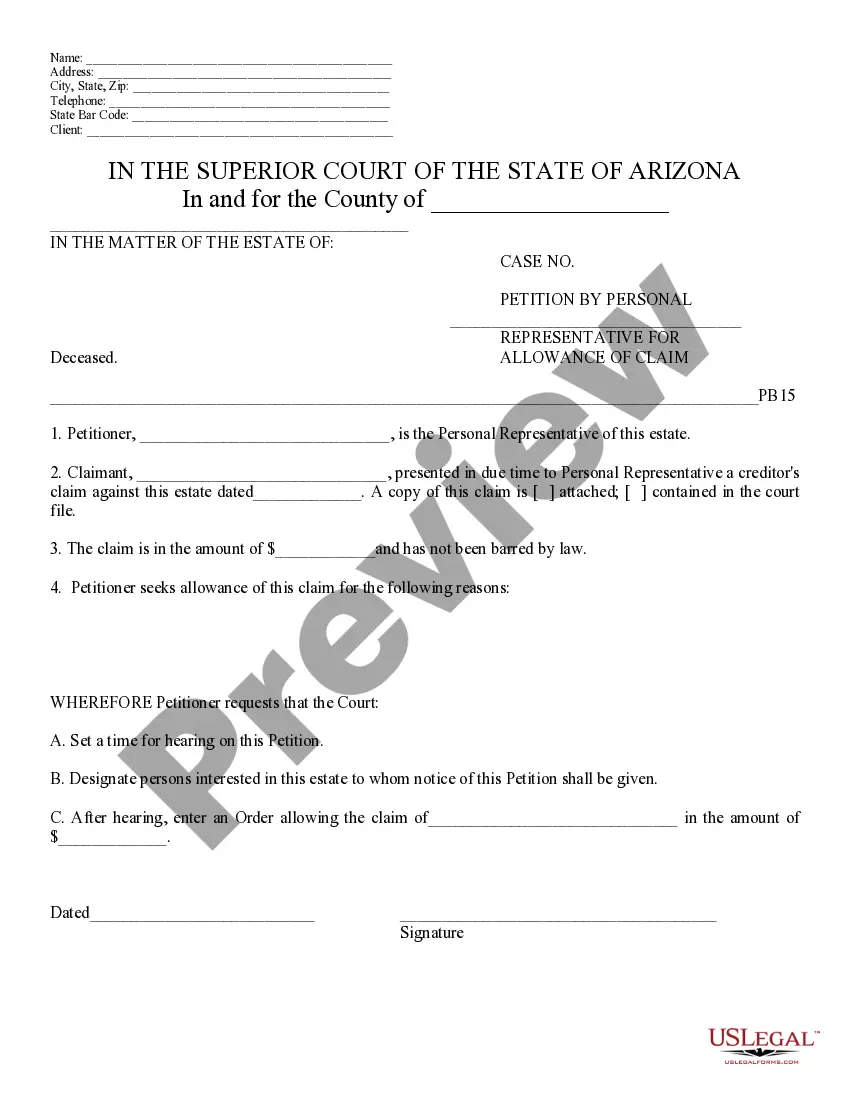

Debts of Estate -Schedule C -Arizona: This form is signed by the Administrator of the estate, upon seeing debts on the estate which need to be paid. The debt is listed in this document, as well as a request that notice be sent to all heirs of the estate. It is available for download in both Word and Rich Text formats.

Surprise Arizona Debts of Estate — Schedule C is a crucial legal document that outlines the various debts associated with an estate located in Surprise, Arizona. It plays a pivotal role in the probate process as it helps in determining the rightful distribution of assets and liabilities. The Schedule C form provides a detailed breakdown of all debts owed by the deceased individual at the time of their passing. It includes both secured and unsecured debts, such as mortgages, personal loans, credit card balances, medical bills, and outstanding taxes. By categorizing these debts, the estate executor gains a comprehensive understanding of the financial obligations that must be settled before the remaining assets can be distributed. Several types of Surprise Arizona Debts of Estate — Schedule C exist, each requiring specific attention and consideration. They include: 1. Secured Debts: These debts are backed by collateral, such as a mortgage on a property or a car loan. Secured debts typically take priority during the probate process, and the executor must ensure that these are settled first to avoid potential legal issues. 2. Unsecured Debts: These debts do not have any collateral associated with them. They often include credit card balances, personal loans, and medical bills. Unsecured debts are usually settled after secured debts, and the executor must negotiate with creditors to determine the appropriate payment amounts. 3. Taxes: Outstanding tax liabilities, both federal and state, are also categorized as debts of the estate. The executor must ensure accurate tax returns are filed and any unpaid taxes are settled using available estate assets. 4. Funeral Expenses: Costs associated with funeral and burial arrangements are considered debts of the estate. These expenses may include funeral service charges, cemetery fees, and costs related to memorialization. 5. Administrative Expenses: Probate-related expenses, including legal fees, court costs, accounting fees, and any professional services rendered during the administration of the estate, are considered administrative debts. These expenses are typically paid from the estate's assets before other debts. It is vital for the executor to meticulously compile and organize all relevant documents, receipts, and statements to accurately complete Surprise Arizona Debts of Estate — Schedule C. This document serves as a critical reference for distributing the remaining assets to beneficiaries and ensures that the decedent's obligations are duly settled in compliance with the law. By carefully addressing and categorizing these various types of debts, the executor ensures a systematic and orderly administration of the estate, fostering transparency and fairness to all parties involved.Surprise Arizona Debts of Estate — Schedule C is a crucial legal document that outlines the various debts associated with an estate located in Surprise, Arizona. It plays a pivotal role in the probate process as it helps in determining the rightful distribution of assets and liabilities. The Schedule C form provides a detailed breakdown of all debts owed by the deceased individual at the time of their passing. It includes both secured and unsecured debts, such as mortgages, personal loans, credit card balances, medical bills, and outstanding taxes. By categorizing these debts, the estate executor gains a comprehensive understanding of the financial obligations that must be settled before the remaining assets can be distributed. Several types of Surprise Arizona Debts of Estate — Schedule C exist, each requiring specific attention and consideration. They include: 1. Secured Debts: These debts are backed by collateral, such as a mortgage on a property or a car loan. Secured debts typically take priority during the probate process, and the executor must ensure that these are settled first to avoid potential legal issues. 2. Unsecured Debts: These debts do not have any collateral associated with them. They often include credit card balances, personal loans, and medical bills. Unsecured debts are usually settled after secured debts, and the executor must negotiate with creditors to determine the appropriate payment amounts. 3. Taxes: Outstanding tax liabilities, both federal and state, are also categorized as debts of the estate. The executor must ensure accurate tax returns are filed and any unpaid taxes are settled using available estate assets. 4. Funeral Expenses: Costs associated with funeral and burial arrangements are considered debts of the estate. These expenses may include funeral service charges, cemetery fees, and costs related to memorialization. 5. Administrative Expenses: Probate-related expenses, including legal fees, court costs, accounting fees, and any professional services rendered during the administration of the estate, are considered administrative debts. These expenses are typically paid from the estate's assets before other debts. It is vital for the executor to meticulously compile and organize all relevant documents, receipts, and statements to accurately complete Surprise Arizona Debts of Estate — Schedule C. This document serves as a critical reference for distributing the remaining assets to beneficiaries and ensures that the decedent's obligations are duly settled in compliance with the law. By carefully addressing and categorizing these various types of debts, the executor ensures a systematic and orderly administration of the estate, fostering transparency and fairness to all parties involved.