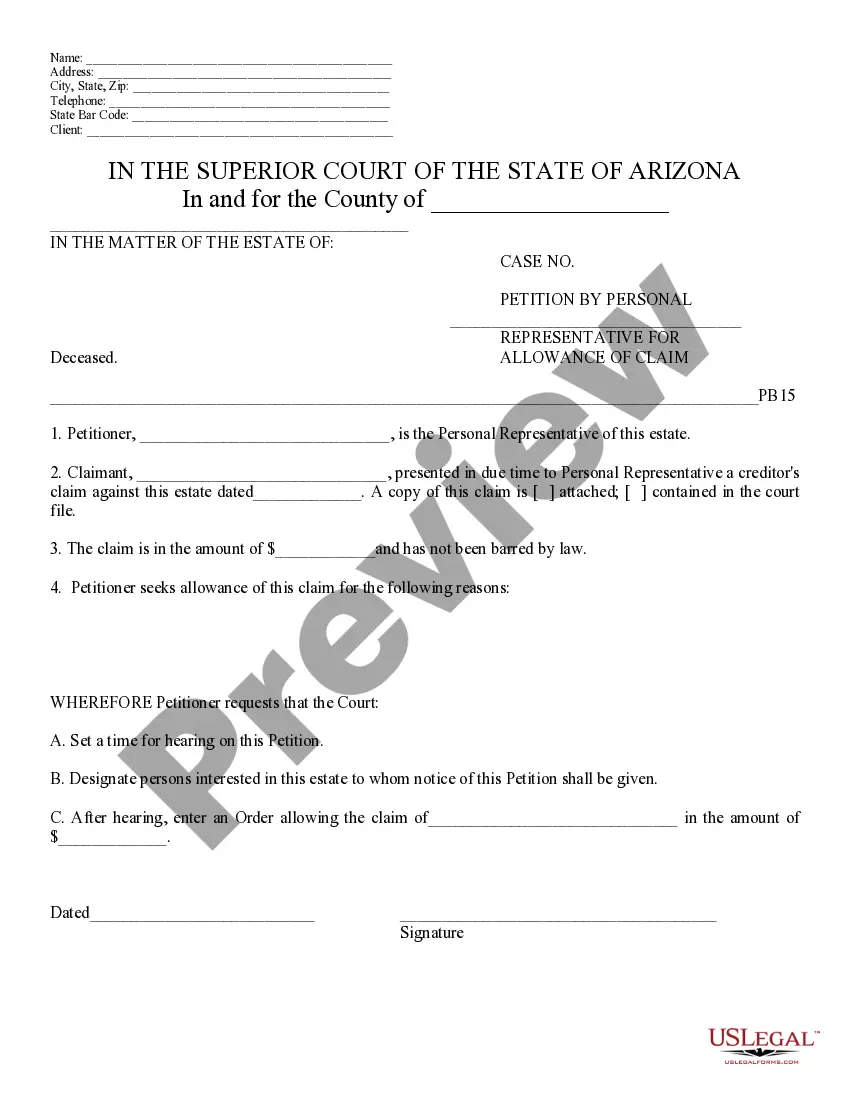

Debts of Estate -Schedule C -Arizona: This form is signed by the Administrator of the estate, upon seeing debts on the estate which need to be paid. The debt is listed in this document, as well as a request that notice be sent to all heirs of the estate. It is available for download in both Word and Rich Text formats.

Mesa Arizona Debts of Estate — Schedule C refers to a specific category of debts that are incurred upon the death of an individual in Mesa, Arizona. The debts of estate under Schedule C are the obligations and liabilities that are left unpaid by the deceased person and need to be settled through their estate. In Mesa, Arizona, Schedule C outlines the various types of debts that can be considered as part of the estate. These may include outstanding mortgages, credit card balances, personal loans, medical bills, student loans, and any other financial obligations that the deceased person may have had at the time of their passing. It is important to note that Schedule C of the Mesa Arizona Debts of Estate primarily focuses on the liabilities and debts of the deceased. These debts are not the responsibility of the heirs or beneficiaries, but rather the estate itself. In other words, the estate is responsible for covering these debts before any remaining assets can be distributed among the beneficiaries. Some different types of Mesa Arizona Debts of Estate that can be included on Schedule C may include: 1. Outstanding Mortgage or Home Loans: Any unpaid balances on the deceased person's mortgage or home loans fall under this category. 2. Credit Card Debt: Any unpaid credit card balances owed by the deceased person are considered as estate debts. 3. Personal Loans: Any loans that the deceased person may have taken out, such as car loans, personal lines of credit, or loans from family and friends, are included as part of the estate debts. 4. Medical Bills: Unpaid medical expenses incurred by the deceased person, including hospital bills, doctor fees, and ongoing treatments, form a part of the estate's debts. 5. Student Loans: If there are any outstanding student loans in the deceased person's name, they are treated as part of their estate debts. 6. Legal and Funeral Expenses: Any legal fees, including attorney charges related to probate, as well as funeral and burial costs, can also be listed as estate debts. The purpose of Schedule C is to ensure that all debts are properly identified and accounted for during the probate process. It allows the estate executor or personal representative to determine the exact amount owed by the estate and prioritize the settlement of these debts using the available assets. In conclusion, Mesa Arizona Debts of Estate — Schedule C is a crucial document that outlines and categorizes the various types of debts incurred by a deceased person in Mesa, Arizona. It helps in ensuring that all creditors are appropriately notified and paid from the estate before distributing the remaining assets to the beneficiaries.Mesa Arizona Debts of Estate — Schedule C refers to a specific category of debts that are incurred upon the death of an individual in Mesa, Arizona. The debts of estate under Schedule C are the obligations and liabilities that are left unpaid by the deceased person and need to be settled through their estate. In Mesa, Arizona, Schedule C outlines the various types of debts that can be considered as part of the estate. These may include outstanding mortgages, credit card balances, personal loans, medical bills, student loans, and any other financial obligations that the deceased person may have had at the time of their passing. It is important to note that Schedule C of the Mesa Arizona Debts of Estate primarily focuses on the liabilities and debts of the deceased. These debts are not the responsibility of the heirs or beneficiaries, but rather the estate itself. In other words, the estate is responsible for covering these debts before any remaining assets can be distributed among the beneficiaries. Some different types of Mesa Arizona Debts of Estate that can be included on Schedule C may include: 1. Outstanding Mortgage or Home Loans: Any unpaid balances on the deceased person's mortgage or home loans fall under this category. 2. Credit Card Debt: Any unpaid credit card balances owed by the deceased person are considered as estate debts. 3. Personal Loans: Any loans that the deceased person may have taken out, such as car loans, personal lines of credit, or loans from family and friends, are included as part of the estate debts. 4. Medical Bills: Unpaid medical expenses incurred by the deceased person, including hospital bills, doctor fees, and ongoing treatments, form a part of the estate's debts. 5. Student Loans: If there are any outstanding student loans in the deceased person's name, they are treated as part of their estate debts. 6. Legal and Funeral Expenses: Any legal fees, including attorney charges related to probate, as well as funeral and burial costs, can also be listed as estate debts. The purpose of Schedule C is to ensure that all debts are properly identified and accounted for during the probate process. It allows the estate executor or personal representative to determine the exact amount owed by the estate and prioritize the settlement of these debts using the available assets. In conclusion, Mesa Arizona Debts of Estate — Schedule C is a crucial document that outlines and categorizes the various types of debts incurred by a deceased person in Mesa, Arizona. It helps in ensuring that all creditors are appropriately notified and paid from the estate before distributing the remaining assets to the beneficiaries.