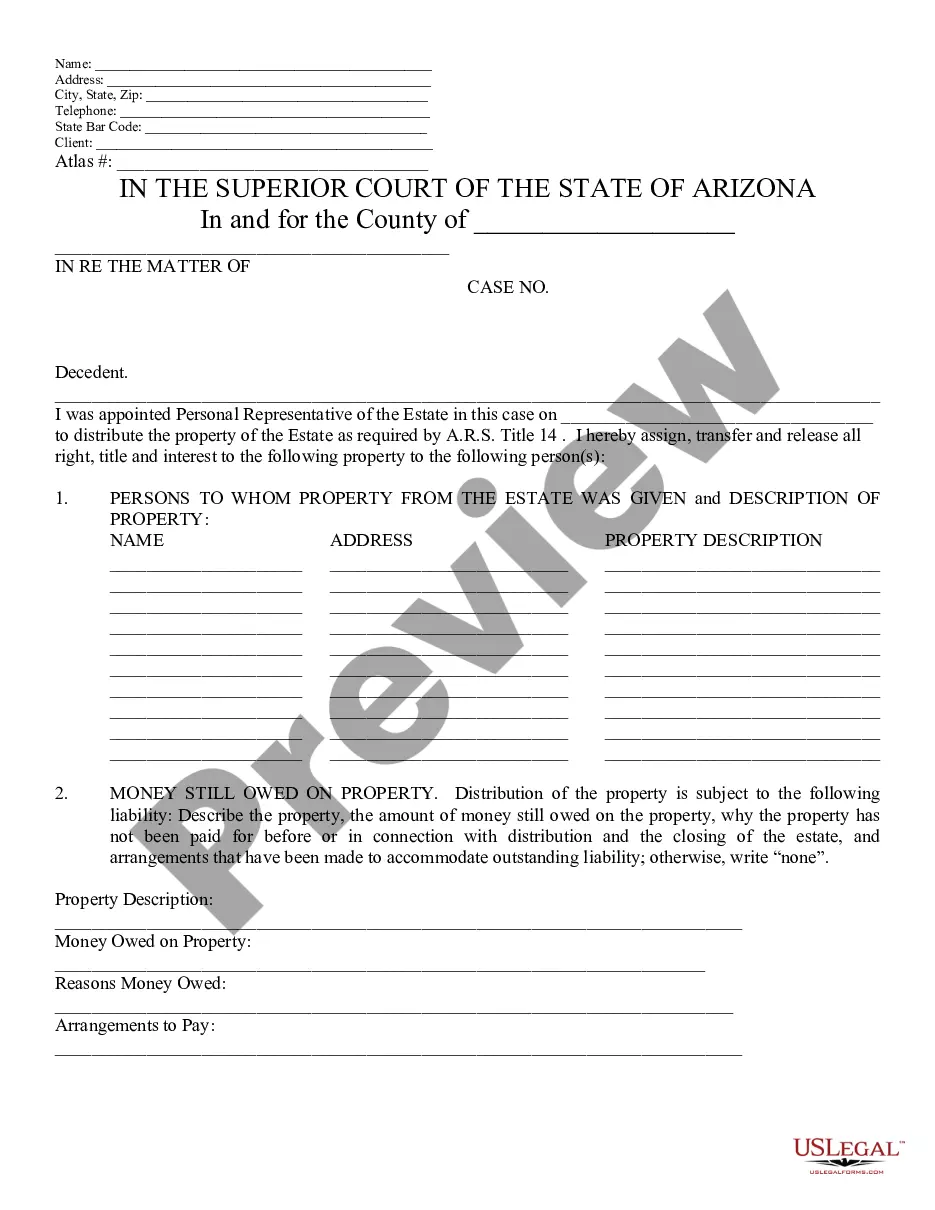

Proposed Distribution of Money and Property of Probate Estate - Schedule H - Arizona: A Proposed Distribution of Estate Property is signed by the Administrator. It fully lists all property in an estate and how he/she sugests it should be divided. It is available for download in both Word and Rich Text formats.

Maricopa Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H is a vital document filed in probate cases that outlines the planned allocation of assets and funds among beneficiaries in Maricopa County, Arizona. This schedule is crucial for ensuring a fair and lawful distribution of an individual's estate after they pass away. It provides a comprehensive breakdown of the assets, liabilities, and beneficiaries involved in the probate estate. The purpose of Maricopa Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H is to provide transparency and clarity regarding the division of the deceased person's estate. It establishes a clear framework for allocating funds, real estate properties, investments, businesses, personal belongings, and other assets to the intended beneficiaries based on the decedent's wishes, state laws, and the terms of the will or trust. There are different types of Maricopa Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H, which usually vary based on the complexity and size of the estate. These may include: 1. Simple Estate Distribution Schedule: This type of schedule is applicable for smaller estates with fewer assets and beneficiaries. It presents a straightforward distribution plan, ensuring that each beneficiary receives their designated share of the probate estate. 2. Complex Estate Distribution Schedule: For larger and more intricate estates, a complex distribution schedule is necessary. It incorporates detailed asset inventory, appraisal values, outstanding debts, and specific instructions for distributing various categories of assets (such as real estate, vehicles, investment accounts) among multiple beneficiaries. 3. Contested Estate Distribution Schedule: In certain situations, the distribution of a probate estate may face disputes or conflicts among the beneficiaries or other interested parties. In such cases, a contested estate distribution schedule is created, clearly presenting the proposed allocation of money and property while addressing any legal challenges or objections. 4. Trust Distribution Schedule: In instances where the decedent's assets are held in a trust, a separate trust distribution schedule may be prepared. This document outlines how the trustee should distribute funds and property to beneficiaries according to the terms of the trust agreement and in compliance with applicable laws. The Maricopa Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H is a crucial element of probate proceedings, allowing for an orderly and equitable distribution of assets. It ensures that all beneficiaries receive their rightful shares while adhering to legal requirements and the decedent's intentions as expressed in their will or trust.