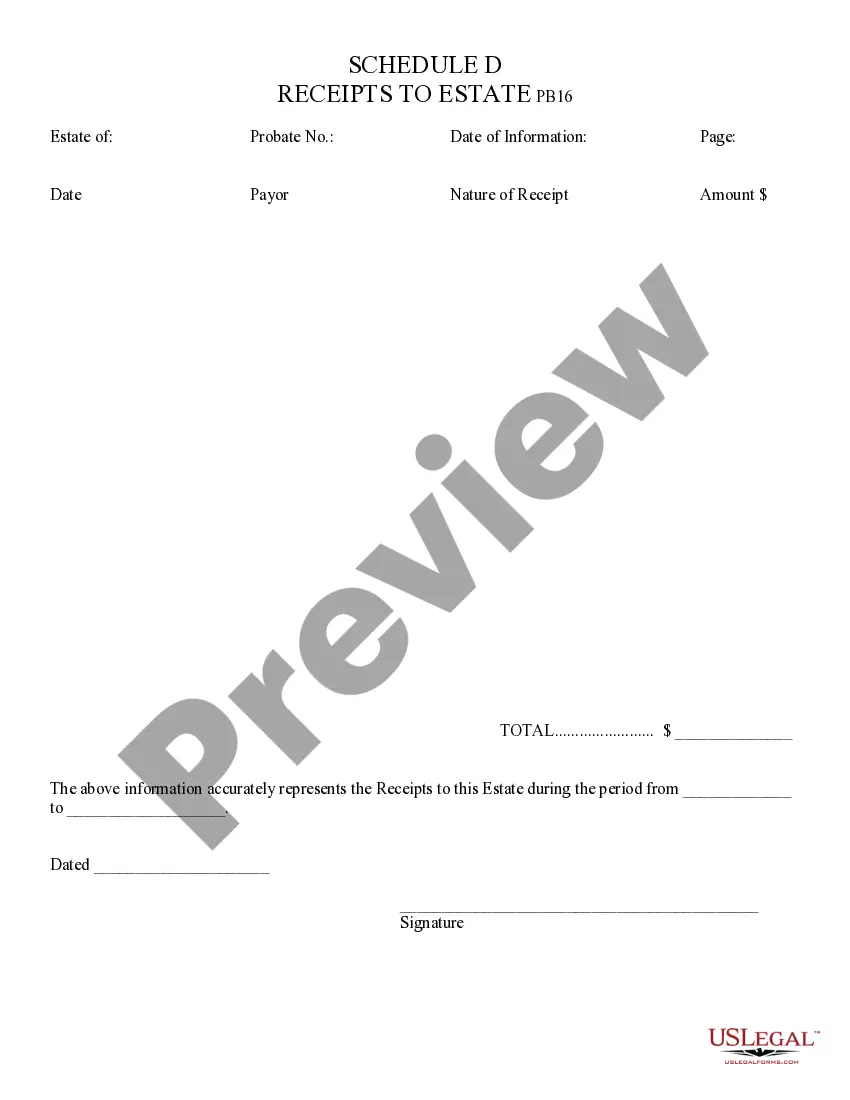

Receipts to Estate - Arizona: This form is used when an administrator of an estate is called upon to list all the receipts of any payments made by the estate. It states the amount of the receipt, as well as the Payor. It is available for download in both Word and Rich Text formats.

Lima Arizona Receipts to Estate refers to the documentation and record-keeping process involved in managing the financial transactions and assets of an estate in Lima, Arizona. It encompasses the gathering, organizing, and recording of receipts related to various activities and transactions conducted on behalf of the estate. These receipts provide a clear and transparent account of the income, expenses, investments, and other financial aspects of the estate. The Lima Arizona Receipts to Estate can be classified into different types based on the nature of transactions they represent: 1. Income Receipts: These receipts include any form of income generated by the estate such as rental payments, dividends from investments, interest earned from bank accounts, or any other inflows of funds into the estate. 2. Expense Receipts: These receipts document the various expenses incurred in managing the estate. They can include bills for utilities, property maintenance costs, legal fees, insurance premiums, property taxes, and other relevant expenses. 3. Investment Receipts: When the estate holds investments such as stocks, bonds, mutual funds, or real estate, receipts related to the purchase, sale, dividends, or interest earned from these investments are maintained. These receipts provide a comprehensive overview of the investment activity and its impact on the estate's financial status. 4. Inheritance Receipts: In the case of inherited property or assets, receipts related to the transfer of ownership, appraisal costs, legal fees, or any other expenses tied to the inherited assets are categorized under this type of receipt. 5. Donations Receipts: If the estate has made charitable donations or contributions, receipts from the charitable organization are collected and recorded to substantiate the estate's philanthropic activities. 6. Gift Receipts: In the event that the estate receives gifts or bequests, receipts documenting these transactions are maintained to establish legal ownership and to account for the asset's value within the estate. Accurate and organized record-keeping of Lima Arizona Receipts to Estate is crucial to ensure proper management of the estate's financial obligations, tax filings, and overall transparency. The receipts serve as evidence of financial transactions and can provide essential information during audits or assessment of the estate's financial health.Lima Arizona Receipts to Estate refers to the documentation and record-keeping process involved in managing the financial transactions and assets of an estate in Lima, Arizona. It encompasses the gathering, organizing, and recording of receipts related to various activities and transactions conducted on behalf of the estate. These receipts provide a clear and transparent account of the income, expenses, investments, and other financial aspects of the estate. The Lima Arizona Receipts to Estate can be classified into different types based on the nature of transactions they represent: 1. Income Receipts: These receipts include any form of income generated by the estate such as rental payments, dividends from investments, interest earned from bank accounts, or any other inflows of funds into the estate. 2. Expense Receipts: These receipts document the various expenses incurred in managing the estate. They can include bills for utilities, property maintenance costs, legal fees, insurance premiums, property taxes, and other relevant expenses. 3. Investment Receipts: When the estate holds investments such as stocks, bonds, mutual funds, or real estate, receipts related to the purchase, sale, dividends, or interest earned from these investments are maintained. These receipts provide a comprehensive overview of the investment activity and its impact on the estate's financial status. 4. Inheritance Receipts: In the case of inherited property or assets, receipts related to the transfer of ownership, appraisal costs, legal fees, or any other expenses tied to the inherited assets are categorized under this type of receipt. 5. Donations Receipts: If the estate has made charitable donations or contributions, receipts from the charitable organization are collected and recorded to substantiate the estate's philanthropic activities. 6. Gift Receipts: In the event that the estate receives gifts or bequests, receipts documenting these transactions are maintained to establish legal ownership and to account for the asset's value within the estate. Accurate and organized record-keeping of Lima Arizona Receipts to Estate is crucial to ensure proper management of the estate's financial obligations, tax filings, and overall transparency. The receipts serve as evidence of financial transactions and can provide essential information during audits or assessment of the estate's financial health.