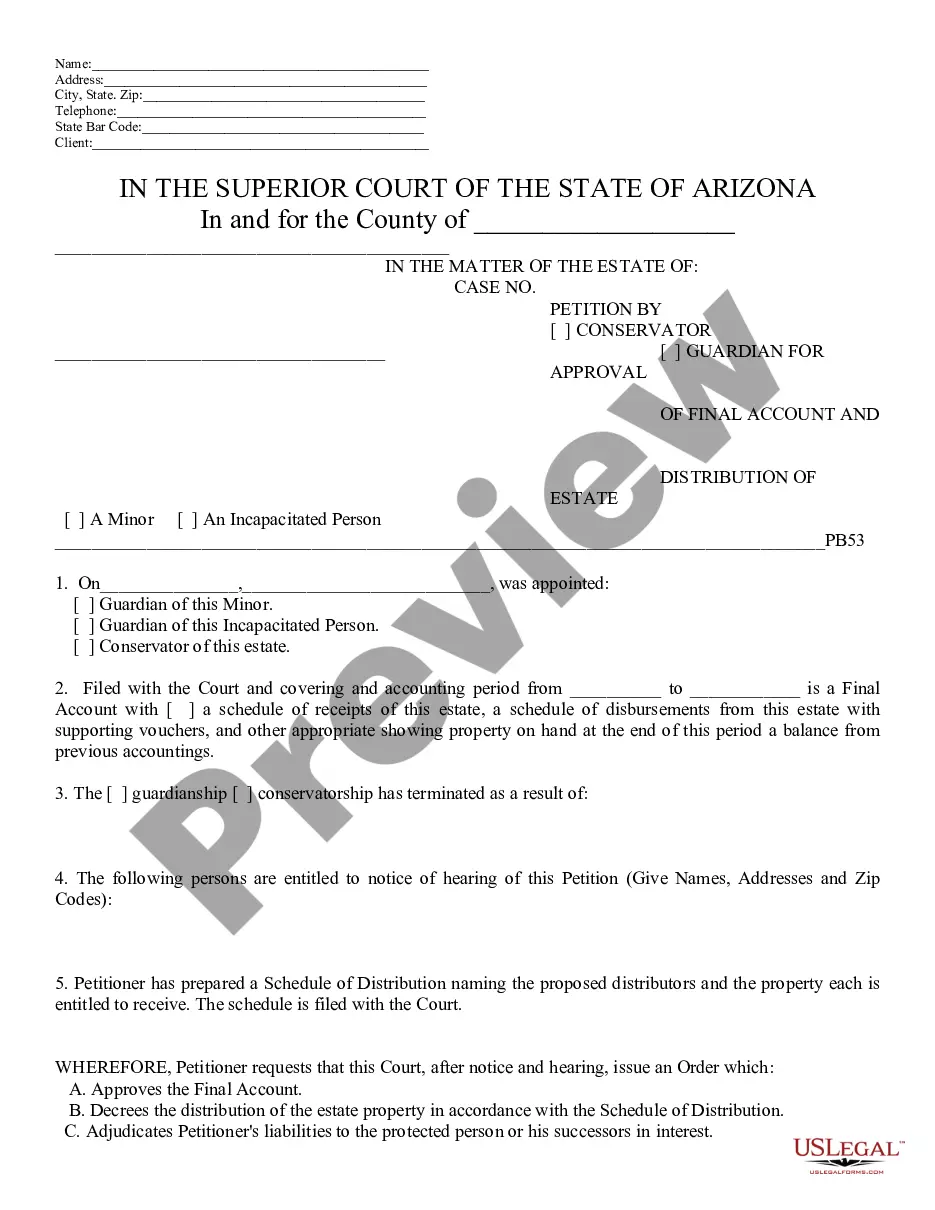

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Approving Account of Personal Representative, Conservator or Guardian - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

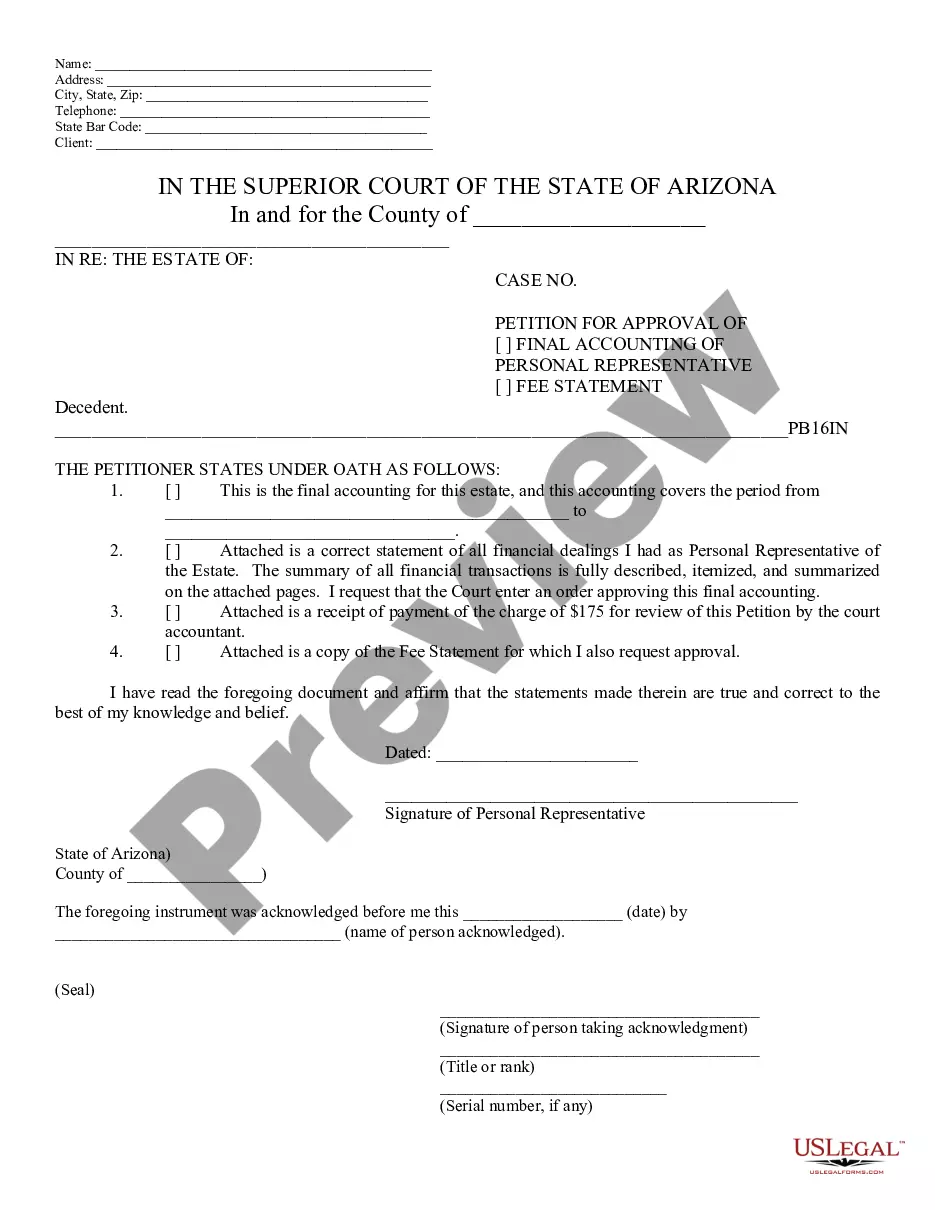

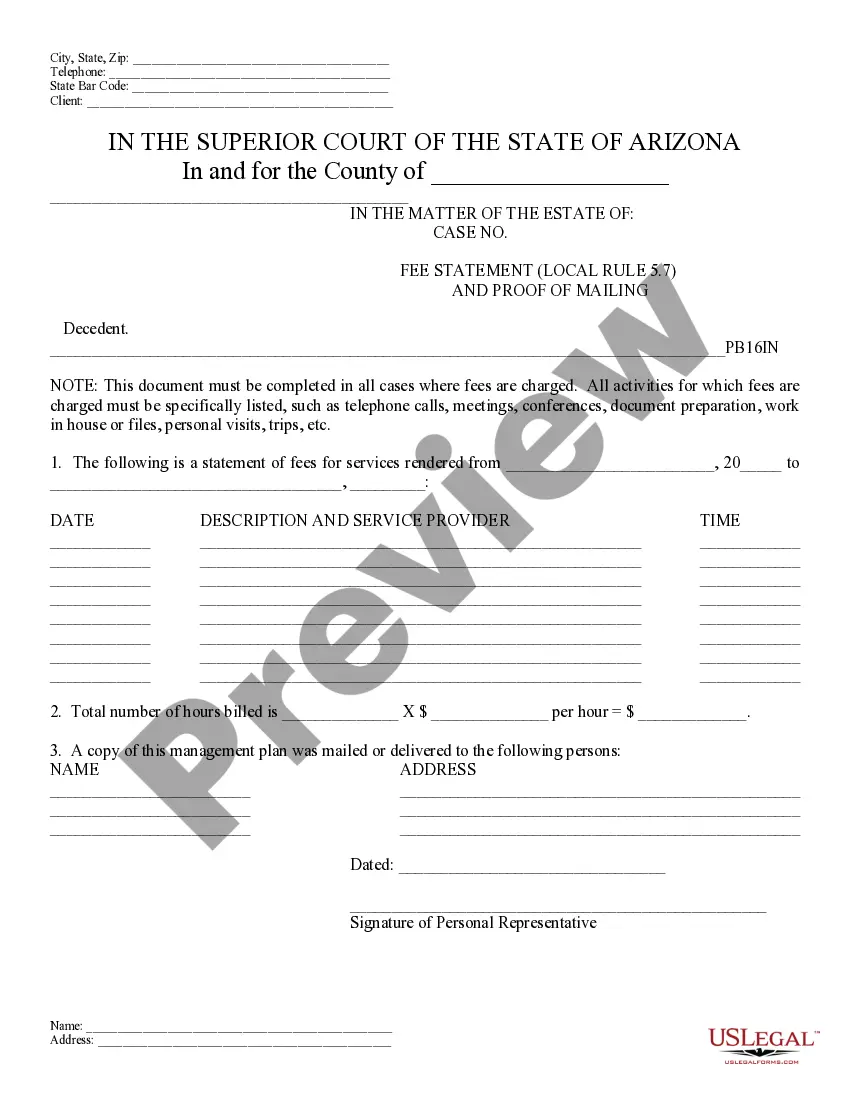

Maricopa Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement

Description

How to fill out Arizona Petition For Approving Of Final Accounting Of Personal Representative Or Fee Statement?

Are you searching for a reliable and cost-effective provider of legal documents to obtain the Maricopa Arizona Petition for Approval of Final Accounting of Personal Representative or Fee Statement? US Legal Forms is your ideal solution.

Whether you require a simple agreement to establish guidelines for living together with your partner or a collection of forms to facilitate your separation or divorce proceedings in court, we have you covered. Our platform provides over 85,000 current legal document templates for individual and corporate use. All templates that we provide are not generic and are structured according to the specifications of specific states and regions.

To download the document, you need to Log In to your account, locate the required form, and click the Download button adjacent to it. Please be aware that you can download your previously purchased form templates at any time from the My documents section.

Is this your first visit to our platform? No problem. You can set up an account with ease, but first, ensure you do the following.

Now you can create your account. Then select the subscription plan and proceed with payment. Once the payment is finalized, download the Maricopa Arizona Petition for Approval of Final Accounting of Personal Representative or Fee Statement in any available file format. You can revisit the website at any moment and redownload the document without incurring any additional costs.

Acquiring updated legal forms has never been simpler. Try US Legal Forms today and put an end to wasting your valuable time searching for legal documents online once and for all.

- Verify if the Maricopa Arizona Petition for Approval of Final Accounting of Personal Representative or Fee Statement aligns with the regulations of your state and locality.

- Review the details of the form (if available) to understand who the document is intended for and its purposes.

- Restart your search if the form does not meet your exact requirements.

Form popularity

FAQ

No, a personal representative is not the same as a Power of Attorney (POA). A personal representative manages the estate of a deceased person, while a POA acts on behalf of an individual who is still alive but incapacitated. Understanding these roles is essential for effective estate management in Maricopa Arizona.

In Arizona, any adult who is of sound mind and has not been convicted of a felony may serve as a personal representative. This includes relatives of the deceased or individuals named in the will. The court ultimately decides based on eligibility and whether the appointment serves the estate's best interests.

Probate in Maricopa County Arizona can vary in duration, typically ranging from several months to over a year. Factors such as the estate's complexity, disputes among heirs, and the efficiency of court processes can all affect the timeline. Staying organized and adhering to deadlines can help expedite the process.

To become a personal representative for a deceased person, you must file a petition in the probate court, along with any required documentation supporting your request. The court will assess your qualifications and may schedule a hearing. If approved, you will receive the authority to manage the deceased's estate in accordance with Arizona law.

To obtain a letter of testamentary in Arizona, you need to file the will along with a petition for probate in the Maricopa County probate court. Once the court validates the will, it will issue the letter, granting the executor authority to manage the estate. This document is crucial for handling assets and debts.

You can get personal representative papers by submitting a petition to the probate court in Maricopa County. This involves providing necessary information about the deceased and your claim for the role. Upon approval, the court will issue the papers that authorize you to act on behalf of the estate.

To become a personal representative for an estate in Arizona, you must file a petition with the probate court and provide documentation that establishes your relationship with the deceased. The court will review your qualifications and, if suitable, appoint you. It is essential to comply with Maricopa Arizona's legal requirements to serve effectively.

An executor is a term typically used in wills, while a personal representative can be appointed by the court in probate cases. In Maricopa Arizona, both roles serve to manage the estate and ensure that the deceased's wishes are carried out. However, the appointment process and authority may differ based on whether the estate is governed by a will or state law.

You can get a personal representative letter by filing the required documents with the Maricopa County probate court. Once your petition for the appointment of a personal representative is approved, the court will issue the letter confirming your authority. This letter is crucial as it allows you to manage the estate's assets legally.

To obtain personal representative papers in Maricopa Arizona, you need to file a petition with the probate court. This petition must include documentation verifying your relationship to the deceased and your eligibility. After the court reviews your petition, you will receive the necessary personal representative papers.