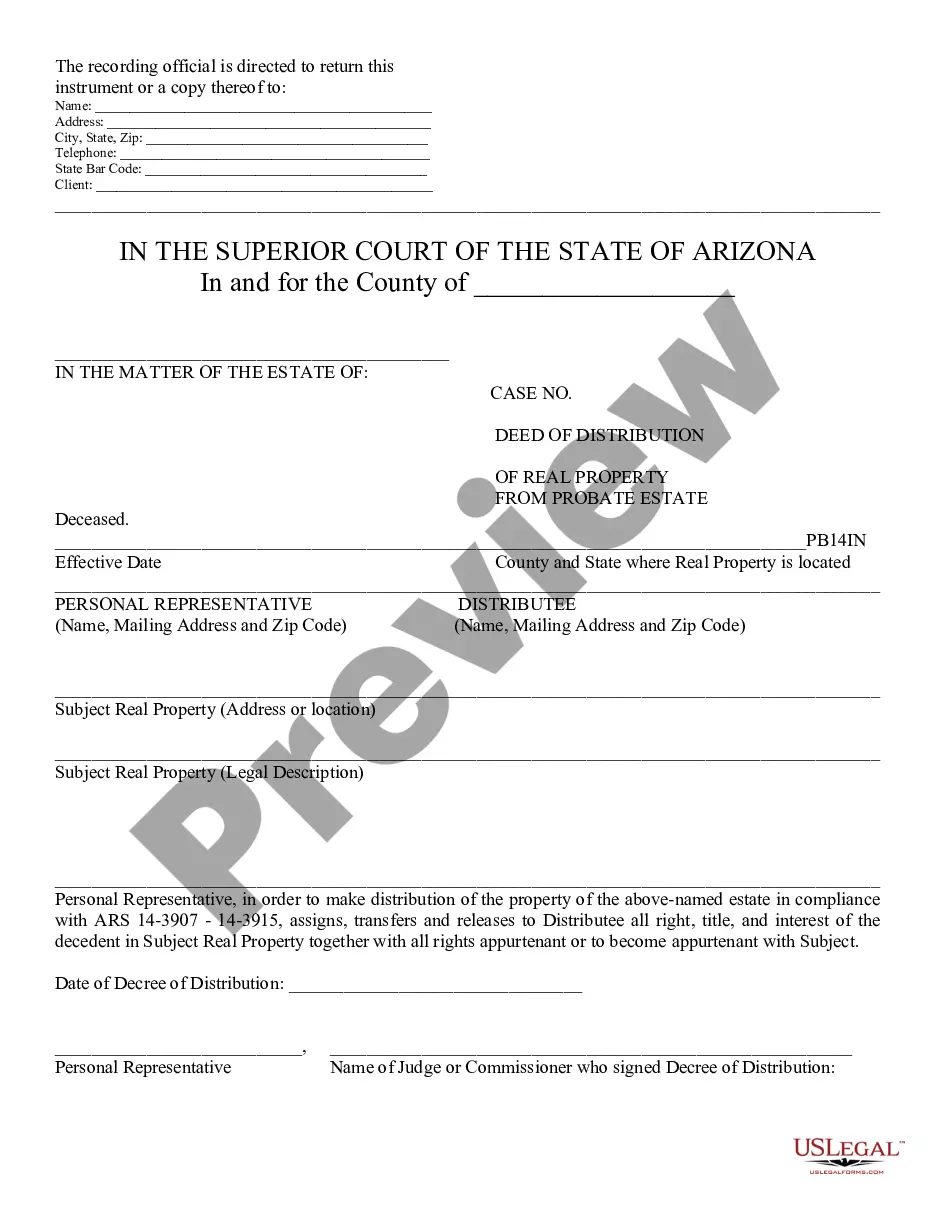

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Distribution of Probate Estate -Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

The Tempe Arizona Deed of Distribution of Probate Estate is a legal document that outlines the transfer of assets from a deceased person's estate to their rightful beneficiaries. It is an important part of the probate process, which is the legal process of administering and distributing a person's estate after their death. This deed serves as a formal record of the distribution and transfer of property, ensuring that assets are properly allocated to the intended recipients. It provides legal protection for both the executor of the estate and the beneficiaries, establishing clear ownership and rights to the distributed assets. There are different types of Tempe Arizona Deed of Distribution of Probate Estate that may be utilized depending on the specific circumstances and assets involved. These may include: 1. Real Estate Deed of Distribution: This type of deed is used when the deceased person owned real property, such as a house, land, or commercial building, and it needs to be transferred to the beneficiaries. 2. Personal Property Deed of Distribution: For assets like vehicles, jewelry, furniture, or other personal belongings, a personal property deed of distribution is used to transfer ownership to the rightful heirs. 3. Financial Account Deed of Distribution: This type of deed is used when the deceased person had financial accounts, such as bank accounts, investment portfolios, or retirement funds, which need to be transferred to the beneficiaries. 4. Business Interest Deed of Distribution: If the deceased person owned shares or interests in a business entity, such as a corporation or partnership, a business interest deed of distribution determines the transfer of those interests to the beneficiaries. It is important to note that the specific requirements and procedures for drafting and executing a Tempe Arizona Deed of Distribution of Probate Estate may vary based on the nature of the assets and the instructions left by the deceased person in their will or trust. It is advisable to consult with a qualified attorney or estate planning professional to ensure compliance with all applicable laws and to accurately distribute the probate estate.The Tempe Arizona Deed of Distribution of Probate Estate is a legal document that outlines the transfer of assets from a deceased person's estate to their rightful beneficiaries. It is an important part of the probate process, which is the legal process of administering and distributing a person's estate after their death. This deed serves as a formal record of the distribution and transfer of property, ensuring that assets are properly allocated to the intended recipients. It provides legal protection for both the executor of the estate and the beneficiaries, establishing clear ownership and rights to the distributed assets. There are different types of Tempe Arizona Deed of Distribution of Probate Estate that may be utilized depending on the specific circumstances and assets involved. These may include: 1. Real Estate Deed of Distribution: This type of deed is used when the deceased person owned real property, such as a house, land, or commercial building, and it needs to be transferred to the beneficiaries. 2. Personal Property Deed of Distribution: For assets like vehicles, jewelry, furniture, or other personal belongings, a personal property deed of distribution is used to transfer ownership to the rightful heirs. 3. Financial Account Deed of Distribution: This type of deed is used when the deceased person had financial accounts, such as bank accounts, investment portfolios, or retirement funds, which need to be transferred to the beneficiaries. 4. Business Interest Deed of Distribution: If the deceased person owned shares or interests in a business entity, such as a corporation or partnership, a business interest deed of distribution determines the transfer of those interests to the beneficiaries. It is important to note that the specific requirements and procedures for drafting and executing a Tempe Arizona Deed of Distribution of Probate Estate may vary based on the nature of the assets and the instructions left by the deceased person in their will or trust. It is advisable to consult with a qualified attorney or estate planning professional to ensure compliance with all applicable laws and to accurately distribute the probate estate.