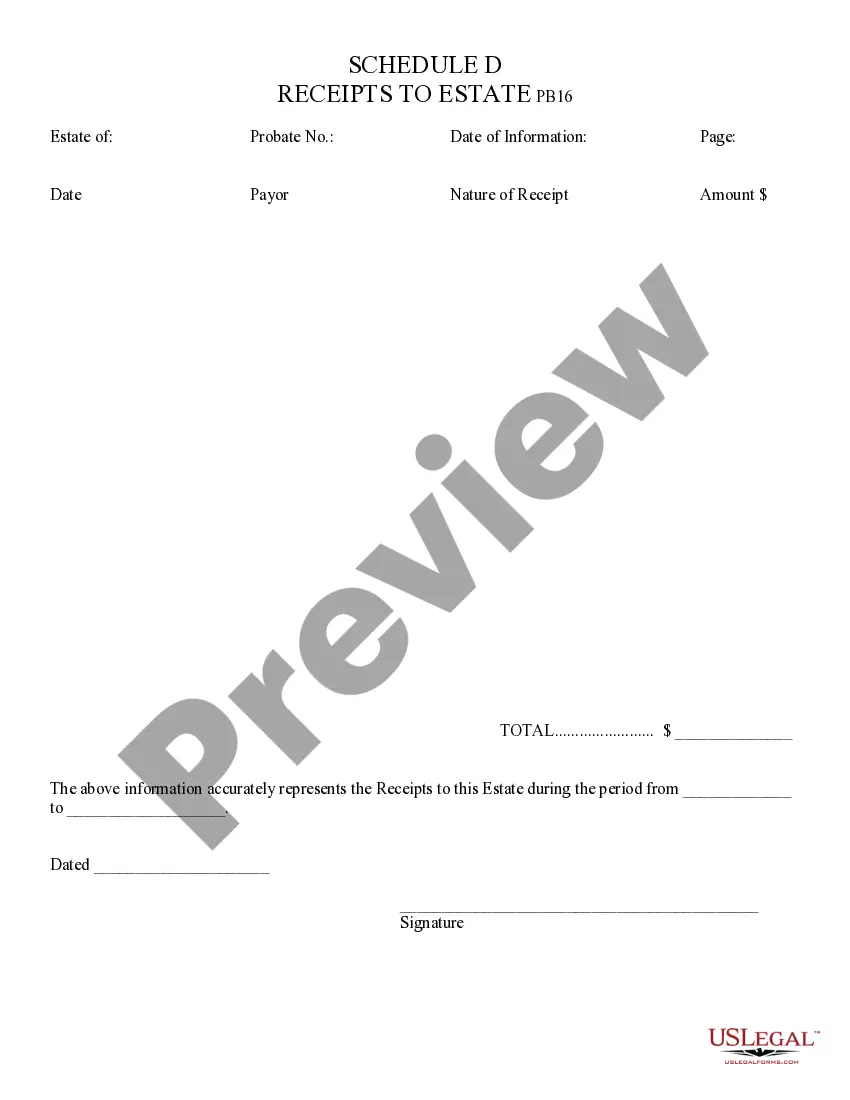

Receipts to Estate - Arizona: This form is used when an administrator of an estate is called upon to list all the receipts of any payments made by the estate. It states the amount of the receipt, as well as the Payor. It is available for download in both Word and Rich Text formats.

Maricopa Arizona Receipts to Estate refers to the documentation of financial transactions performed during the settlement of an estate in Maricopa, Arizona. These receipts serve as important evidence and records of all income and expenses related to the estate. They are crucial in ensuring transparency and accuracy in the distribution of assets, paying off debts, and fulfilling the legal obligations associated with an estate settlement. In Maricopa, Arizona, there are various types of receipts that can be included in the estate documentation. Some of these may include: 1. Probate Court Filing Receipts: These receipts are issued by the Maricopa County Probate Court upon the submission of required documents to initiate the estate settlement process. They confirm the acceptance of the filed documents and may include a case number for reference. 2. Executor/Administrator Receipts: These receipts document the income received by the executor or administrator of the estate as they carry out the necessary tasks and responsibilities, such as selling assets, collecting debts, and managing investments. These receipts are crucial in providing a clear picture of the estate's financial transactions. 3. Estate Sale Receipts: In cases where personal belongings, property, or other assets are sold as part of the estate settlement process, receipts from these sales are obtained. These receipts provide proof of the sale, including the amount received, date, and description of the item sold. 4. Receipts for Debt Payments: If the deceased owed any outstanding debts, receipts obtained from paying off these debts are important. These receipts should include details such as the name of the creditor, amount paid, payment date, and any relevant reference numbers. 5. Receipts for Tax Payments: Estate settlements often involve the settlement of any outstanding taxes owed by the deceased or the estate itself. Receipts from tax payments made to the Maricopa County Treasurer or the Internal Revenue Service (IRS) may be included to demonstrate compliance with tax obligations. 6. Receipts for Funeral Expenses: Receipts related to funeral expenses may also be part of the estate documentation. These receipts document the costs incurred for services like funeral home charges, cemetery plots, grave markers, and other related expenses. Having accurate and comprehensive Maricopa Arizona Receipts to Estate is pivotal in ensuring a smooth and efficient settlement process. These receipts not only provide evidence of financial transactions but also help protect the rights and interests of all parties involved in the estate settlement.Maricopa Arizona Receipts to Estate refers to the documentation of financial transactions performed during the settlement of an estate in Maricopa, Arizona. These receipts serve as important evidence and records of all income and expenses related to the estate. They are crucial in ensuring transparency and accuracy in the distribution of assets, paying off debts, and fulfilling the legal obligations associated with an estate settlement. In Maricopa, Arizona, there are various types of receipts that can be included in the estate documentation. Some of these may include: 1. Probate Court Filing Receipts: These receipts are issued by the Maricopa County Probate Court upon the submission of required documents to initiate the estate settlement process. They confirm the acceptance of the filed documents and may include a case number for reference. 2. Executor/Administrator Receipts: These receipts document the income received by the executor or administrator of the estate as they carry out the necessary tasks and responsibilities, such as selling assets, collecting debts, and managing investments. These receipts are crucial in providing a clear picture of the estate's financial transactions. 3. Estate Sale Receipts: In cases where personal belongings, property, or other assets are sold as part of the estate settlement process, receipts from these sales are obtained. These receipts provide proof of the sale, including the amount received, date, and description of the item sold. 4. Receipts for Debt Payments: If the deceased owed any outstanding debts, receipts obtained from paying off these debts are important. These receipts should include details such as the name of the creditor, amount paid, payment date, and any relevant reference numbers. 5. Receipts for Tax Payments: Estate settlements often involve the settlement of any outstanding taxes owed by the deceased or the estate itself. Receipts from tax payments made to the Maricopa County Treasurer or the Internal Revenue Service (IRS) may be included to demonstrate compliance with tax obligations. 6. Receipts for Funeral Expenses: Receipts related to funeral expenses may also be part of the estate documentation. These receipts document the costs incurred for services like funeral home charges, cemetery plots, grave markers, and other related expenses. Having accurate and comprehensive Maricopa Arizona Receipts to Estate is pivotal in ensuring a smooth and efficient settlement process. These receipts not only provide evidence of financial transactions but also help protect the rights and interests of all parties involved in the estate settlement.