps determine the amount of taxable income that should be reported. There are different types of Phoenix Arizona Schedule B forms based on the specific tax return being filed. For individual taxpayers, the most commonly used form is Schedule B-1, which covers interest and ordinary dividends received during the tax year. This form requires taxpayers to report the name of the payer, amount received, and any tax-exempt interest earned. Additionally, if the individual received dividends from foreign sources, Form Schedule B-1 also helps in reporting those. For businesses, there is Schedule B-2, which is specifically designed for corporations and partnerships. This form is used to disclose interest and dividend income earned by such entities, similar to Schedule B-1 for individuals. It requires companies to provide information on the payer name, amount received, and tax-exempt interest. Schedule B-2 also covers foreign dividends received by the business, ensuring full disclosure of all income sources. Both individual and business taxpayers must ensure accurate and complete reporting on Phoenix Arizona Schedule B forms to avoid any potential penalties or audits. It is crucial to carefully review and cross-check the information provided to ensure the highest level of accuracy. Failing to include all interest and dividend income earned during the tax year may result in underreporting income and potential liability. In summary, Phoenix Arizona Schedule B is an essential tax form used in the city to report interest and dividend income for both individual and business taxpayers. Its variations, Schedule B-1 and Schedule B-2, cater to the specific needs of individuals and corporations/partnerships, respectively. Accurate reporting on these forms is essential to comply with tax regulations and avoid potential penalties.