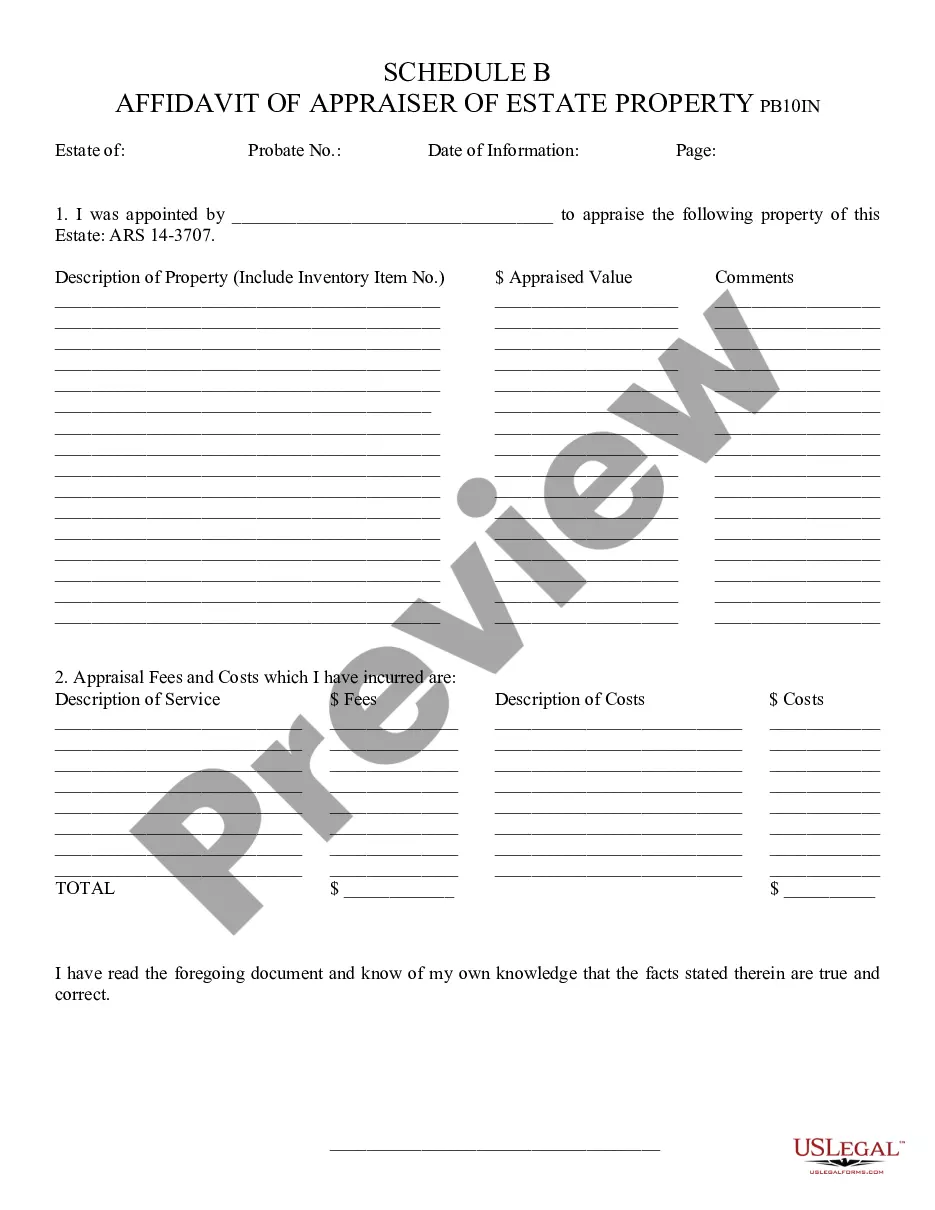

Affidavit of Appraiser of Estate Property, Schedule B - Arizona: This affidavit details the appraisal of an estate's property. The appraiser lists all the property and then gives an estimate as to its value. He/She then signs the form in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Scottsdale Arizona Schedule B is a document used for reporting interest and dividend income earned by residents of Scottsdale, Arizona. It is an additional attachment to the federal tax return, specifically Form 1040. The purpose of Scottsdale Arizona Schedule B is to provide a breakdown of the interest and dividend income that individuals or businesses in Scottsdale have received throughout the tax year. This schedule allows taxpayers to accurately report their investment income to the Internal Revenue Service (IRS) and the Arizona Department of Revenue (ODOR). There are different types of Scottsdale Arizona Schedule B that individuals or businesses may need to complete based on their sources of income. These types include: 1. Schedule B for Interest Income: This form is used to report all interest income received from various sources such as bank accounts, savings accounts, certificates of deposit, and interest-bearing bonds or notes. 2. Schedule B for Dividend Income: This form is used to report all dividend income received from stocks, mutual funds, and other qualified dividend-paying investments. Both Schedule B forms require detailed information about the income received, such as the payer's name, address, and the amount received during the tax year. Taxpayers are required to provide accurate and complete information to avoid any penalties or legal issues. It is important to note that Schedule B is not used to report capital gains or losses. Those should be reported on Schedule D for federal tax purposes.