An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Approving Account of Personal Representative, Conservator or Guardian - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

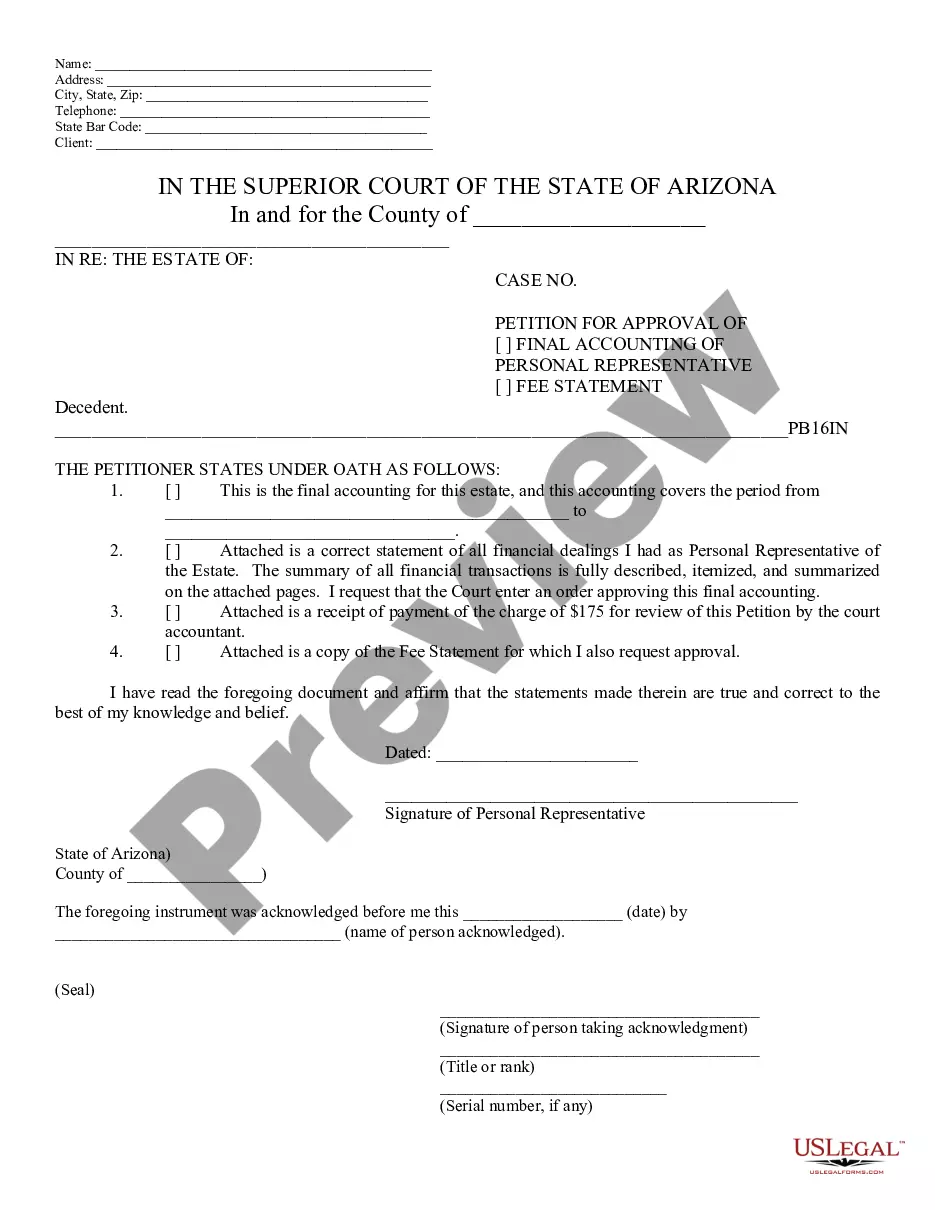

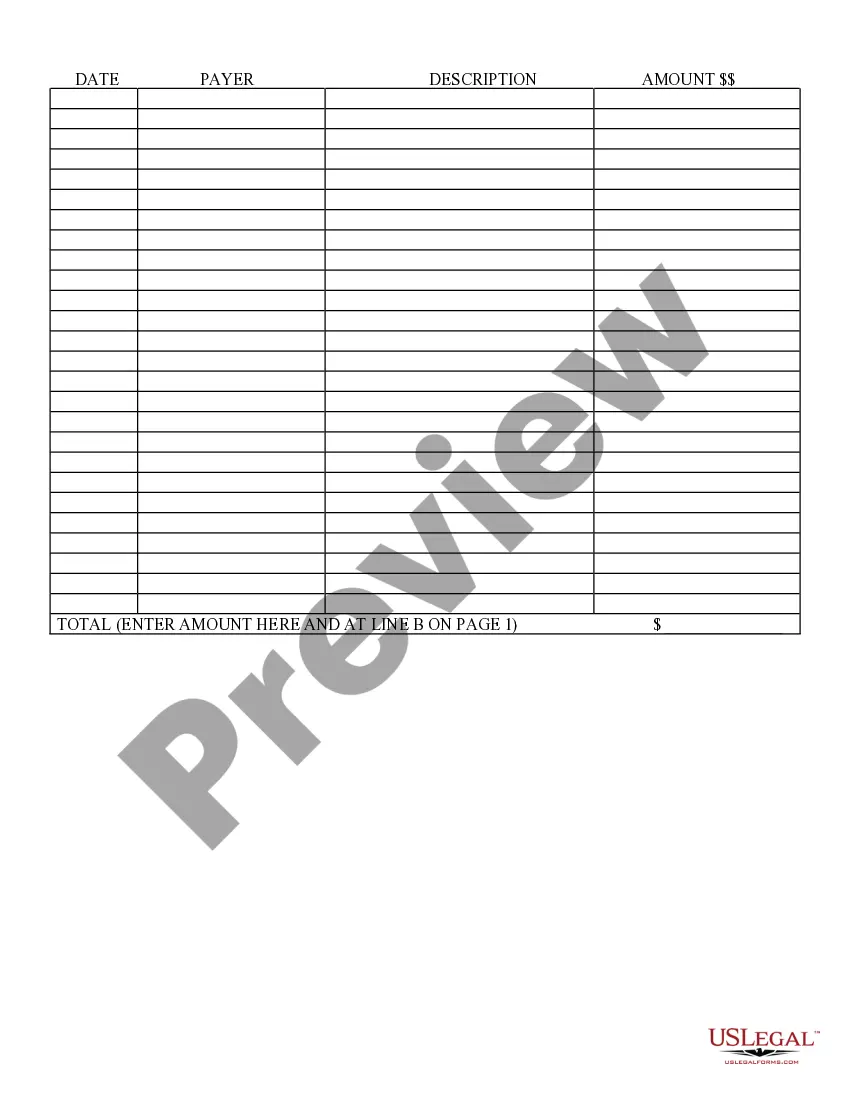

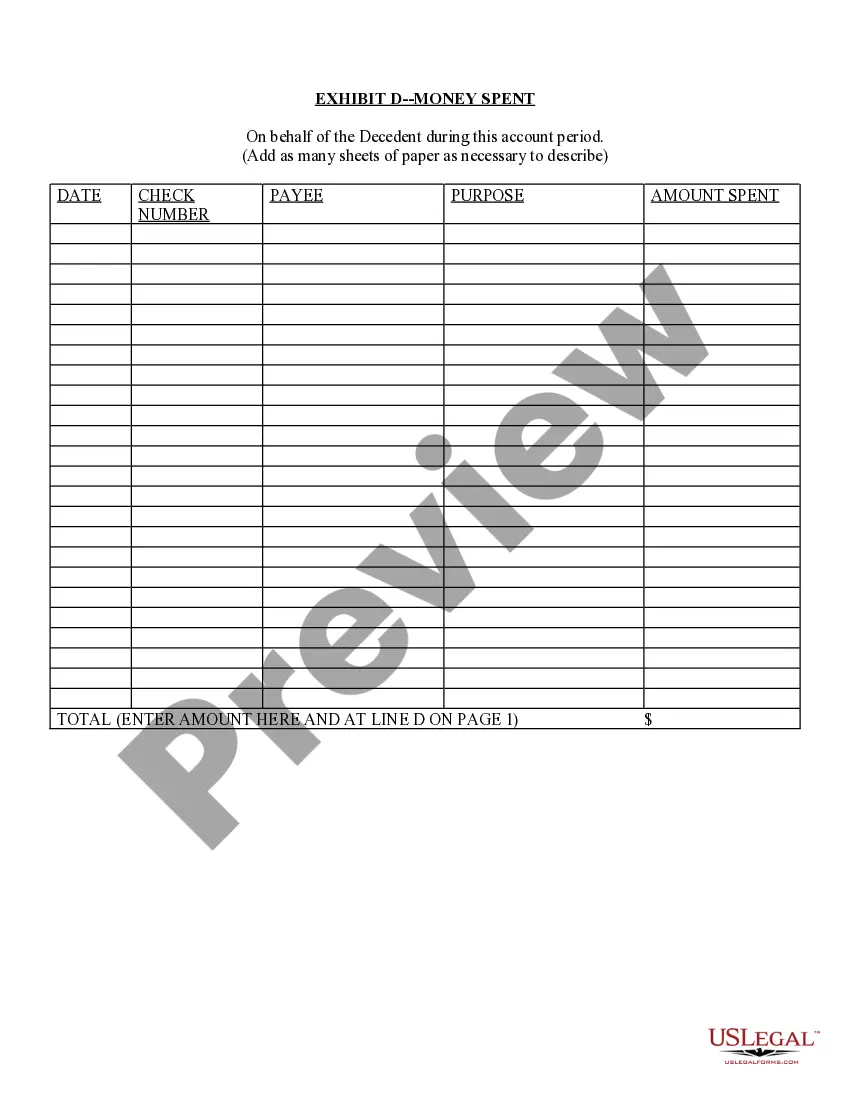

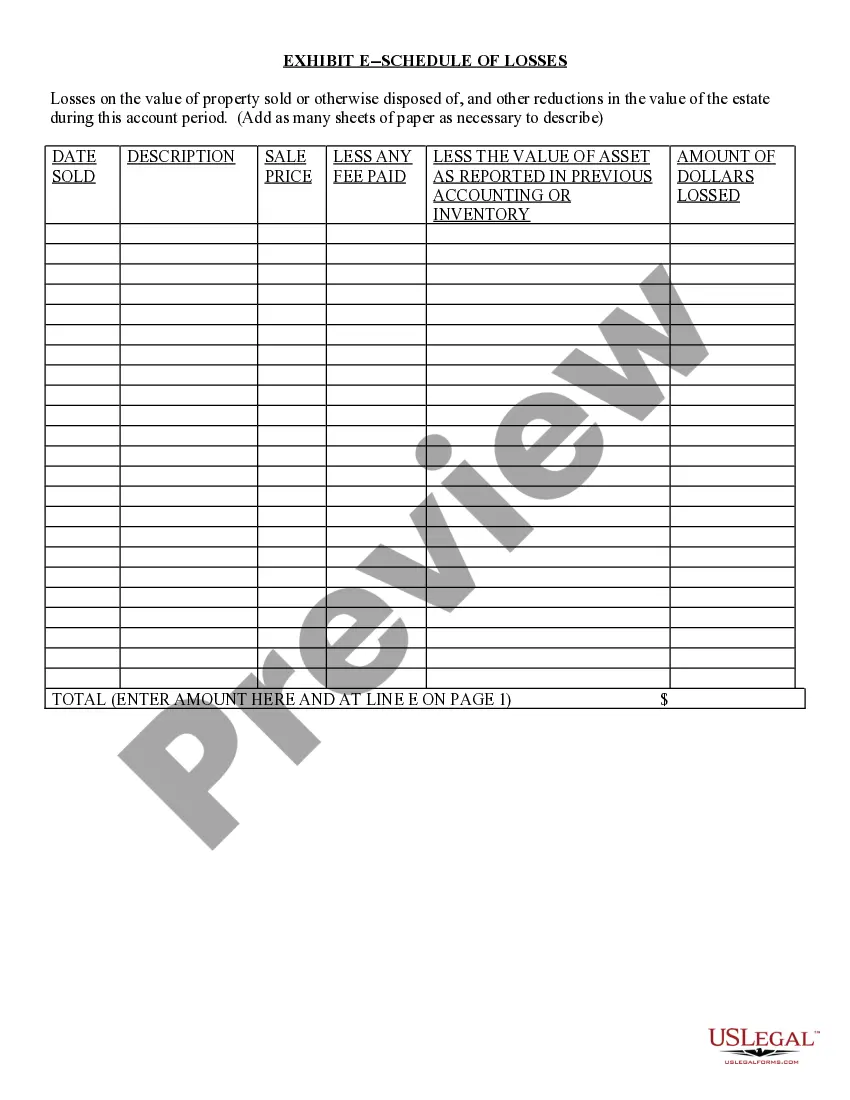

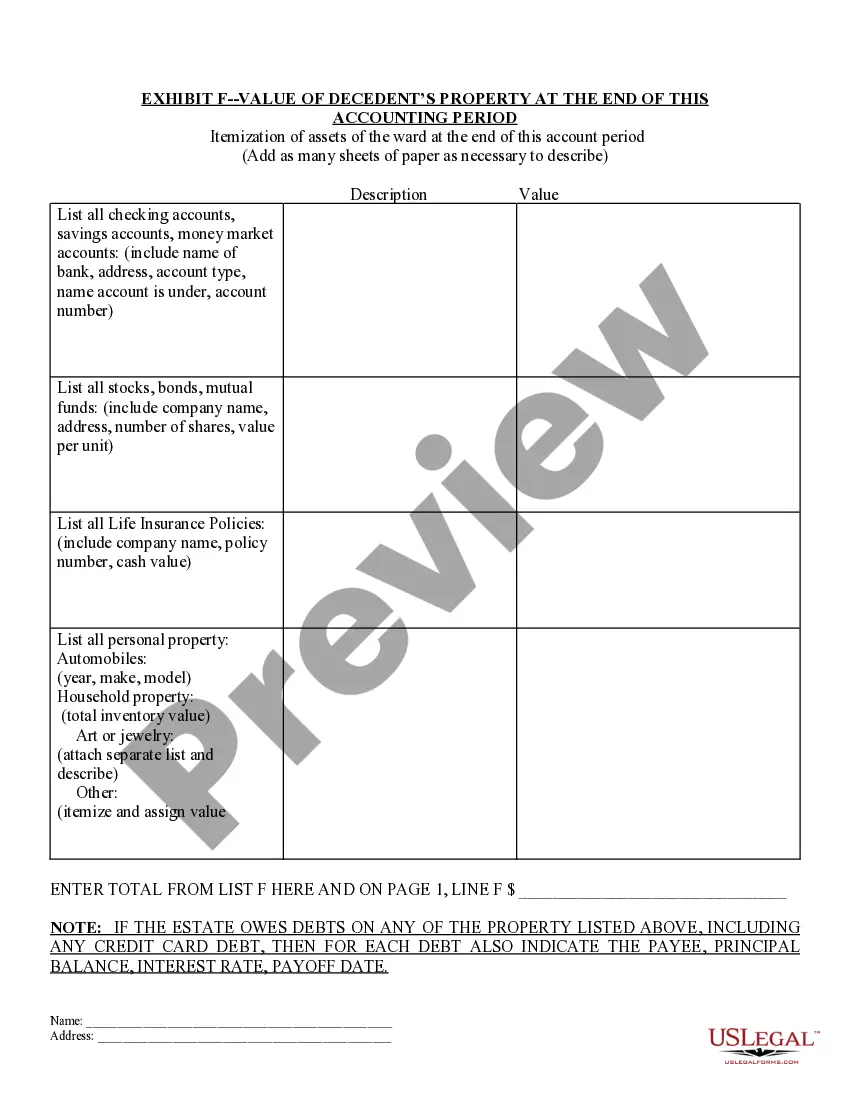

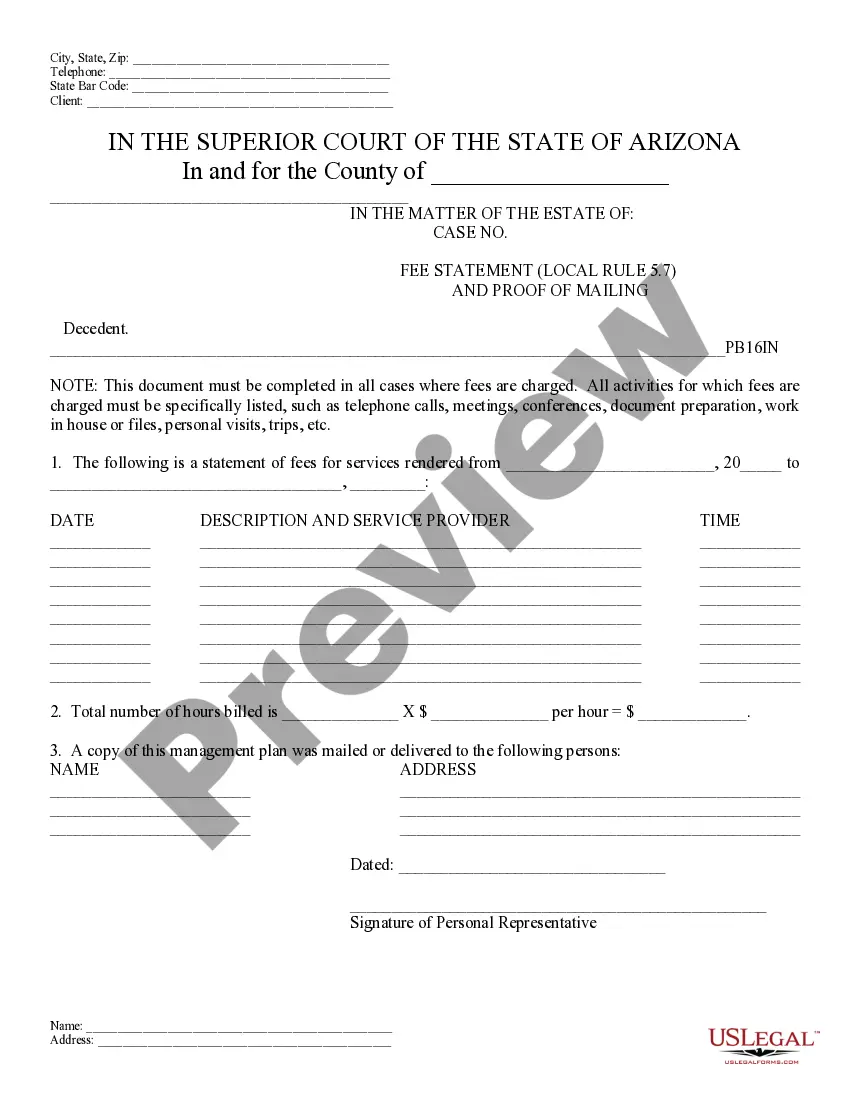

Chandler Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement is a legal document that allows the personal representative of an estate to present a final accounting of all financial transactions carried out during the administration of the estate. This petition seeks approval from the court to ensure transparency and accuracy in the distribution of assets to beneficiaries. The Chandler Arizona Probate Court requires a Petition for Approving of Final Accounting of Personal Representative or Fee Statement to be filed before the estate can be closed. This document provides a comprehensive breakdown of all income received, debts paid, expenses incurred, and distributions made. It serves as a final report on the financial transactions of the estate, offering a clear picture of how the assets were managed. The purpose of this petition is to allow beneficiaries and interested parties to review and verify the financial transactions of the estate. It ensures that the personal representative has fulfilled their fiduciary duties and that the distribution of assets is fair and unbiased. The court reviews the petition to confirm compliance with state laws and regulations regarding probate administration. Key elements included in the Chandler Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement are: 1. Identification of the estate: This section provides details about the estate being administered, including the name of the deceased, the case number assigned by the court, and the date of death. 2. Appointment of the personal representative: The petition includes information about the personal representative, such as their name, address, and contact information. It confirms their appointment by the court and their authority to manage the estate. 3. Summary of financial transactions: This section contains a detailed overview of all financial activities related to the estate. It includes the opening balance of the estate, income received (such as rental payments or investment earnings), expenses incurred (such as funeral expenses or attorney fees), and debts paid (including outstanding loans or outstanding taxes). 4. Distributions made: The petition lists all distributions made from the estate to beneficiaries, including cash bequests, property transfers, or specific gifts as directed by the deceased's will or state law. It specifies the beneficiaries' names and the value or type of assets distributed. 5. Personal representative's fee statement: If the personal representative is entitled to a fee for their services, this section outlines the basis for calculating the fee and provides the total amount due. It may include a breakdown of the hours worked, hourly rates, or a percentage of the estate's value. Variations of the Chandler Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement may include specific additional requirements based on the complexity of the estate or unique circumstances. For example, if there are disputes among beneficiaries or questions regarding the personal representative's actions, the petition may include supporting documents, affidavits, or statements from interested parties. In conclusion, the Chandler Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement is a crucial legal document that ensures transparency, accuracy, and fairness in the administration and distribution of an estate's assets. It serves as a final report on the financial transactions carried out and requires court approval before the estate can be closed.Chandler Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement is a legal document that allows the personal representative of an estate to present a final accounting of all financial transactions carried out during the administration of the estate. This petition seeks approval from the court to ensure transparency and accuracy in the distribution of assets to beneficiaries. The Chandler Arizona Probate Court requires a Petition for Approving of Final Accounting of Personal Representative or Fee Statement to be filed before the estate can be closed. This document provides a comprehensive breakdown of all income received, debts paid, expenses incurred, and distributions made. It serves as a final report on the financial transactions of the estate, offering a clear picture of how the assets were managed. The purpose of this petition is to allow beneficiaries and interested parties to review and verify the financial transactions of the estate. It ensures that the personal representative has fulfilled their fiduciary duties and that the distribution of assets is fair and unbiased. The court reviews the petition to confirm compliance with state laws and regulations regarding probate administration. Key elements included in the Chandler Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement are: 1. Identification of the estate: This section provides details about the estate being administered, including the name of the deceased, the case number assigned by the court, and the date of death. 2. Appointment of the personal representative: The petition includes information about the personal representative, such as their name, address, and contact information. It confirms their appointment by the court and their authority to manage the estate. 3. Summary of financial transactions: This section contains a detailed overview of all financial activities related to the estate. It includes the opening balance of the estate, income received (such as rental payments or investment earnings), expenses incurred (such as funeral expenses or attorney fees), and debts paid (including outstanding loans or outstanding taxes). 4. Distributions made: The petition lists all distributions made from the estate to beneficiaries, including cash bequests, property transfers, or specific gifts as directed by the deceased's will or state law. It specifies the beneficiaries' names and the value or type of assets distributed. 5. Personal representative's fee statement: If the personal representative is entitled to a fee for their services, this section outlines the basis for calculating the fee and provides the total amount due. It may include a breakdown of the hours worked, hourly rates, or a percentage of the estate's value. Variations of the Chandler Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement may include specific additional requirements based on the complexity of the estate or unique circumstances. For example, if there are disputes among beneficiaries or questions regarding the personal representative's actions, the petition may include supporting documents, affidavits, or statements from interested parties. In conclusion, the Chandler Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement is a crucial legal document that ensures transparency, accuracy, and fairness in the administration and distribution of an estate's assets. It serves as a final report on the financial transactions carried out and requires court approval before the estate can be closed.