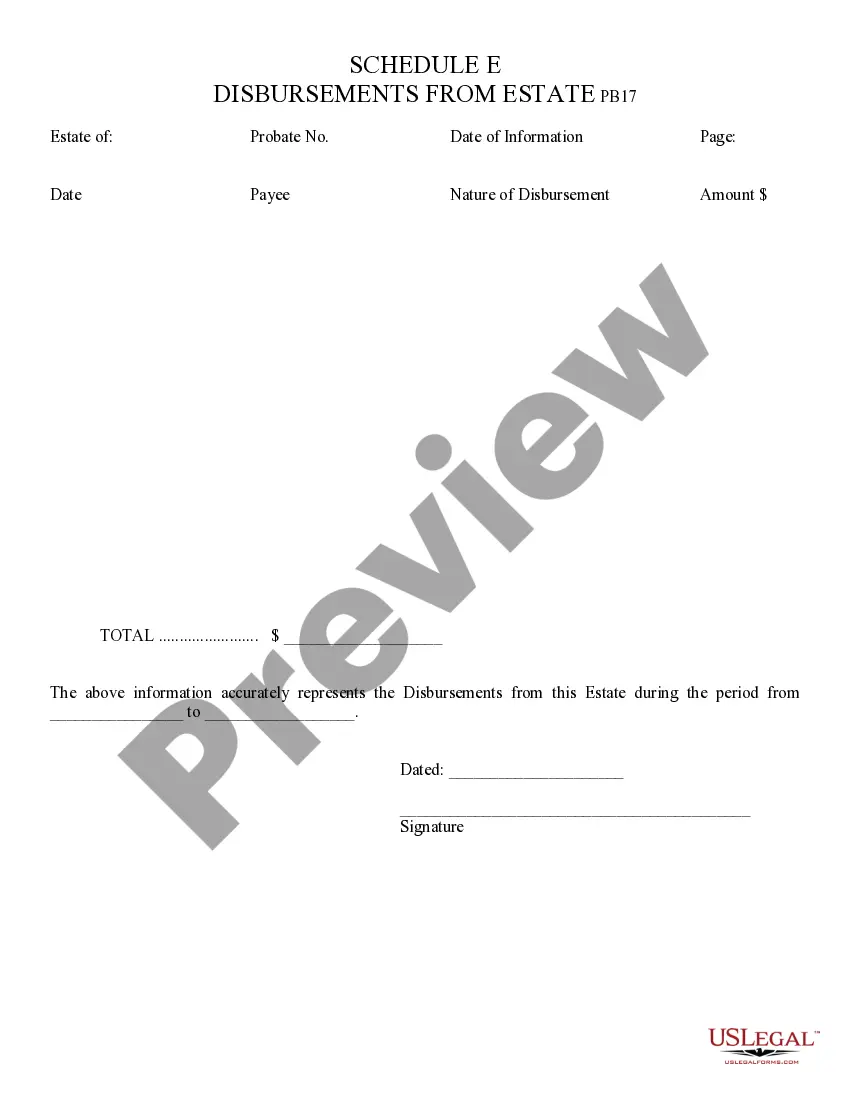

Disbursements from Estate Schedule E - Arizona: This document lists all of the disbursements, or payments, made by the estate during the year. It states the amount paid, as well as to who the payment was made. It is available for download in both Word and Rich Text formats.

Chandler, Arizona Disbursements from Estate Schedule E: Detailed Explanation and Different Types Chandler, Arizona Disbursements from Estate Schedule E refers to the process of distributing assets and liabilities of a deceased individual's estate according to the guidelines set forth by Schedule E of the Internal Revenue Service (IRS). This schedule plays a crucial role in determining the specific tax obligations related to the estate administration, including various types of disbursements. Disbursements from Estate Schedule E typically encompass a wide range of financial transactions involving the distribution of estate assets, payments to creditors, taxes, and other expenses related to the estate settlement process. These disbursements are made by the executor or personal representative responsible for managing the estate's financial affairs. Here are a few key types of Chandler, Arizona disbursements from Estate Schedule E: 1. Payments to Beneficiaries: This refers to the distribution of assets to the beneficiaries as specified in the deceased's will or trust documents. The executor must follow the stipulations outlined in the will, ensuring that the distribution process is conducted in compliance with relevant laws and regulations. 2. Creditor Payments: Outstanding debts and obligations of the deceased individual are settled through disbursements from the estate. The executor is responsible for identifying outstanding debts, validating claims made by creditors, and making necessary payments using available estate funds. 3. Professional Fees: Disbursements may also cover payments made to lawyers, accountants, appraisers, and any other professionals involved in managing and settling the estate. These fees are usually paid from the estate's assets and should be properly documented for tax purposes. 4. Administrative Expenses: Estate administration entails various expenses, such as court filing fees, estate administration costs, and fees related to obtaining necessary documentation. These disbursements are necessary for ensuring a smooth and efficient estate settlement process. 5. Taxes and Payroll Withholding: Disbursements from estates must also include the payment of any outstanding taxes owed by the deceased individual, as well as any payroll withholding, such as Social Security or Medicare taxes, that remain unpaid. Ensuring proper tax compliance is crucial to avoid penalties and legal issues. It is essential to maintain accurate records and documentation of all disbursements made from the estate, as these records are crucial for tax reporting and potential audits by the IRS. Executors or personal representatives should seek professional guidance to ensure compliance with IRS guidelines and to accurately complete Schedule E. Overall, Chandler, Arizona Disbursements from Estate Schedule E involve the orderly distribution of assets, payment of debts, taxes, and various administrative expenses associated with settling an estate. Executors must handle these disbursements with utmost care, diligence, and adherence to legal requirements to successfully fulfill their fiduciary duties.Chandler, Arizona Disbursements from Estate Schedule E: Detailed Explanation and Different Types Chandler, Arizona Disbursements from Estate Schedule E refers to the process of distributing assets and liabilities of a deceased individual's estate according to the guidelines set forth by Schedule E of the Internal Revenue Service (IRS). This schedule plays a crucial role in determining the specific tax obligations related to the estate administration, including various types of disbursements. Disbursements from Estate Schedule E typically encompass a wide range of financial transactions involving the distribution of estate assets, payments to creditors, taxes, and other expenses related to the estate settlement process. These disbursements are made by the executor or personal representative responsible for managing the estate's financial affairs. Here are a few key types of Chandler, Arizona disbursements from Estate Schedule E: 1. Payments to Beneficiaries: This refers to the distribution of assets to the beneficiaries as specified in the deceased's will or trust documents. The executor must follow the stipulations outlined in the will, ensuring that the distribution process is conducted in compliance with relevant laws and regulations. 2. Creditor Payments: Outstanding debts and obligations of the deceased individual are settled through disbursements from the estate. The executor is responsible for identifying outstanding debts, validating claims made by creditors, and making necessary payments using available estate funds. 3. Professional Fees: Disbursements may also cover payments made to lawyers, accountants, appraisers, and any other professionals involved in managing and settling the estate. These fees are usually paid from the estate's assets and should be properly documented for tax purposes. 4. Administrative Expenses: Estate administration entails various expenses, such as court filing fees, estate administration costs, and fees related to obtaining necessary documentation. These disbursements are necessary for ensuring a smooth and efficient estate settlement process. 5. Taxes and Payroll Withholding: Disbursements from estates must also include the payment of any outstanding taxes owed by the deceased individual, as well as any payroll withholding, such as Social Security or Medicare taxes, that remain unpaid. Ensuring proper tax compliance is crucial to avoid penalties and legal issues. It is essential to maintain accurate records and documentation of all disbursements made from the estate, as these records are crucial for tax reporting and potential audits by the IRS. Executors or personal representatives should seek professional guidance to ensure compliance with IRS guidelines and to accurately complete Schedule E. Overall, Chandler, Arizona Disbursements from Estate Schedule E involve the orderly distribution of assets, payment of debts, taxes, and various administrative expenses associated with settling an estate. Executors must handle these disbursements with utmost care, diligence, and adherence to legal requirements to successfully fulfill their fiduciary duties.