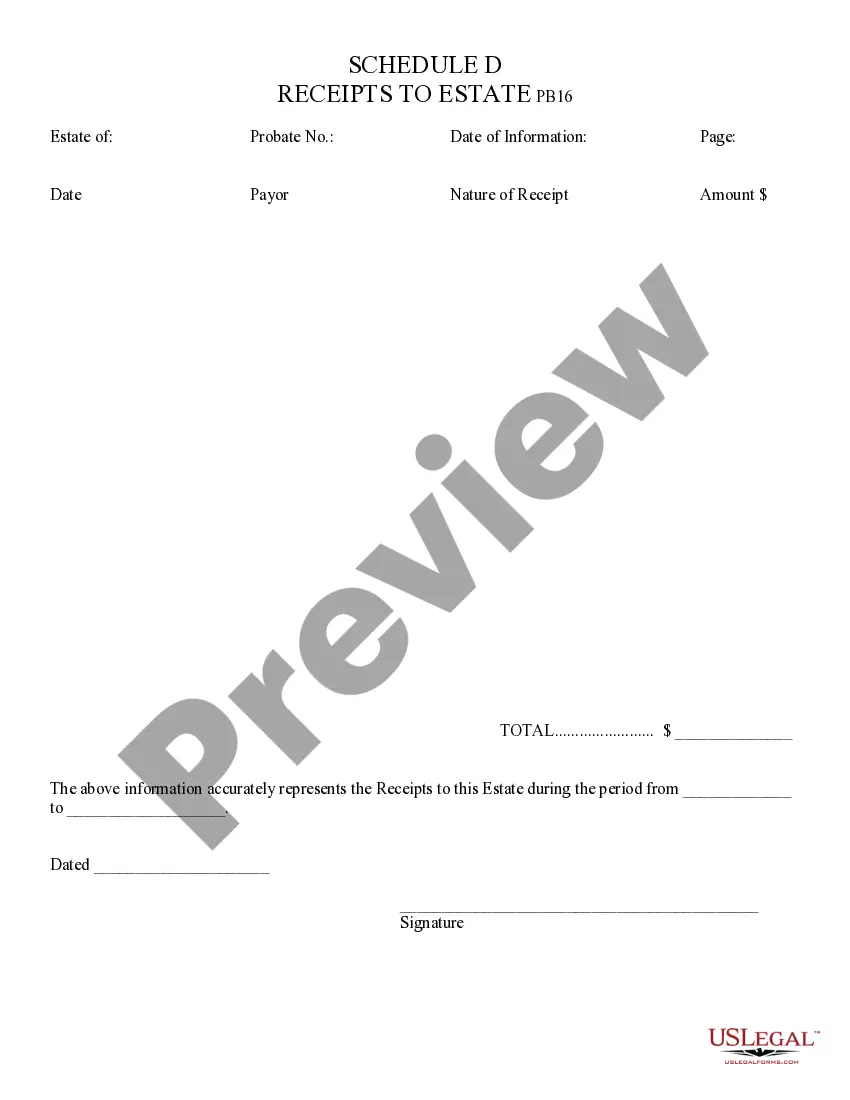

Receipts to Estate - Arizona: This form is used when an administrator of an estate is called upon to list all the receipts of any payments made by the estate. It states the amount of the receipt, as well as the Payor. It is available for download in both Word and Rich Text formats.

Chandler Arizona Receipts to Estate refer to the records or proof of financial transactions related to the transfer of an individual's assets and belongings upon their death in Chandler, Arizona. These receipts are essential for accurately documenting the deceased person's financial affairs and ensuring a proper distribution of their estate among beneficiaries and creditors. There are several types of Chandler Arizona Receipts to Estate, including but not limited to: 1. Probate Sale Receipts: These receipts pertain to the sale of assets owned by the deceased as part of the probate process. Probate refers to the legal procedure through which a deceased person's estate is administered and distributed to beneficiaries or heirs. 2. Inheritance Tax Receipts: In cases where inheritance or estate taxes are applicable, these receipts provide evidence of the payment made by the estate to the government authorities. In Chandler, Arizona, inheritance taxes may be levied on certain types of assets or above a certain threshold. 3. Property Sale Receipts: If any real estate or property owned by the deceased is sold as part of the estate settlement, these receipts document the details of the transaction, including the purchase price, buyer information, and any associated fees. 4. Financial Account Receipts: When closing the deceased person's bank accounts, investment accounts, or retirement plans, receipts are generated by the financial institutions, showing the withdrawal or transfer of funds to the estate. 5. Creditor Payment Receipts: In some cases, the estate might have outstanding debts or liabilities. Receipts verifying the payments made to creditors, such as credit card companies, lenders, and utility service providers, help in resolving these financial obligations. Overall, Chandler Arizona Receipts to Estate play a significant role in the probate process, ensuring transparency and accountability in distributing the deceased person's assets. These records serve as crucial evidence for the administration of the estate, tracking financial transactions, and safeguarding the interests of all involved parties.Chandler Arizona Receipts to Estate refer to the records or proof of financial transactions related to the transfer of an individual's assets and belongings upon their death in Chandler, Arizona. These receipts are essential for accurately documenting the deceased person's financial affairs and ensuring a proper distribution of their estate among beneficiaries and creditors. There are several types of Chandler Arizona Receipts to Estate, including but not limited to: 1. Probate Sale Receipts: These receipts pertain to the sale of assets owned by the deceased as part of the probate process. Probate refers to the legal procedure through which a deceased person's estate is administered and distributed to beneficiaries or heirs. 2. Inheritance Tax Receipts: In cases where inheritance or estate taxes are applicable, these receipts provide evidence of the payment made by the estate to the government authorities. In Chandler, Arizona, inheritance taxes may be levied on certain types of assets or above a certain threshold. 3. Property Sale Receipts: If any real estate or property owned by the deceased is sold as part of the estate settlement, these receipts document the details of the transaction, including the purchase price, buyer information, and any associated fees. 4. Financial Account Receipts: When closing the deceased person's bank accounts, investment accounts, or retirement plans, receipts are generated by the financial institutions, showing the withdrawal or transfer of funds to the estate. 5. Creditor Payment Receipts: In some cases, the estate might have outstanding debts or liabilities. Receipts verifying the payments made to creditors, such as credit card companies, lenders, and utility service providers, help in resolving these financial obligations. Overall, Chandler Arizona Receipts to Estate play a significant role in the probate process, ensuring transparency and accountability in distributing the deceased person's assets. These records serve as crucial evidence for the administration of the estate, tracking financial transactions, and safeguarding the interests of all involved parties.