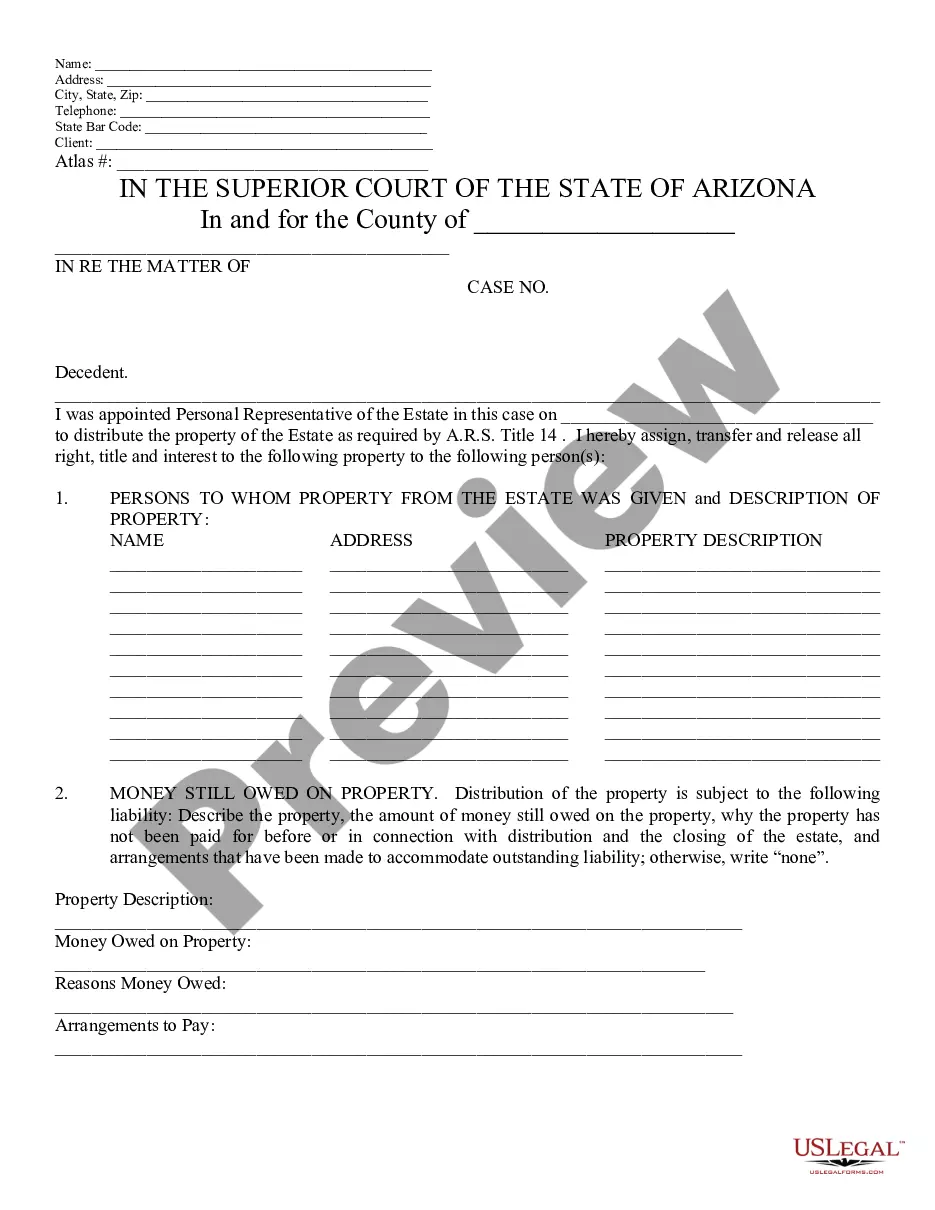

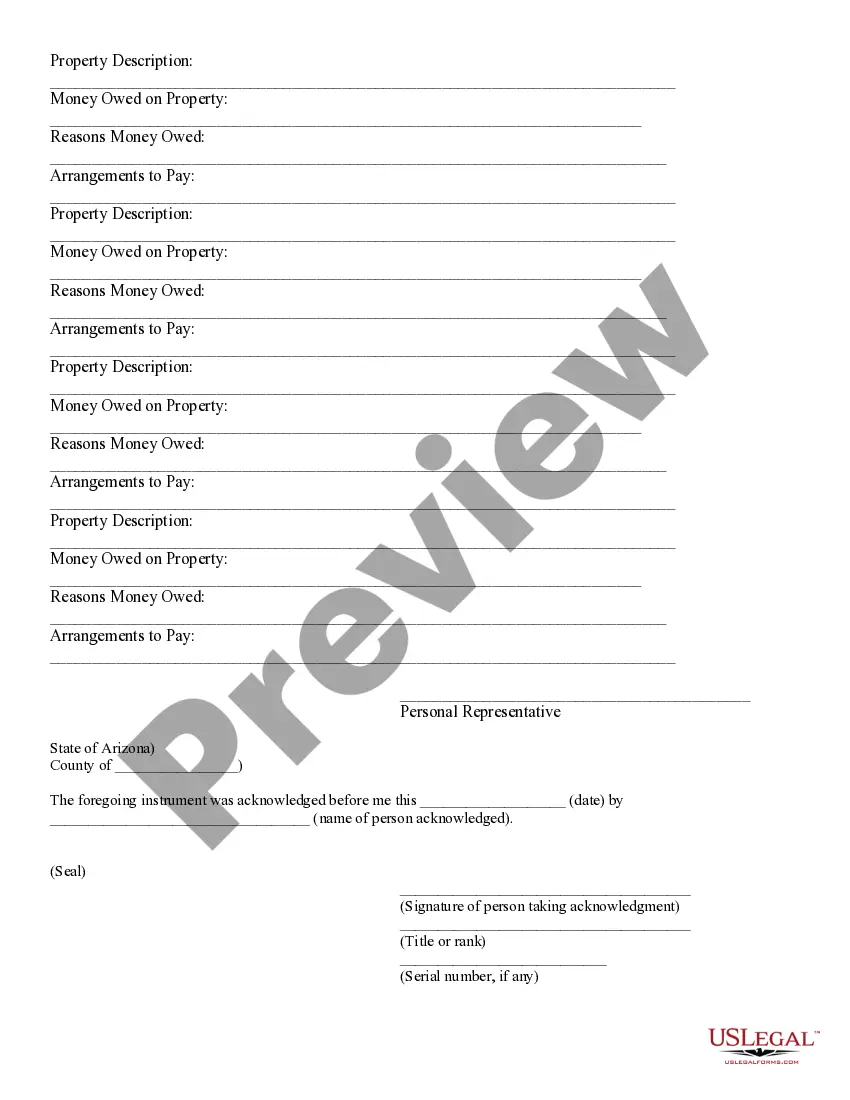

Proposed Distribution of Money and Property of Probate Estate - Schedule H - Arizona: A Proposed Distribution of Estate Property is signed by the Administrator. It fully lists all property in an estate and how he/she sugests it should be divided. It is available for download in both Word and Rich Text formats.

In Phoenix, Arizona, the Proposed Distribution of Money and Property of Probate Estate — Schedule H is a legal document that outlines the allocation and division of assets and funds within a probate estate. This schedule is an essential component of the probate process, ensuring a fair and equitable distribution of the decedent's wealth among their designated beneficiaries. This document provides a detailed breakdown of the assets, liabilities, and debts of the estate, along with the proposed distribution plan. It lists all the beneficiaries or heirs entitled to a share of the estate and specifies the percentage or amount each one is set to receive. The proposed distribution may include various types of assets such as real estate properties, personal possessions, financial accounts, stocks, bonds, or any other valuable possessions. Different types or variations of the Phoenix Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H may include: 1. Cash Distribution: This refers to the allocation of money from the estate, such as cash held in bank accounts, investment profits, or insurance proceeds. 2. Real Estate Distribution: This involves the transfer of ownership or sale proceedings of any real property owned by the decedent, such as houses, land, or commercial buildings. 3. Personal Property Distribution: This covers the distribution of personal possessions, including furniture, vehicles, jewelry, artwork, collectibles, and any other valuable items owned by the decedent. 4. Financial Asset Distribution: This category includes the allocation of financial assets like stocks, bonds, mutual funds, retirement accounts, or any other investment instruments held by the deceased. 5. Debt and Liability Settlement: The proposed distribution plan also addresses any outstanding debts, loans, or liabilities of the estate, prioritizing their settlement before the final distribution of assets. It is essential for the proposed distribution plan to comply with Arizona probate laws and follow the specific instructions and wishes outlined in the decedent's will, if there is one. The document must be submitted to the probate court for approval and will ultimately guide the executor or personal representative in carrying out the distribution of the probate estate.