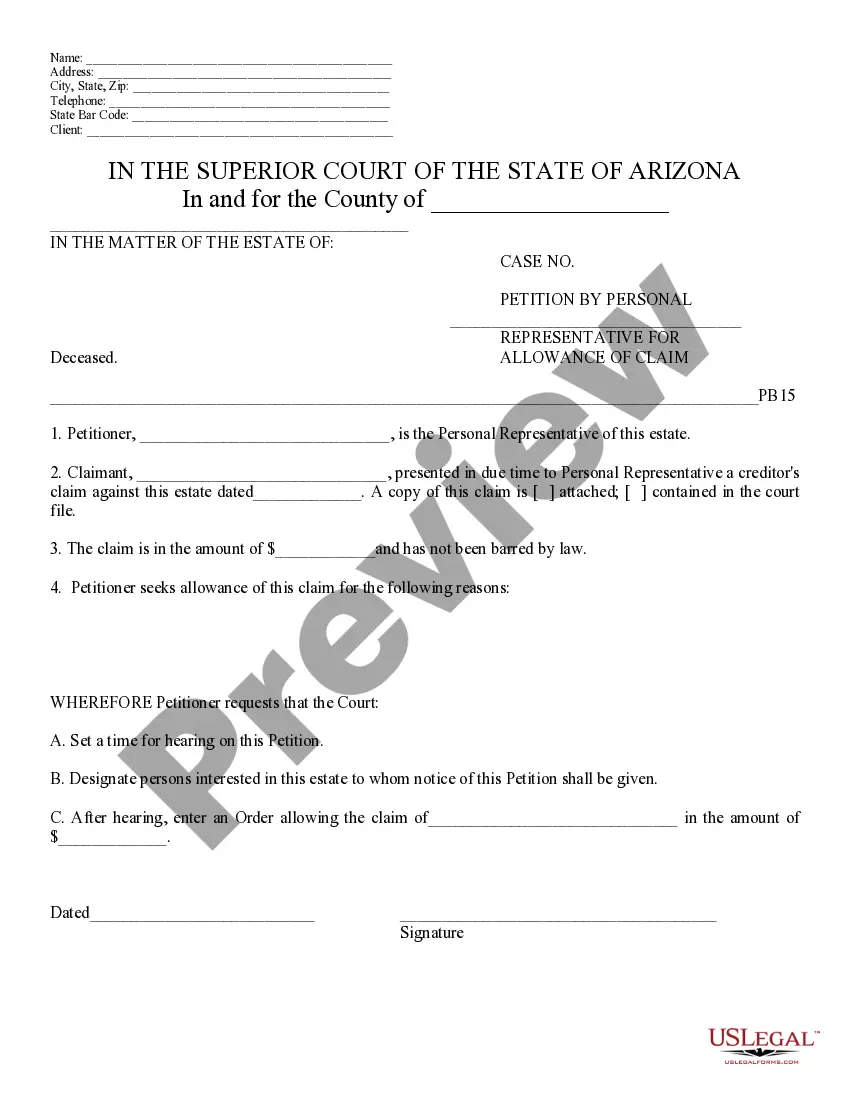

Debts of Estate -Schedule C -Arizona: This form is signed by the Administrator of the estate, upon seeing debts on the estate which need to be paid. The debt is listed in this document, as well as a request that notice be sent to all heirs of the estate. It is available for download in both Word and Rich Text formats.

Scottsdale Arizona Debts of Estate — Schedule C refers to the specific section in the probate process where all the debts owed by an estate are recorded and itemized. This is a crucial step in the administration of an estate in Scottsdale, Arizona, as it determines how the deceased individual's assets will be distributed and any outstanding debts settled. The Schedule C document provides a comprehensive overview of the estate's financial obligations, helping the executor and legal representatives navigate the complex legal procedures involved. Some common types of debts that may be listed in Scottsdale Arizona Debts of Estate — Schedule C include: 1. Mortgage loans: If the deceased individual owned a property with an outstanding mortgage, this debt would need to be noted in Schedule C. The executor will work with the relevant lending institution to determine the remaining amount and establish a plan to settle it. 2. Credit card debt: Any unpaid balances on credit cards or personal loans held by the deceased will be included as outstanding debts. These creditors will need to be notified, and payment arrangements or negotiations may be required. 3. Auto loans: If the deceased owned a vehicle that was financed through a loan, the remaining balance will be considered a debt of the estate. The executor may need to coordinate with the lender to arrange for the repayment or transfer of the vehicle. 4. Medical bills: Unpaid medical expenses, including hospital bills, prescription costs, and any other outstanding healthcare-related debts, are also typically recorded in Schedule C. The executor must ensure that medical providers are aware of the individual's passing and work towards resolving these debts. 5. Personal loans: If the deceased had borrowed money from family members, friends, or other individuals, these loans would be listed as debts of the estate. The executor would need to liaise with the respective lenders to determine the repayment terms and ensure a fair resolution. 6. Taxes: Any outstanding federal, state, or local taxes owed by the deceased will be documented in Schedule C. The executor must work closely with tax authorities to settle these obligations appropriately. It's important to note that Scottsdale Arizona Debts of Estate — Schedule C is specific to the probate process in this region. The laws and regulations related to estate debts may vary in other states or jurisdictions. Executors and legal professionals involved in managing an estate in Scottsdale should consult local experts to ensure compliance with all applicable rules and procedures.Scottsdale Arizona Debts of Estate — Schedule C refers to the specific section in the probate process where all the debts owed by an estate are recorded and itemized. This is a crucial step in the administration of an estate in Scottsdale, Arizona, as it determines how the deceased individual's assets will be distributed and any outstanding debts settled. The Schedule C document provides a comprehensive overview of the estate's financial obligations, helping the executor and legal representatives navigate the complex legal procedures involved. Some common types of debts that may be listed in Scottsdale Arizona Debts of Estate — Schedule C include: 1. Mortgage loans: If the deceased individual owned a property with an outstanding mortgage, this debt would need to be noted in Schedule C. The executor will work with the relevant lending institution to determine the remaining amount and establish a plan to settle it. 2. Credit card debt: Any unpaid balances on credit cards or personal loans held by the deceased will be included as outstanding debts. These creditors will need to be notified, and payment arrangements or negotiations may be required. 3. Auto loans: If the deceased owned a vehicle that was financed through a loan, the remaining balance will be considered a debt of the estate. The executor may need to coordinate with the lender to arrange for the repayment or transfer of the vehicle. 4. Medical bills: Unpaid medical expenses, including hospital bills, prescription costs, and any other outstanding healthcare-related debts, are also typically recorded in Schedule C. The executor must ensure that medical providers are aware of the individual's passing and work towards resolving these debts. 5. Personal loans: If the deceased had borrowed money from family members, friends, or other individuals, these loans would be listed as debts of the estate. The executor would need to liaise with the respective lenders to determine the repayment terms and ensure a fair resolution. 6. Taxes: Any outstanding federal, state, or local taxes owed by the deceased will be documented in Schedule C. The executor must work closely with tax authorities to settle these obligations appropriately. It's important to note that Scottsdale Arizona Debts of Estate — Schedule C is specific to the probate process in this region. The laws and regulations related to estate debts may vary in other states or jurisdictions. Executors and legal professionals involved in managing an estate in Scottsdale should consult local experts to ensure compliance with all applicable rules and procedures.