An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Approving Account of Personal Representative, Conservator or Guardian - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

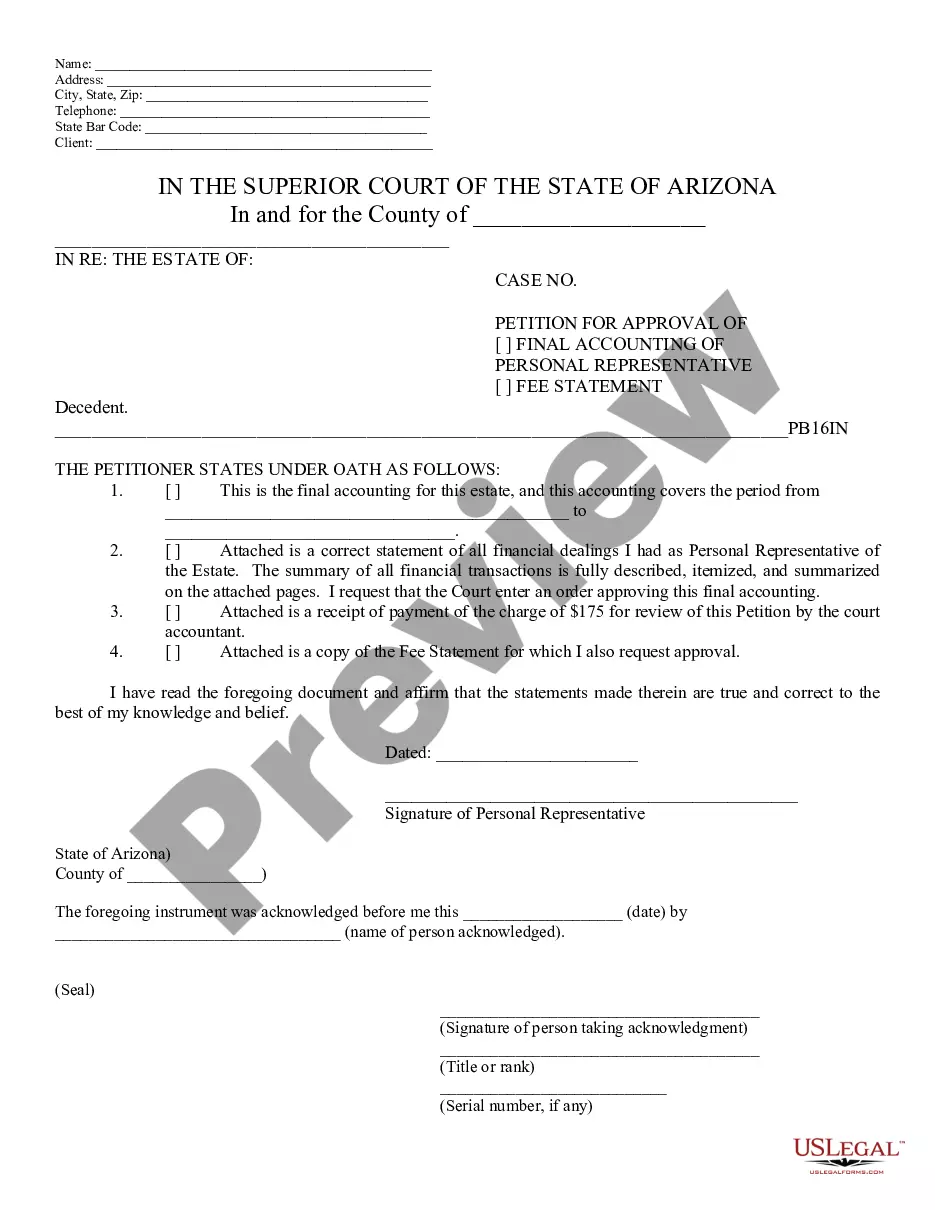

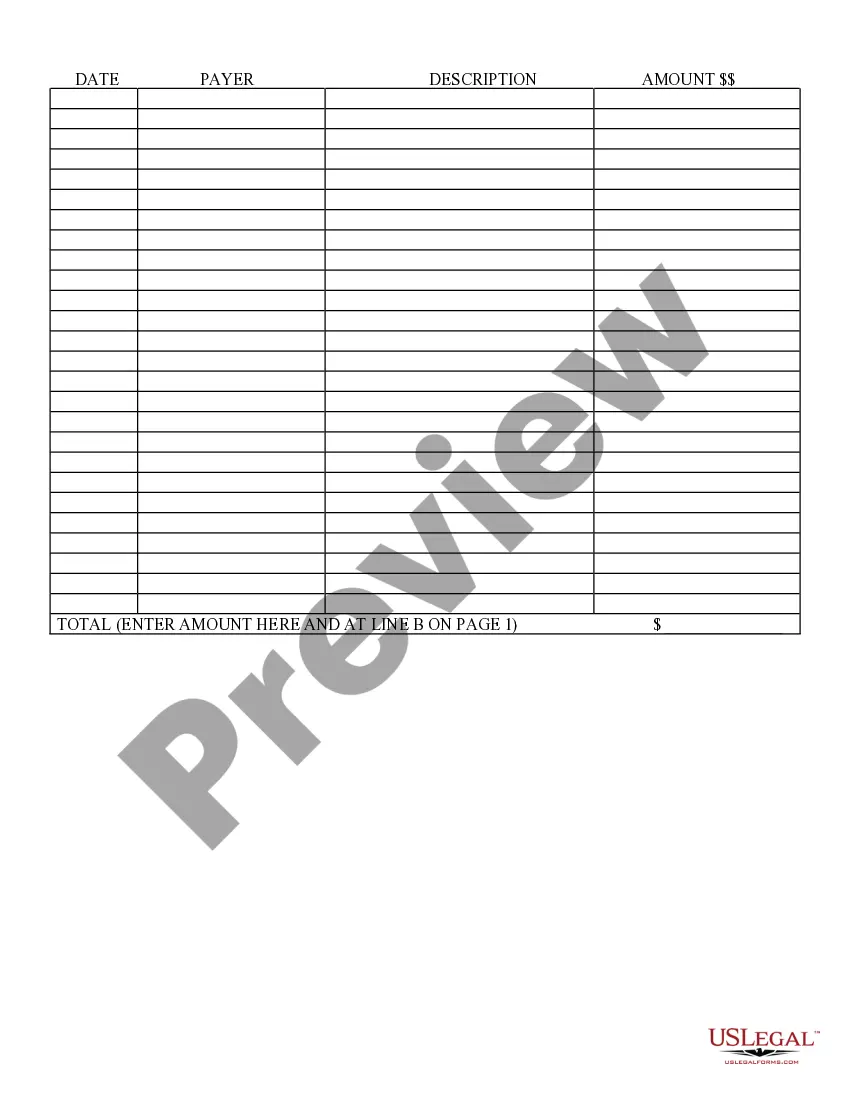

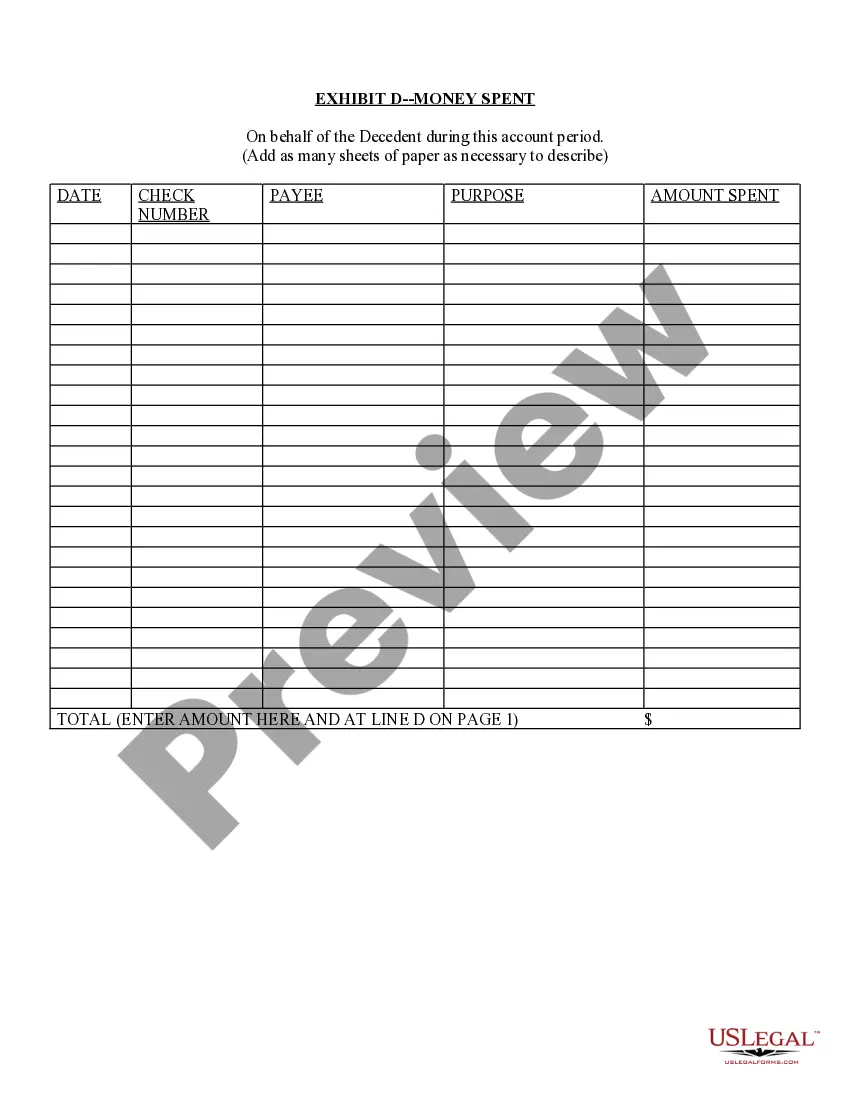

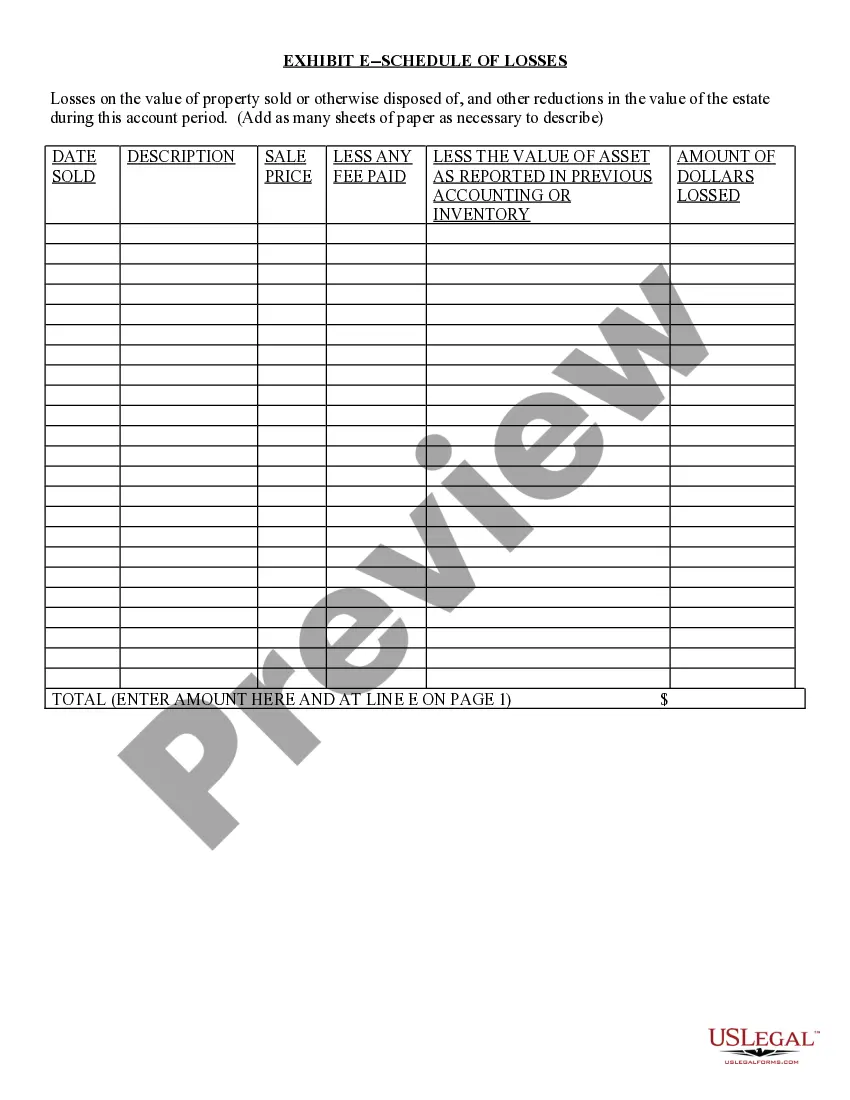

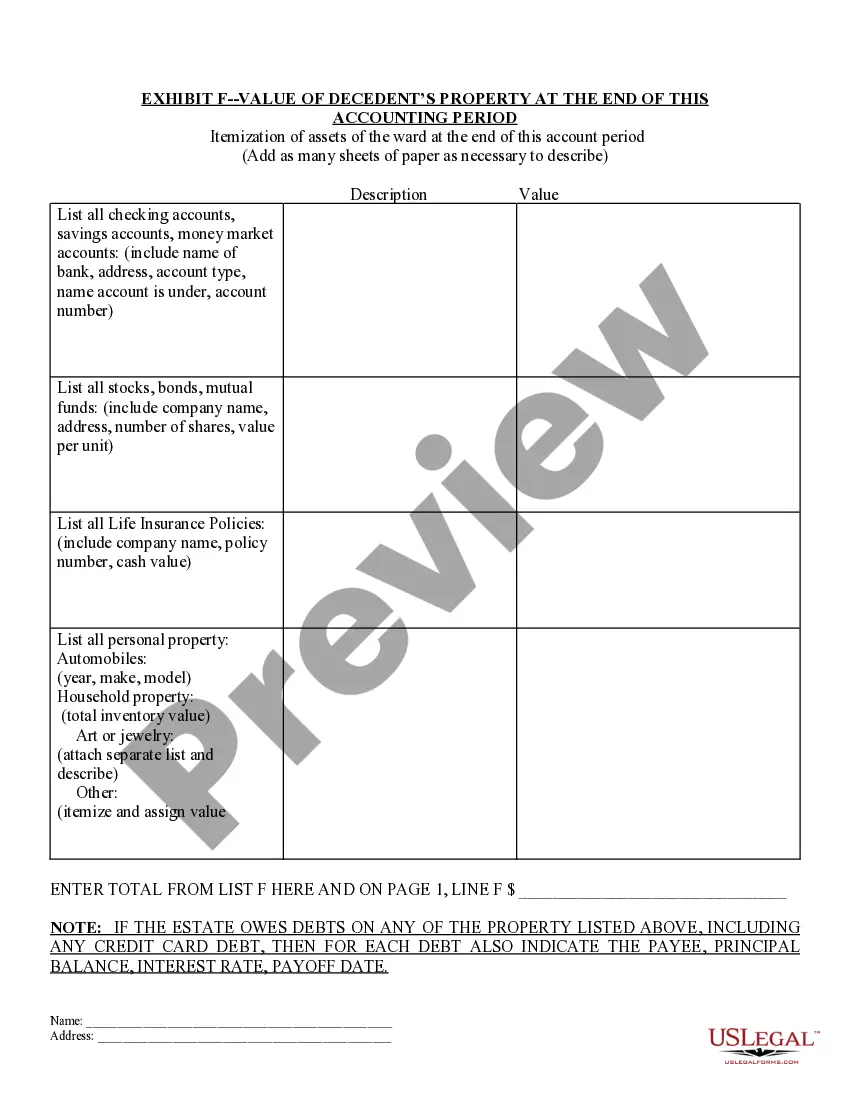

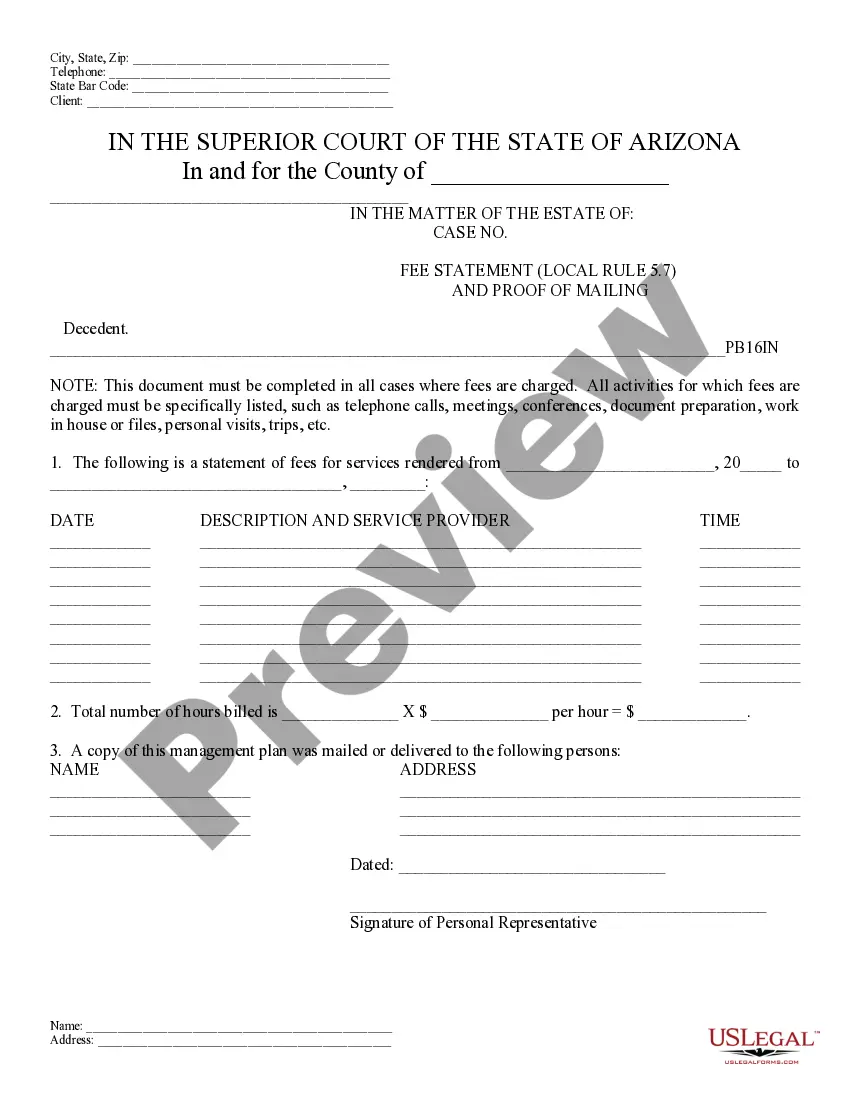

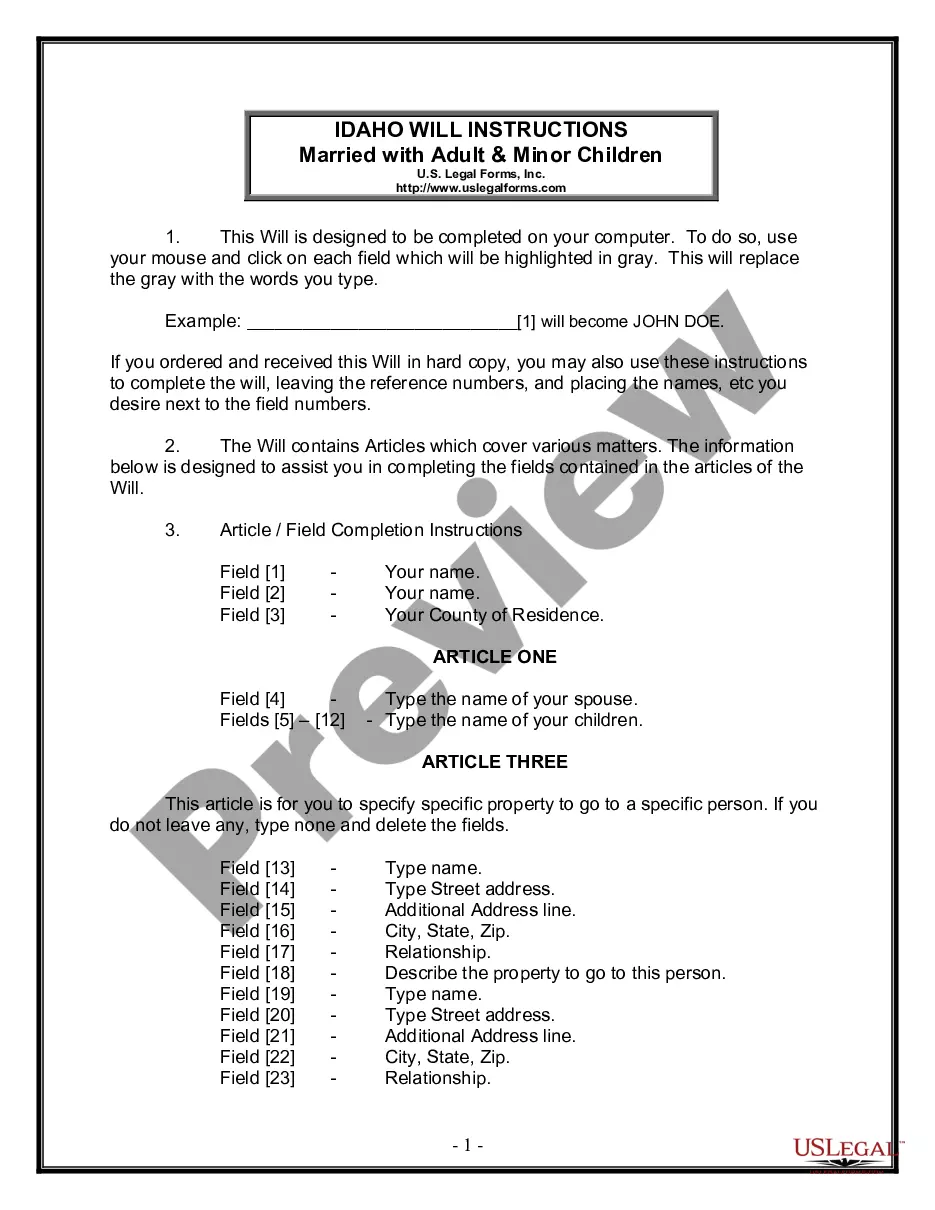

Title: Tucson Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement — Detailed Overview and Types Explained Keywords: Tucson Arizona, Petition for Approving of Final Accounting, Personal Representative, Fee Statement, types Introduction: In Tucson, Arizona, a critical step in the probate process involves submitting a Petition for Approving of Final Accounting of Personal Representative or Fee Statement. This essential document ensures transparency and accountability in the management and distribution of an estate. In this article, we will provide a comprehensive description of this petition and explore any possible variations based on different scenarios. Overview: The Petition for Approving of Final Accounting of Personal Representative or Fee Statement serves as a formal request to the court seeking approval for the final accounting of an estate's assets and expenses. The purpose is to demonstrate to the court and interested parties that the personal representative has accurately recorded all transactions and fulfilled their duties in administering the estate. Types of Tucson Arizona Petition for Approving Final Accounting or Fee Statement: 1. Petition for Approving Final Accounting: This type of petition is filed by the personal representative of the estate, presenting a comprehensive and detailed account of assets, income, expenses, distributions, and any other relevant financial records. It aims to provide a clear snapshot of the estate's financial status and establish that all necessary obligations have been met. 2. Petition for Approving Fee Statement: In some cases, the personal representative may submit a separate petition specifically addressing the fees incurred during the estate administration process. This statement outlines the personal representative's compensation and details any expenses accrued during the administration, such as attorney fees, accountant fees, court fees, or other professional services. It serves to justify the reasonableness of the fees charged. 3. Combined Petition: Alternatively, the personal representative may combine both the final accounting and fee statement into a single comprehensive petition. This type of petition includes all financial information related to the estate, such as assets, income, expenses, distributions, and a breakdown of fees and costs. Consolidating these elements ensures a more concise submission. Importance of the Petition for Approving of Final Accounting or Fee Statement: 1. Accountability: The petition holds the personal representative accountable by allowing interested parties, including the court, heirs, and beneficiaries, to review and verify the accuracy of the accounts and transactions related to the estate. It helps ensure transparency and avoid potential fraud or mismanagement. 2. Legal Compliance: Submitting the petition demonstrates compliance with Tucson's probate laws and regulations. The court's approval signifies that the estate administration process has been carried out appropriately, in compliance with legal requirements. 3. Facilitates Closure of the Estate: The approval of the final accounting and fee statement petitions paves the way for the final distribution of assets among the heirs and beneficiaries. It allows the court to close the probate case once all outstanding matters have been resolved. Conclusion: In Tucson, Arizona, the Petition for Approving of Final Accounting of Personal Representative or Fee Statement plays a vital role in ensuring transparency, accountability, and legal compliance during the estate administration process. By accurately recording all financial transactions and fees, personal representatives can seek court approval, ultimately leading to a final distribution of assets. Various types of petitions, such as the Petition for Approving Final Accounting or Petition for Approving Fee Statement, cater to specific aspects of the estate administration, offering a comprehensive overview of the estate's financial status.Title: Tucson Arizona Petition for Approving of Final Accounting of Personal Representative or Fee Statement — Detailed Overview and Types Explained Keywords: Tucson Arizona, Petition for Approving of Final Accounting, Personal Representative, Fee Statement, types Introduction: In Tucson, Arizona, a critical step in the probate process involves submitting a Petition for Approving of Final Accounting of Personal Representative or Fee Statement. This essential document ensures transparency and accountability in the management and distribution of an estate. In this article, we will provide a comprehensive description of this petition and explore any possible variations based on different scenarios. Overview: The Petition for Approving of Final Accounting of Personal Representative or Fee Statement serves as a formal request to the court seeking approval for the final accounting of an estate's assets and expenses. The purpose is to demonstrate to the court and interested parties that the personal representative has accurately recorded all transactions and fulfilled their duties in administering the estate. Types of Tucson Arizona Petition for Approving Final Accounting or Fee Statement: 1. Petition for Approving Final Accounting: This type of petition is filed by the personal representative of the estate, presenting a comprehensive and detailed account of assets, income, expenses, distributions, and any other relevant financial records. It aims to provide a clear snapshot of the estate's financial status and establish that all necessary obligations have been met. 2. Petition for Approving Fee Statement: In some cases, the personal representative may submit a separate petition specifically addressing the fees incurred during the estate administration process. This statement outlines the personal representative's compensation and details any expenses accrued during the administration, such as attorney fees, accountant fees, court fees, or other professional services. It serves to justify the reasonableness of the fees charged. 3. Combined Petition: Alternatively, the personal representative may combine both the final accounting and fee statement into a single comprehensive petition. This type of petition includes all financial information related to the estate, such as assets, income, expenses, distributions, and a breakdown of fees and costs. Consolidating these elements ensures a more concise submission. Importance of the Petition for Approving of Final Accounting or Fee Statement: 1. Accountability: The petition holds the personal representative accountable by allowing interested parties, including the court, heirs, and beneficiaries, to review and verify the accuracy of the accounts and transactions related to the estate. It helps ensure transparency and avoid potential fraud or mismanagement. 2. Legal Compliance: Submitting the petition demonstrates compliance with Tucson's probate laws and regulations. The court's approval signifies that the estate administration process has been carried out appropriately, in compliance with legal requirements. 3. Facilitates Closure of the Estate: The approval of the final accounting and fee statement petitions paves the way for the final distribution of assets among the heirs and beneficiaries. It allows the court to close the probate case once all outstanding matters have been resolved. Conclusion: In Tucson, Arizona, the Petition for Approving of Final Accounting of Personal Representative or Fee Statement plays a vital role in ensuring transparency, accountability, and legal compliance during the estate administration process. By accurately recording all financial transactions and fees, personal representatives can seek court approval, ultimately leading to a final distribution of assets. Various types of petitions, such as the Petition for Approving Final Accounting or Petition for Approving Fee Statement, cater to specific aspects of the estate administration, offering a comprehensive overview of the estate's financial status.