An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Approving Account of Personal Representative, Conservator or Guardian - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

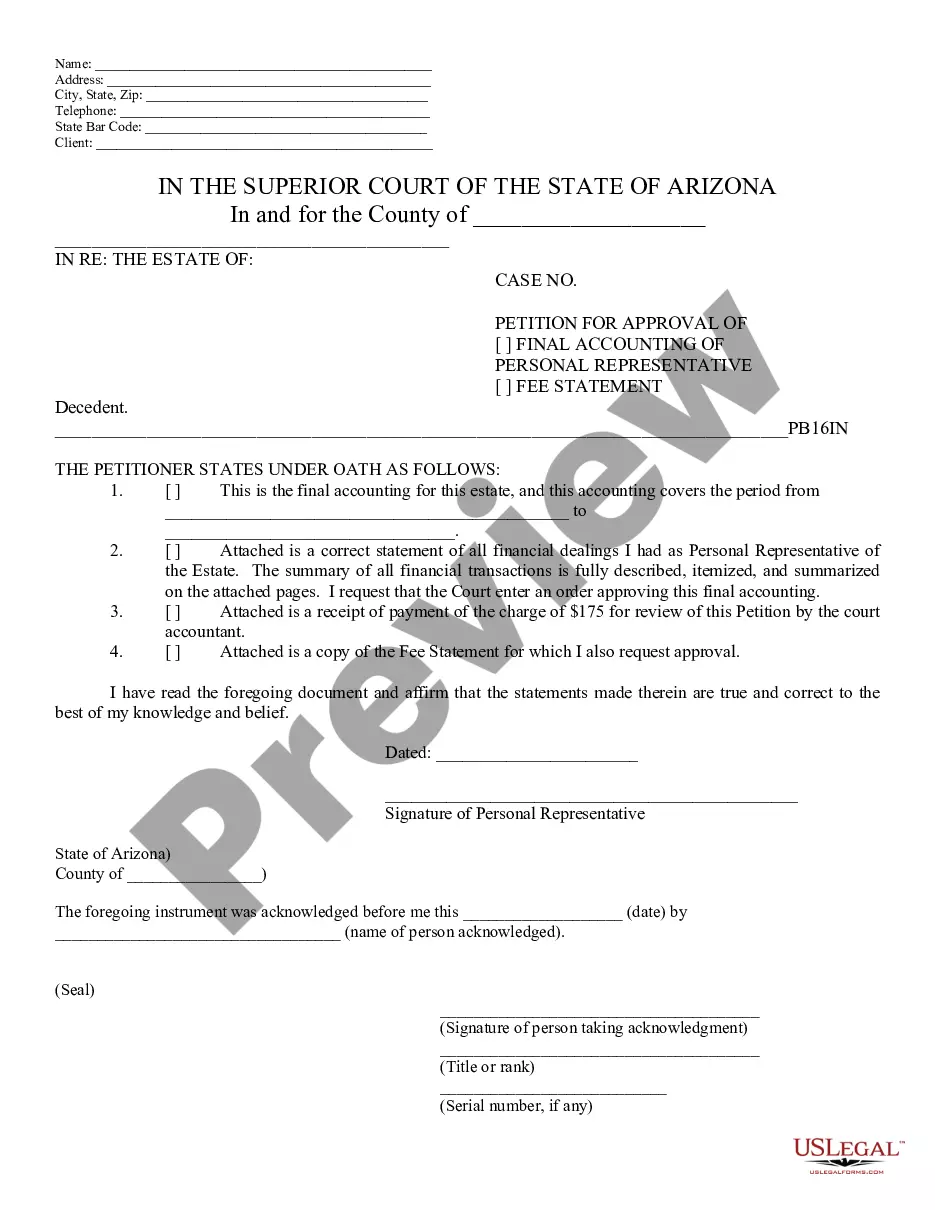

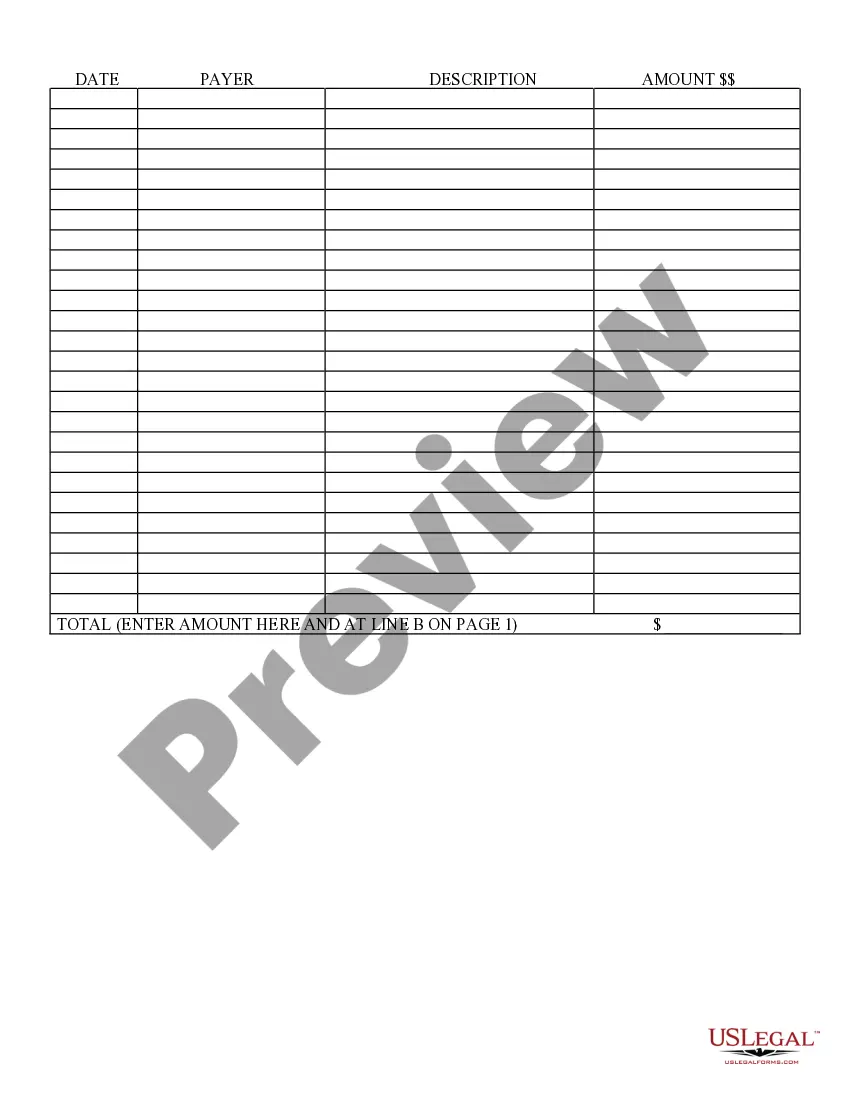

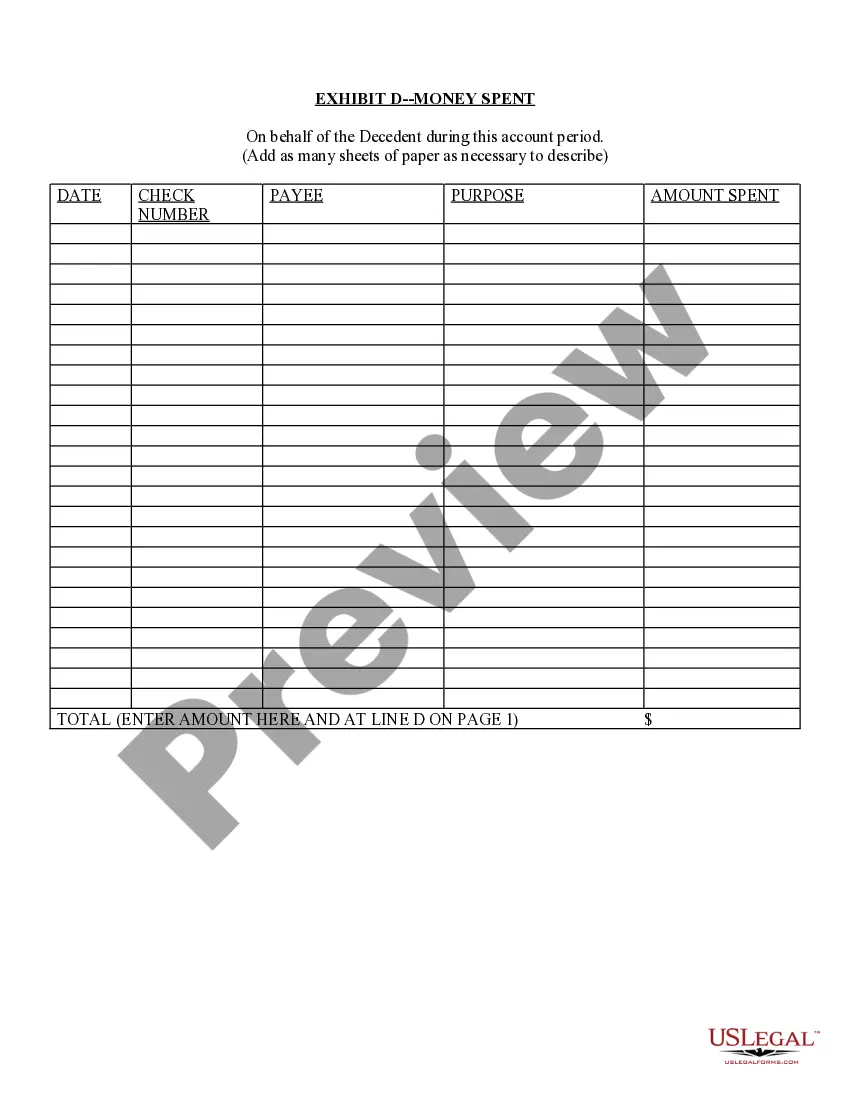

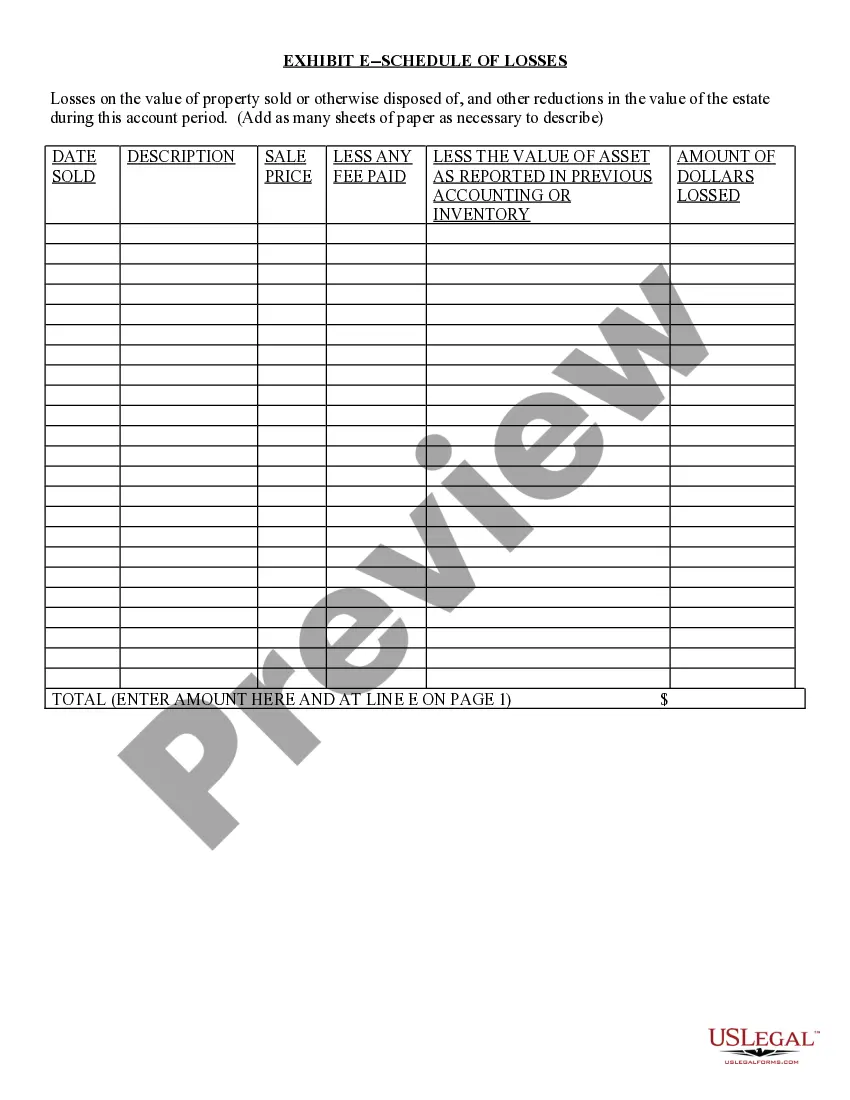

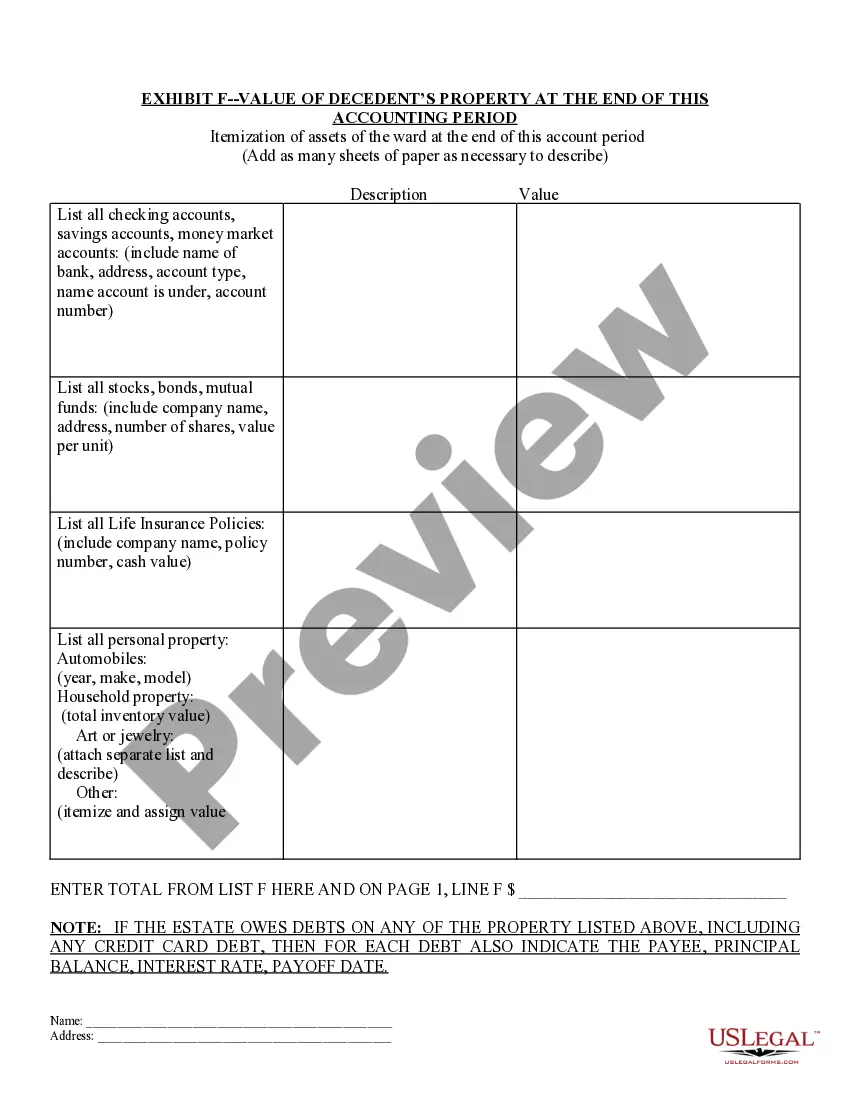

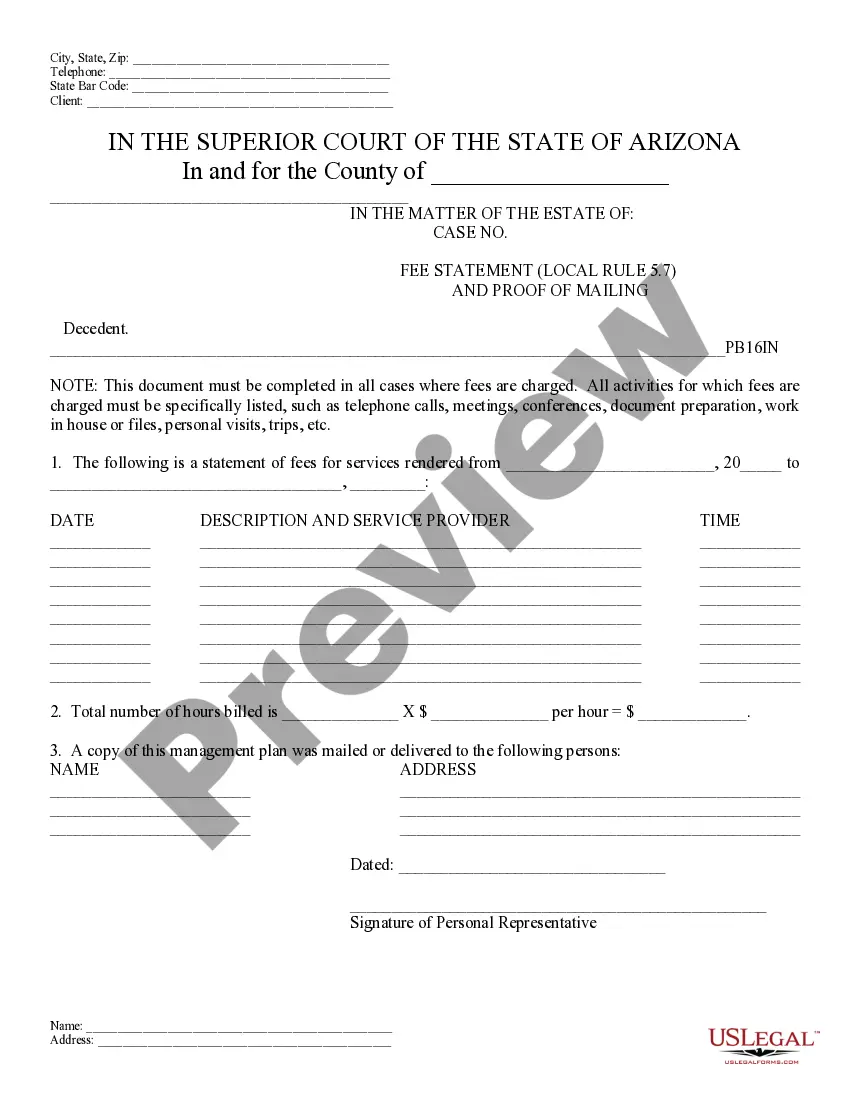

Title: Understanding the Surprise Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement Description: In Surprise, Arizona, the legal process of settling an estate involves various intricate steps, including the filing of a Petition for Approving of Final Accounting of Personal Representative or Fee Statement. This petition plays a crucial role in ensuring that the estate's financial matters are accounted for accurately, giving closure to the probate proceedings. The Surprise Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement is a legal document submitted to the court by the personal representative, also known as the executor or administrator of an estate. It outlines the financial transactions and distributions made during the probate process, allowing the court to review and approve them. Keywords: Surprise Arizona, Petition for Approving, Final Accounting, Personal Representative, Fee Statement, estate, probate proceedings, financial matters, legal document, court, executor, administrator, distributions. Different Types of Surprise Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement: 1. Simple Estate: — This type of petition is applicable when the estate undergoing probate is relatively straightforward, with limited financial transactions or assets involved. 2. Complex Estate: — In cases where the estate comprises multiple assets, substantial financial transactions, or intricate legal matters, a separate type of petition may be required. This type of petition caters to complex estates that necessitate detailed financial accounting and may involve several court proceedings. 3. Fee Statement: — Besides the main petition, the personal representative may also have to submit a separate Fee Statement, detailing the fees charged for their services during the probate process. This statement is intended to provide transparency and accountability regarding the compensation received for executing their responsibilities. In conclusion, the Surprise Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement is a vital document in the estate settlement process. It ensures that all financial matters, including distributions and fees, are accurately accounted for and approved by the court. Estate representatives must prepare and file the appropriate petition depending on the complexity of the estate, enabling a smooth and transparent probate experience.