An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Approving Account of Personal Representative, Conservator or Guardian - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

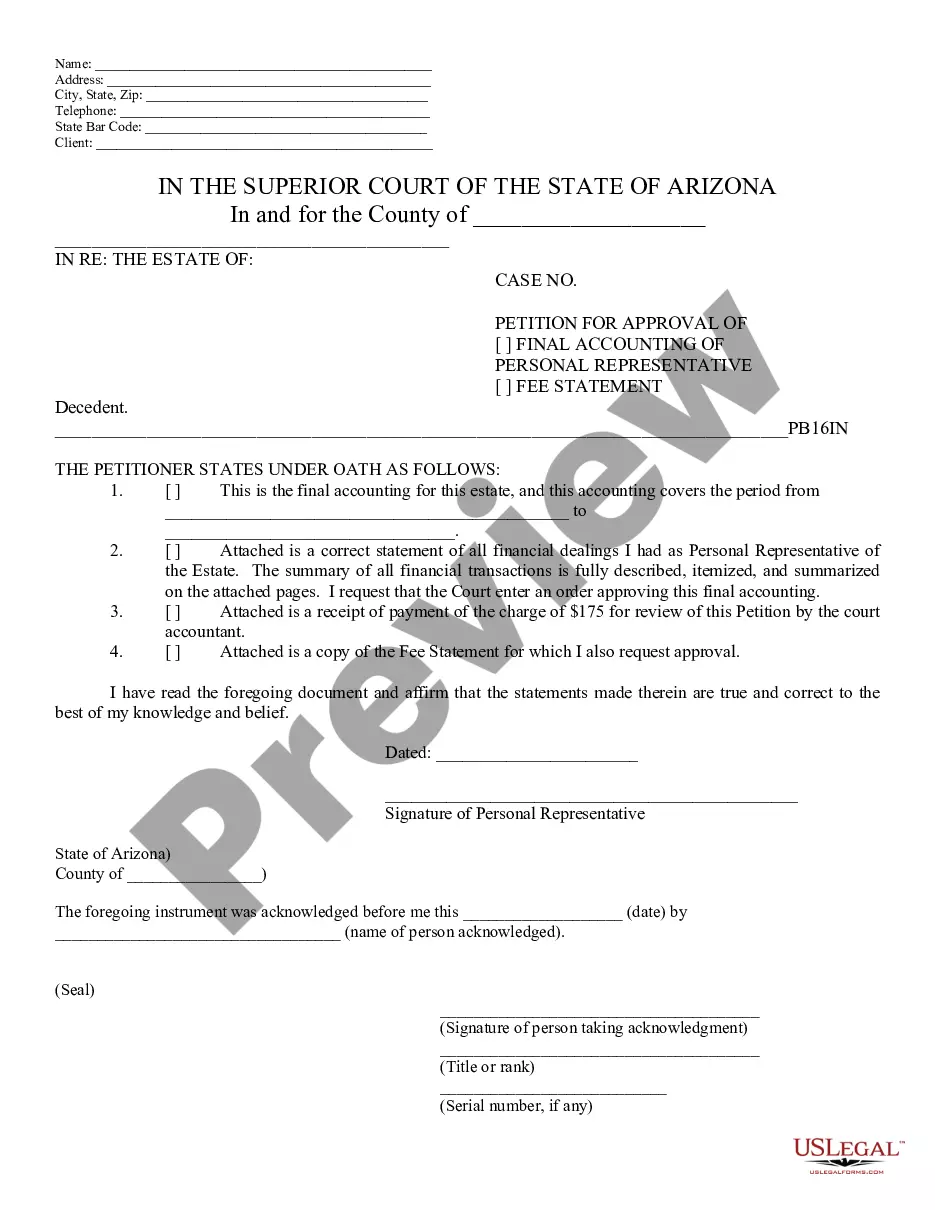

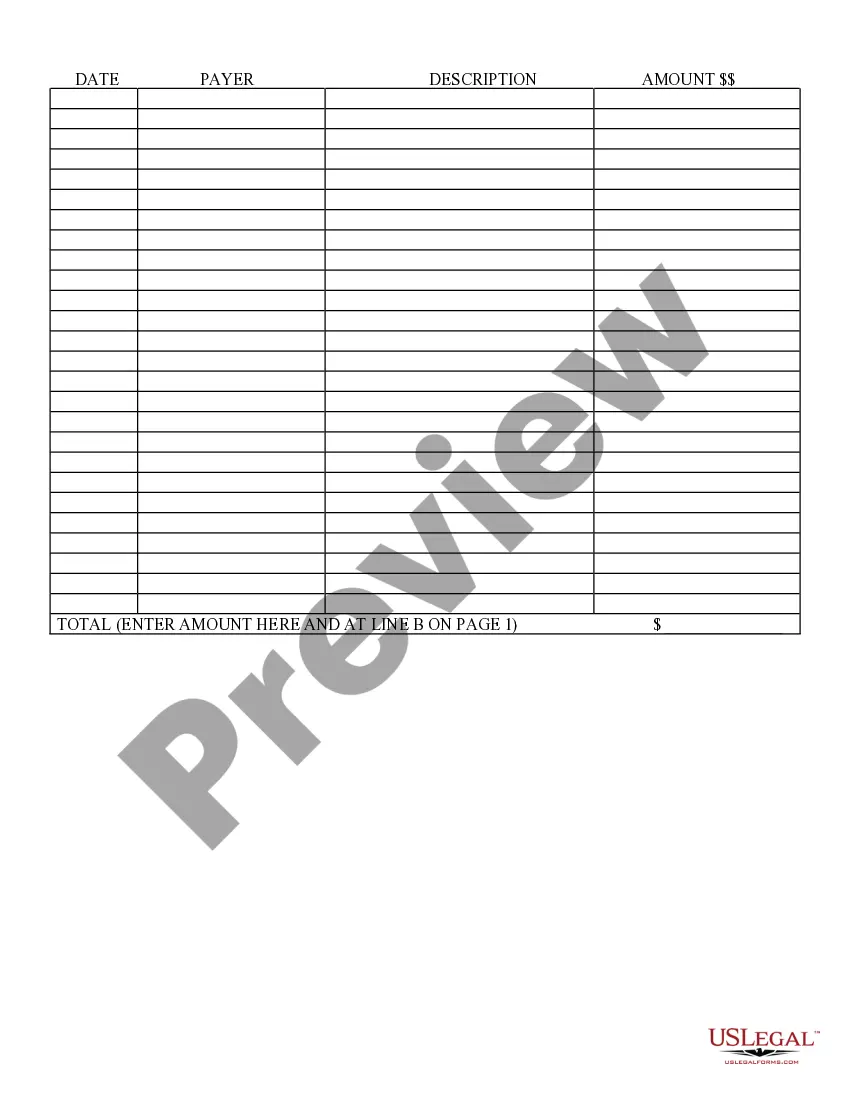

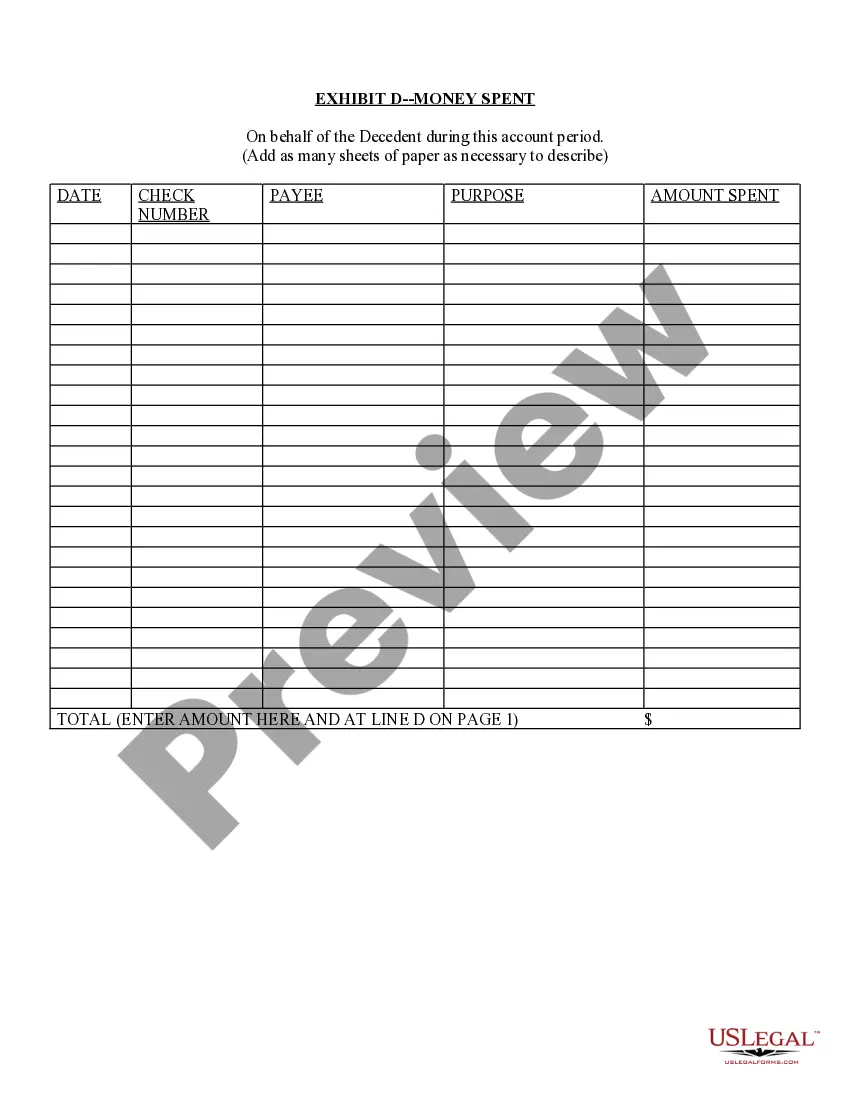

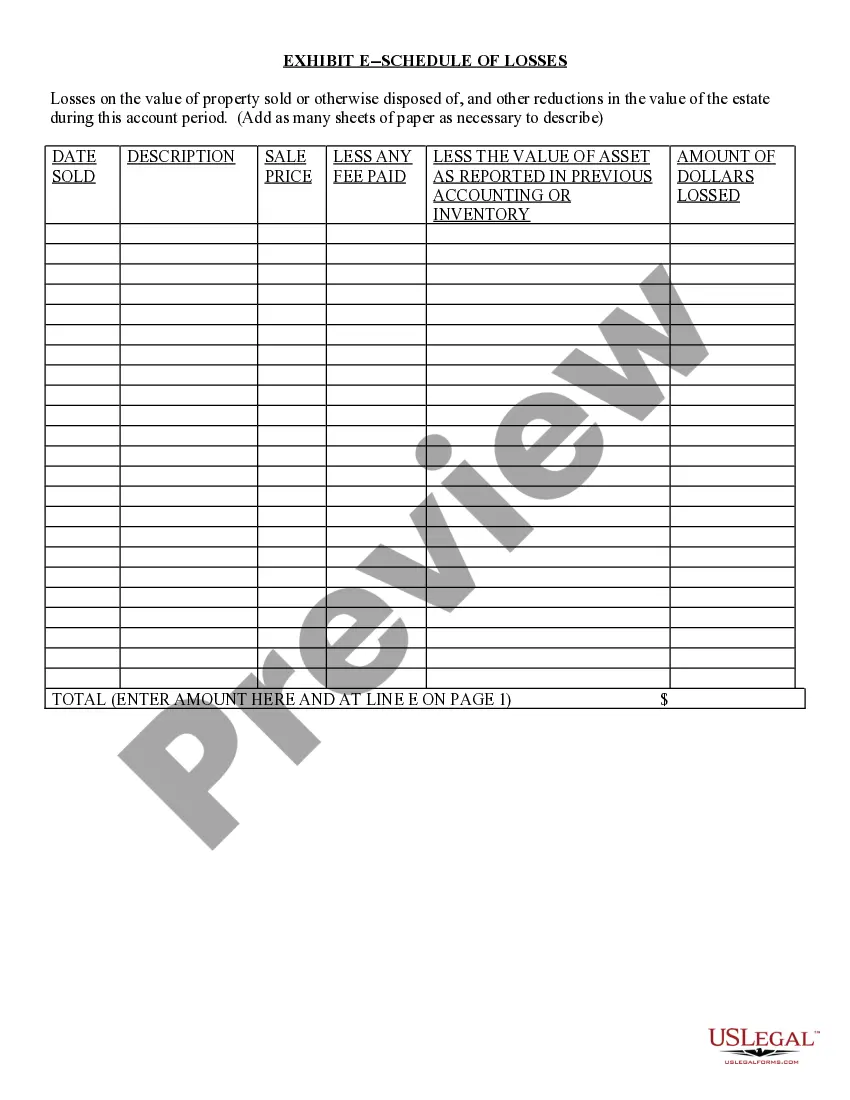

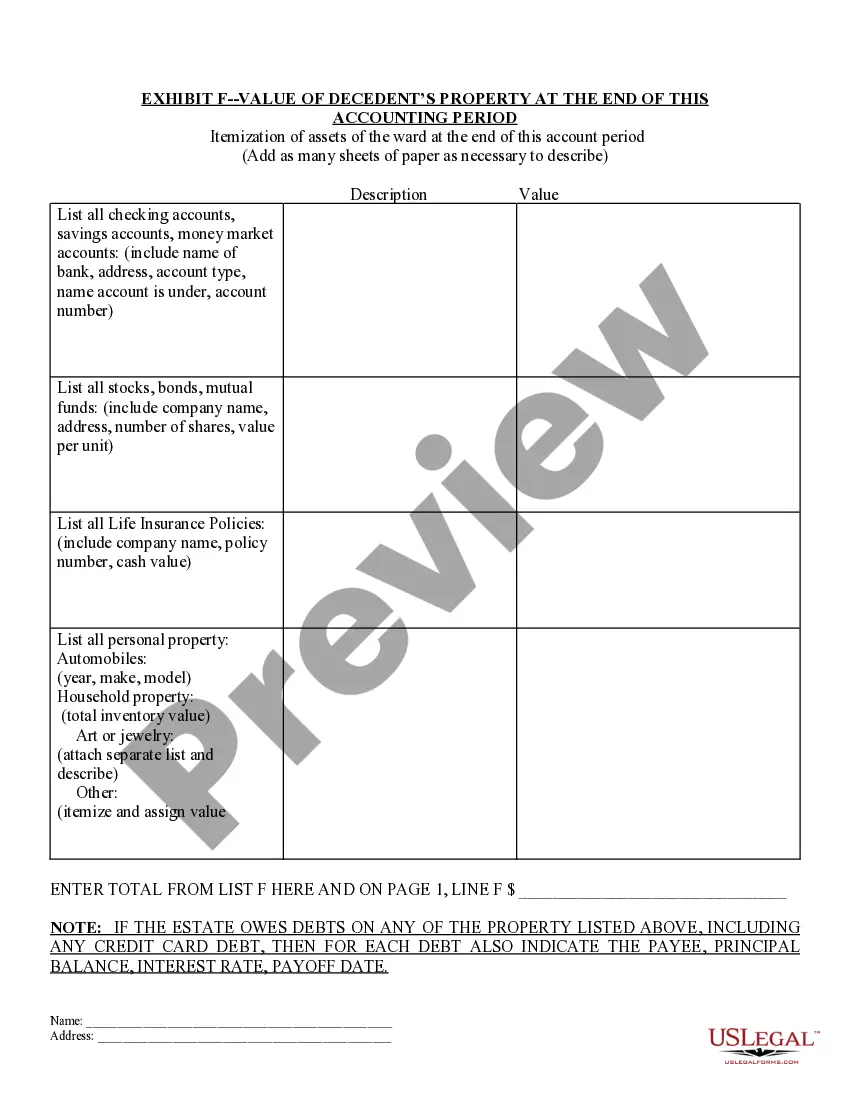

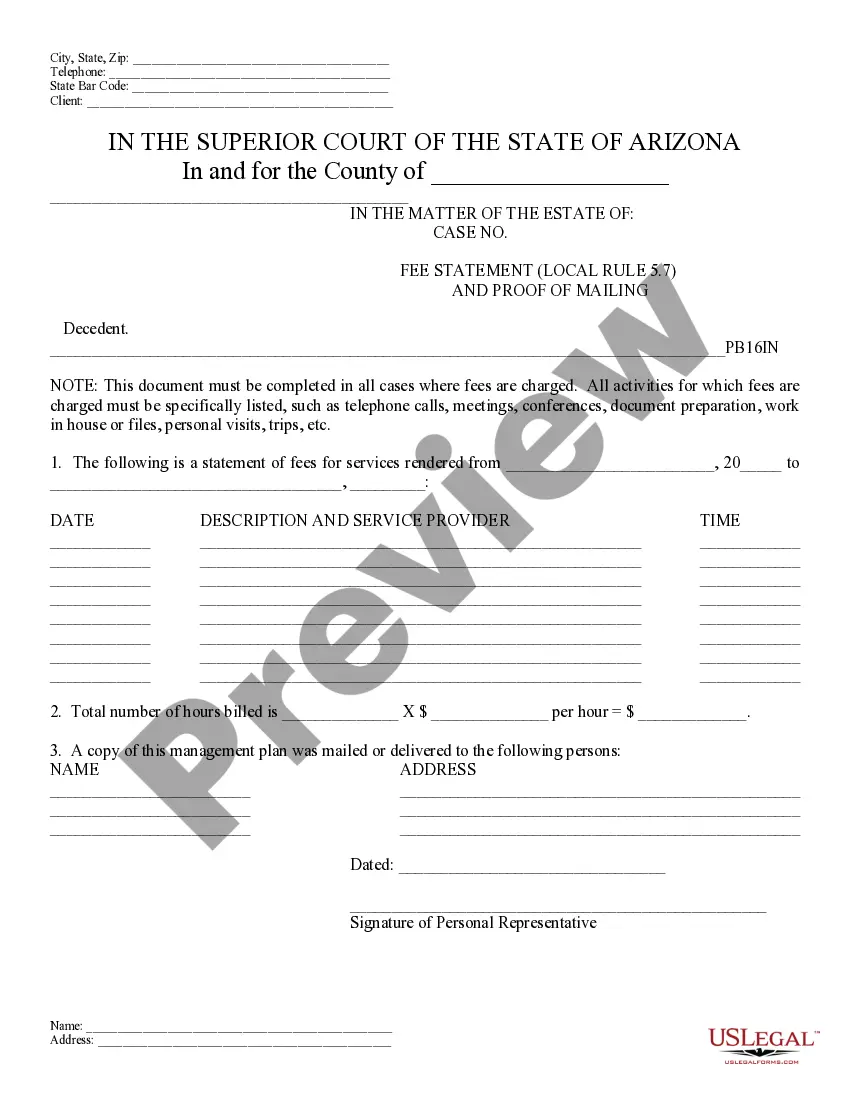

Title: Mesa Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement: A Comprehensive Overview Introduction: In the realm of probate law, a Mesa Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement is a crucial legal document that ensures the transparency and integrity of estate administration. This detailed description aims to shed light on the purpose, process, and different types of petitions related to the final accounting or fee statements in Mesa, Arizona. Key Points: 1. Defining the Petition: — A Mesa Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement is filed with the probate court to request the court's approval for the final accounting and distribution of assets in an estate. — It serves as a legal instrument to validate the personal representative's actions, ensuring compliance with probate laws and regulations. — The petition also serves as an opportunity for beneficiaries or interested parties to voice any objections or concerns regarding the accounting and fee statements. 2. Purpose and Necessity: — The primary purpose of the petition is to provide an accurate, complete, and transparent representation of all assets, liabilities, income, expenses, distributions, and fees associated with the estate. — Its approval by the court ensures the fair and proper distribution of the estate's assets, protects the interests of beneficiaries, and minimizes the potential for disputes or mismanagement. — The personal representative is legally obligated to file this petition once all estate-related matters have been settled, debts paid, and assets accounted for. 3. Filing Process: — To initiate the petition, the personal representative (commonly an executor or administrator) must complete the necessary forms, usually provided by the Mesa probate court. — These forms typically require detailed information such as the names and addresses of beneficiaries, assets and liabilities, income and expenses, final distribution plan, and a comprehensive fee statement. — All supporting documents, including receipts, bank statements, invoices, and relevant financial records, must be attached to the petition for thorough review by the court. 4. Different Types of Petitions: a. Petition for Final Accounting: — This type of petition provides a thorough reconciliation of all financial transactions, including income, expenses, distributions, gains or losses, and any outstanding debts or claims. — It enables the court to review whether the personal representative has accurately managed and accounted for estate finances. b. Petition for Approval of Personal Representative Fees: — This petition specifically focuses on the personal representative's compensation for fulfilling their duties during the estate administration process. — It requires a breakdown of the representative's services, hourly rates, time spent, and any additional expenses incurred. Conclusion: The Mesa Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement safeguards the integrity and transparency of estate administration while protecting the interests of beneficiaries. Mastering the filing process and understanding the different types of petitions involved will ensure an efficient and fair distribution of assets and prevent potential disputes. It is essential to consult an attorney or legal professional for expert guidance throughout this probate process.Title: Mesa Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement: A Comprehensive Overview Introduction: In the realm of probate law, a Mesa Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement is a crucial legal document that ensures the transparency and integrity of estate administration. This detailed description aims to shed light on the purpose, process, and different types of petitions related to the final accounting or fee statements in Mesa, Arizona. Key Points: 1. Defining the Petition: — A Mesa Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement is filed with the probate court to request the court's approval for the final accounting and distribution of assets in an estate. — It serves as a legal instrument to validate the personal representative's actions, ensuring compliance with probate laws and regulations. — The petition also serves as an opportunity for beneficiaries or interested parties to voice any objections or concerns regarding the accounting and fee statements. 2. Purpose and Necessity: — The primary purpose of the petition is to provide an accurate, complete, and transparent representation of all assets, liabilities, income, expenses, distributions, and fees associated with the estate. — Its approval by the court ensures the fair and proper distribution of the estate's assets, protects the interests of beneficiaries, and minimizes the potential for disputes or mismanagement. — The personal representative is legally obligated to file this petition once all estate-related matters have been settled, debts paid, and assets accounted for. 3. Filing Process: — To initiate the petition, the personal representative (commonly an executor or administrator) must complete the necessary forms, usually provided by the Mesa probate court. — These forms typically require detailed information such as the names and addresses of beneficiaries, assets and liabilities, income and expenses, final distribution plan, and a comprehensive fee statement. — All supporting documents, including receipts, bank statements, invoices, and relevant financial records, must be attached to the petition for thorough review by the court. 4. Different Types of Petitions: a. Petition for Final Accounting: — This type of petition provides a thorough reconciliation of all financial transactions, including income, expenses, distributions, gains or losses, and any outstanding debts or claims. — It enables the court to review whether the personal representative has accurately managed and accounted for estate finances. b. Petition for Approval of Personal Representative Fees: — This petition specifically focuses on the personal representative's compensation for fulfilling their duties during the estate administration process. — It requires a breakdown of the representative's services, hourly rates, time spent, and any additional expenses incurred. Conclusion: The Mesa Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement safeguards the integrity and transparency of estate administration while protecting the interests of beneficiaries. Mastering the filing process and understanding the different types of petitions involved will ensure an efficient and fair distribution of assets and prevent potential disputes. It is essential to consult an attorney or legal professional for expert guidance throughout this probate process.