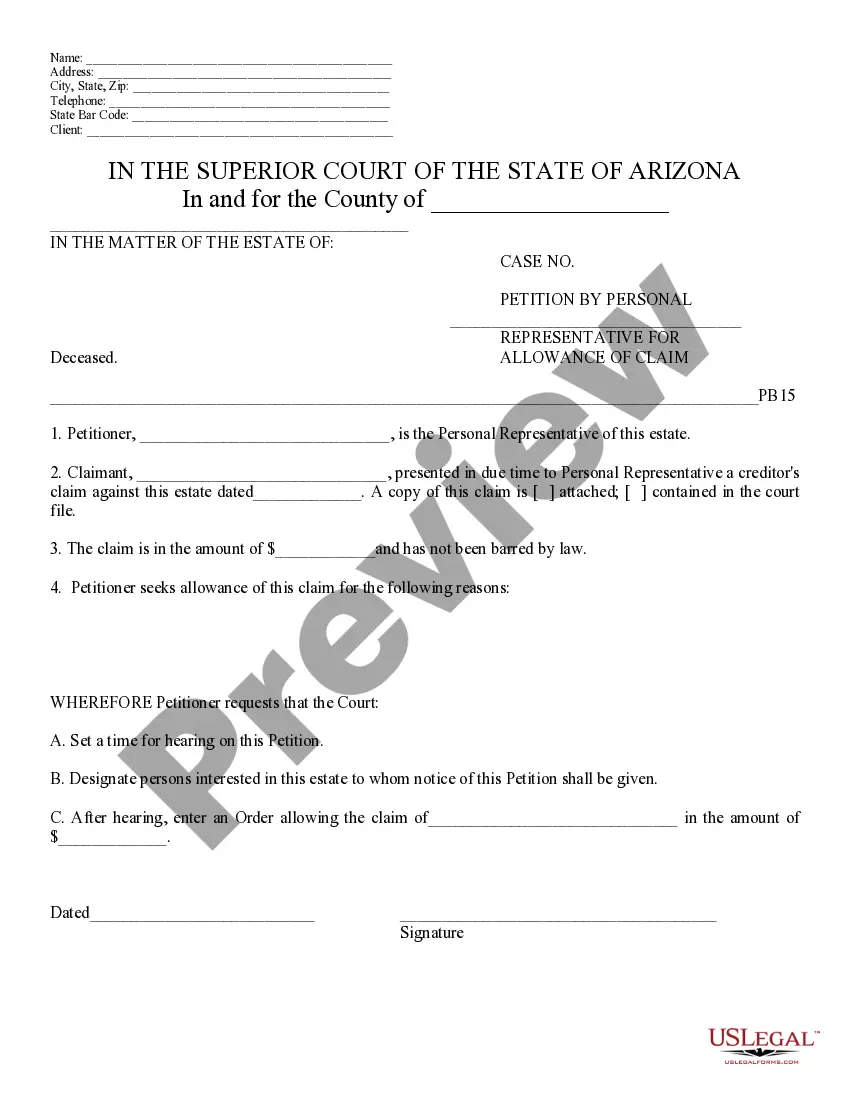

Debts of Estate -Schedule C -Arizona: This form is signed by the Administrator of the estate, upon seeing debts on the estate which need to be paid. The debt is listed in this document, as well as a request that notice be sent to all heirs of the estate. It is available for download in both Word and Rich Text formats.

In Phoenix, Arizona, Debts of Estate — Schedule C refers to a specific form that needs to be filed when dealing with the estate of a deceased individual. This form is essential for accurately disclosing and settling any outstanding debts or liabilities that the deceased person may have had at the time of their death. The Debts of Estate — Schedule C provides a comprehensive overview of the debts owed by the estate, including details such as creditor information, the date the debt was incurred, the nature of the debt, and the outstanding balance. It is essential to accurately record this information to ensure proper distribution of the estate's assets and meet legal obligations. There can be various types of debts that fall under the purview of this form. Some common examples of debts that may be included in Phoenix Arizona Debts of Estate — Schedule C are: 1. Mortgages or Loans: This includes any outstanding balances on mortgages, loans, or other financial obligations secured by the deceased individual. This category may involve debts related to residential or commercial properties, vehicles, or personal loans. 2. Credit Card Debts: Any unpaid credit card bills or outstanding balances on credit accounts held by the deceased are included here. It is crucial to clearly specify the name of the credit card issuer and the amount owed. 3. Medical Bills: Medical expenses incurred by the deceased, such as hospital bills, medication costs, or healthcare services, fall under this category. It is important to list all healthcare providers and include the corresponding amounts owed. 4. Taxes: Unpaid taxes, both federal and state, should be disclosed in this section. This includes income tax, property tax, or any other taxes owed by the estate. 5. Unpaid Utilities: Outstanding balances on utility bills, such as electricity, water, gas, or phone services, should be included in this category. It is essential to note that these are just a few examples, and the Debts of Estate — Schedule C form may include other types of debts depending on the specific circumstances of the deceased individual. Overall, Phoenix Arizona Debts of Estate — Schedule C is a crucial document that ensures transparency and fairness in the distribution of assets by accurately accounting for and settling outstanding debts of a deceased individual's estate.In Phoenix, Arizona, Debts of Estate — Schedule C refers to a specific form that needs to be filed when dealing with the estate of a deceased individual. This form is essential for accurately disclosing and settling any outstanding debts or liabilities that the deceased person may have had at the time of their death. The Debts of Estate — Schedule C provides a comprehensive overview of the debts owed by the estate, including details such as creditor information, the date the debt was incurred, the nature of the debt, and the outstanding balance. It is essential to accurately record this information to ensure proper distribution of the estate's assets and meet legal obligations. There can be various types of debts that fall under the purview of this form. Some common examples of debts that may be included in Phoenix Arizona Debts of Estate — Schedule C are: 1. Mortgages or Loans: This includes any outstanding balances on mortgages, loans, or other financial obligations secured by the deceased individual. This category may involve debts related to residential or commercial properties, vehicles, or personal loans. 2. Credit Card Debts: Any unpaid credit card bills or outstanding balances on credit accounts held by the deceased are included here. It is crucial to clearly specify the name of the credit card issuer and the amount owed. 3. Medical Bills: Medical expenses incurred by the deceased, such as hospital bills, medication costs, or healthcare services, fall under this category. It is important to list all healthcare providers and include the corresponding amounts owed. 4. Taxes: Unpaid taxes, both federal and state, should be disclosed in this section. This includes income tax, property tax, or any other taxes owed by the estate. 5. Unpaid Utilities: Outstanding balances on utility bills, such as electricity, water, gas, or phone services, should be included in this category. It is essential to note that these are just a few examples, and the Debts of Estate — Schedule C form may include other types of debts depending on the specific circumstances of the deceased individual. Overall, Phoenix Arizona Debts of Estate — Schedule C is a crucial document that ensures transparency and fairness in the distribution of assets by accurately accounting for and settling outstanding debts of a deceased individual's estate.