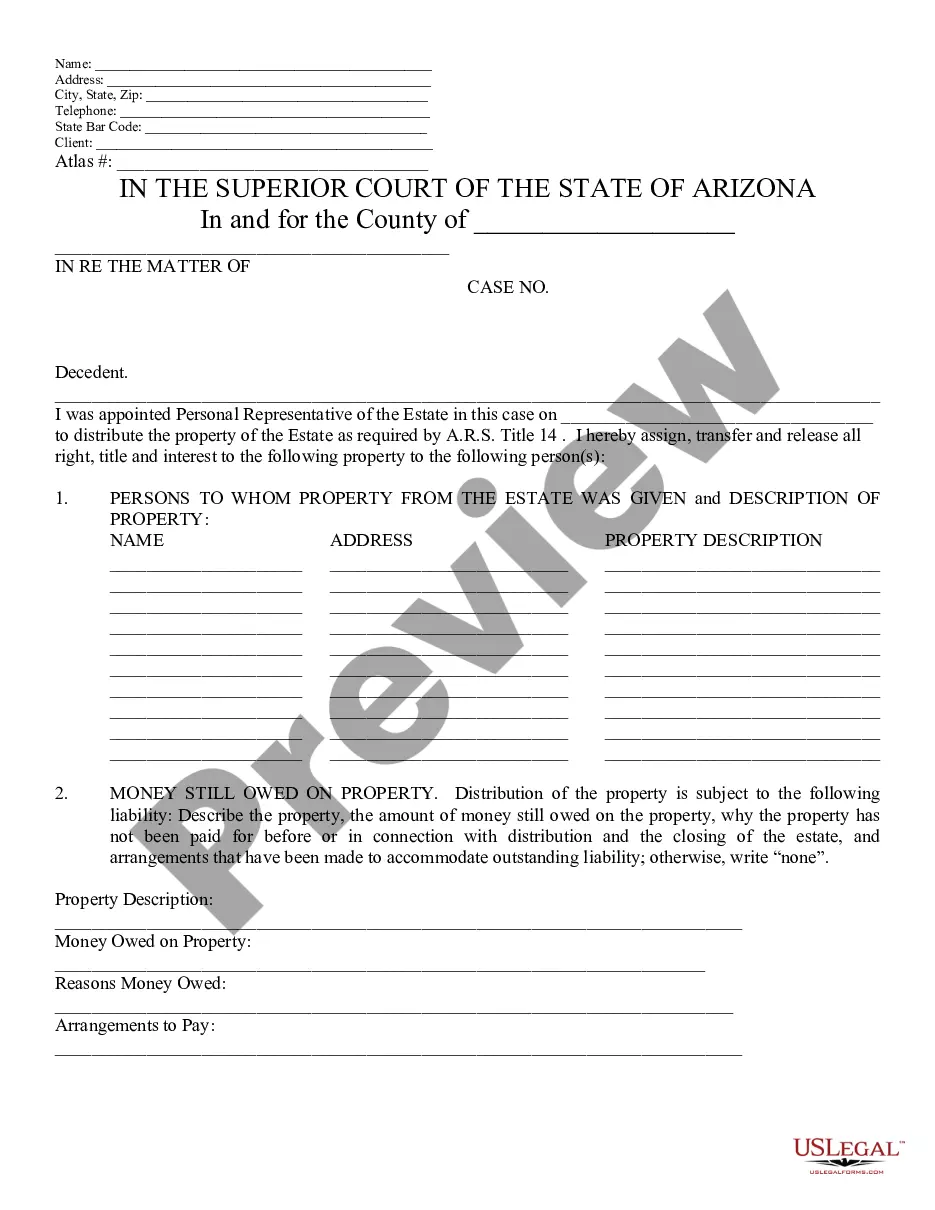

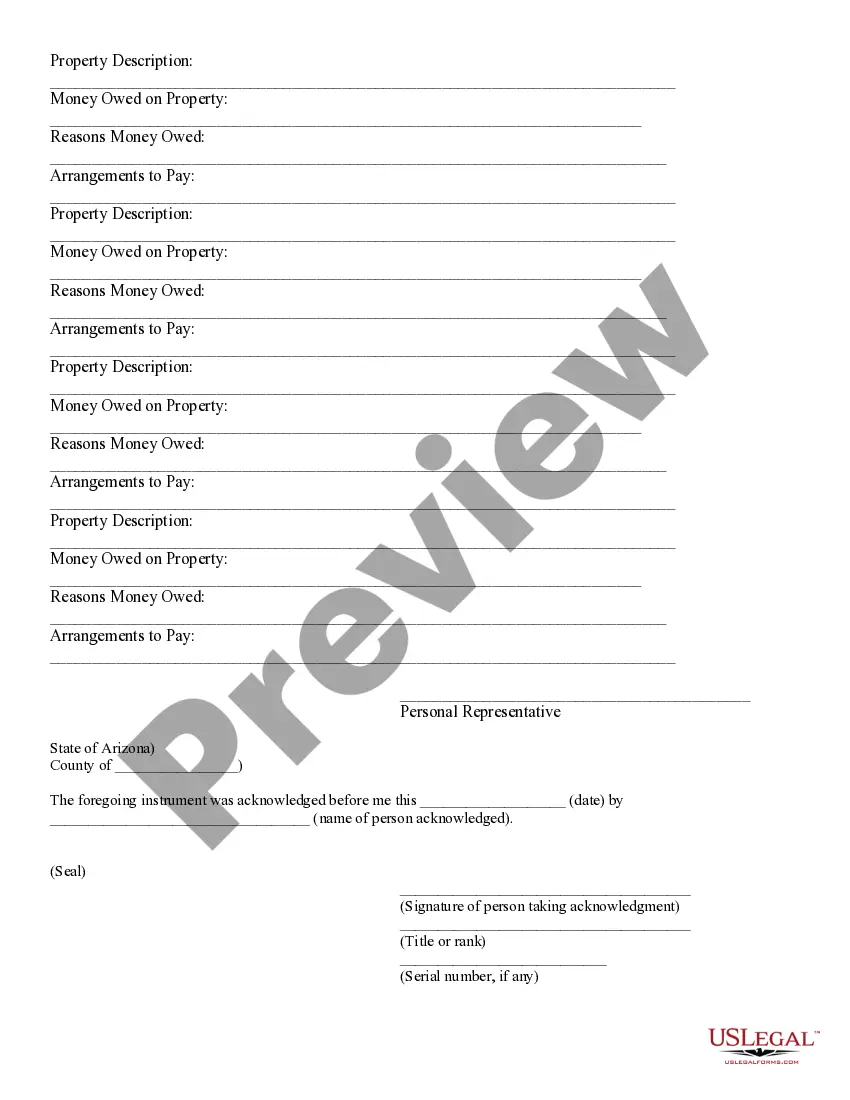

Proposed Distribution of Money and Property of Probate Estate - Schedule H - Arizona: A Proposed Distribution of Estate Property is signed by the Administrator. It fully lists all property in an estate and how he/she sugests it should be divided. It is available for download in both Word and Rich Text formats.

The Tempe Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H is an essential document in the probate process that outlines the planned allocation of assets and finances within an estate. It serves as a comprehensive guide, illustrating how the deceased individual's property and money will be distributed among the rightful heirs and beneficiaries. This schedule is typically created by the estate's executor or administrator, with the aim of ensuring a fair and transparent distribution of the estate's assets. In Tempe, Arizona, there are several types of proposed distributions of money and property of a probate estate, including: 1. Traditional Assets: This category encompasses physical possessions such as real estate properties, vehicles, jewelry, artwork, furniture, and any other tangible assets owned by the deceased individual. 2. Financial Assets: This category involves money-related assets, including bank accounts, investment portfolios, stocks, bonds, retirement accounts, and any other financial holdings owned by the deceased person. These assets are typically liquidated or transferred to the designated heirs and beneficiaries in accordance with the schedule. 3. Debts and Liabilities: In this section, all outstanding debts and liabilities of the deceased individual are identified and addressed. This may include mortgages, loans, credit card debts, unpaid taxes, and any other financial obligations. The schedule outlines how these debts will be settled using the available estate funds and assets. 4. Specific Bequests: Sometimes, the deceased individual may have made specific requests regarding the distribution of certain assets to specific individuals or organizations. These requests are documented in the schedule and are followed accordingly during the distribution process. For example, a person may have designated a specific piece of artwork to be given to a particular family member or donated to a charity. 5. Residuary Estate: The residuary estate refers to any remaining assets or finances after all debts, specific bequests, and expenses have been accounted for. This residual portion is distributed among the remaining beneficiaries in accordance with the deceased individual's will or, in the absence of a will, Arizona state law. The Tempe Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H is a crucial document to ensure the fair and legal distribution of a deceased person's assets. It helps to maintain transparency and avoid disputes among the heirs and beneficiaries. Executors and administrators should consult an experienced probate attorney to assist them in preparing this schedule accurately and in compliance with Arizona probate laws.