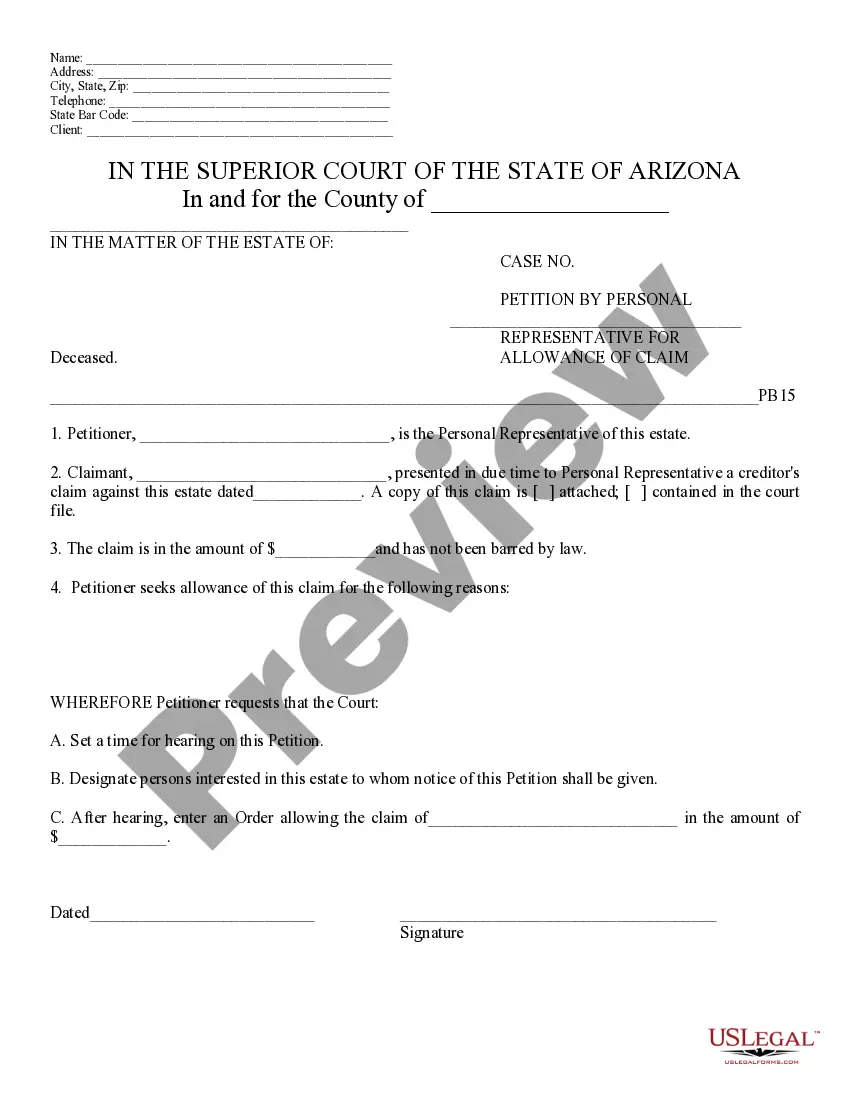

Debts of Estate -Schedule C -Arizona: This form is signed by the Administrator of the estate, upon seeing debts on the estate which need to be paid. The debt is listed in this document, as well as a request that notice be sent to all heirs of the estate. It is available for download in both Word and Rich Text formats.

Lima Arizona Debts of Estate — Schedule C is a vital document that plays a significant role in settling the financial affairs of an estate in Lima, Arizona. This schedule outlines the various debts and obligations that must be addressed when handling the estate of a deceased individual. It provides a comprehensive breakdown of the estate's liabilities, allowing for proper distribution of assets and ensuring a fair and lawful resolution. The purpose of the Lima Arizona Debts of Estate — Schedule C is to prioritize and categorize debts, allowing the executor or personal representative of the estate to manage them efficiently. This document assists in identifying and quantifying outstanding obligations, ensuring that all debts and expenses are appropriately addressed during the estate administration process. Keywords: Lima, Arizona, debts of estate, Schedule C, financial affairs, estate settlement, liabilities, assets, obligations, deceased individual, distribution, executor, personal representative, outstanding obligations, estate administration. Different types of Lima Arizona Debts of Estate — Schedule C may include: 1. Funeral Expenses: This category covers the costs associated with the funeral service, burial or cremation, casket, grave site, and other related expenses. 2. Medical Bills: Any outstanding medical expenses incurred by the deceased individual before their passing, including hospital bills, medication costs, and nursing care fees. 3. Credit Card Debts: This section includes any outstanding credit card balances or debts accumulated by the deceased individual during their lifetime. 4. Mortgage or Rent Payments: If the deceased had an outstanding mortgage or rent, this segment identifies the remaining balances or arrears, allowing for appropriate resolution. 5. Loans and Lines of Credit: Any outstanding personal loans, auto loans, student loans, or lines of credit that the deceased individual had taken during their lifetime are listed in this category. 6. Taxes Owed: This section highlights any unpaid taxes, including federal, state, or local income taxes, property taxes, or any other tax liabilities. 7. Utility Bills: Outstanding utility bills such as electricity, water, gas, or other utility services that need to be settled as part of the estate administration process. 8. Legal and Professional Fees: This category covers any unpaid legal fees, accounting fees, or fees for other professional services acquired during the deceased individual's lifetime. By accurately documenting and prioritizing these different types of debts, the Lima Arizona Debts of Estate — Schedule C ensures that the estate settlement process is diligently handled, allowing for the proper distribution of assets and the resolution of outstanding obligations.Lima Arizona Debts of Estate — Schedule C is a vital document that plays a significant role in settling the financial affairs of an estate in Lima, Arizona. This schedule outlines the various debts and obligations that must be addressed when handling the estate of a deceased individual. It provides a comprehensive breakdown of the estate's liabilities, allowing for proper distribution of assets and ensuring a fair and lawful resolution. The purpose of the Lima Arizona Debts of Estate — Schedule C is to prioritize and categorize debts, allowing the executor or personal representative of the estate to manage them efficiently. This document assists in identifying and quantifying outstanding obligations, ensuring that all debts and expenses are appropriately addressed during the estate administration process. Keywords: Lima, Arizona, debts of estate, Schedule C, financial affairs, estate settlement, liabilities, assets, obligations, deceased individual, distribution, executor, personal representative, outstanding obligations, estate administration. Different types of Lima Arizona Debts of Estate — Schedule C may include: 1. Funeral Expenses: This category covers the costs associated with the funeral service, burial or cremation, casket, grave site, and other related expenses. 2. Medical Bills: Any outstanding medical expenses incurred by the deceased individual before their passing, including hospital bills, medication costs, and nursing care fees. 3. Credit Card Debts: This section includes any outstanding credit card balances or debts accumulated by the deceased individual during their lifetime. 4. Mortgage or Rent Payments: If the deceased had an outstanding mortgage or rent, this segment identifies the remaining balances or arrears, allowing for appropriate resolution. 5. Loans and Lines of Credit: Any outstanding personal loans, auto loans, student loans, or lines of credit that the deceased individual had taken during their lifetime are listed in this category. 6. Taxes Owed: This section highlights any unpaid taxes, including federal, state, or local income taxes, property taxes, or any other tax liabilities. 7. Utility Bills: Outstanding utility bills such as electricity, water, gas, or other utility services that need to be settled as part of the estate administration process. 8. Legal and Professional Fees: This category covers any unpaid legal fees, accounting fees, or fees for other professional services acquired during the deceased individual's lifetime. By accurately documenting and prioritizing these different types of debts, the Lima Arizona Debts of Estate — Schedule C ensures that the estate settlement process is diligently handled, allowing for the proper distribution of assets and the resolution of outstanding obligations.