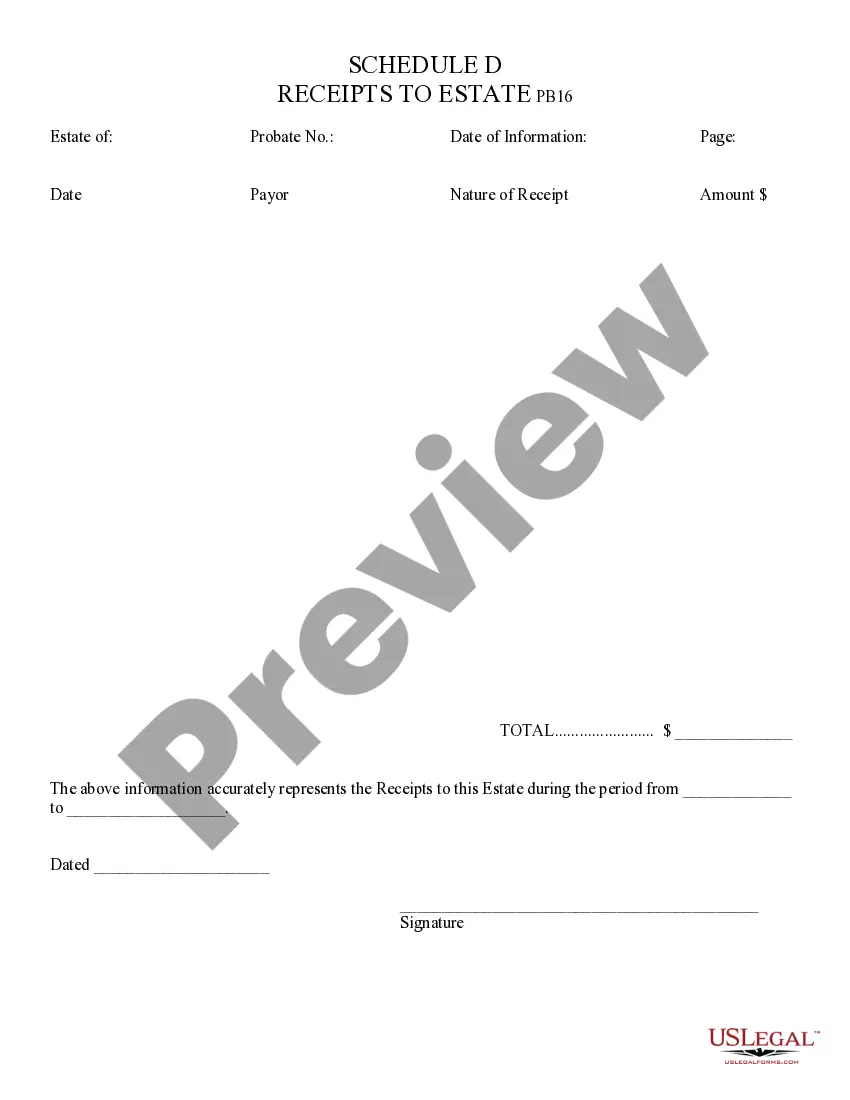

Receipts to Estate - Arizona: This form is used when an administrator of an estate is called upon to list all the receipts of any payments made by the estate. It states the amount of the receipt, as well as the Payor. It is available for download in both Word and Rich Text formats.

Scottsdale Arizona Receipts to Estate refer to the financial documentation needed to account for the assets and liabilities of an estate in Scottsdale, Arizona. These receipts serve as proof of transactions, expenses, and income related to the estate, ensuring an accurate record of the estate's financial status. Various types of Scottsdale Arizona Receipts to Estate can include: 1. Probate Expense Receipts: These receipts track the expenses incurred during the probate process, such as court fees, attorney fees, and administrative costs. They provide a detailed breakdown of the probate expenditures, ensuring transparency in estate administration. 2. Property Sale Receipts: If any property within the estate is sold, these receipts provide evidence of the sale price, closing costs, agent commissions, and any other relevant expenses or income generated from the property transaction. This type of receipt is crucial for accurately valuing the estate. 3. Investment Account Receipts: In cases where the estate holds investment accounts, such as stocks, bonds, or mutual funds, these receipts document any dividends, interest income, or capital gains earned within the account. They also record any fees or charges associated with managing these investments. 4. Real Estate Rental Receipts: If the estate owns rental properties in Scottsdale, receipts for rental income, property management fees, repairs, and maintenance expenses are required to track the financial performance of the estate's real estate holdings. 5. Debt and Loan Receipts: If the estate holds any outstanding debts or loans, receipts for interest payments, loan repayments, or credit card statements are necessary to document these financial obligations. 6. Inheritance Receipts: If the estate receives any inheritances or transfers from other estates or individuals, receipts for these assets ensure proper documentation and valuation within the estate. Accurate record-keeping using Scottsdale Arizona Receipts to Estate is essential for managing the estate's finances, calculating estate taxes, and distributing assets to beneficiaries as per the will or state laws. These receipts provide transparency and accountability during estate administration, enabling administrators, executors, and beneficiaries to make informed financial decisions.Scottsdale Arizona Receipts to Estate refer to the financial documentation needed to account for the assets and liabilities of an estate in Scottsdale, Arizona. These receipts serve as proof of transactions, expenses, and income related to the estate, ensuring an accurate record of the estate's financial status. Various types of Scottsdale Arizona Receipts to Estate can include: 1. Probate Expense Receipts: These receipts track the expenses incurred during the probate process, such as court fees, attorney fees, and administrative costs. They provide a detailed breakdown of the probate expenditures, ensuring transparency in estate administration. 2. Property Sale Receipts: If any property within the estate is sold, these receipts provide evidence of the sale price, closing costs, agent commissions, and any other relevant expenses or income generated from the property transaction. This type of receipt is crucial for accurately valuing the estate. 3. Investment Account Receipts: In cases where the estate holds investment accounts, such as stocks, bonds, or mutual funds, these receipts document any dividends, interest income, or capital gains earned within the account. They also record any fees or charges associated with managing these investments. 4. Real Estate Rental Receipts: If the estate owns rental properties in Scottsdale, receipts for rental income, property management fees, repairs, and maintenance expenses are required to track the financial performance of the estate's real estate holdings. 5. Debt and Loan Receipts: If the estate holds any outstanding debts or loans, receipts for interest payments, loan repayments, or credit card statements are necessary to document these financial obligations. 6. Inheritance Receipts: If the estate receives any inheritances or transfers from other estates or individuals, receipts for these assets ensure proper documentation and valuation within the estate. Accurate record-keeping using Scottsdale Arizona Receipts to Estate is essential for managing the estate's finances, calculating estate taxes, and distributing assets to beneficiaries as per the will or state laws. These receipts provide transparency and accountability during estate administration, enabling administrators, executors, and beneficiaries to make informed financial decisions.