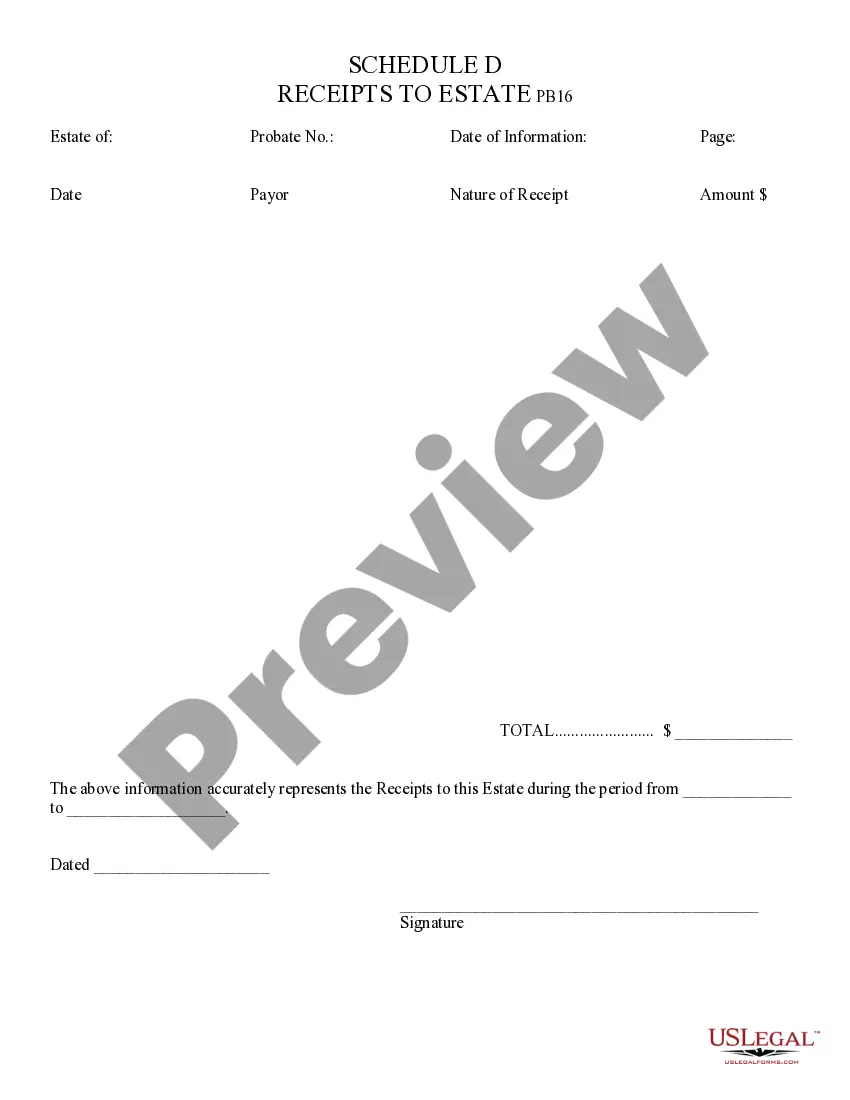

Receipts to Estate - Arizona: This form is used when an administrator of an estate is called upon to list all the receipts of any payments made by the estate. It states the amount of the receipt, as well as the Payor. It is available for download in both Word and Rich Text formats.

Tucson Arizona Receipts to Estate refers to the collection of official documents that record financial transactions and expenses related to the management and distribution of a deceased person's assets and liabilities in Tucson, Arizona. These receipts are crucial in providing a detailed account of the estate's financial transactions and ensuring transparency and accuracy in probate proceedings. There are different types of Tucson Arizona Receipts to Estate, each serving a specific purpose and documenting various aspects of the estate administration process. Some of these receipts include: 1. Funeral Expenses Receipts: These receipts detail the costs incurred for funeral arrangements, including the funeral home services, casket or urn, burial or cremation fees, transportation, flowers, and other related expenses. 2. Legal Fees Receipts: This category includes receipts provided by attorneys or law firms involved in the estate administration process. It consists of invoices for legal advice, drafting of documents such as the will, filing fees, court appearances, and any other legal services rendered. 3. Administrative Expenses Receipts: These receipts encompass expenses associated with managing the estate. This may include costs for obtaining death certificates, securing property appraisals, mailing notices to creditors and beneficiaries, and other administrative tasks relevant to the estate settlement. 4. Property-Related Receipts: This type of receipt pertains to the transfer or sale of property/assets within the estate. It may include receipts for real estate agent commissions, property repairs, maintenance fees, insurance premiums, and any other expenses incurred during the sale or transfer process. 5. Tax-Related Receipts: These receipts document the estate's tax obligations, including income taxes, estate taxes, and any other tax liabilities. It comprises receipts for tax preparation services and payments made to the Internal Revenue Service (IRS) or the Arizona Department of Revenue. 6. Miscellaneous Receipts: This category includes any other relevant receipts that do not fall into the above categories but still contribute to the overall financial records of the estate. It may consist of receipts related to bank fees, utility bills, professional services hired for estate-related matters, or any other expenditure directly linked to the estate settlement. In summary, Tucson Arizona Receipts to Estate cover a range of financial documents that meticulously record expenses and transactions relevant to the management and distribution of a deceased person's assets and liabilities. These documents play a crucial role in the probate process, allowing for accurate accounting, transparency, and compliance with legal requirements.Tucson Arizona Receipts to Estate refers to the collection of official documents that record financial transactions and expenses related to the management and distribution of a deceased person's assets and liabilities in Tucson, Arizona. These receipts are crucial in providing a detailed account of the estate's financial transactions and ensuring transparency and accuracy in probate proceedings. There are different types of Tucson Arizona Receipts to Estate, each serving a specific purpose and documenting various aspects of the estate administration process. Some of these receipts include: 1. Funeral Expenses Receipts: These receipts detail the costs incurred for funeral arrangements, including the funeral home services, casket or urn, burial or cremation fees, transportation, flowers, and other related expenses. 2. Legal Fees Receipts: This category includes receipts provided by attorneys or law firms involved in the estate administration process. It consists of invoices for legal advice, drafting of documents such as the will, filing fees, court appearances, and any other legal services rendered. 3. Administrative Expenses Receipts: These receipts encompass expenses associated with managing the estate. This may include costs for obtaining death certificates, securing property appraisals, mailing notices to creditors and beneficiaries, and other administrative tasks relevant to the estate settlement. 4. Property-Related Receipts: This type of receipt pertains to the transfer or sale of property/assets within the estate. It may include receipts for real estate agent commissions, property repairs, maintenance fees, insurance premiums, and any other expenses incurred during the sale or transfer process. 5. Tax-Related Receipts: These receipts document the estate's tax obligations, including income taxes, estate taxes, and any other tax liabilities. It comprises receipts for tax preparation services and payments made to the Internal Revenue Service (IRS) or the Arizona Department of Revenue. 6. Miscellaneous Receipts: This category includes any other relevant receipts that do not fall into the above categories but still contribute to the overall financial records of the estate. It may consist of receipts related to bank fees, utility bills, professional services hired for estate-related matters, or any other expenditure directly linked to the estate settlement. In summary, Tucson Arizona Receipts to Estate cover a range of financial documents that meticulously record expenses and transactions relevant to the management and distribution of a deceased person's assets and liabilities. These documents play a crucial role in the probate process, allowing for accurate accounting, transparency, and compliance with legal requirements.