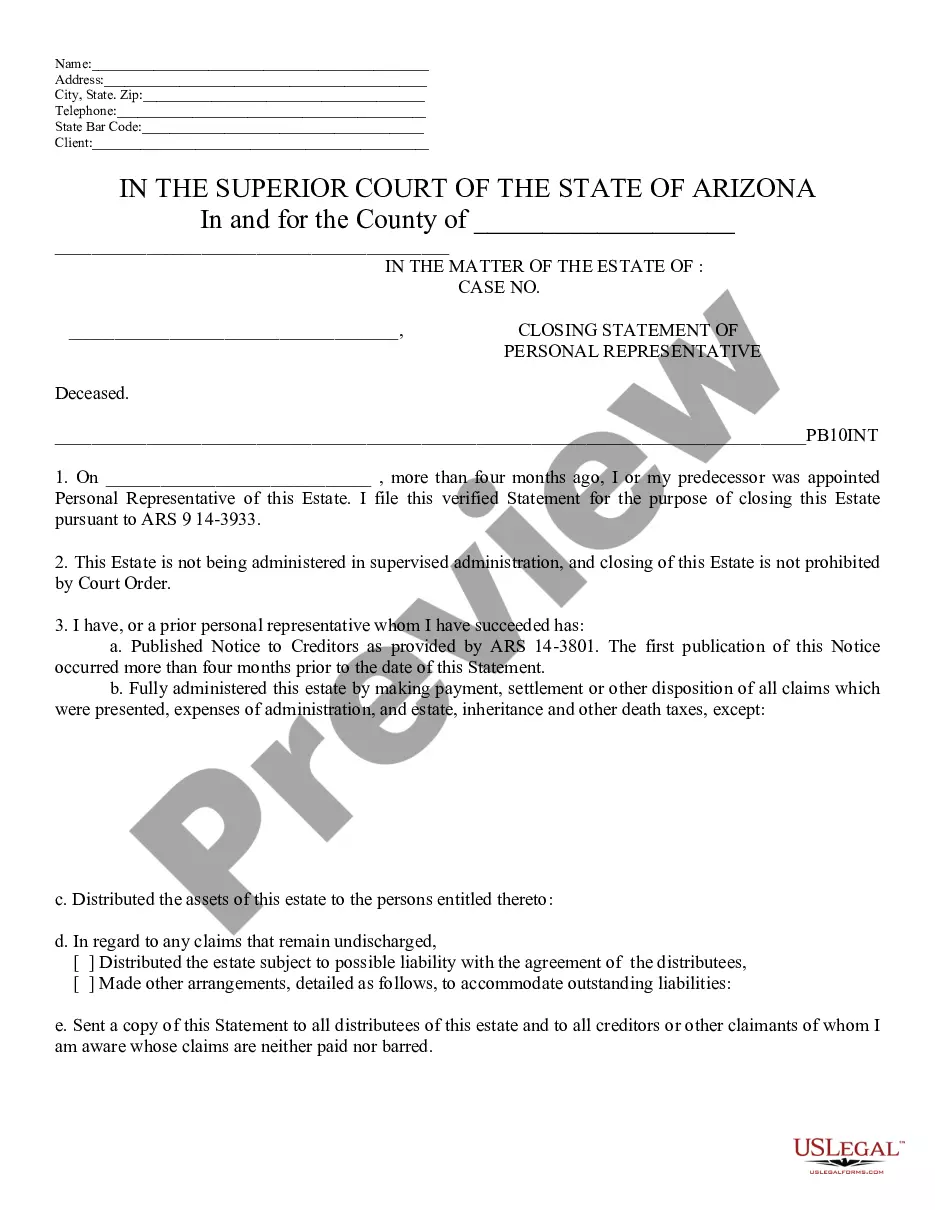

Closing Statement of Personal Rep. - Arizona: A Closing Statement is signed by the administrator of an estate, upon completion of his/her services, which includes distribution of all property in the estate. This form is to be signed in front of a Notary Public. It is available for download in both Word and Rich Text formats.

The Tempe Arizona Closing Statement of Personal Representative is a legal document that summarizes the final financial transactions, assets, and distributions made by the personal representative of an estate. It serves as a conclusive record of the actions taken during the probate process. This document is crucial to ensure transparency and accountability in the estate administration. Here are some key keywords related to the Tempe Arizona Closing Statement of Personal Representative: 1. Estate administration: Refers to the process of collecting, managing, and distributing the assets of a deceased person (decedent) in line with their wishes or applicable laws. 2. Probate process: The legal procedure that validates a will and oversees the distribution of a decedent's assets, payment of debts, and resolution of any claims against the estate. 3. Personal representative: Also known as an executor or estate administrator, this is the individual appointed by the court to administer the estate. They are responsible for gathering assets, paying debts, and distributing the remaining property to beneficiaries or heirs. 4. Closing statement: The final financial report prepared by the personal representative, summarizing the estate's assets, debts, income, expenses, and distributions. It provides an overview of the entire probate process. 5. Distribution of assets: Refers to the allocation of the decedent's property, including real estate, investments, personal belongings, and any other assets among the beneficiaries or heirs named in the will or determined by intestate succession laws. 6. Final accounting: A detailed record of all financial transactions involving the estate, including income, expenses, debts paid, and distributions made to beneficiaries. This information is crucial for the preparation of the closing statement. Different types of Tempe Arizona Closing Statement of Personal Representative might include: 1. Informal Closing Statement: This type of closing statement may be used when the estate administration process is relatively straightforward and doesn't require extensive court involvement. 2. Formal Closing Statement: In more complex cases or when there is a disputed will or claims against the estate, a formal closing statement might be required. This involves court oversight and approval of the personal representative's actions. 3. Small Estate Closing Statement: When the total value of the estate is below a certain threshold, usually determined by state law, a simplified closing statement or affidavit may be used instead. This allows for a quicker and less formal process. 4. Supervised Closing Statement: If the court decides to supervise the estate administration due to the decedent's debts, potential conflicts among beneficiaries, or other reasons, a supervised closing statement may be required. This involves more scrutiny and involvement from the court. It is important to consult with a legal professional or an estate attorney in Tempe, Arizona to understand the specific requirements and procedures relating to the Closing Statement of Personal Representative, as they can vary depending on the nature and complexity of the estate.The Tempe Arizona Closing Statement of Personal Representative is a legal document that summarizes the final financial transactions, assets, and distributions made by the personal representative of an estate. It serves as a conclusive record of the actions taken during the probate process. This document is crucial to ensure transparency and accountability in the estate administration. Here are some key keywords related to the Tempe Arizona Closing Statement of Personal Representative: 1. Estate administration: Refers to the process of collecting, managing, and distributing the assets of a deceased person (decedent) in line with their wishes or applicable laws. 2. Probate process: The legal procedure that validates a will and oversees the distribution of a decedent's assets, payment of debts, and resolution of any claims against the estate. 3. Personal representative: Also known as an executor or estate administrator, this is the individual appointed by the court to administer the estate. They are responsible for gathering assets, paying debts, and distributing the remaining property to beneficiaries or heirs. 4. Closing statement: The final financial report prepared by the personal representative, summarizing the estate's assets, debts, income, expenses, and distributions. It provides an overview of the entire probate process. 5. Distribution of assets: Refers to the allocation of the decedent's property, including real estate, investments, personal belongings, and any other assets among the beneficiaries or heirs named in the will or determined by intestate succession laws. 6. Final accounting: A detailed record of all financial transactions involving the estate, including income, expenses, debts paid, and distributions made to beneficiaries. This information is crucial for the preparation of the closing statement. Different types of Tempe Arizona Closing Statement of Personal Representative might include: 1. Informal Closing Statement: This type of closing statement may be used when the estate administration process is relatively straightforward and doesn't require extensive court involvement. 2. Formal Closing Statement: In more complex cases or when there is a disputed will or claims against the estate, a formal closing statement might be required. This involves court oversight and approval of the personal representative's actions. 3. Small Estate Closing Statement: When the total value of the estate is below a certain threshold, usually determined by state law, a simplified closing statement or affidavit may be used instead. This allows for a quicker and less formal process. 4. Supervised Closing Statement: If the court decides to supervise the estate administration due to the decedent's debts, potential conflicts among beneficiaries, or other reasons, a supervised closing statement may be required. This involves more scrutiny and involvement from the court. It is important to consult with a legal professional or an estate attorney in Tempe, Arizona to understand the specific requirements and procedures relating to the Closing Statement of Personal Representative, as they can vary depending on the nature and complexity of the estate.