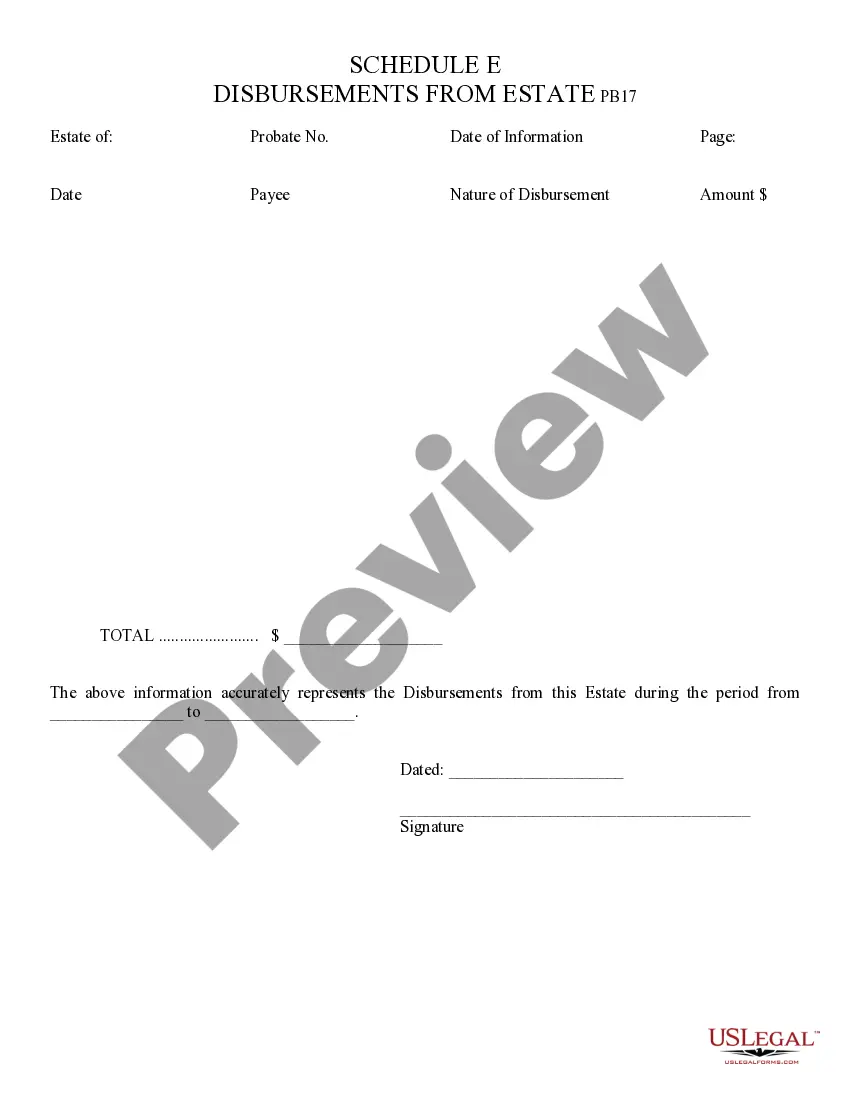

Disbursements from Estate Schedule E - Arizona: This document lists all of the disbursements, or payments, made by the estate during the year. It states the amount paid, as well as to who the payment was made. It is available for download in both Word and Rich Text formats.

Gilbert Arizona Disbursements from Estate Schedule E: Detailed Description and Types When it comes to estate administration in Gilbert, Arizona, Disbursements from Estate Schedule E holds significant importance. This schedule outlines the disbursed funds and assets from an estate, including various expenses, debts, and distributions. These disbursements ensure the proper allocation of assets and settlement of debts, ultimately winding up the deceased person's estate. Now, let's explore the different types of Gilbert Arizona Disbursements from Estate Schedule E: 1. Creditors and Debts: This section encompasses any outstanding debts owed by the deceased, such as mortgages, loans, credit cards, medical bills, or other liabilities. The estate's representative is responsible for settling these claims, ensuring that creditors receive proper compensation from the estate funds. 2. Funeral and Estate Administration Expenses: Funeral costs and expenses related to estate administration are eligible disbursements. These may include funeral and burial expenses, costs associated with hiring an attorney or an estate representative, court fees, accounting fees, or any other administrative costs incurred in managing and settling the estate. 3. Taxes: Estate taxes, income taxes, or any other outstanding tax liabilities of the deceased need to be settled using the estate's assets. These tax disbursements ensure compliance with relevant tax laws and regulations. 4. Distribution to Heirs and Beneficiaries: After settling debts, expenses, and taxes from the estate, the remaining assets can be distributed among the designated beneficiaries or heirs as mentioned in the deceased person's will or as determined by state laws in the absence of a will. The Schedule E includes details of the distribution, such as the beneficiaries' names, the assets they receive, and their corresponding values. 5. Miscellaneous Disbursements: This category may include any other relevant expenses or disbursements that arise during the estate settlement process but don't fall under the aforementioned categories. This could include costs related to property maintenance, asset appraisals, professional advisor fees, or any other expenses necessary for the proper administration of the estate. In summary, Gilbert Arizona Disbursements from Estate Schedule E outlines the various disbursements made during estate settlement. These disbursements primarily focus on settling debts, expenses, taxes, and ultimately distributing assets to the heirs and beneficiaries. Properly managing and documenting these disbursements ensures a smooth and legal closure of the estate, providing financial clarity to all involved parties.Gilbert Arizona Disbursements from Estate Schedule E: Detailed Description and Types When it comes to estate administration in Gilbert, Arizona, Disbursements from Estate Schedule E holds significant importance. This schedule outlines the disbursed funds and assets from an estate, including various expenses, debts, and distributions. These disbursements ensure the proper allocation of assets and settlement of debts, ultimately winding up the deceased person's estate. Now, let's explore the different types of Gilbert Arizona Disbursements from Estate Schedule E: 1. Creditors and Debts: This section encompasses any outstanding debts owed by the deceased, such as mortgages, loans, credit cards, medical bills, or other liabilities. The estate's representative is responsible for settling these claims, ensuring that creditors receive proper compensation from the estate funds. 2. Funeral and Estate Administration Expenses: Funeral costs and expenses related to estate administration are eligible disbursements. These may include funeral and burial expenses, costs associated with hiring an attorney or an estate representative, court fees, accounting fees, or any other administrative costs incurred in managing and settling the estate. 3. Taxes: Estate taxes, income taxes, or any other outstanding tax liabilities of the deceased need to be settled using the estate's assets. These tax disbursements ensure compliance with relevant tax laws and regulations. 4. Distribution to Heirs and Beneficiaries: After settling debts, expenses, and taxes from the estate, the remaining assets can be distributed among the designated beneficiaries or heirs as mentioned in the deceased person's will or as determined by state laws in the absence of a will. The Schedule E includes details of the distribution, such as the beneficiaries' names, the assets they receive, and their corresponding values. 5. Miscellaneous Disbursements: This category may include any other relevant expenses or disbursements that arise during the estate settlement process but don't fall under the aforementioned categories. This could include costs related to property maintenance, asset appraisals, professional advisor fees, or any other expenses necessary for the proper administration of the estate. In summary, Gilbert Arizona Disbursements from Estate Schedule E outlines the various disbursements made during estate settlement. These disbursements primarily focus on settling debts, expenses, taxes, and ultimately distributing assets to the heirs and beneficiaries. Properly managing and documenting these disbursements ensures a smooth and legal closure of the estate, providing financial clarity to all involved parties.