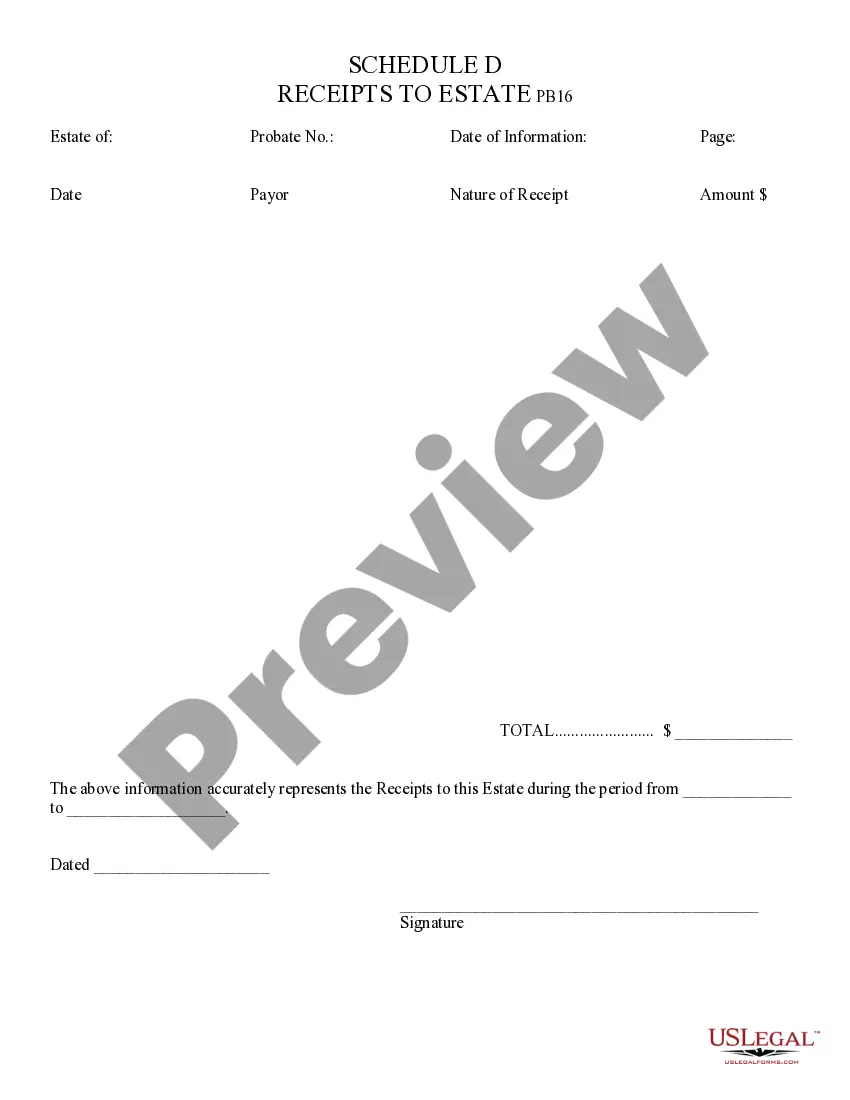

Receipts to Estate - Arizona: This form is used when an administrator of an estate is called upon to list all the receipts of any payments made by the estate. It states the amount of the receipt, as well as the Payor. It is available for download in both Word and Rich Text formats.

Surprise Arizona Receipts to Estate: A Comprehensive Guide Introduction: Surprise, Arizona, is a vibrant city known for its economic growth and development. As residents and businesses thrive in this bustling community, it is essential to understand the importance of Surprise Arizona receipts to estate. These receipts hold significant value for both individuals and families when it comes to the management and distribution of assets after someone's passing. In this detailed description, we will explore the concept of Surprise Arizona receipts to estate, discuss their various types, and highlight the relevance of keywords to offer a comprehensive understanding of this crucial matter. Key Concepts and Keywords: 1. Estate Receipts: Estate receipts are legal documents that provide evidence of financial transactions related to an individual's estate. These receipts serve as official records of a deceased person's assets, liabilities, and expenses, ensuring transparency and accountability during estate settlement. Some relevant keywords include estate administration, financial documentation, inventory records, and accounting. Different Types of Surprise Arizona Receipts to Estate: 1. Property Receipts: Property receipts are crucial in establishing ownership and value of real estate assets within the deceased person's estate. These receipts document property purchases, transfers, leases, mortgage payments, property taxes, and any improvements made. Keywords associated with property receipts include property records, land ownership, title deeds, mortgage statements, and property valuations. 2. Financial Receipts: Financial receipts encompass a broad range of transactions that involve money within the estate. These receipts can include bank statements, investment account statements, loan agreements, credit card bills, and tax return documents. Keywords related to financial receipts include banking transactions, investment portfolio, loan obligations, credit card statements, and taxation records. 3. Personal Property Receipts: Personal property receipts account for items such as vehicles, jewelry, furniture, artwork, and other valuable possessions. These receipts establish ownership, value, and insurance details of personal assets, facilitating their distribution among heirs and beneficiaries. Keywords relevant to personal property receipts are asset inventory, valuation appraisals, insurance coverage, personal belongings, and inheritance distribution. 4. Business Receipts: In cases where the deceased person owned a business, business receipts play a crucial role in determining the value, profitability, and assets of the enterprise. These receipts can include financial statements, sales records, customer invoices, payroll documents, and tax filings. Keywords associated with business receipts include business financials, profit and loss statements, invoice records, employee wages, and tax compliance. Relevance and Importance: Surprise Arizona receipts to estate are vital for several reasons. Firstly, these receipts provide a comprehensive overview of the deceased person's financial affairs, ensuring that all assets and liabilities are correctly accounted for during estate administration. They also serve as evidence in case of disputes or challenges related to the estate. Receipts provide a clear understanding of the deceased person's wishes concerning asset distribution and can help prevent fraud or mishandling of assets. Furthermore, these receipts play a crucial role in estate tax planning and filing, avoiding potential penalties and ensuring compliance with legal requirements. Conclusion: Surprise Arizona receipts to estate from the backbone of effective estate administration and asset distribution upon a person's passing. Property, financial, personal property, and business receipts are all essential components that contribute to the overall management and settlement of an estate. Understanding the relevance of these receipts, along with their associated keywords, is vital for individuals, families, and professionals involved in estate planning, administration, and probate processes in Surprise, Arizona.Surprise Arizona Receipts to Estate: A Comprehensive Guide Introduction: Surprise, Arizona, is a vibrant city known for its economic growth and development. As residents and businesses thrive in this bustling community, it is essential to understand the importance of Surprise Arizona receipts to estate. These receipts hold significant value for both individuals and families when it comes to the management and distribution of assets after someone's passing. In this detailed description, we will explore the concept of Surprise Arizona receipts to estate, discuss their various types, and highlight the relevance of keywords to offer a comprehensive understanding of this crucial matter. Key Concepts and Keywords: 1. Estate Receipts: Estate receipts are legal documents that provide evidence of financial transactions related to an individual's estate. These receipts serve as official records of a deceased person's assets, liabilities, and expenses, ensuring transparency and accountability during estate settlement. Some relevant keywords include estate administration, financial documentation, inventory records, and accounting. Different Types of Surprise Arizona Receipts to Estate: 1. Property Receipts: Property receipts are crucial in establishing ownership and value of real estate assets within the deceased person's estate. These receipts document property purchases, transfers, leases, mortgage payments, property taxes, and any improvements made. Keywords associated with property receipts include property records, land ownership, title deeds, mortgage statements, and property valuations. 2. Financial Receipts: Financial receipts encompass a broad range of transactions that involve money within the estate. These receipts can include bank statements, investment account statements, loan agreements, credit card bills, and tax return documents. Keywords related to financial receipts include banking transactions, investment portfolio, loan obligations, credit card statements, and taxation records. 3. Personal Property Receipts: Personal property receipts account for items such as vehicles, jewelry, furniture, artwork, and other valuable possessions. These receipts establish ownership, value, and insurance details of personal assets, facilitating their distribution among heirs and beneficiaries. Keywords relevant to personal property receipts are asset inventory, valuation appraisals, insurance coverage, personal belongings, and inheritance distribution. 4. Business Receipts: In cases where the deceased person owned a business, business receipts play a crucial role in determining the value, profitability, and assets of the enterprise. These receipts can include financial statements, sales records, customer invoices, payroll documents, and tax filings. Keywords associated with business receipts include business financials, profit and loss statements, invoice records, employee wages, and tax compliance. Relevance and Importance: Surprise Arizona receipts to estate are vital for several reasons. Firstly, these receipts provide a comprehensive overview of the deceased person's financial affairs, ensuring that all assets and liabilities are correctly accounted for during estate administration. They also serve as evidence in case of disputes or challenges related to the estate. Receipts provide a clear understanding of the deceased person's wishes concerning asset distribution and can help prevent fraud or mishandling of assets. Furthermore, these receipts play a crucial role in estate tax planning and filing, avoiding potential penalties and ensuring compliance with legal requirements. Conclusion: Surprise Arizona receipts to estate from the backbone of effective estate administration and asset distribution upon a person's passing. Property, financial, personal property, and business receipts are all essential components that contribute to the overall management and settlement of an estate. Understanding the relevance of these receipts, along with their associated keywords, is vital for individuals, families, and professionals involved in estate planning, administration, and probate processes in Surprise, Arizona.