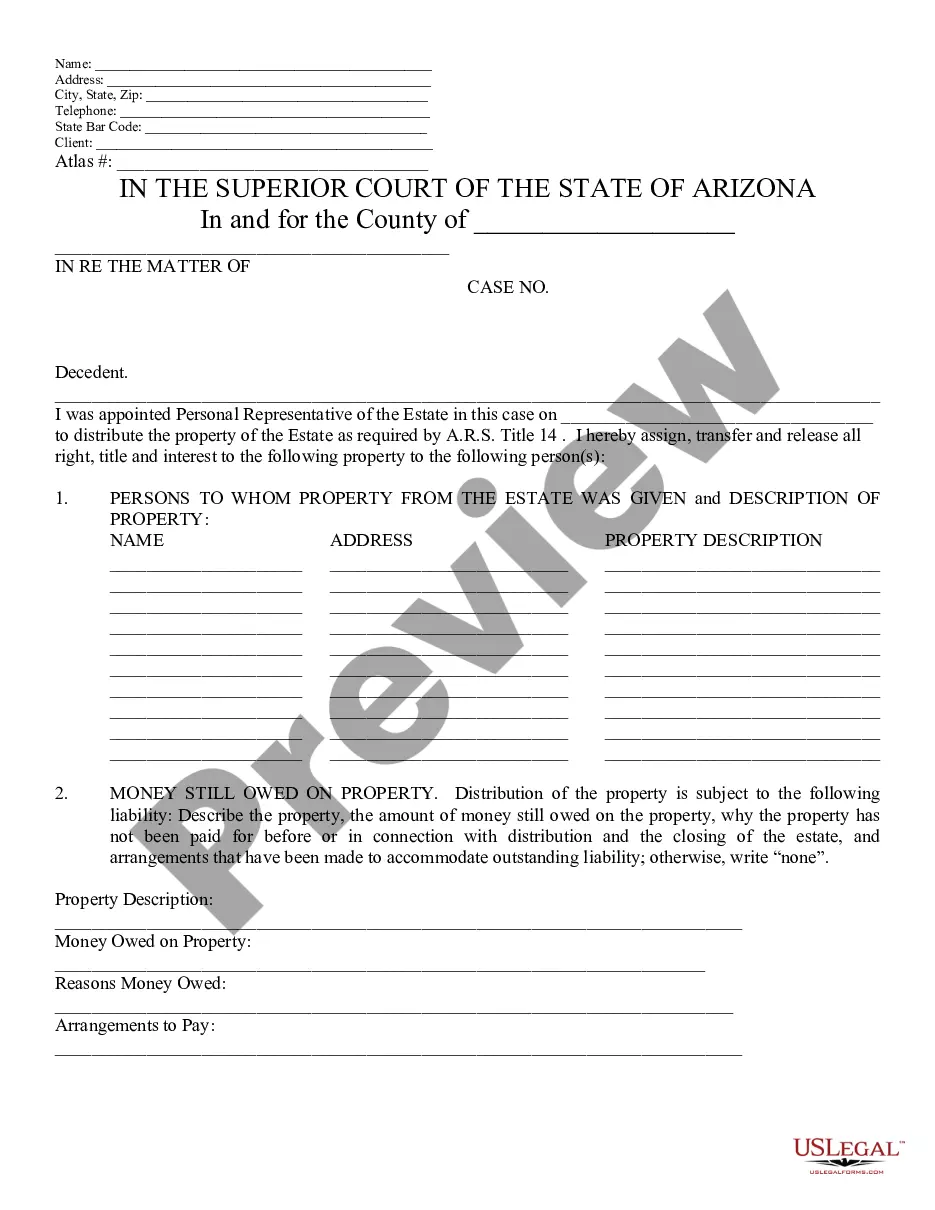

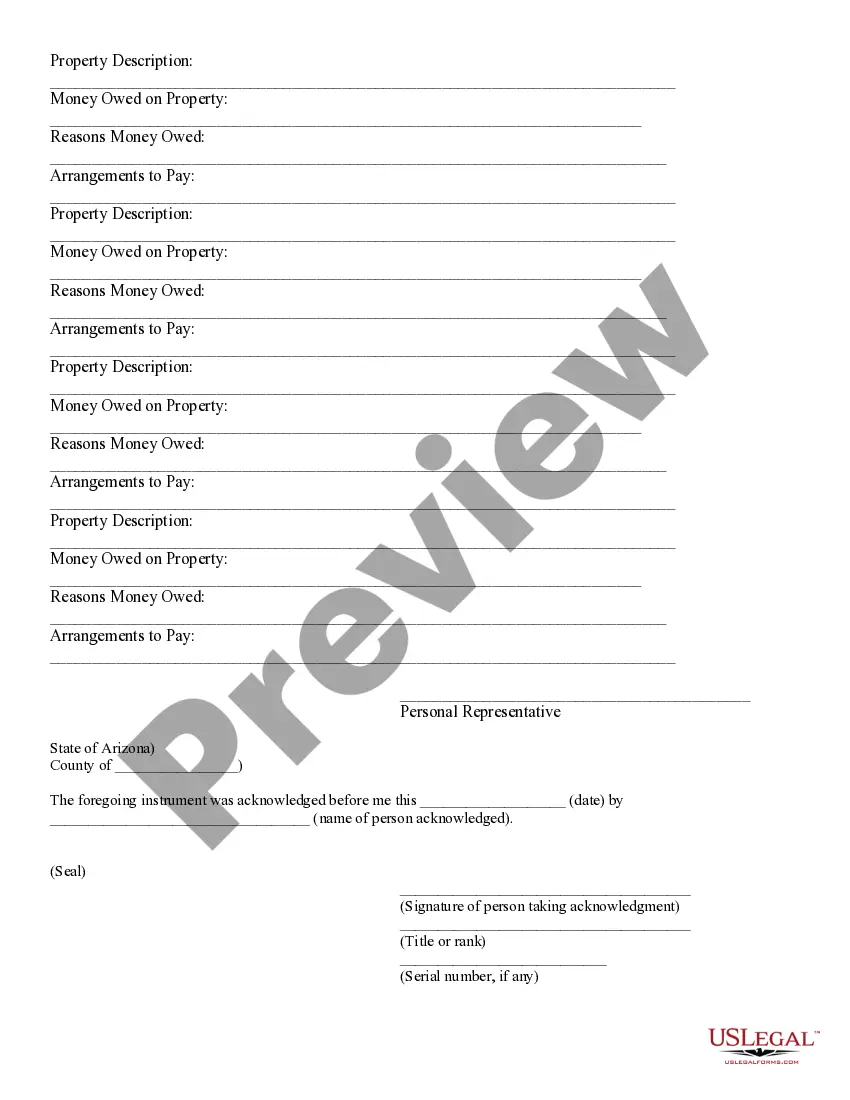

Proposed Distribution of Money and Property of Probate Estate - Schedule H - Arizona: A Proposed Distribution of Estate Property is signed by the Administrator. It fully lists all property in an estate and how he/she sugests it should be divided. It is available for download in both Word and Rich Text formats.

Tucson Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H is a legal document that outlines the allocation of assets and funds among beneficiaries during the probate process in Tucson, Arizona. This schedule provides a detailed breakdown of how the deceased's estate will be distributed, ensuring fairness and adherence to the applicable laws. The proposed distribution in Tucson Arizona Probate Estate — Schedule H involves various types of assets and monetary values, which may include real estate properties, bank accounts, investments, personal belongings, and other valuables. The specific items and their respective values are meticulously documented to ensure accurate allocation among the intended recipients. Additionally, Tucson Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H may also encompass different categories or classes of beneficiaries. These could include immediate family members, such as spouses, children, and grandchildren, as well as extended family members, friends, or charitable organizations mentioned in the deceased's will. To properly draft Tucson Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H, it is crucial to adhere to the legal requirements and guidelines established by Tucson's probate court. The document should be prepared by an experienced probate attorney or estate planner to ensure compliance with state laws and to avoid any disputes or potential legal challenges from beneficiaries. When preparing Tucson Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H, the following keywords may be relevant: 1. Probate estate distribution: Describes the process of allocating assets and funds among beneficiaries during the probate process. 2. Tucson, Arizona: Indicates that the document is specific to the legal procedures and regulations of Tucson, Arizona. 3. Schedule H: Refers to the particular section or schedule in the probate documentation that details the proposed distribution of money and property. 4. Asset allocation: Refers to the specific breakdown of assets, such as real estate, investments, and personal belongings, and how they will be divided among beneficiaries. 5. Beneficiaries: Refers to the individuals or organizations who will receive portions of the estate as outlined in the proposed distribution. 6. Legal requirements: Highlights the importance of complying with Tucson's probate court regulations and guidelines while drafting the proposed distribution document. 7. Estate planner/Probate attorney: Suggests that the document should be prepared by a knowledgeable professional to ensure accuracy and legality. Different types or variations of Tucson Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H may exist based on specific factors or circumstances of the estate. Some examples include distributions involving complex assets like businesses, multiple properties, or trusts.Tucson Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H is a legal document that outlines the allocation of assets and funds among beneficiaries during the probate process in Tucson, Arizona. This schedule provides a detailed breakdown of how the deceased's estate will be distributed, ensuring fairness and adherence to the applicable laws. The proposed distribution in Tucson Arizona Probate Estate — Schedule H involves various types of assets and monetary values, which may include real estate properties, bank accounts, investments, personal belongings, and other valuables. The specific items and their respective values are meticulously documented to ensure accurate allocation among the intended recipients. Additionally, Tucson Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H may also encompass different categories or classes of beneficiaries. These could include immediate family members, such as spouses, children, and grandchildren, as well as extended family members, friends, or charitable organizations mentioned in the deceased's will. To properly draft Tucson Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H, it is crucial to adhere to the legal requirements and guidelines established by Tucson's probate court. The document should be prepared by an experienced probate attorney or estate planner to ensure compliance with state laws and to avoid any disputes or potential legal challenges from beneficiaries. When preparing Tucson Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H, the following keywords may be relevant: 1. Probate estate distribution: Describes the process of allocating assets and funds among beneficiaries during the probate process. 2. Tucson, Arizona: Indicates that the document is specific to the legal procedures and regulations of Tucson, Arizona. 3. Schedule H: Refers to the particular section or schedule in the probate documentation that details the proposed distribution of money and property. 4. Asset allocation: Refers to the specific breakdown of assets, such as real estate, investments, and personal belongings, and how they will be divided among beneficiaries. 5. Beneficiaries: Refers to the individuals or organizations who will receive portions of the estate as outlined in the proposed distribution. 6. Legal requirements: Highlights the importance of complying with Tucson's probate court regulations and guidelines while drafting the proposed distribution document. 7. Estate planner/Probate attorney: Suggests that the document should be prepared by a knowledgeable professional to ensure accuracy and legality. Different types or variations of Tucson Arizona Proposed Distribution of Money and Property of Probate Estate — Schedule H may exist based on specific factors or circumstances of the estate. Some examples include distributions involving complex assets like businesses, multiple properties, or trusts.