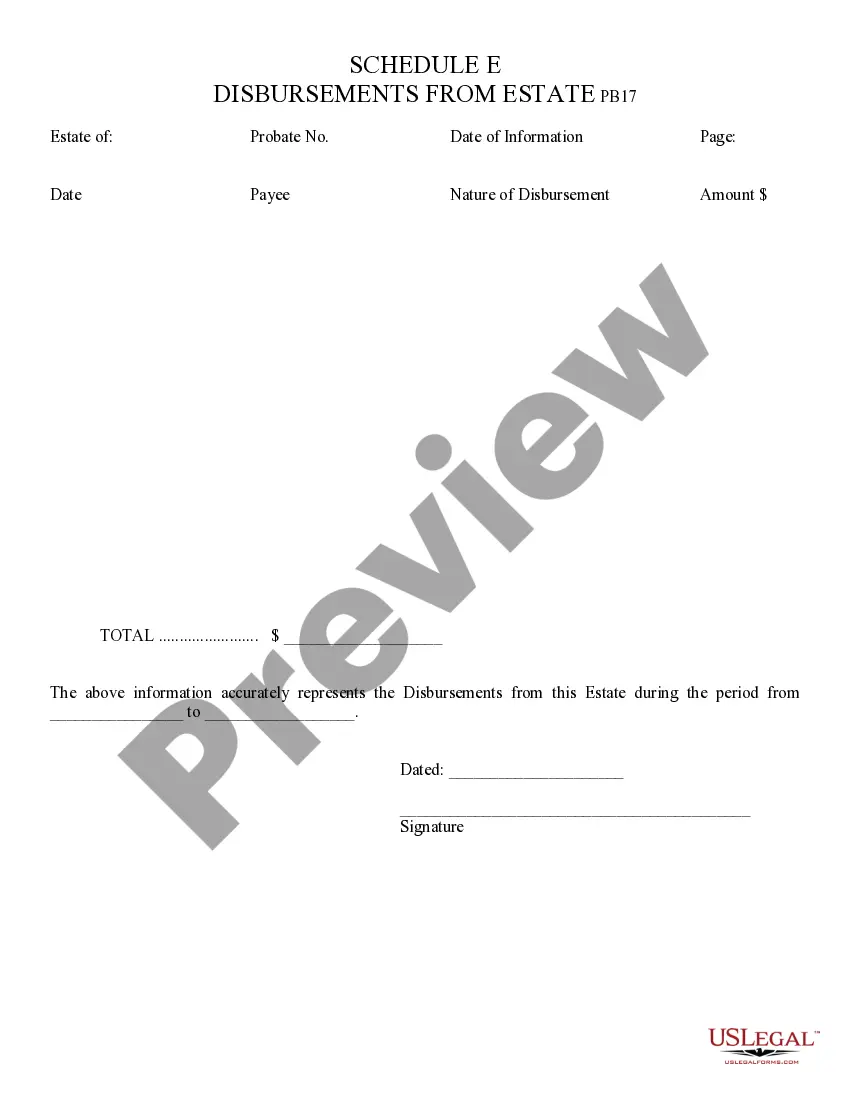

Disbursements from Estate Schedule E - Arizona: This document lists all of the disbursements, or payments, made by the estate during the year. It states the amount paid, as well as to who the payment was made. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Disbursements from Estate Schedule E refers to a specific document used in estate administration that outlines the disbursements made from an estate located in Phoenix, Arizona. This schedule provides a detailed breakdown of all the expenses, payments, and distributions that have been made from the estate during the administration process. Some relevant keywords associated with Phoenix Arizona Disbursements from Estate Schedule E include estate administration, estate expenses, estate payments, estate distributions, Phoenix, Arizona, and schedule E. The document typically contains various categories representing different types of disbursements, which may vary depending on the specific circumstances of the estate. Some possible types of Phoenix Arizona Disbursements from Estate Schedule E may include: 1. Funeral and burial expenses: These include costs associated with funeral services, casket, burial plot, headstone, and any other related expenses. 2. Administrative expenses: This category encompasses fees paid to attorneys, accountants, and other professionals involved in the estate administration process. 3. Estate taxes: If applicable, estate taxes or any other tax liabilities owed by the estate are included in this category. 4. Debts and liabilities: This section lists any outstanding debts or liabilities of the deceased individual that have been paid off from the estate. 5. Maintenance and preservation expenses: These include expenses incurred for the maintenance, upkeep, or preservation of estate assets, such as real estate or personal property. 6. Distribution to beneficiaries: This category includes the specific amounts or properties distributed to the beneficiaries of the estate. 7. Miscellaneous expenses: Any other expenses not covered by the above categories may be listed here. Each disbursement entry on Phoenix Arizona Disbursements from Estate Schedule E typically includes a description of the expense, the date of disbursement, the payee or recipient of the disbursement, and the amount paid. This level of detail provides transparency and accountability in the estate administration process. Overall, Phoenix Arizona Disbursements from Estate Schedule E is a crucial document that enables the personal representative of an estate to accurately record, track, and report all financial transactions associated with the estate's administration in Phoenix, Arizona.Phoenix Arizona Disbursements from Estate Schedule E refers to a specific document used in estate administration that outlines the disbursements made from an estate located in Phoenix, Arizona. This schedule provides a detailed breakdown of all the expenses, payments, and distributions that have been made from the estate during the administration process. Some relevant keywords associated with Phoenix Arizona Disbursements from Estate Schedule E include estate administration, estate expenses, estate payments, estate distributions, Phoenix, Arizona, and schedule E. The document typically contains various categories representing different types of disbursements, which may vary depending on the specific circumstances of the estate. Some possible types of Phoenix Arizona Disbursements from Estate Schedule E may include: 1. Funeral and burial expenses: These include costs associated with funeral services, casket, burial plot, headstone, and any other related expenses. 2. Administrative expenses: This category encompasses fees paid to attorneys, accountants, and other professionals involved in the estate administration process. 3. Estate taxes: If applicable, estate taxes or any other tax liabilities owed by the estate are included in this category. 4. Debts and liabilities: This section lists any outstanding debts or liabilities of the deceased individual that have been paid off from the estate. 5. Maintenance and preservation expenses: These include expenses incurred for the maintenance, upkeep, or preservation of estate assets, such as real estate or personal property. 6. Distribution to beneficiaries: This category includes the specific amounts or properties distributed to the beneficiaries of the estate. 7. Miscellaneous expenses: Any other expenses not covered by the above categories may be listed here. Each disbursement entry on Phoenix Arizona Disbursements from Estate Schedule E typically includes a description of the expense, the date of disbursement, the payee or recipient of the disbursement, and the amount paid. This level of detail provides transparency and accountability in the estate administration process. Overall, Phoenix Arizona Disbursements from Estate Schedule E is a crucial document that enables the personal representative of an estate to accurately record, track, and report all financial transactions associated with the estate's administration in Phoenix, Arizona.