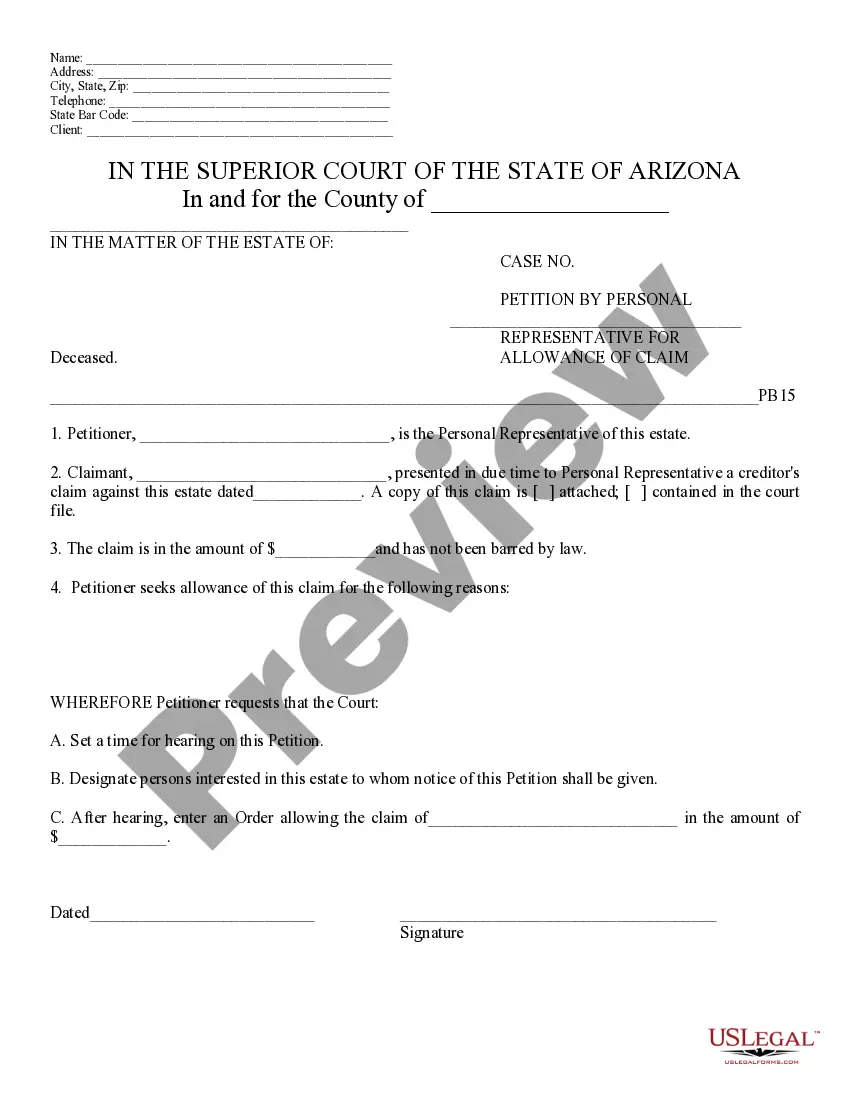

Debts of Estate -Schedule C -Arizona: This form is signed by the Administrator of the estate, upon seeing debts on the estate which need to be paid. The debt is listed in this document, as well as a request that notice be sent to all heirs of the estate. It is available for download in both Word and Rich Text formats.

Tempe Arizona Debts of Estate — Schedule C: Everything You Need to Know In the realm of estate planning and probate, one crucial aspect is the management of debts of an estate. When dealing with an estate in Tempe, Arizona, it is essential to understand the significance of Debts of Estate — Schedule C. This document outlines all the debts owed by the deceased person and plays a pivotal role in ensuring their estate is settled appropriately. Keywords: Tempe Arizona, Debts of Estate, Schedule C, estate planning, probate, management, deceased person, settle What is Debts of Estate — Schedule C? Debtestateat— - Schedule C is a legal document that itemizes and categorizes all outstanding debts owed by the deceased individual. It is part of the probate process, aimed at organizing and prioritizing the distribution of the decedent's assets to settle debts, thus ensuring a fair division among creditors and beneficiaries. Types of Tempe Arizona Debts of Estate — Schedule C: 1. Secured Debts: These are debts that are secured by collateral, such as a mortgage or car loan. In the event of default, the collateral can be seized by the creditor. Examples include home loans, auto loans, or any type of debt with an underlying asset as collateral. 2. Unsecured Debts: These debts are not backed by collateral and include credit card debt, medical bills, personal loans, and outstanding utility bills. Unsecured debts are typically ranked lower in priority for repayment compared to secured debts. 3. Taxes: Any outstanding tax obligations owed by the deceased person, such as unpaid income taxes, property taxes, or estate taxes, will also be listed on Debts of Estate — Schedule C. It is essential to settle these tax liabilities to avoid any legal complications. 4. Administrative Expenses: This category includes fees associated with the probate process and estate administration. It encompasses expenses such as court fees, attorney fees, executor fees, and accounting fees. These costs are usually addressed and settled before other debts. 5. Funeral and Burial Expenses: Debts related to funeral and burial costs are also part of Debts of Estate — Schedule C. These expenses cover funeral services, cremation or burial fees, purchase of a cemetery plot, and other related costs. 6. Other Debts: Miscellaneous debts, such as outstanding debts owed to friends, family members, or other non-traditional creditors, may be included on Schedule C as well. Managing Debts of Estate — Schedule C: When it comes to administering an estate and managing Debts of Estate — Schedule C, the executor or personal representative has the responsibility to accurately account for all debts and ensure their appropriate settlement. This involves notifying creditors, reviewing claims, negotiating repayment terms, and ultimately using estate assets to settle outstanding debts. It is important to consult with a knowledgeable Arizona probate attorney throughout the process to ensure compliance with state laws, ascertain the proper order of debt repayment, and protect the interests of both creditors and beneficiaries. In conclusion, understanding and properly managing Debts of Estate — Schedule C is crucial when dealing with the probate process and estate settlement in Tempe, Arizona. By thoroughly documenting all outstanding debts, the estate can be administered in a fair, orderly, and legally compliant manner, allowing for the smooth distribution of assets to creditors and beneficiaries.Tempe Arizona Debts of Estate — Schedule C: Everything You Need to Know In the realm of estate planning and probate, one crucial aspect is the management of debts of an estate. When dealing with an estate in Tempe, Arizona, it is essential to understand the significance of Debts of Estate — Schedule C. This document outlines all the debts owed by the deceased person and plays a pivotal role in ensuring their estate is settled appropriately. Keywords: Tempe Arizona, Debts of Estate, Schedule C, estate planning, probate, management, deceased person, settle What is Debts of Estate — Schedule C? Debtestateat— - Schedule C is a legal document that itemizes and categorizes all outstanding debts owed by the deceased individual. It is part of the probate process, aimed at organizing and prioritizing the distribution of the decedent's assets to settle debts, thus ensuring a fair division among creditors and beneficiaries. Types of Tempe Arizona Debts of Estate — Schedule C: 1. Secured Debts: These are debts that are secured by collateral, such as a mortgage or car loan. In the event of default, the collateral can be seized by the creditor. Examples include home loans, auto loans, or any type of debt with an underlying asset as collateral. 2. Unsecured Debts: These debts are not backed by collateral and include credit card debt, medical bills, personal loans, and outstanding utility bills. Unsecured debts are typically ranked lower in priority for repayment compared to secured debts. 3. Taxes: Any outstanding tax obligations owed by the deceased person, such as unpaid income taxes, property taxes, or estate taxes, will also be listed on Debts of Estate — Schedule C. It is essential to settle these tax liabilities to avoid any legal complications. 4. Administrative Expenses: This category includes fees associated with the probate process and estate administration. It encompasses expenses such as court fees, attorney fees, executor fees, and accounting fees. These costs are usually addressed and settled before other debts. 5. Funeral and Burial Expenses: Debts related to funeral and burial costs are also part of Debts of Estate — Schedule C. These expenses cover funeral services, cremation or burial fees, purchase of a cemetery plot, and other related costs. 6. Other Debts: Miscellaneous debts, such as outstanding debts owed to friends, family members, or other non-traditional creditors, may be included on Schedule C as well. Managing Debts of Estate — Schedule C: When it comes to administering an estate and managing Debts of Estate — Schedule C, the executor or personal representative has the responsibility to accurately account for all debts and ensure their appropriate settlement. This involves notifying creditors, reviewing claims, negotiating repayment terms, and ultimately using estate assets to settle outstanding debts. It is important to consult with a knowledgeable Arizona probate attorney throughout the process to ensure compliance with state laws, ascertain the proper order of debt repayment, and protect the interests of both creditors and beneficiaries. In conclusion, understanding and properly managing Debts of Estate — Schedule C is crucial when dealing with the probate process and estate settlement in Tempe, Arizona. By thoroughly documenting all outstanding debts, the estate can be administered in a fair, orderly, and legally compliant manner, allowing for the smooth distribution of assets to creditors and beneficiaries.