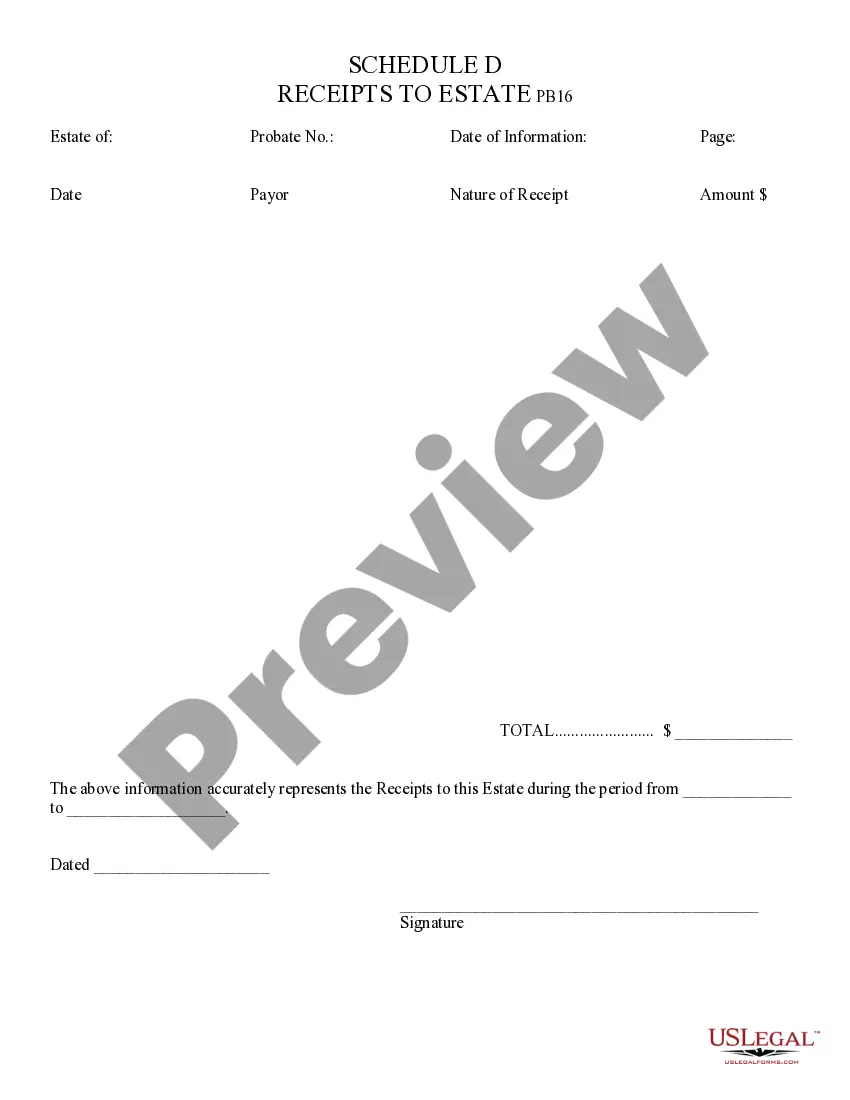

Receipts to Estate - Arizona: This form is used when an administrator of an estate is called upon to list all the receipts of any payments made by the estate. It states the amount of the receipt, as well as the Payor. It is available for download in both Word and Rich Text formats.

Gilbert Arizona Receipts to Estate is a legal document that provides proof of funds received by the estate of a deceased individual in the town of Gilbert, Arizona. These receipts are crucial for accurately tracking and managing the financial assets and liabilities of the estate during the probate process. When a person passes away in Gilbert, Arizona, their estate enters a legal process known as probate. During this process, the deceased individual's assets, debts, and taxes are managed and settled. Gilbert Arizona Receipts to Estate play a vital role in this process as they provide a clear record of all financial transactions related to the estate. There are various types of Gilbert Arizona Receipts to Estate that may exist, including: 1. Inheritance Receipts: These receipts document the transfer of inheritance assets to the estate. They typically involve the distribution of cash, real estate, securities, or other valuable assets to the deceased individual's estate. 2. Debt Settlement Receipts: When the deceased individual had outstanding debts, creditors may provide receipts once the estate settles these obligations. These receipts serve as evidence of the debt settlement and can assist in resolving any financial disputes. 3. Tax Payment Receipts: Gilbert Arizona Receipts to Estate also include records of tax payments made by the estate. This could entail income tax, property tax, estate tax, or any other applicable taxes. These receipts are crucial to ensure the estate's compliance with tax regulations. 4. Sale of Estate Assets Receipts: If the estate sells any assets, such as properties, vehicles, or valuable items, receipts will be generated to indicate the transfer of funds to the estate. These receipts provide a transparent trail for tracking the financial transactions related to the estate's asset sales. Overall, Gilbert Arizona Receipts to Estate are fundamental documents utilized in the probate process to maintain accurate financial records. They help ensure transparency and accountability when managing the deceased individual's estate, providing security to both beneficiaries and creditors.Gilbert Arizona Receipts to Estate is a legal document that provides proof of funds received by the estate of a deceased individual in the town of Gilbert, Arizona. These receipts are crucial for accurately tracking and managing the financial assets and liabilities of the estate during the probate process. When a person passes away in Gilbert, Arizona, their estate enters a legal process known as probate. During this process, the deceased individual's assets, debts, and taxes are managed and settled. Gilbert Arizona Receipts to Estate play a vital role in this process as they provide a clear record of all financial transactions related to the estate. There are various types of Gilbert Arizona Receipts to Estate that may exist, including: 1. Inheritance Receipts: These receipts document the transfer of inheritance assets to the estate. They typically involve the distribution of cash, real estate, securities, or other valuable assets to the deceased individual's estate. 2. Debt Settlement Receipts: When the deceased individual had outstanding debts, creditors may provide receipts once the estate settles these obligations. These receipts serve as evidence of the debt settlement and can assist in resolving any financial disputes. 3. Tax Payment Receipts: Gilbert Arizona Receipts to Estate also include records of tax payments made by the estate. This could entail income tax, property tax, estate tax, or any other applicable taxes. These receipts are crucial to ensure the estate's compliance with tax regulations. 4. Sale of Estate Assets Receipts: If the estate sells any assets, such as properties, vehicles, or valuable items, receipts will be generated to indicate the transfer of funds to the estate. These receipts provide a transparent trail for tracking the financial transactions related to the estate's asset sales. Overall, Gilbert Arizona Receipts to Estate are fundamental documents utilized in the probate process to maintain accurate financial records. They help ensure transparency and accountability when managing the deceased individual's estate, providing security to both beneficiaries and creditors.