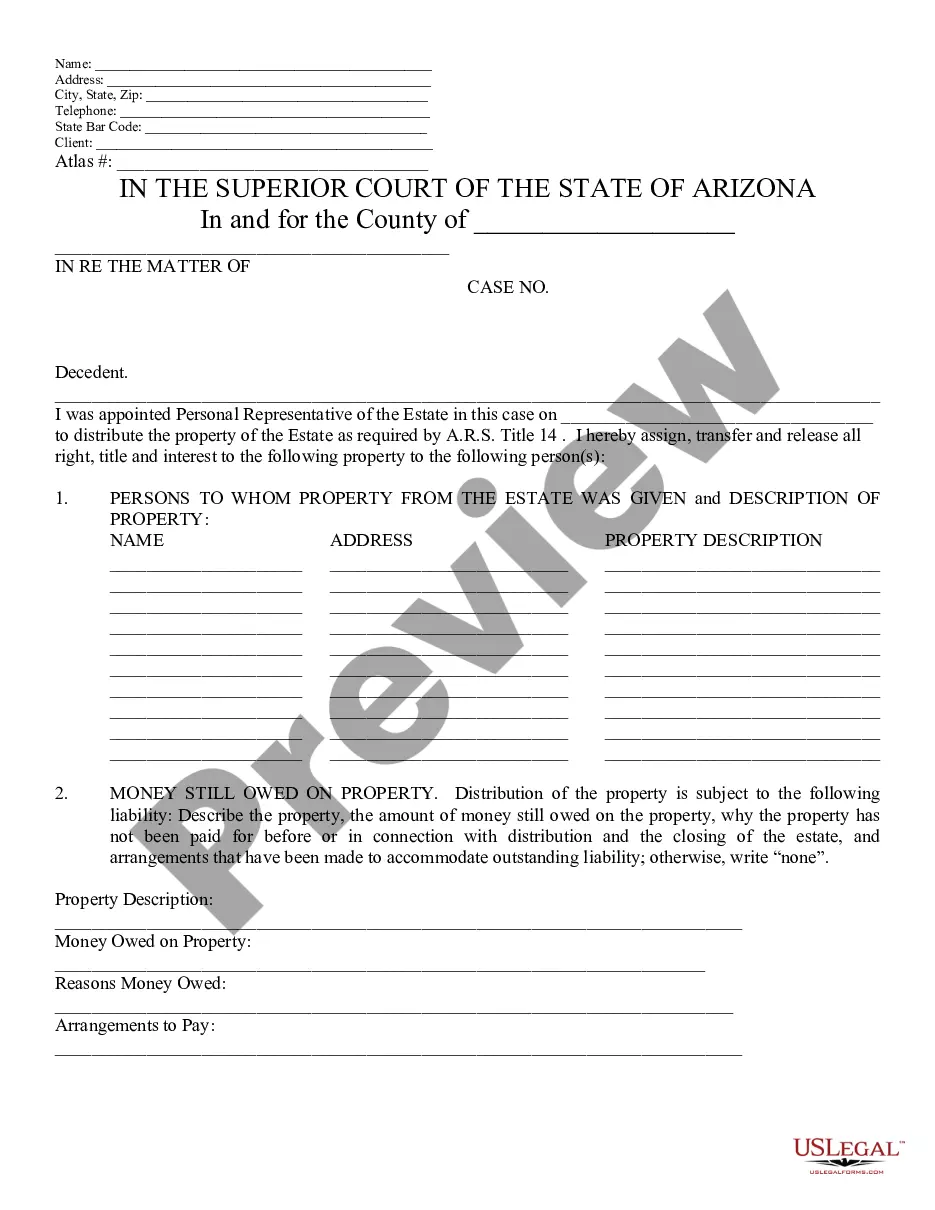

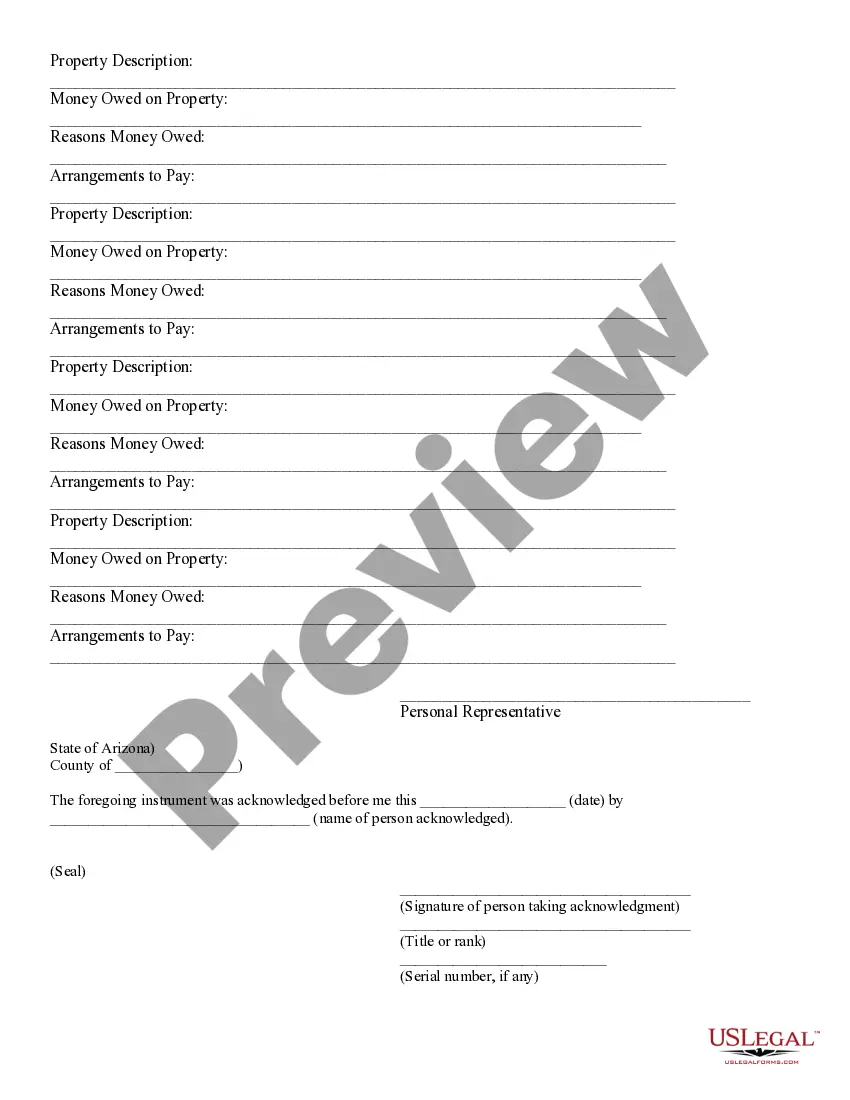

Proposed Distribution of Money and Property of Probate Estate - Schedule H - Arizona: A Proposed Distribution of Estate Property is signed by the Administrator. It fully lists all property in an estate and how he/she sugests it should be divided. It is available for download in both Word and Rich Text formats.

Title: Surprise, Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H Keywords: Surprise Arizona, Probate Estate, Proposed Distribution, Money and Property, Schedule H Introduction: In Surprise, Arizona, the Proposed Distribution of Money and Property of a Probate Estate holds significant importance during the estate settlement process. Schedule H outlines the comprehensive plan for the allocation of assets, ensuring a fair distribution among beneficiaries and creditors. This article aims to provide a detailed description of Surprise, Arizona's Proposed Distribution of Money and Property of Probate Estate — Schedule H, highlighting its key elements and various types. 1. General Overview: The Proposed Distribution of Money and Property of Probate Estate — Schedule H acts as a crucial document in the probate estate administration process. It declares how the estate's assets, including money, real estate, personal property, and investments, will be distributed among heirs, legatees, or other interested parties. 2. Components of Schedule H: a. Identification of Property: Schedule H begins with an identification section, stating the detailed inventory and valuation of all assets within the probate estate. It encompasses bank accounts, securities, real estate holdings, vehicles, household items, and any other relevant possessions. b. Detailed List of Beneficiaries: The schedule provides a comprehensive list of all beneficiaries entitled to receive a portion of the estate. This includes heirs designated by law, individuals named in the decedent's will, and any other interested parties acknowledged by the court. c. Allocated Percentages: The proposal specifies the percentage distribution of the estate's property and money to each beneficiary, ensuring a fair share according to applicable laws and the decedent's wishes as expressed in their will (if applicable). d. Specific Bequests or Legacies: Schedule H may include any explicit instructions regarding specific bequests or legacies granted to particular individuals or organizations. These specific bequests usually include sentimental items or charitable donations. e. Debts, Taxes, and Expenses: The schedule outlines the payment of outstanding debts, taxes, and administration expenses directly from the estate's assets, ensuring the fulfillment of any financial obligations before distribution. 3. Types of Surprise Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H: a. Solemn Distribution: In cases where the decedent's will explicitly designate the distribution percentages and beneficiaries, a solemn distribution schedule H is created to implement the decedent's wishes accordingly. b. Statutory Distribution: If the decedent has not left a valid will or the will does not offer specific instructions for asset distribution, the court follows the applicable state laws to determine the statutory distribution percentages and beneficiaries. This ensures a fair and equitable distribution among the closest family members. c. Modified Distribution: In some instances, heirs and other interested parties may reach a mutual agreement to modify the distribution percentages or arrangements outlined in Schedule H. This may require court approval to ensure fairness and legality. Conclusion: Surprise, Arizona's Proposed Distribution of Money and Property of Probate Estate — Schedule H plays a pivotal role in administering an estate's distribution process. Whether it follows the decedent's will, statutory guidelines, or undergoes modifications, this schedule ensures an equitable allocation of assets among beneficiaries while taking care of debts, taxes, and expenses associated with the estate settlement. Proper attention to Schedule H guarantees a smooth transition of ownership and a respectful closure to the probate estate.Title: Surprise, Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H Keywords: Surprise Arizona, Probate Estate, Proposed Distribution, Money and Property, Schedule H Introduction: In Surprise, Arizona, the Proposed Distribution of Money and Property of a Probate Estate holds significant importance during the estate settlement process. Schedule H outlines the comprehensive plan for the allocation of assets, ensuring a fair distribution among beneficiaries and creditors. This article aims to provide a detailed description of Surprise, Arizona's Proposed Distribution of Money and Property of Probate Estate — Schedule H, highlighting its key elements and various types. 1. General Overview: The Proposed Distribution of Money and Property of Probate Estate — Schedule H acts as a crucial document in the probate estate administration process. It declares how the estate's assets, including money, real estate, personal property, and investments, will be distributed among heirs, legatees, or other interested parties. 2. Components of Schedule H: a. Identification of Property: Schedule H begins with an identification section, stating the detailed inventory and valuation of all assets within the probate estate. It encompasses bank accounts, securities, real estate holdings, vehicles, household items, and any other relevant possessions. b. Detailed List of Beneficiaries: The schedule provides a comprehensive list of all beneficiaries entitled to receive a portion of the estate. This includes heirs designated by law, individuals named in the decedent's will, and any other interested parties acknowledged by the court. c. Allocated Percentages: The proposal specifies the percentage distribution of the estate's property and money to each beneficiary, ensuring a fair share according to applicable laws and the decedent's wishes as expressed in their will (if applicable). d. Specific Bequests or Legacies: Schedule H may include any explicit instructions regarding specific bequests or legacies granted to particular individuals or organizations. These specific bequests usually include sentimental items or charitable donations. e. Debts, Taxes, and Expenses: The schedule outlines the payment of outstanding debts, taxes, and administration expenses directly from the estate's assets, ensuring the fulfillment of any financial obligations before distribution. 3. Types of Surprise Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H: a. Solemn Distribution: In cases where the decedent's will explicitly designate the distribution percentages and beneficiaries, a solemn distribution schedule H is created to implement the decedent's wishes accordingly. b. Statutory Distribution: If the decedent has not left a valid will or the will does not offer specific instructions for asset distribution, the court follows the applicable state laws to determine the statutory distribution percentages and beneficiaries. This ensures a fair and equitable distribution among the closest family members. c. Modified Distribution: In some instances, heirs and other interested parties may reach a mutual agreement to modify the distribution percentages or arrangements outlined in Schedule H. This may require court approval to ensure fairness and legality. Conclusion: Surprise, Arizona's Proposed Distribution of Money and Property of Probate Estate — Schedule H plays a pivotal role in administering an estate's distribution process. Whether it follows the decedent's will, statutory guidelines, or undergoes modifications, this schedule ensures an equitable allocation of assets among beneficiaries while taking care of debts, taxes, and expenses associated with the estate settlement. Proper attention to Schedule H guarantees a smooth transition of ownership and a respectful closure to the probate estate.