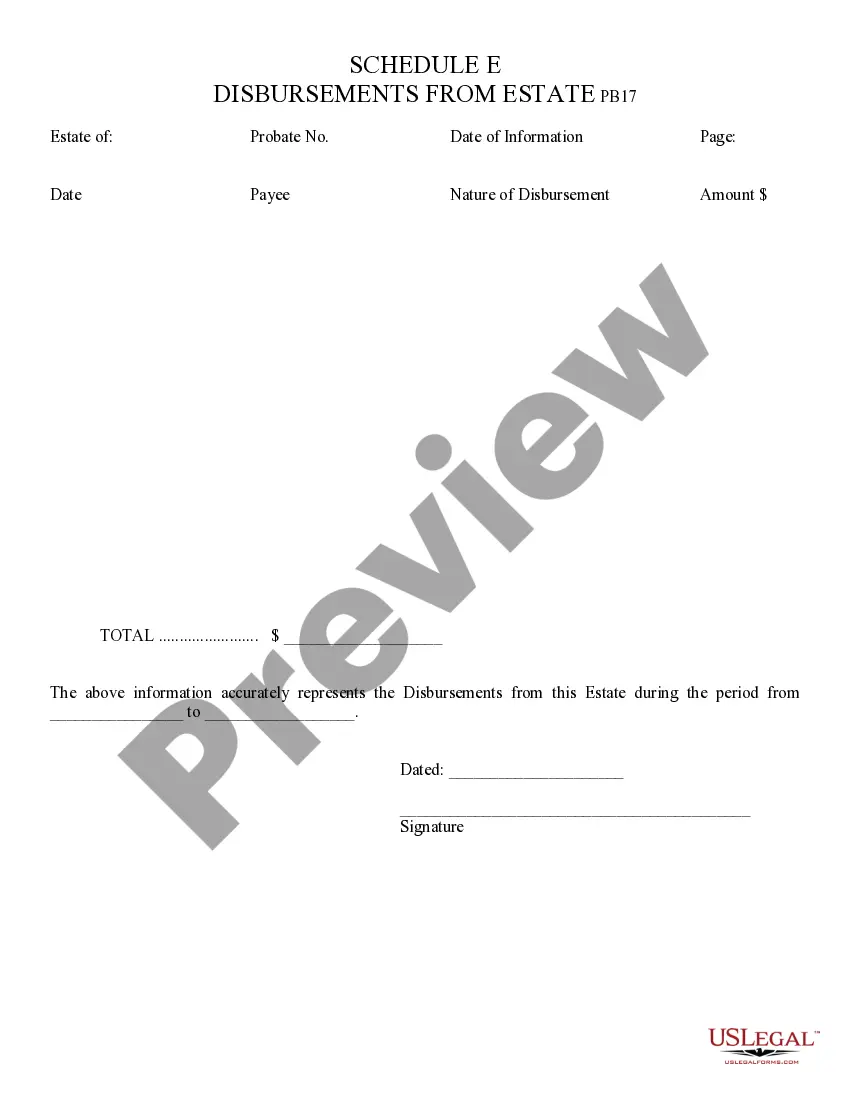

Disbursements from Estate Schedule E - Arizona: This document lists all of the disbursements, or payments, made by the estate during the year. It states the amount paid, as well as to who the payment was made. It is available for download in both Word and Rich Text formats.

Glendale Arizona Disbursements from Estate Schedule E: A Comprehensive Overview In Glendale, Arizona, Disbursements from Estate Schedule E refer to the financial transactions and distributions made from an estate during the administration process. It is an essential part of the estate settlement procedure, allowing beneficiaries and creditors to receive their respective shares and using the funds for various purposes. These disbursements encompass a wide range of payments, reimbursements, loans, and distributions that need to be accurately documented and reported for taxation purposes. The Schedule E form is specifically designed to record and summarize these disbursements, ensuring proper transparency and compliance with legal and accounting requirements. To provide a thorough understanding, here are some of the different types of Glendale Arizona Disbursements from Estate Schedule E: 1. Funeral and Burial Expenses Disbursement: This refers to payments made by the estate to cover the costs associated with the deceased's funeral service, including the casket, burial plot, memorial service, cremation, transportation, and any related expenses. Keywords: Glendale Arizona, estate, Schedule E, disbursements, funeral expenses, burial expenses, funeral service, cremation, memorial service, transportation, deceased. 2. Debts and Liabilities Disbursement: This type of disbursement involves settling the outstanding debts and liabilities of the deceased. It includes payments for mortgages, loans, credit card bills, medical bills, taxes owed, and any other financial obligations. Keywords: Glendale Arizona, estate, Schedule E, disbursements, debts, liabilities, mortgages, loans, credit card bills, medical bills, taxes. 3. Administrative Expenses Disbursement: These disbursements cover the costs incurred during the administration of the estate. It includes payments for legal and accounting services, appraisal fees, executor or administrator fees, court costs, publication expenses, and other administrative expenses. Keywords: Glendale Arizona, estate, Schedule E, disbursements, administrative expenses, legal services, accounting services, appraisal fees, executor fees, court costs, publication expenses. 4. Bequests and Legacies Disbursement: This category involves distributing specific assets or cash payments to beneficiaries as stated in the deceased's will. It includes gifts, inheritances, personal property, real estate, investments, and any other assets intended for specific individuals or organizations. Keywords: Glendale Arizona, estate, Schedule E, disbursements, bequests, legacies, beneficiaries, will, gifts, inheritances, personal property, real estate, investments. 5. Residual Beneficiary Disbursement: This disbursement occurs after all debts, expenses, and specific bequests have been settled. It involves distributing the remaining assets, also referred to as the residue or residue estate, to the residual beneficiaries, who typically receive a percentage share or proportionate portion of the estate. Keywords: Glendale Arizona, estate, Schedule E, disbursements, residual beneficiary, residue estate, remaining assets. It is important to note that the specifics of each estate's disbursements may vary based on the deceased's individual circumstances, their will, outstanding obligations, and the overall value and composition of the estate. When documenting these disbursements on Schedule E, accuracy, organization, and compliance with relevant laws and regulations are essential to ensure a smooth administration and settlement process. Disclaimer: This information serves as a general guide and does not constitute legal or financial advice. It is recommended to consult with professionals or legal experts for specific details and guidance regarding Glendale Arizona Disbursements from Estate Schedule E.Glendale Arizona Disbursements from Estate Schedule E: A Comprehensive Overview In Glendale, Arizona, Disbursements from Estate Schedule E refer to the financial transactions and distributions made from an estate during the administration process. It is an essential part of the estate settlement procedure, allowing beneficiaries and creditors to receive their respective shares and using the funds for various purposes. These disbursements encompass a wide range of payments, reimbursements, loans, and distributions that need to be accurately documented and reported for taxation purposes. The Schedule E form is specifically designed to record and summarize these disbursements, ensuring proper transparency and compliance with legal and accounting requirements. To provide a thorough understanding, here are some of the different types of Glendale Arizona Disbursements from Estate Schedule E: 1. Funeral and Burial Expenses Disbursement: This refers to payments made by the estate to cover the costs associated with the deceased's funeral service, including the casket, burial plot, memorial service, cremation, transportation, and any related expenses. Keywords: Glendale Arizona, estate, Schedule E, disbursements, funeral expenses, burial expenses, funeral service, cremation, memorial service, transportation, deceased. 2. Debts and Liabilities Disbursement: This type of disbursement involves settling the outstanding debts and liabilities of the deceased. It includes payments for mortgages, loans, credit card bills, medical bills, taxes owed, and any other financial obligations. Keywords: Glendale Arizona, estate, Schedule E, disbursements, debts, liabilities, mortgages, loans, credit card bills, medical bills, taxes. 3. Administrative Expenses Disbursement: These disbursements cover the costs incurred during the administration of the estate. It includes payments for legal and accounting services, appraisal fees, executor or administrator fees, court costs, publication expenses, and other administrative expenses. Keywords: Glendale Arizona, estate, Schedule E, disbursements, administrative expenses, legal services, accounting services, appraisal fees, executor fees, court costs, publication expenses. 4. Bequests and Legacies Disbursement: This category involves distributing specific assets or cash payments to beneficiaries as stated in the deceased's will. It includes gifts, inheritances, personal property, real estate, investments, and any other assets intended for specific individuals or organizations. Keywords: Glendale Arizona, estate, Schedule E, disbursements, bequests, legacies, beneficiaries, will, gifts, inheritances, personal property, real estate, investments. 5. Residual Beneficiary Disbursement: This disbursement occurs after all debts, expenses, and specific bequests have been settled. It involves distributing the remaining assets, also referred to as the residue or residue estate, to the residual beneficiaries, who typically receive a percentage share or proportionate portion of the estate. Keywords: Glendale Arizona, estate, Schedule E, disbursements, residual beneficiary, residue estate, remaining assets. It is important to note that the specifics of each estate's disbursements may vary based on the deceased's individual circumstances, their will, outstanding obligations, and the overall value and composition of the estate. When documenting these disbursements on Schedule E, accuracy, organization, and compliance with relevant laws and regulations are essential to ensure a smooth administration and settlement process. Disclaimer: This information serves as a general guide and does not constitute legal or financial advice. It is recommended to consult with professionals or legal experts for specific details and guidance regarding Glendale Arizona Disbursements from Estate Schedule E.