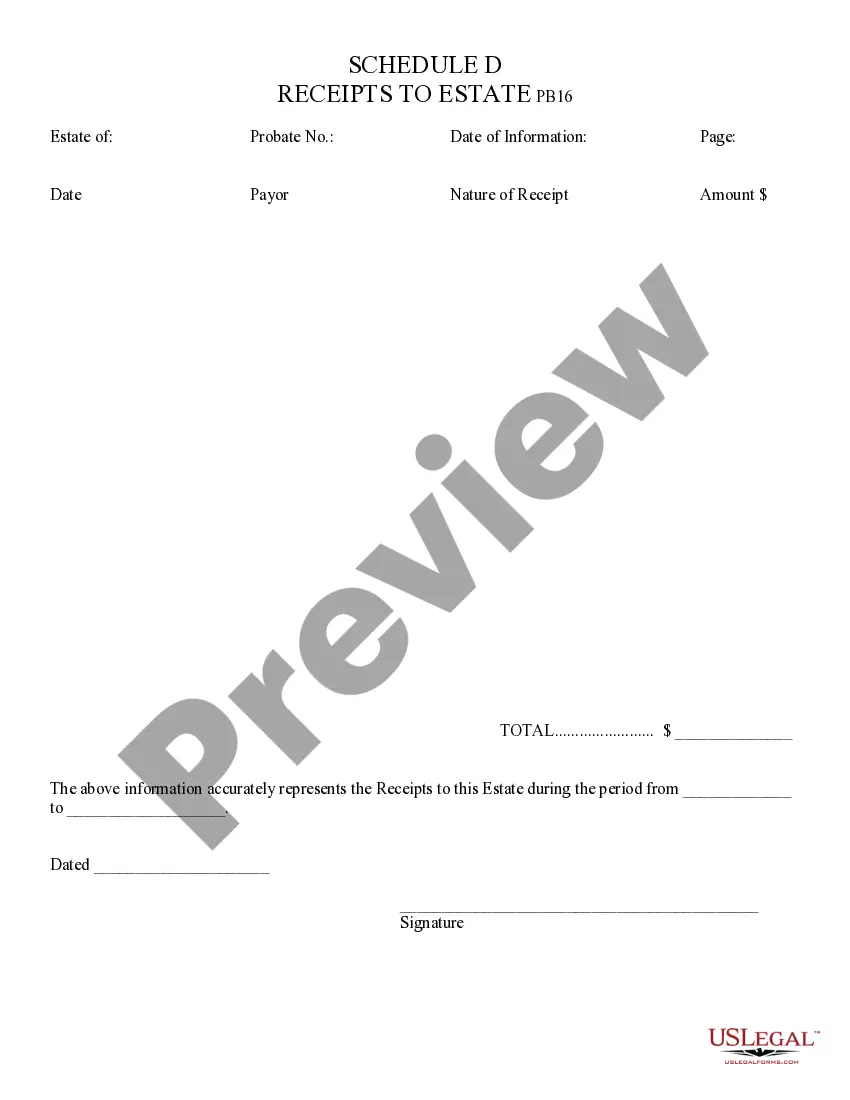

Receipts to Estate - Arizona: This form is used when an administrator of an estate is called upon to list all the receipts of any payments made by the estate. It states the amount of the receipt, as well as the Payor. It is available for download in both Word and Rich Text formats.

Glendale Arizona Receipts to Estate refer to the official records and documentation related to any financial transactions or monetary assets of an individual or entity that are passed down to their estate after they pass away. These receipts serve as evidence and proof of the various financial activities and transactions that occurred during the individual's lifetime. The different types of Glendale Arizona Receipts to Estate may include: 1. Property Receipts: These receipts pertain to any real estate or property owned by the deceased that is transferred to their estate. This can include purchase receipts, rental receipts, mortgage payment receipts, or records of property taxes paid. 2. Investment Receipts: This category includes receipts for investments made by the deceased, such as stock purchase receipts, dividend statements, or records of bond investments. 3. Bank Account Receipts: These receipts involve records of deposits, withdrawals, and bank account statements of the deceased. They provide a comprehensive overview of the deceased's financial activities, including statements from savings accounts, checking accounts, or any other financial institution. 4. Business Receipts: If the deceased owned a business, there might be receipts related to business operations, including sales receipts, expense receipts, records of business assets, or any other financial document relevant to the business's operations. 5. Tax Receipts: This category encompasses receipts related to tax payments made by the deceased. It includes receipts for income tax payments, property tax payments, sales tax payments, and any other forms of taxes paid during their lifetime. 6. Personal Receipts: These include receipts for personal expenses made by the deceased, such as receipts for household bills, insurance premiums, medical expenses, or any other personal financial transactions. It is critical to maintain these receipts to ensure accurate financial record-keeping for the estate. They can assist in calculating the value of the estate, distribution of assets, paying off outstanding debts, and fulfilling any tax obligations. It is recommended to work with an experienced estate attorney or executor to properly organize and manage Glendale Arizona Receipts to Estate in compliance with legal requirements.